Published on December 18, 2024 by Sreeja Roy Chowdhury , Debarati Dutta , Mahesh Agrawal , Jenil Mehta , Archana Anumula and Somya Dixit

Global market overview

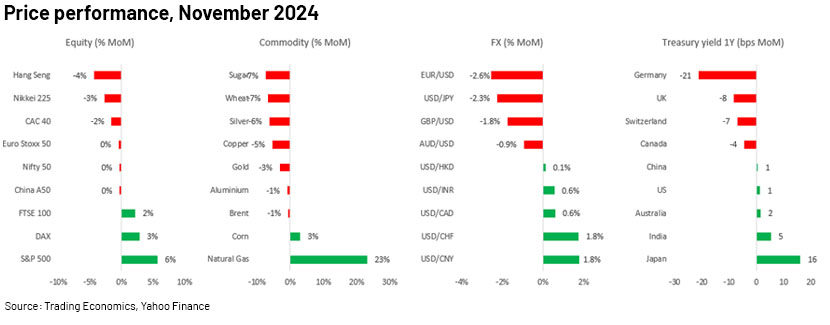

Donald Trump’s victory in the US presidential election provided fresh impetus to the US equity market, with the S&P500 outperforming major global indices in November. This is a key highlight in global market insights for the month. The European market also traded positively last month, while Asia traded in the red on concerns of protectionist policies in the US next year.

The positive trend could continue in 2025 if earnings meet expectations, but risks are skewed to the downside if new policies disappoint investors, potentially impacting the US economic outlook and overall global sentiment. For the oil market, OPEC has again postponed plans for increasing supply due to demand concerns. The oil market risks spilling into a deeper surplus as and when OPEC decides to raise production. Expectations of colder weather in the US pushed natural gas prices higher by around 23% last month, although inventories are comfortably high, and a reasonable demand increment should be easily met. Precious metals could continue the positive run next year as trade frictions and geopolitical concerns keep investment flowing to safe-haven assets.

The USD extended its gains in November, as Trump's policies are seen as inflationary for next year, which could push the Fed to keep rates higher. This development plays a significant role in shaping the US economic outlook for 2025. The longer end of the US yield curve tightened last month, reflecting expectations of higher rates. Meanwhile, inflation continues to soften in the UK, affirming the Bank of England’s (BoE’s) rate-cut stance, which helped push the GBP lower last month. For the EUR, the yield path remains uncertain, with fears looming of a sovereign debt crisis in certain countries, including in France and Spain. In the FX market, threats of a tariff war and geopolitical concerns in the Middle East and Europe could keep demand strong for safer currencies, including the CHF, JPY and USD, to some extent.

Charts for the month

Equity market

-

Review: The US and European markets recovered last month while the Asian markets continued to retreat. Trump's victory in the US was broadly seen as positive for the US market, as local investments could pick up. President-elect Trump was quite vocal about the growth of local industries during his campaign, and expectations are that the new administration’s policies could be beneficial to US companies. On the other hand, Trump has pledged to impose a 10% import tariff on Chinese goods and a 25% import tariff on goods from Canada and Mexico; this weighed on Asian markets last month. Meanwhile, the earnings season is underway, and the US has reported steady growth over 3Q24. S&P500 companies reported 8.2% y/y profit growth[1] and 5.1% y/y growth in overall sales, according to data from Oppenheimer Asset Management. The technology and healthcare sectors outperformed in 3Q24, while energy, industrial and materials lagged. In India, earnings have been relatively disappointing, maintaining pressure on the Nifty 50.

