Published on September 8, 2020 by Manish Garg

Background

The rapid spread of COVID-19, no less than a “black-swan” event, has brought many leading economies to a standstill, halting global economic growth. Although most countries have similar experiences, the impact on their economies and sectors may vary, depending on how a country responds to this crisis, as we see no international co-ordination that was evident after the 2008-09 global financial crisis.

Amid the overall economic impact, some sectors are hit particularly hard. Real estate is one such sector, affected severely in terms of fewer project launches, lower sales and prices/rents, falling fresh investments, and subdued leasing and transaction activity.

Market dynamics facing the heat

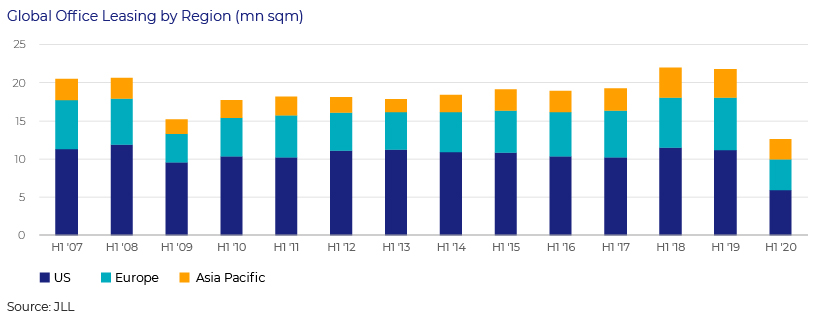

The world has faced several economic headwinds, but unlike previous challenges, this pandemic has had an immediate and larger effect on commercial real estate (CRE) markets and investment activity, although the effects have varied by region and asset type. Amid the ongoing uncertainty, re-negotiation of tenancy contracts has become a widespread challenge. Many prospective tenants have shelved their leasing requirements or expansion plans, reducing take-up across the board. For example, global office gross leasing volumes dropped by over 40% to 12.6m sqm1 (the lowest, at least since 2007) in the first half of 2020, compared to the first half of 2019.

While office, retail and hotel assets have faced extensive disruptions, the industrial sector has shown some resilience thanks to online buying and the continued supply of essential items. The global vacancy rate for industrial assets tipped up marginally to 8.2%1 in 2Q 2020 (slightly up for the US at 5.5%1, down for Europe at 4.7%1 and up for Asia Pacific at 13.5%1). Rentals for US industrial assets have remained largely unchanged from the start of 2020.

Transactions plummeting

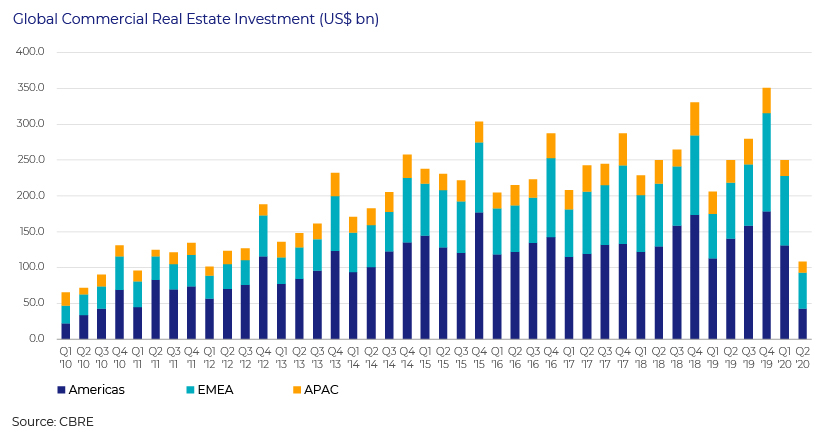

Investment deal activities have been pushed back as key decision makers were unable to visit property sites and perform due diligence amid the ongoing travel restrictions. Global investment volume fell by c.57% y/y to c.USD108bn2 in 2Q 2020, the lowest quarterly total since 2Q 2012, due to increased uncertainty and valuation concerns.

All set to recover

With unprecedented global damage, the global economy is in imminent danger of contraction in 2020. Global GDP is estimated to contract by 2.4% in 2020 before it rebounds to 5.9% growth next year, as per S&P Global forecasts. The markets are likely to open up gradually as governments lift restrictions, but it will likely be a tightrope walk to recovery in the short term.

Vacancy rates are likely to rise globally in the near term, although these could be offset by limited new supply (especially in the form of less speculative developments). Rising vacancy rates will have a bearing on property prices and rentals this year, before they start to recover some of their lost ground in 2021. Once travel restrictions are eased and on-site meetings resume, transaction activity is likely to pick up, albeit with safer investment criteria in place.

