Published on March 4, 2024 by Avishek Suman

Executive summary

International investors are looking to invest in Japan as the country undergoes long-awaited transformation. Its equity market is booming while the government’s efforts to streamline corporate governance practices should continue to attract global investors. Japan is still a challenging market for global money managers, who would need reliable partners to provide research solutions to navigate it.

After years of sluggish performance, Japanese stocks are finally soaring

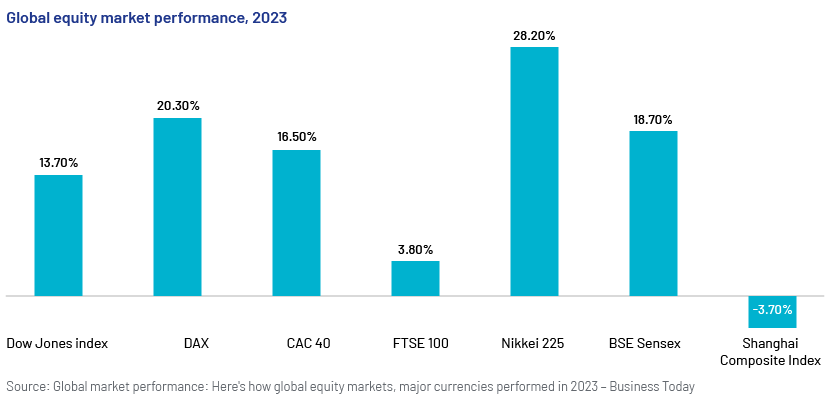

On 9 February 2024, Japan’s benchmark index, the Nikkei 225, breached the 37,000 mark, hitting the 34-year high reached in 1990. In 2023, the Nikkei 225 returned 28%, beating the S&P 500’s stellar return of 24% over the period. The Nikkei 225’s rally has continued in 2024, and the all-time high of 38,195 that it reached in 1989 is within striking distance.

A host of factors combine to make Japan’s stock market attractive

Years of negative interest rates in Japan have pushed household savings into stocks. More importantly, the Japanese yen has depreciated significantly compared with other major foreign currencies, making Japanese equities cheaper for foreign investors. A cheaper yen has also benefited export-oriented Japanese companies. Total net profits of listed Japanese manufacturers grew more than 20% y/y from April to December 2023. All these factors bode well for the Japanese stock market given that the country’s GDP continues to grow.

Japan’s push for corporate governance is also attracting global investors

Japan is also putting in place a robust framework for corporate governance that promises to benefit shareholders significantly. All listed companies trading at a price-to-book value of less than 1 may face the risk of delisting by 2026, since the regulators believe that the low ratio indicates inefficiency in allocating capital. This should push these companies to increase dividends and share buybacks. The framework also attacks Japan’s infamous cross-shareholding, which is often blamed for obstructing reform and yielding poor stock returns. Cross-ownership reduced to around 8% of total equity in March 2023 from around 12% in March 2015, according to a report by Fidelity. The country is encouraging companies to improve carbon disclosures so as to enhance its ESG ratings. The framework also mandates for better diversity and independence of corporate boards. Japan aims to have at least one woman on a company board by 2025 and for women to constitute 30% of the boards of its largest companies by 2030. It mandates that independent directors account for a third of the boards of listed companies, in an effort to protect shareholder interests.

Such actions are already attracting foreign investors: international investors invested a net USD10bn in Japanese stocks in the first three weeks of January 2024.

Japan is still a difficult market and presents unique challenges

Despite the positives, the Japanese market is still challenging for global investors. Years of sluggish performance have forced sell-side analysts to drop coverage of Japanese companies. Only half of the listed Japanese companies have sell-side research coverage, compared with almost 99% coverage of S&P 500 companies. In addition, any research coverage is limited to the large companies in Japan, and research coverage of the smaller companies is poor. Additionally, complex shareholding, inadequate disclosure and management that is generally considered to be unfriendly to shareholders make international investors looking to invest in Japanese stocks wary. Language-related barriers also make it difficult for global investors to analyse Japanese companies for the purpose of investment.

How Acuity Knowledge Partners can help

Global investment banks and asset managers leverage our sector-specific experience to rapidly increase internal analyst bandwidth and expand coverage. We set up dedicated teams of analysts (CAs, MBAs, CFAs) with Japanese-language skills to support our clients on a wide range of activities including idea generation, financial analysis, thematic research, building databases and providing regular sector coverage. Each output is customised, based on the client’s requirement, and made available for their exclusive use. This ensures our clients a unique, sustainable edge.

Sources:

Tags:

What's your view?

About the Author

Avishek Suman manages the Investment Research business at Acuity Knowledge Partners, Beijing. He has close to 19 years of work experience in research, including 15 years in Acuity Knowledge Partners. Prior to assuming this responsibility in Beijing, Avishek served as Delivery Manager for buy-side and sell-side clients.

Like the way we think?

Next time we post something new, we'll send it to your inbox