-

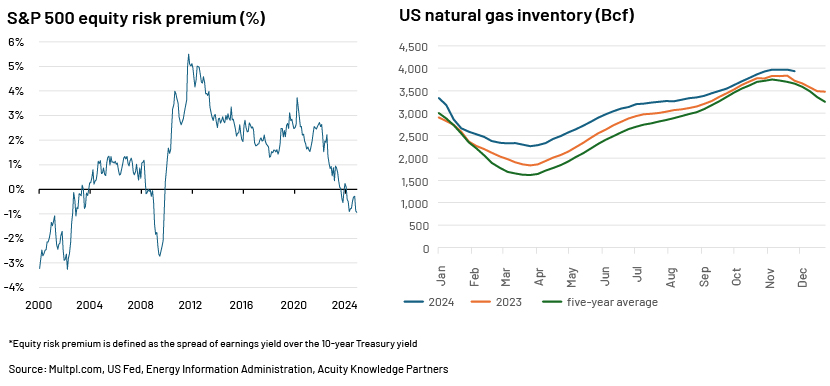

Outlook: With the earnings season nearly over, the focus could shift back to the macro economy and political sentiment in the short term. The US economy could be a major focus as the market speculates the quantum of rate cuts, depending on the US economic scenario. Earnings growth in the US has been healthy this year, but market valuation appears to be discounting even higher growth (as also seen through negative equity risk premium in the US, defined as the spread of earnings yield over the longer-term Treasury yield), and risks would be skewed to the downside if the new administration disappoints on investment-friendly policies. In Europe, discounts against US peers have been high as European equities lagged due to trade war-related concerns, lower sales growth in local markets and fiscal consolidation in major European countries. Consensus on European equities is for 8% profitability growth in 2025, which could be challenging to achieve due to political uncertainty, although some of the sectors, including defence and technology, could outperform. Reasonable rate cuts by the European Central Bank (ECB) could lower the financing cost for companies so they could achieve profitability even if sales growth underperforms. For Asia, higher demand from the US was a primary factor for profitability growth in some markets, including India. Trade restrictions could have positive and negative impacts on selected sectors, although overall, these could be broadly negative for market valuation. Policy support in China to increase economic growth could boost sentiment, although this may have to compete against higher tariffs from the US.

Commodities market

-

Review: US natural gas prices reported substantial gains last month, with front-month Henry Hub futures rallying over 23% m/m as expectations of colder weather supported the demand outlook, while lower-than-expected storage in the US raised supply concerns. In addition, geopolitical tensions between Russia and Ukraine broadly supported natural gas prices as peak demand season approached. In precious metals, gold and silver prices fell over 3.2% and 6.3%, respectively, last month, weighed down by the strength in the USD and Treasury yields. Industrial metals also remained under pressure as expected due to heightened uncertainty after the US presidential election, given their sensitivity to trade dynamics and industrial demand. In agri-commodities, sugar prices fell sharply, by 7.4% m/m, in November on estimates of a shrinking global supply deficit. Hopes of a narrowing deficit in the sugar market largely overshadowed the unfavourable weather conditions in top producing countries (Brazil and India), impacting sugar production.

-

Outlook: Precious metals may remain under pressure this month. Trump’s victory in the 2024 US presidential election leaves market participants expecting more dramatic policy and economic changes as the new administration takes charge. Industrial metals are also expected to underperform following the seasonal demand lull and continued uncertainty over trade dynamics. In contrast, energy markets may receive short-term support due to the possibility of stricter enforcement of sanctions against Iran. Meanwhile, OPEC+ members' recent decision to extend their additional voluntary supply cuts of 2.2m b/d by a further three months would also support prices. However, in the medium to longer term, a Trump victory could be more bearish for oil due to higher domestic production, trade and foreign policy.

FX market

-

Review: Global FX currency movements were driven largely by the US election for most of November. The Republican win in the US played a significant role in USD strength in post-election market reactions. The USD rally remained predominant for most of the month. Although the USD retreated slightly due to the CPI inflation release (broadly in line with expectations), the USD stabilised by the end of November as market focus turned towards economic data (personal consumption expenditure picked up) and Fed Chair Powell’s speech prior to the December meeting, to get cues on further policy movement by the Fed. The JPY weakened to a three-month low, with the USDJPY climbing close to 155. The weakness largely reflected the US election results, changes to the Bank of Japan’s (BoJ’s) monetary policy stance and continued global political uncertainty. The Tokyo CPI inflation print came in strong, reaffirming market expectations of possible rate hikes and trimming some loss in JPY sell-offs by end-November. The EUR came under pressure from expectations of tariff hikes by the newly elected US administration and a likely collapse of the French government. The BoE lowered its policy rates as expected in November. The GBP reached its lowest in three months as inflation momentum continued to ease, reaffirming expectations of further cuts by the BoE in the near term. Emerging-market FX was more volatile, with markets turning bearish due to anticipation of new tariffs and trade threats by the Trump administration. The Reserve Bank of India’s (RBI’s) governor signalled support for the currency as the INR reached record lows during the month, touching 84 against the USD. The South Korean currency took a steep fall after a surprise cut by the Bank of Korea (BoK). In Russia, the rouble weakened against the USD beyond 110, prompting the authorities to announce a pause in FX currency buying to stabilise volatility in its financial markets.

