Published on October 16, 2024 by Rohan Kapoor

In today’s fiercely competitive marketplace, distinguishing oneself from the competition is more difficult than ever. Businesses are constantly trying to gain a competitive edge, build their brand visibility and boost their reputation with their target audiences.

Amid this increasing competition, financial sponsorship is an effective strategy that can act as a catalyst not only for elevating brand presence but also for maximising its resonance.

What is financial sponsorship?

Financial sponsorship is more of a strategic association and involves a partnership between a brand and an individual, organisation or event to benefit mutually through funds. It goes beyond the traditional approach of marketing and offers a unique opportunity for enhancing reputation and credibility, elevating brand presence and visibility, targeted exposure and customer acquisition and ultimately driving revenue.

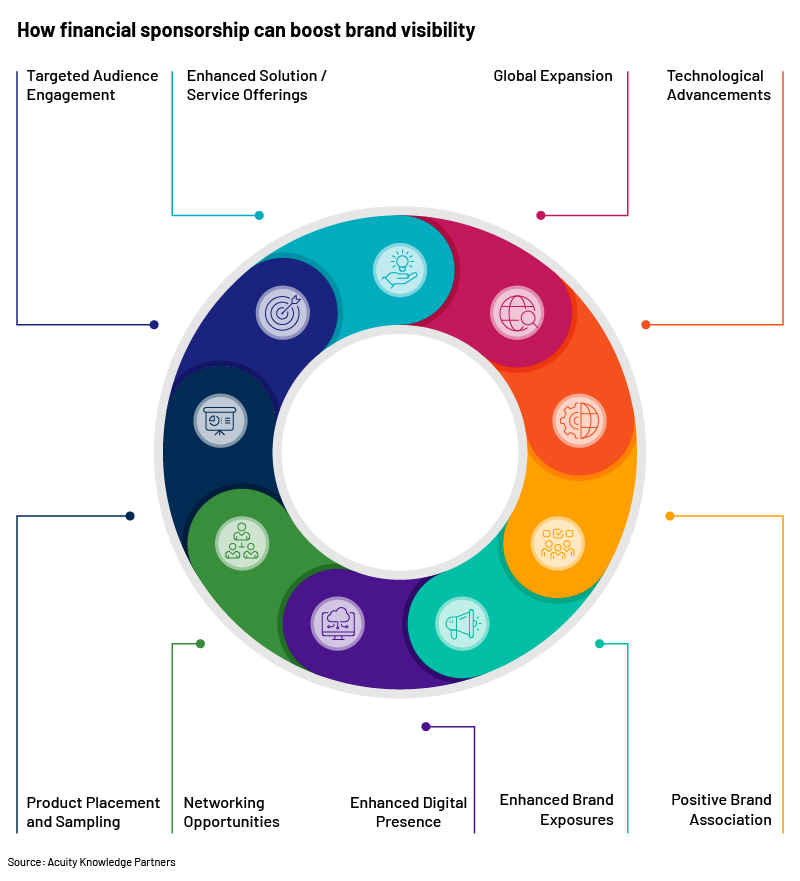

In this blog, we delve into how financial sponsorships can amplify brand visibility and provide tips on maximising the benefits of these partnerships. Key strategic benefits include the following:

-

Enhanced solution/service offerings: Enables the brand/portfolio companies to expand and improve their solution/service offerings in providing high-value research, analytics and business intelligence to the financial services sector.

-

For instance, in 2017, Phadia was acquired by fund manager Cinven, which expedited the launch of a comprehensive product suite, including two new instruments for allergy and autoimmunity testing. These innovative technologies, capable of integrating both testing types, achieved throughput four to five times higher than any other combined instrument available at that time.

-

-

Global expansion: The partnership facilitates global expansion, enabling portfolio companies to serve a broader client base and increase their market presence.

-

To illustrate, in 2012, Summit Partners acquired Infor, a provider of enterprise application software. The firms had worked closely with management to source and evaluate several acquisition opportunities to “broaden product reach and capabilities”. Since Summit’s investment, Infor has completed nine strategic acquisitions, including GT Nexus, the world’s largest cloud-based global commerce platform. As a result, by 2017, over half of Infor’s software revenue was derived from its cloud applications. The company added 13,000 customers since Summit’s 2012 investment and grew its employee headcount by 3,000 over five years. In 2020, Infor was acquired by Koch Industries in a deal pegged at nearly USD13bn.

-

-

Technological advancements: Enables the brand/portfolio companies to leverage innovative technology solutions, improving operational efficiency and delivering greater value to clients.

-

For instance, Bain Capital's investment in Kantar, a marketing research and media company, would support this statement on how digitalisation may play out in value-creation strategies. Kantar was looking for ways to digitally transform and implement better processes, supplier and risk management, data collection and analysis and spend control. Furthermore, Kantar worked to develop a “robust business case” and assisted with sourcing the right cloud-based procurement technology platform. The new system gave the company greater procurement control, agility and risk mitigation.

-

Stats: Portfolio companies receiving private equity (PE) investment saw an average 14% increase in their IT budgets, along with a nearly 4% increase in the number of AI-related job postings.

-

Expanding IT budgets increased hiring by 11% and sales by 9%.

-

Adding AI jobs increased hiring by nearly 8% and sales by 7%.

-

-

Positive brand association: Partnering with a well-regarded sponsor bolsters reputation and credibility in the industry. The positive affiliation can enhance public perception and foster trust with potential customers and blue-chip clients.

-

To illustrate, in 2007, the Blackstone Group acquired Hilton Worldwide for USD26bn. During Blackstone’s ownership, Hilton experienced significant enhancements, including a comprehensive restructuring and an expansion of its hotel portfolio. By the time Hilton went public again in 2013, it had grown into one of the largest and most successful hotel chains worldwide.

-

-

Enhanced brand exposures: Offers a global financial news outlet, highlighting the strengths and potential of brands/portfolio companies. Boosts the brand’s profile in the individual sectors and enables increased participation of brands in key industry events and conferences, showcasing its capabilities and expanding its reach to new clients and markets.

-

For instance, Permira’s acquisition of Acuity Knowledge Partners (Acuity) significantly boosted the brand’s exposure. By leveraging Permira’s extensive global network and expertise in tech-enabled services, Acuity’s visibility in the financial services sector was greatly enhanced.

-

-

Enhanced digital presence: Partnership supports improved digital marketing strategy, including a revamped website and increased activity on social media platforms, further enhancing brand visibility. It also attracts global media coverage, increasing visibility for both sponsor and brands, with a positive impact on the brand’s market position and improved capabilities brought by the sponsor.

-

For example, Vista Equity Partners acquired Mindbody, a wellness technology platform, in 2019. Following the acquisition, Vista made substantial investments to enhance Mindbody’s digital capabilities. This included upgrading its software platform and expanding its online booking and payment systems. As a result, Mindbody’s digital presence and customer engagement witnessed significant improvements.

-

-

The PE guide to digital transformation

-

Networking opportunities: Sponsorships frequently include networking opportunities, enabling portfolio companies to connect with prime businesses and influential stakeholders. This leads to increased participation in conducting industry events, where they can network with other businesses, potential clients and industry experts.

-

For instance, in 2016, KKR acquired enterprise software company Epicor, enabling Epicor to leverage KKR’s global network. The agreement’s access fostered new business relationships and partnerships, helping Epicor expand its customer base and enter new markets.

-

-

Product placement and sampling: Enables brands to conduct a number of product demonstrations for potential clients within the sponsor’s extensive network, showcasing their capabilities in research and analytics, and to launch pilot programmes, providing real-world examples of their effectiveness and driving subsequent full-scale adoption.

-

To illustrate, TPG acquired McAfee, after which McAfee continued building on its success and proven track record of growth as a pure-play consumer cybersecurity leader and launched multiple pilot programmes to test new cybersecurity solutions and obtain feedback from new users.

-

-

Targeted audience engagement: Provides customised research and analytics solutions/services catering to clients, increasing satisfaction. Helps implement targeted marketing campaigns, reaching key decision-makers within specific sectors, while communicating unique value propositions.

Conclusion

Financial sponsors work towards representing the strength of strategic partnerships in driving growth and innovation. Collaboration between a financial sponsor and a portfolio company augments the brand’s service/solution offerings and market reach, and significantly improves its visibility and credibility. Portfolio companies/brands can use targeted audience engagement, extensive media coverage and valuable networking opportunities to establish their position as leaders in their respective sectors. Furthermore, collaborations provide the resources and proficiency required to drive brands to new heights, benefiting both the companies and their clients. Lastly, well-aligned investments can have a progressive impact on fostering industry leadership and long-term achievements.

How Acuity Knowledge Partners can help

We operate through a single platform for all specialised financial sponsor group (FSG) solutions across the investment cycle. We have the expertise to support FSG clients in several multifaceted tasks such as valuations and portfolio benchmarking. We also have effective FSG capabilities to provide advisory services. We deploy a strategic and consultative approach to identifying new opportunities and enhancing portfolio performance.

References:

-

https://hbswk.hbs.edu/item/weighing-digital-tradeoffs-in-private-equity-do-costly-upgrades-pay-off

-

https://hotelmergers.com/ma-case-study/ma-case-study-blackstone-acquires-hilton-hotels-2007/

-

https://www.permira.com/news-and-insights/insights/partnership-series-acuity-knowledge

Tags:

What's your view?

About the Author

Rohan has been associated with Acuity’s Investment Banking team for over 11 years. During his tenure at Acuity, he has supported a couple of US based investment banks and in his last role he was part of Financial Sponsors team of a leading US based investment bank. He has managed end to end project lifecycle across multiple coverage groups including Technology, Financial Sponsors, Healthcare, Industrials & Consumer amongst others and has extensive experience in client engagement and in executing complex tasks. Previously, Rohan was associated with a Research & Analytics firm based out of India and was part of a dedicated team supporting Healthcare / Technology team of a..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox