Published on October 7, 2024 by Arpan Polley

Introduction

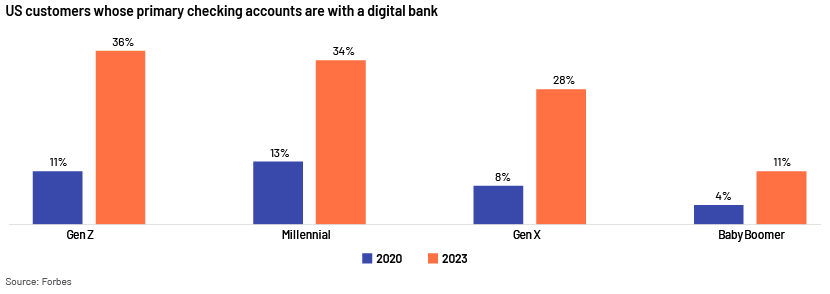

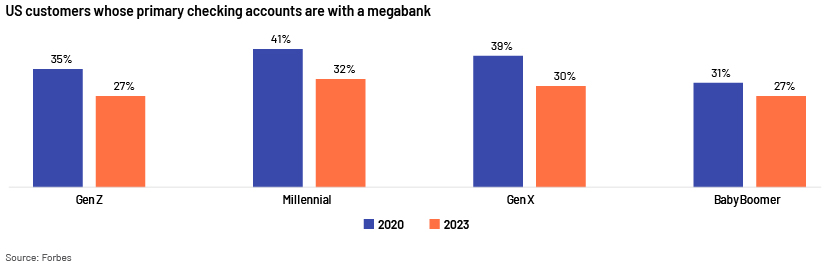

Cash management accounts, generally a hybrid of checking and savings accounts, enable users to do all their banking through one account. These accounts are viewed as an important medium for building financial relationships with customers. Traditionally, only brick-and-mortar banks used to offer checking and savings accounts to customers. However, with the rise of financial technology (fintech) firms, megabanks are facing tough competition and losing customer share as wel.

Key drivers of the trend

-

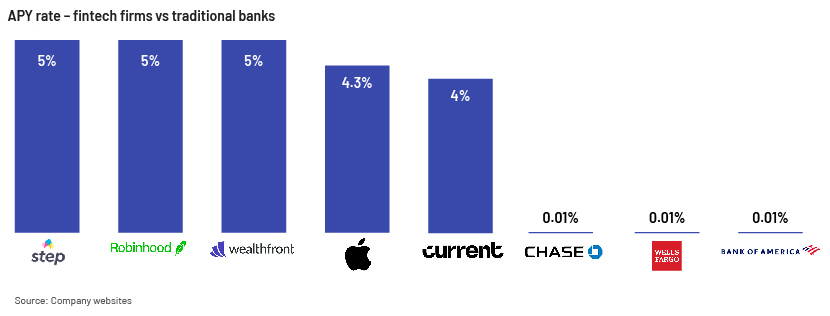

Low annual percentage yield (APY) rate offered by traditional banks: US-based fintech firms are making their banking services more appealing to customers by rolling out new products that address critical customer pain points, one of which is the low APY rate offered by traditional banks.

0.61% The national average yield for savings accounts in the US, as of 12 August

-

Digital banks offer much higher APY rates than do megabanks. They can pass on more money to customers in the form of interest, as they do not have the overhead expenses that brick-and-mortar banks do. The wide gap between interest offered by a traditional bank and that offered by a fintech firm attracts customers to open accounts with fintech firms.

-

Banking with fintech firms is more convenient: For savings accounts, many traditional banks charge fees for maintenance, overdrafts and even transfers. However, a number of fintech firms have started offering accounts that require no monthly fees and no monthly balance requirements; account opening is also quite easy and user-friendly. They also offer several personal financial management tools that banks do not.

For instance, Wealthfront, a US-based fintech firm, offers cash accounts that come with no account fees, fee-free withdrawals and a withdrawal limit of USD250,000.

-

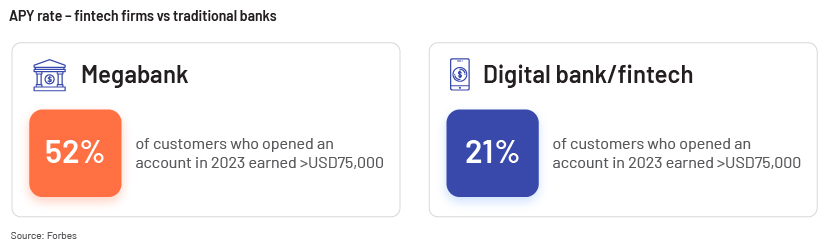

Traditional banks do not focus much on low-income and underbanked groups: Traditional banks have mainly focused on more affluent customers and have failed to provide services to millions of underbanked Americans. 21.7% of unbanked households surveyed (c.5.9m Americans) say they do not have a bank account mainly because they “don't have enough money to meet minimum-balance requirements”. On the other hand, fintech firms offer critical financial services to this segment; this is expected to change the way businesses serve such customers.