-

Outlook: The markets await Fed Chair Powell’s speech in early December to get cues on the course of monetary policy. The BoJ and financial authorities in China continue to warn investors about the weakening JPY and remain firm on intervention if required. Inflationary pressures and rising import costs may prompt earlier rate hikes by the BoJ to support the JPY. In the UK, the GBP could see pressure if markets price in more rate cuts by the BoE as inflation eases. The EUR is likely to see further sell-off ahead of the ECB’s December meeting, anticipating another rate cut. Trump’s recent threat to impose a 100% tariff on BRICS nations has increased market qualm as the BRICS nations consider agreeing on a new currency for trade other than the USD.

Debt market

-

Review: In November, the US election was the main focus, with the results having the expected effect on the bond market, causing a significant increase in Treasury bond yields. The confirmation of a Republican sweep led to long-duration rates rising as much as 20bps. After the election-related spike, yields remained range-bound overall, with nothing significant emerging in terms of economic data and the FOMC slashing rates by 25bps as anticipated. The US election results led to a steepening of the yield curve in Europe, with tariff hikes now becoming imminent. Notably, political upheavals in Germany and France took centre stage in November. The collapse of the German government sent European bond yields to multi-week lows. The German 10y bund yield fell 30bps from end-October. Expectations of the French government’s collapse increased in November, leading to the OAT-BUND spread widening more than 85bps. Prolonged instability in the French government led to threats of a no-confidence vote in the passage of the 2025 budget. In the UK, 10y gilt yields continued to march higher since the budget announcement in October. In Japan, JGB yields rose (the 2y yield rose 14.9bps from end-October) in reaction to the US election results and BoJ Governor Ueda’s hawkish stance on the back of a weaker JPY.

-

Outlook: With the expectation of higher tariffs, stricter immigration policy and tax cuts under the Trump administration, yields are expected to rise. Political turmoil will likely continue to affect core European countries. French debt risk premium had already fallen after the government’s collapse at the time of writing this report. The yield path remains uncertain, with fears of a sovereign debt crisis looming. In Japan, JGB yields are expected to rise, and investors now expect a rate hike in December owing to a higher-than-expected inflation print.

Key data releases:

| Major macro indicators | Country | Release date | Consensus (actual) | Previous |

| CPI (% y/y, November, final) | US | 11-Dec-24 | 2.7% | 2.6% |

| Eurozone | 18-Dec-24 | 2.3% | 2.0% | |

| UK | 18-Dec-24 | - | 2.3% | |

| China | 09-Dec-24 | 0.5% | 0.3% | |

| Japan | 20-Dec-24 | - | 2.3% | |

| Manufacturing PMI (Index, December, flash) | US | 16-Dec-24 | - | 49.7 |

| Eurozone | 16-Dec-24 | - | 45.2 | |

| UK | 16-Dec-24 | - | 48.0 | |

| China | 31-Dec-24 | - | 50.3 | |

| Japan | 16-Dec-24 | - | 49.0 | |

| Retail sales (% m/m, November) | US | 17-Dec-24 | - | 0.4% |

| Eurozone* | 05-Dec-24 | (-0.5) | 0.5% | |

| UK | 23-Dec-24 | - | -0.7% | |

| China^ | 16-Dec-24 | - | 4.8% | |

| Japan | 28-Dec-24 | - | 0.1% | |

| GDP (% q/q, 3Q, final estimate) | US | 19-Dec-24 | 2.8% | 3.0% |

| Eurozone | 06-Dec-24 | (0.4) | 0.2% | |

| UK | 23-Dec-24 | 0.1% | 0.5% | |

| Japan | 09-Dec-24 | 0.2% | 0.7% | |

| Policy rate decisions (%, December) | US | 19-Dec-24 | - | 4.750% |

| Eurozone | 12-Dec-24 | 3.15% | 3.40% | |

| UK | 19-Dec-24 | - | 4.75% | |

| China** | 20-Dec-24 | - | 3.10% | |

| Japan | 19-Dec-24 | 0.50% | 0.25% | |

| Major events due in December | ||||

| Virtual ministerial meeting | OPEC+ | 05-Dec-24 | ||

| Fed Chair Powell’s speech at NYT event | US | 05-Dec-24 | ||

| Annual CEWC meeting | China | 11-12 Dec 24 | ||

| BoJ meeting minutes for December | Japan | 24-Dec-24 | ||

Notes: *October release; ^% y/y; #final release; **1y LPR. Dates are reported in IST (UTC+05:30)

Source: National Statistical Offices, central banks, Trading Economics

How Acuity Knowledge Partners can help

Our large pool of macro experts is experienced in providing research and strategic support across the value chain. We have partnered with macro research firms, global investment banks, asset management firms and hedge funds over the years, working closely with their research, strategy and investment teams to provide them with the information and analysis required in the investment decision-making process, ensuring they stay informed about the global economic outlook.

We also provide tech-enabled data-management solutions and modelling and analytics services covering macroeconomics, FX and commodities forecasts [Macro Economic Research, FX and Commodities Analysis | Acuity Knowledge Partners (acuitykp.com)].

[1] S&P 500 Companies' Quarterly Earnings Tracking 8.2% Higher Year Over Year, Oppenheimer Says

Tags:

What's your view?

About the Authors

Sreeja has over 5 years of experience in economics and equity research. She has been with Acuity Knowledge Partners (Acuity) since 2018, providing sell-side research support to a global investment bank. At Acuity, she is part of the Cross-Asset Research Support team, specializing in macroeconomics research, high-frequency data tracking and financial modelling. Prior to joining Acuity, she worked as an equity research analyst with Zacks Research. Sreeja holds a Master of Science (Economics) from the University of Calcutta, India.

A postgraduate in Economics with over 7 years of experience in economic research. Currently at Acuity Knowledge Partners, is Delivery Manager, supporting a leading investment bank specializing in macroeconomics research. Responsibilities broadly involve analyzing country-specific macroeconomic data, tracking macro indicator releases and their evolution. Debarati holds a Master of Arts (Economics) from Madras Christian College (Autonomous), India and Bachelor of Science (Economics) from the University of Calcutta, India.

Mahesh has over 14 years of experience in commodity and macroeconomic research and has been associated with Acuity Knowledge Partners (Acuity) since September 2012. At Acuity, he supports a leading European investment bank’s commodity research desk in analysing commodity markets, preparing research notes and creating presentations for conferences and client interactions. Mahesh holds a master’s degree in Science (Energy Trading) from the University of Petroleum and Energy Studies, Gurugram, and a Bachelor of Science from Bikaner University, Bikaner.

Jenil Mehta is part of the Specialized Solution team at Acuity Knowledge Partner. He is part of a team of Asian equity derivatives strategists at one of the leading Japanese investment banks. He contributes to highlighting and publishing trade ideas, bespoke reports, and idea back testing based on fundamental and quantitative analysis. Before working here, he was a fixed-income derivatives trader and research analyst for North American and Brazilian markets. Jenil holds a bachelor’s degree in computer engineering and has passed all three CFA Levels.

Archana has over 16 years of experience in economics research, with proficiency in areas such as writing country-specific economic reports, real-time macroeconomic indicator release coverage and building and maintenance of large datasets. She has been with Acuity Knowledge Partners since 2011 and currently manages the Macroeconomics Research teams for two top-tier global firms. She is responsible for hiring, client engagement and account management. She is also in charge of business development for the Macroeconomics Research sub-vertical under Quantitative Services. Archana holds a Master of Arts (Economics) from St Joseph‘s College (Autonomous), India and a Bachelor of Commerce from Bangalore University, India.

A management postgraduate with over 12 years of experience in the Commodities Market. Well conversant with the fundamental aspects, inter-market relationships and Geo-political issues impacting the market. Currently at Acuity Knowledge Partners as Delivery Manager responsible for providing market analysis and assisting the client in preparing research analysis for the commodities (Energy, Metals & Agri). Well-acquainted with the use of data sources such as Thomson Reuters and Bloomberg. Somya holds a postgraduate degree in finance and a bachelor's degree in electronics engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox