Published on August 14, 2024 by Sahil Kumar

Introduction

The past seven months have been a rollercoaster ride for the sugar industry, with the price reaching its highest in five years (USc27.95/lb on 11 November 2023) and then its lowest in 18 months (a c.35% decline to USc18.13/lb six months later on 7 May 2024), according to Bloomberg Sugar No.11 contract data (the global benchmark contract for raw-sugar trading).

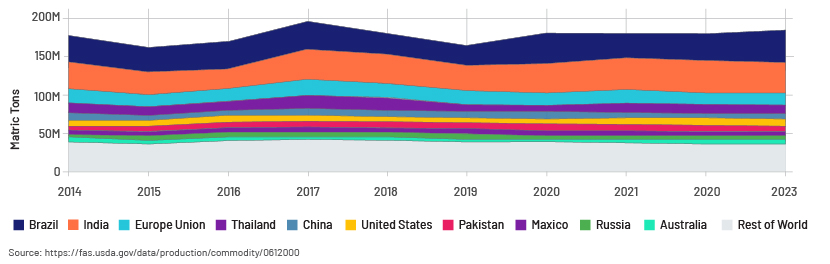

Global sugar production was 183.5m tons in 2023/24, according to the US Department of Agriculture (USDA), with c.62% of the production coming from the top five sugar-producing nations. Brazil, the main producer, accounted for c.25% of global sugar production with 45.54m tons, followed by India accounting for 19% of global sugar production with 34m tons.

Top Producing Countries

| Market | % of Global Production | Total Production (2023/2024, Metric Tons) |

|---|---|---|

| Brazil | 25% | 45.54 Million |

| India | 19% | 34 Million |

| European Union | 8% | 14.99 Million |

| China | 5% | 9.9 Million |

| Thailand | 5% | 8.8 Million |

| United States | 5% | 8.28 Million |

| Pakistan | 4% | 6.66 Million |

| Russia | 4% | 6.6 Million |

| Mexico | 3% | 4.93 Million |

| Australia | 2% | 4.1 Million |

What drove the sugar price to its highest in five years

El Niño had a significant impact on global sugar supply in 2023 as unusually dry weather damaged harvests in India and Thailand, the world’s second- and third-largest sugar exporters, respectively.

The All India Sugar Trade Association in April 2023 reduced India’s sugar production estimates by c.3% for the crop year October 2022 to September 2023, citing unseasonal rainfall in Maharashtra, which accounts for more than one-third of India’s sugar production. This resulted in lower exports from India, impacting global sugar supply. Lower production was aggravated by poor beet crops in Europe, driven by the summer drought and reduced acreage.

In Thailand, El Niño impacted the quality and quantity of harvest. A report by the USDA in October 2023 predicted a 15% dip in Thailand’s output.

All these factors led to a rally in the sugar price to its highest in five years.

Drivers of the decline

The main reason for the decline in price was the expectation of a bumper crop in Brazil. It is projected to produce a record-high 43.1m tons of sugar in 2024/25, primarily because mills are prioritising sugar over ethanol because of the higher margins.

The high sugar price encouraged investment in sugar production capacity, especially in mills in Central-South Brazil, which increased their crystallisation capacity to increase sugar output. This raised global sugar production capacity to more than 200m tons, enough to meet requirements for several years.

Traders’ speculative positions

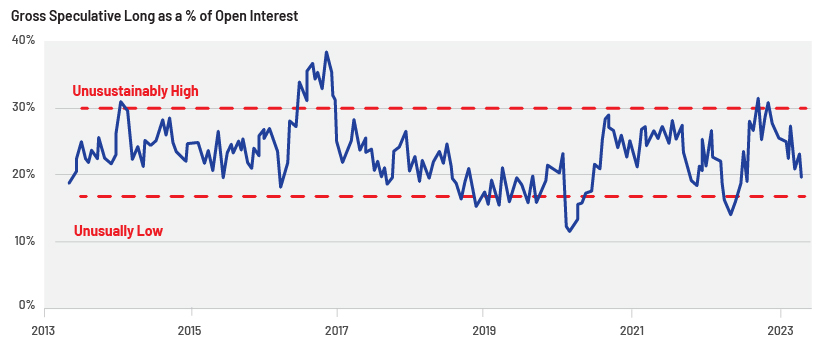

Prices of a number of commodities rallied from mid-2020 to mid-2022 due to pent-up demand amid the pandemic, supply-chain disruptions and Russia’s invasion of Ukraine. Since mid-2022, however, traders decided to remain sideways, and this was the case for sugar as well. The sugar price reflected optimism at the start of 2023, because traders were concerned about the El Niño impact on Asian cane crops, but the price rally lost its momentum after expectations of a bumper crop in Brazil and as the El Niño impact faded.

Sugar demand and supply outlook

Demand: The global sugar market is experiencing stable growth, driven by growing demand in the food and beverage sector for products such as beverages, bakery products and confectionery. Sugar is also used in the pharma sector to add bulk and consistency to medications. The personal care sector is another source of demand as consumers demand natural ingredients that do not harm the skin, e.g., demand for sugar in body scrubs is increasing, as it smooths and moisturises the skin, and reduces signs of ageing.

The International Sugar Organization (ISO) increased its 2023/24 global sugar consumption forecast by 1.786m tons to 182.22m tons and reduced the estimate for global sugar production by 479k tons to 179.27m tons on 13 June 2024. This was mainly due to reduced production estimates from Thailand and India. As a result, it raised its 2023/24 global sugar deficit estimate to 2.95m tons from 689k tons.

