Published on September 13, 2021 by Anurag and Harshvinder Kaur Anand

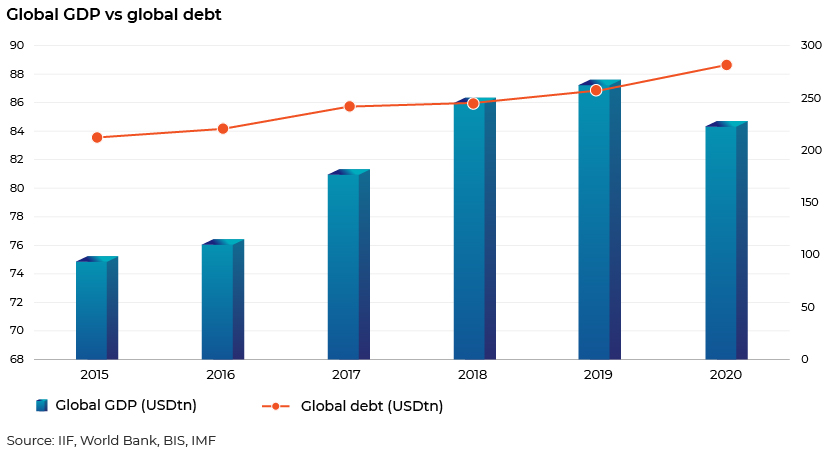

The pandemic has driven the global economy to an unsustainable debt situation, a likely “fourth wave” of debt accumulation. Around USD24tn was added to global debt in 2020, according to the Institute of International Finance's (IIF’s) global debt monitor, taking it to USD281tn compared to USD257tn in 2019. The global debt-to-GDP ratio surged 35% to over 355% in 2020, exceeding pre-pandemic levels. Although more than half of this increase is attributable to government support programmes, global firms added USD5.4tn, banks USD3.9tn and households USD2.6tn.

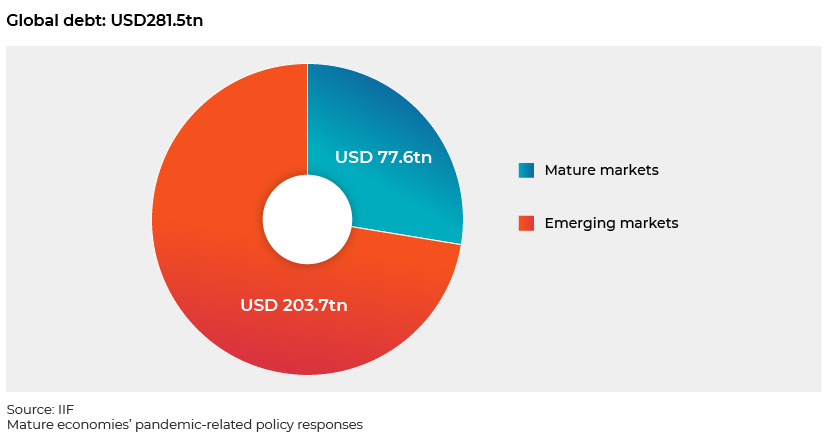

Mature-market debt was at its highest at USD203.7tn at end-2020, according to an IIF report, while emerging-market debt stood at USD77.7tn.

US

The US’s fiscal response was unrivalled; it launched a number of programmes from April to June 2020 to assist households and businesses. The initiatives include the Coronavirus Aid, Relief, and Economic Security (CARES) Act, Coronavirus Preparedness & Response Supplemental Appropriations Act, Paycheck Protection Program (PPP) and Health Care Enhancement Act. An additional USD868bn (c.4.1% of GDP) coronavirus relief and government funding bill was signed by the president as part of the Consolidated Appropriations Act of 2021 to help provide unemployment benefits, another round of PPP loans, resources for vaccines, testing and tracing and funding for K-12 education.

The combined effect of such measures, coupled with a depressed economy, increased the federal deficit by about USD2tn, resulting in a record budget deficit of USD3.1tn for FY20. Overall US output was estimated to fall by 3.6% in 2020, but recover to 3.5% in 2021 (source: World Bank, Global Economic Prospects 2021).

Euro area

The euro-area economies responded through automatic stabilisers and discretionary action such as budgetary and liquidity measures. Initially, most member states (Germany, France, Italy and Spain) rolled out fiscal emergency packages to protect firms and workers amid the lockdowns, providing adequate public healthcare facilities and support for household income. The UK was the worst hit in the second quarter of FY20, when GDP fell by 19.5%. Growth in the euro area contracted by 7.4% in 2020.

Debt was elevated particularly in Greece, Spain, the UK and Canada. Switzerland was the only mature market to record a decline in its debt ratio, according to the IIF's country analysis.

Global debt and global debt to GDP in 2021

Global debt rose by USD1.7tn to an estimated USD289tn during the first quarter of 2021, according to IIF records. This was due to mature-market debt dropping USD2.3tn to below USD203tn. Indebtedness across emerging economies marked a slight increase of over USD86tn, largely due to fiscal constraint.

Regardless of this decline, global debt has increased by USD30tn since the end of FY19; it is now estimated at USD288tn. Mature economies have accounted for two-thirds of the rise, driven mainly by government spending. Global debt to GDP has continued to rise, given the sluggish economic activity.

Is the global economy recovering in 2021?

The global recovery depends largely on each nation’s pace of vaccination, the amalgamation of low- and middle-income economies with major economic blocs and governments’ and central banks’ ability to provide fiscal and monetary stimulus.

Access to vaccination in many emerging and developing economies is slow, and this leads to virus mutation and further lockdowns, delaying economic recovery. Central banks injecting more money in such a scenario is supportive, but this increases the debt burden.

Emerging economies, therefore, are facing more challenges than mature ones. With mature economies’ recovery rates improving, interest rates are rising, increasing the cost of borrowing for low-income and emerging economies.

The Organisation for Economic Co-operation and Development (OECD) recently raised its forecast for global output growth to 5.8%, from 5.6%, and expects economic growth of 4.2% in 2021, noting that although the global economy is recovering, the pace of recovery is uneven.

Growth in the US and China has picked up momentum, with economic activity close to pre-pandemic levels owing to high vaccination rates and a drop in infections. Growth in the euro area is forecast to reach pre-pandemic levels by next year, with growth projected at 4.3% in 2022 and 4.4% in 2023. This would depend on increased fiscal support and external demand, particularly from the US. The Spring 2021 Economic Forecast projects that unemployment in the euro area will decline by 2022.

How Acuity Knowledge Partners can help:

We support global and regional commercial banks and investment banks with constant and granular monitoring of their portfolios. Our analysts (MBAs, chartered accountants, CFAs), working from our delivery centres in India, Sri Lanka and Costa Rica, function as an extension of client teams and provide support on portfolio-monitoring activities in the credit space. This includes financial modelling and valuation, financial spreading, covenant monitoring, extrapolating bankruptcy threshold triggers, providing refined early warning signals (negative news support), credit ratings, customised credit reports, short-term outlook, and a host of other value-added research involving art-of-the-craft IT solutions. All credit solutions are customised to reflect a client’s proprietary and differentiated analysis, giving the client a unique sustainable edge.

Sources:

https://www.imf.org/en/Topics/imf-and-covid19/Policy-Responses-to-COVID-19

https://www.oecd.org/economic-outlook/may-2021/

https://www.iif.com/Portals/0/Files/content/Global%20Debt%20Monitor_Feb2021_vf.pdf

https://www.stlouisfed.org/on-the-economy/2020/december/financing-response-covid19

What's your view?

About the Authors

Anurag has over 13 years of experience in the financial services and banking domains in managing commercial credit portfolios and writing reports such as thematic credit, credit rating, annual review and counterparty risk reports. His key responsibilities at Acuity include managing a credit portfolio for a US-based regional bank. Prior to joining Acuity in 2019, Anurag worked as a manager with a large US bank.

Harshvinder is a credit analyst with 5+ years of experience in financial analysis, research and covenant monitoring. Her key responsibilities at Acuity include financial analysis and covenant monitoring for a regional US bank. Prior to joining Acuity in 2021, Harshvinder worked as a risk analyst for a large third-party service provider.

Like the way we think?

Next time we post something new, we'll send it to your inbox