Factors driving fintech firms to offer cash management accounts

-

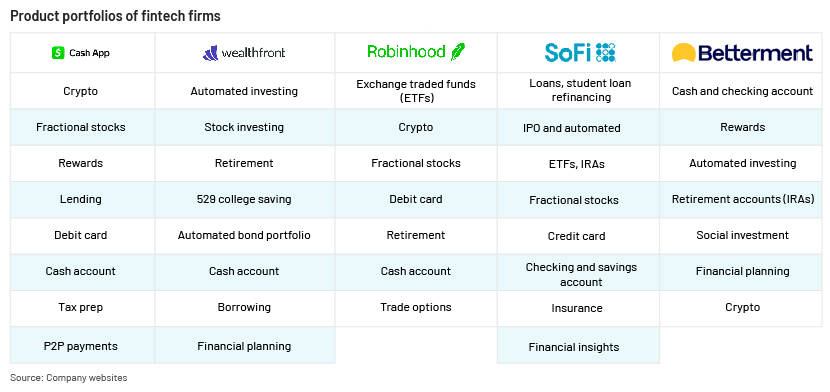

Complete financial service model: Fintech firms wish to build a comprehensive financial platform so they become a one-stop shop, enabling customers to avail themselves of any financial product they need without switching apps. For instance, Robinhood started as a commission-free stock trading company in 2013 and has since added new premium services such as Robinhood Gold, Robinhood Crypto and Robinhood Retirement.

-

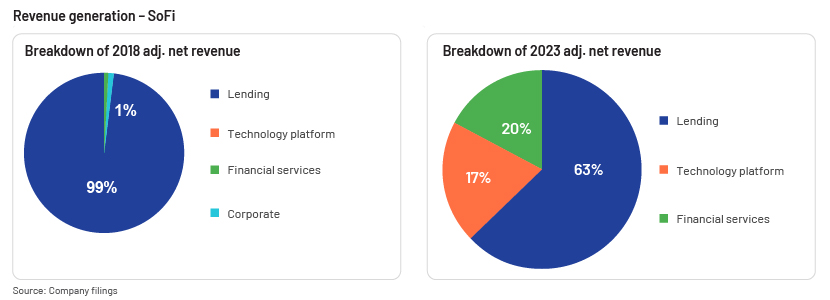

Revenue diversification: Fintech firms no longer want to depend on a single product/service for revenue generation. They are diversifying their revenue streams through new offerings to minimise the impact of a disruption to any segment.

For example, SoFi, a US-based fintech, generated 99% of its adjusted net revenue only from lending services in 2018. However, by 2023, it was able to generate 37% of its adjusted net revenue from the technology platform and financial services.

-

New-customer acquisition:One of the largest cost components for a fintech company is customer acquisition cost, the cost involved in finding prospective customers and converting them into customers. Easy ways in which fintech firms acquire new customers include by offering attractive banking products and services such as commission-free trading and high-yield savings accounts.

-

Cross-selling opportunities:Once a fintech firm acquires a new customer via offering attractive high-yield savings accounts, it starts cross-selling other products such as loans and investment products. Companies such as Betterment and Wealthfront offer free financial planning tools that help them build formal relationships with customers and subsequently cross-sell their investment products.

Steps banks could take to win back customers: Fintech firms and banks have their respective strengths and weaknesses. Fintech firms have a lean organisation structure, are agile, have the latest financial technology systems and offer customised products and services. On the other hand, banks are the only institutions licensed to provide obligatory services such as safeguarding accounts, and they are equipped with significant industry knowledge and expertise.

-

Some banks perceive fintech firms as a threat, while others see them as an opportunity to integrate their solutions, widen the user group and leverage their advanced technologies through partnerships. In 2023, for example, Apple launched the Apple Card savings account in partnership with Goldman Sachs.

-

Incumbents need to significantly improve customer services, provide customers more convenient ways of doing business, extend financial access to underbanked individuals and operate more like a fintech firm.

-

Banks could also consider M&A and build new products and services around the target company. However, success would depend on post-merger integration.

Conclusion

The impact of fintech on financial services has forced banks to consider new developments. Fintech firms are already engaged in practices that banks are only planning to experiment with. Banks, therefore, need to rebuild themselves to compete with fintech firms. However, it does not have to be a zero-sum game, as banks and fintech firms could mutually benefit from cooperation. It would be interesting to see how the sector will evolve in the coming years.

How Acuity Knowledge Partners can help

For nearly two decades, we have supported diverse stakeholders in the global fintech domain – fintech firms, consultants and fintech-focused private equity firms, which have benefited from our flexible, scalable and bespoke research services. We support clients to identify new opportunities and to stay competitive and compliant. We also help identify strategic moves by competitors and analyse key performance indicators. We keep our clients updated on regulations and advanced technologies, helping them navigate the ever-evolving tech market.

Our unique approach, combining process, people and technology in the fintech domain, delivers faster results and drives excellence for our clients. A number of our clients leverage our proprietary suite of Business Excellence and Automation Tools (BEAT) to unlock new levers of business growth and unmatched returns on investment.

References:

-

https://www.bankrate.com/banking/savings/average-savings-interest-rates/

-

https://www.bankrate.com/banking/savings/average-savings-interest-rates/

-

https://s27.q4cdn.com/749715820/files/doc_financials/2023/Investor-Presentation-2.pdf

-

https://s27.q4cdn.com/749715820/files/doc_financials/2020/Financials_Presentation.pdf

Tags:

What's your view?

About the Author

Arpan Polley is a part of Acuity Knowledge Partners – Corporate & Consulting team with experience in strategy building and business research. He has executed various projects involving competitive intelligence, market entry, growth strategy, market sizing, identifying business opportunities, and benchmarking studies, as well as provided strategic recommendations to clients across various industries including Technology, Semiconductor, Payments, Banking and Fintech. Arpan holds an MBA in Marketing from Christ University, India, and has a bachelor’s degree in Chemistry from Calcutta University

Like the way we think?

Next time we post something new, we'll send it to your inbox