Market research company IMARC expects the global sugar market to grow at a 1.4% CAGR from 2024 to 219.2m tons by 2032.

Supply and the significance of sugarcane ethanol: Depending on the price, mills/distilleries allocate sugarcane juice between sugar and ethanol production. Sugarcane ethanol is an alcohol-based fuel, produced by the fermentation of sugarcane juice and molasses. It is a clean, affordable and low-carbon biofuel and has emerged as a leading renewable fuel for the transport sector.

Sugarcane and corn are the two major sources of ethanol produced. Brazilian mills are currently boosting their sugar production, as the price of sugar is higher than the price of ethanol there due to increased corn supply. The price of hydrous ethanol was BRL2,740/m3 on 12 July 2024, according to Bloomberg; using the BRL5.43:USD1 rate, this is USc16.76/lb of sugar equivalent versus the price of sugar of USc19.20/lb.

Brazil is the world’s largest sugarcane ethanol producer and a pioneer in using ethanol as a motor fuel. Since 1976, Brazil’s government has made it mandatory to blend ethanol with gasoline. The lower house approved the “Fuel of the future” bill on 14 March 2024, requiring an increase in ethanol blending from 22% to 27% and to 30% in the future, if technical feasibility is verified. India, the world’s second-largest sugar producer, aims to roll out 20% ethanol-blended gasoline by 2025.

With increasing energy consumption globally, ethanol has a unique preposition, as it combines energy security and a cleaner environment due to reducing carbon emissions. Fortune Business Insights valued the global ethanol market at USD87.71bn in 2022 and expects it to grow at a CAGR of 5.6%, from USD92.48bn in 2023 to USD135.07bn by 2030.

A number of factors impact sugar supply versus ethanol, such as the global sugar price; policies of governments and authorities relating to fossil fuel emissions; the price of oil price, as it determines ethanol pricing; and weather conditions.

Conclusion

The World Bank expects sugar supply from India and Thailand to ease in 2024 as the El Niño effect fades, resulting in price decreases of 3% and 8% in 2024 and 2025, respectively.

The sugar price surged to USc20/lb (the highest in two months) in June 2024, driven by concerns over reduced supply from India in its effort to check domestic inflation. However, it declined in the first week of July as the market expected above-normal monsoon rains in India to boost sugar output. India received 225.7mm of rain until 7 July, according to the Indian Meteorological Department, 2% more than the long-term average of 221.6mm. The Indian Sugar & Bio-energy Manufacturers Association (ISMA) expects India’s 2023/24 sugar reserves at 9.1m tons and a surplus of 3.6m tons. The ISMA urged the government to allow export of surplus sugar, which should ease prices in the export market. Brazil’s robust sugar output is also bearish for the sugar price. Brazil’s sugar production for crop year 2024/25 was up 14.4% y/y at 10.95m tons until the first half of June, according to a 28 June 2024 UNICA report. For the 2023/24 marketing year (April-March), Brazil’s sugar output rose by 25.7% y/y to 42.425m tons (19 April 2024 UNICA report), and Brazil’s crop agency CONAB on 25 April 2024 projected Brazil’s 2024/25 sugar production to increase by 1.3% y/y to 46.292m tons as sugar acreage in Brazil increased by 4.1% to 8.7m hectares (21.5m acres), the most in seven years.

Arguments for a positive outlook

The ISMA on 13 May 2024 reported that India’s 2023/24 (October-April) sugar production fell by 1.6% to 31.4m tons because as of 30 April 2024, 516 sugar mills had closed operations versus 460 mills during the same period last year. Thailand’s sugarcane crops may be damaged by the extreme heat wave there, with sugar mills reporting the lowest yield of crushed sugarcane in the past 13 years. The ISO on 10 June 2024 widened its global 2023/24 sugar deficit estimate to 2.95m tons from an estimated deficit of 689k tons in February 2024. It also raised the estimate for 2023/24 global sugar demand to 182.2m tons from 180.4m tons, driven by higher consumption in India. The USDA, in its bi-annual report on 23 May 2024, expects sugar output in 2024/25 to reach 186.02m tons (+1.4% y/y) and global sugar stock by end-2024/25 to fall to 38.34m tons (-4.7% y/y), the lowest in 13 years.

The market expects normal weather conditions in Brazil for crop year 2024/25, but an unusual weather event could be negative for the expected bumper sugarcane crop and positive for pricing.

How Acuity Knowledge Partners can help

We help clients expand their sector coverage. This support is not only cost-effective but also brings a different perspective and a wealth of knowledge. Our professionally qualified staff (CAs, MBAs, CFAs) provide a wide range of services, including market research, due diligence, financial modelling and analysis, and idea generation, offering our clients a sustainable ecosystem of support.

Source

-

https://www.weforum.org/agenda/2023/11/global-sugar-prices-el-nino/

-

https://www.czapp.com/analyst-insights/how-will-the-drop-in-sugar-price-impact-production/

-

https://www.fortunebusinessinsights.com/industry-reports/ethanol-market-101567

-

Sugar Prices Pressured By Above-Average Monsoon Rain In India (barchart.com)

Tags:

What's your view?

About the Author

Sahil Kumar has around 11 years of experience in equity research. He has been with Acuity Knowledge Partners (Acuity) since February-2020. He currently manages delivery for a buy-side client in the USA, supporting them with their research needs, and covering Financials sectors. Prior to joining Acuity, he worked with JP Morgan Asset and Wealth Management. Sahil Kumar holds a Chartered Account degree from The Institute of Chartered Accountant of India.

Like the way we think?

Next time we post something new, we'll send it to your inbox