Published on April 8, 2021 by Avishek Suman

Executive summary

A host of factors are making China’s A-share market attractive to global fund managers, while at the same time, Chinese fund managers are increasingly investing in selected overseas markets for purposes of diversification and stability. Sell-side firms, on the other hand, are looking for ways to ramp up their coverage of the China market, where broker research is still patchy. While the China market poses overwhelming challenges to both global and Chinese sell-side companies, many of them are partnering with reliable third-party research firms so they can quickly scale up research coverage at significantly low cost.

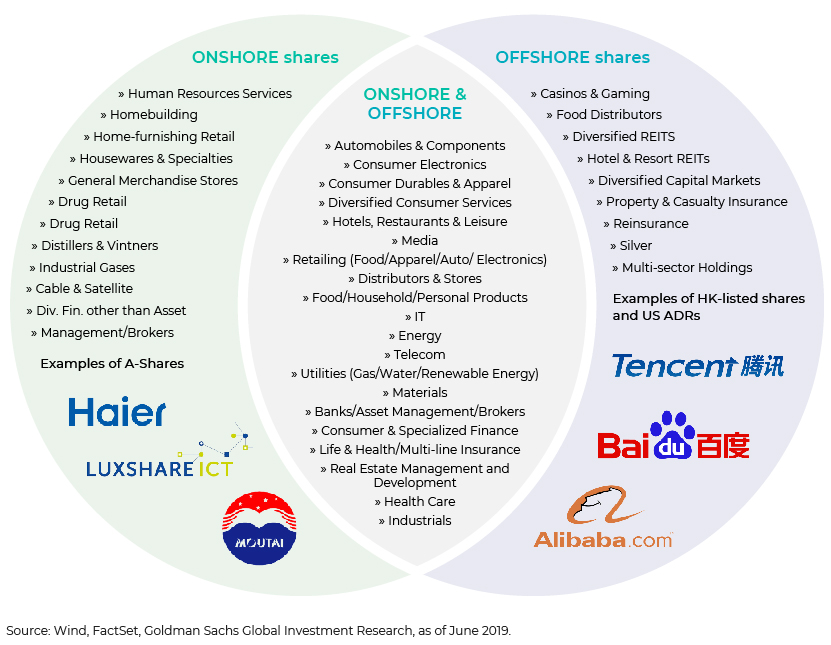

In the pandemic-rattled global economy, China is the only major market posting considerable growth. Chinese equities are available to global investors through various markets, including A shares, H shares and US-listed Chinese stocks. The onshore A-share market represents Chinese companies listed on the domestic Shanghai and Shenzen stock markets and traded in RMB. H shares are Chinese equities listed on the Hong Kong Stock Exchange and traded in Hong King dollars, while there are some Chinese companies listed on US stock exchanges as American depositary receipts (ADRs).

Index-centric portfolio managers are keen on investing in Chinese equities

The MSCI has been accelerating the inclusion of A shares in its Emerging Markets Index, considered to be a benchmark index for global investors seeking emerging-market exposure. Portfolio managers, who design their funds to mimic the index, are looking for ways to invest in A shares. Additionally, A-share markets are becoming increasingly accessible to international investors due to easing regulations in China.

A shares are a must for a complete China play

A shares, the second-largest market in the world, provide the most comprehensive set of Chinese companies to international asset managers through almost 3,800 companies listed on the Shanghai and Shenzhen stock markets. There are only 266 Chinese companies listed in Hong Kong as H shares and 170 in the US. While the offshore markets (H shares and US-listed companies) are heavily skewed towards large-cap old-economy shares, the onshore A-share markets are well diversified, with new-economy shares from various sectors that capture China’s shift from an export-driven economy to one led by consumption. The onshore markets have plenty of options from value-added sectors, including tourism, entertainment and industrial automation.

Chinese fund managers are looking at global stocks in their pursuit of diversification and rationality

While international money managers are showing interest in Chinese stocks, Chinese portfolio managers looking to diversify their portfolios and pursue profitable global themes are increasingly investing in overseas markets, which they believe are more stable and rational. Rhodium Group (an independent research provider) estimates that by the end of 2020, Chinese investors held USD700bn worth of US equities alone.

Chinese institutional investors are allowed to invest in overseas securities through a qualified domestic institutional investor (QDII) scheme if they meet certain criteria. This scheme is subject to individual quotas that the Chinese authorities grant to each participant. The Chinese authorities have been issuing fresh quotas for QDII and may also allow individual investors to invest in overseas stocks subject to a quota of USD50,000 per person a year going forward.

Global sell-side firms, however, are struggling to quickly scale up research coverage for global and Chinese fund managers

More than half the Chinese companies lack research coverage by any sell-side firm. Research coverage of Chinese companies by global sell-side firms is even lower. With growing interest from international investors, global and local sell-side firms are looking for ways to ramp up their research coverage of Chinese companies, although this is not easy.

Many global sell-side firms do not have a presence on the mainland. They lack the internal bandwidth to overcome the language- and regulation-related challenges in China to quickly initiate research on Chinese firms. Establishing a large research team on the mainland is costly and time-consuming, as the analyst pool for bilingual research talent is limited and expensive.

Chinese securities firms also face challenges. Their research output currently targets individual investors, who dominate the A-share markets. To be able to attract the attention of global funds, local securities firms need to overhaul their research teams. They also need to produce the research output in English, for consumption by international fund managers.

Additionally, both global as well as Chinese sell-side firms wanting to serve local fund managers investing overseas would need large teams of smart bilingual analysts who can understand global companies and produce research in the Chinese language.

Forward-looking sell-side firms are leveraging offshore research partners for comprehensive coverage

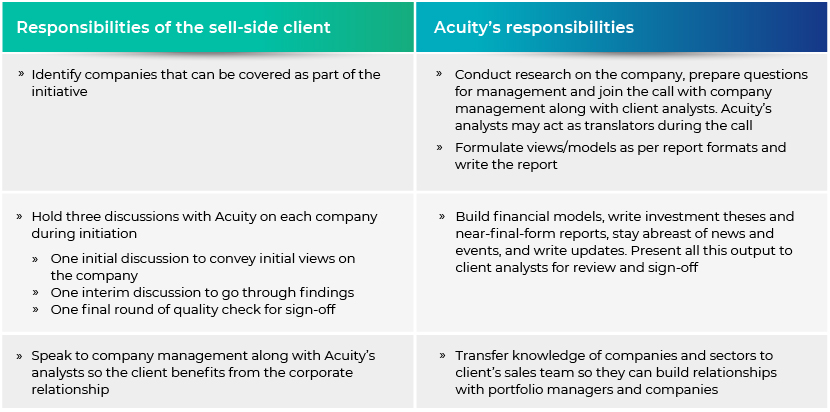

Many sell-side companies are collaborating with credible third-party research firms such as Acuity Knowledge Partners (Acuity) to help them scale up their research coverage of the China market. Such investment banks are able to leverage Acuity’s analyst support for research initiation and coverage without having to add senior analyst headcount to their books. As part of such partnerships, Acuity’s experienced bilingual analysts provide pre-final-form research reports on Chinese companies in English and on global companies in Chinese that can be finalised by lead sector analysts at global client firms. With Acuity taking on the responsibility for producing almost 90% of the research reports, the cost of research coverage expansion is usually a fraction of a client’s in-house costs. Sell-side firms could engage with Acuity through a number of commercial methods, including paying Acuity on an FTE model, i.e., per analyst deployed, or sharing realised revenue with Acuity on a pre-determined ratio.

In such a partnership, the sell-side firm retains its overall thesis, the robustness of the research process and final stock recommendations through a joint responsibility matrix as detailed below.

Acuity has been present in Beijing since 2009 and currently has over 150 analysts (MBAs, CFAs, and accountants), proficient in Mandarin and English. Partnering sell-side firms also utilise Acuity’s institutional knowledge through its experience of serving global buy-side and sell-side firms, its deep domain knowledge of ESG and its data sciences capability to produce differentiated research products and maintain a sustainable edge.

What's your view?

About the Author

Avishek Suman manages the Investment Research business at Acuity Knowledge Partners, Beijing. He has close to 19 years of work experience in research, including 15 years in Acuity Knowledge Partners. Prior to assuming this responsibility in Beijing, Avishek served as Delivery Manager for buy-side and sell-side clients.

Like the way we think?

Next time we post something new, we'll send it to your inbox