Trophy assets (in prime locations) and fully occupied properties with stable rental income are expected to attract attention.

The industrial/logistics real estate market, which remained healthier relative to other property types amid the outbreak, is expected to trade well with the growing trend of online shopping. Amazons recent lease agreement for a large NYC warehouse space highlights the continued demand for industrial properties.

Retail and hotel real estate are also gradually opening up, but with limited footfall and lower occupancy. The near-term outlook for retail real estate remains uncertain, as the ongoing social-distancing measures may limit recovery of operators and retailers. The hospitality sector, too, is not expected to return to full normalcy in the near term. Thus, unlike other commercial properties, retail and hotel properties may take longer to recover.

Healthy liquidity and ultralow interest rates to support the recovery

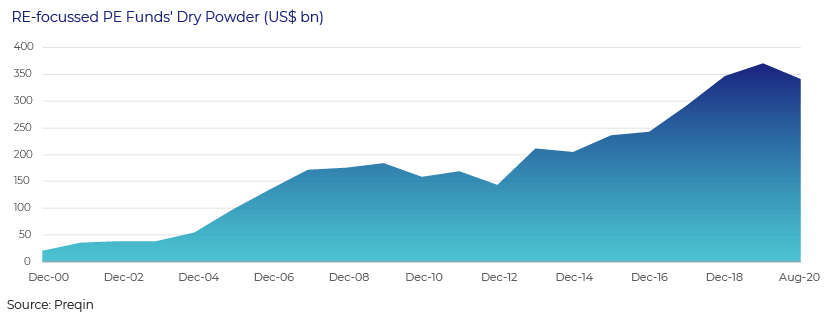

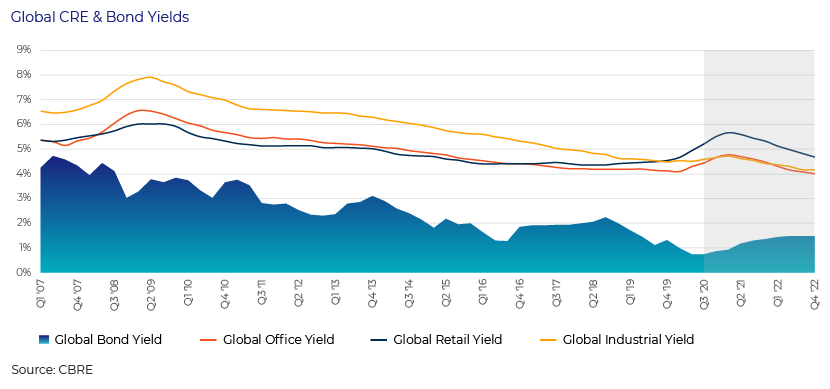

Liquidity, also known as dry powder, in the hands of real estate-focused private equity funds is at near-peak levels, at least since 2000 (at c.USD340bn3 as of 10 August 2020), and waiting to capitalise on the opportunities. In addition, lending activity is not likely to be halted (unlike after the 2008 global financial crisis), although it may become slightly more conservative (lowering loan-to-value ratios). This, coupled with low interest rates (as a result of monetary stimulus), would ensure capital flow to the CRE market. Global bond yields are likely to stay at historically low levels amid this ultralow interest rate scenario, making CRE look more appealing to prospective investors

While different geographies will recover and grow at different rates, well-positioned markets with global prominence and strong fundamentals are likely to lead the recovery in investment activity. For example, London, a global city with an ideal investment scenario and solid track record, has historically been a safe haven for foreign investors. It has proved its resilience post-Brexit as well.

How Acuity Knowledge Partners can help

Our deep domain knowledge and extensive research and analytics capabilities in the real estate sector enable clients to leverage our vast resource pool to increase their bandwidth and focus on high value-add and decision-making tasks. With years of experience across the investment lifecycle and all property types, we have established best practices and are fully equipped to handle all labour-intensive, yet critical, client tasks.

For more details on our real estate solutions, click here.

Sources:

1JLL Global Real Estate Research Aug 2020

3Preqin

https://www.us.jll.com/en/trends-and-insights/research/global/gmp/office

General Google searches

Tags:

What's your view?

About the Author

Manish has over 13 years of experience in financial and investment research, with a focus on real estate and distress debt strategies. He holds extensive experience in managing real estate investment projects across the deal pipeline spanning opportunity screening, due diligence support, portfolio monitoring and ad-hoc research projects. He has played an important role in setting up the real estate delivery teams at Acuity. His core areas of work include account management, client relationship, maintaining control over quality and timeliness of team projects.

His previous experience includes working with a commodity research firm and a real estate thematic fund, where he primarily focussed on..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox