Published on August 14, 2024 by Sreeja Roy Chowdhury , Debarati Dutta , Mahesh Agrawal , Jenil Mehta , Archana Anumula and Somya Dixit

Global market overview

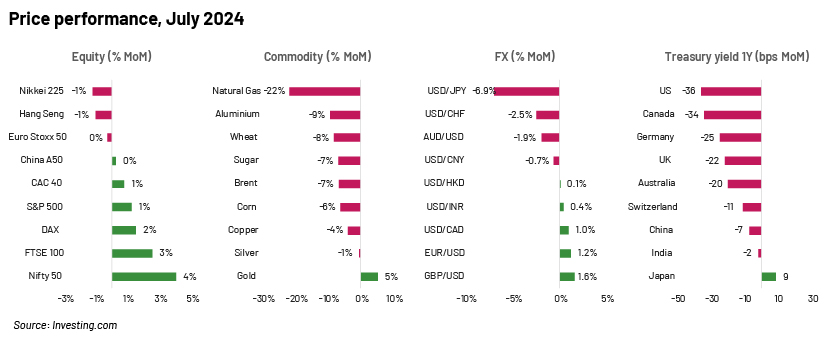

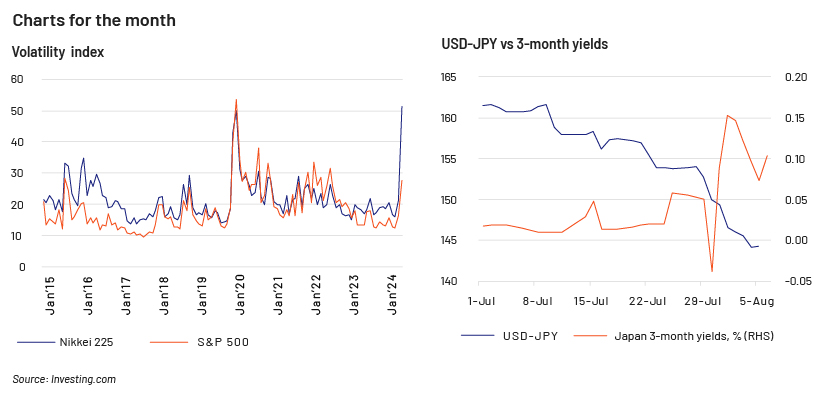

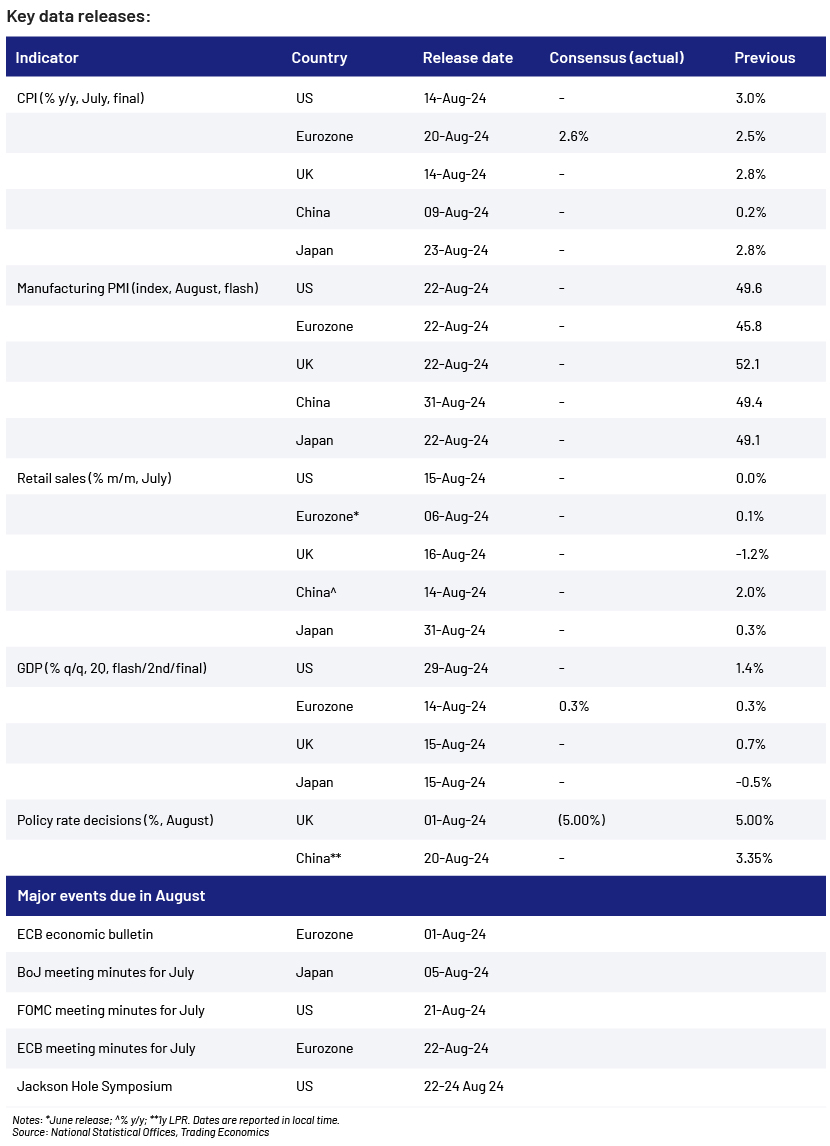

Global equity markets have turned highly volatile since the start of the month as uncertainty over central bank decisions on interest rates takes centre stage. The recent move by Japan to raise the benchmark interest rate started the unwinding of the JPY carry trade, which quickly reverberated through the equity market. Higher interest rates and concerns of a tech slowdown pushed the Nikkei down to around 30,000 this month before it recovered to around 35,000 as of the time of writing. Similar moves were seen in commodity markets, where energy and industrial metals faced a sell-off due to concerns of a global economic slowdown. Higher volatility is likely to remain in the near term due to geopolitical tensions in the Middle East, the fair amount of uncertainty surrounding the US Federal Reserve’s (Fed’s) decisions and a focus on short-term economic data.

The JPY has appreciated sharply against the USD this month, after the Bank of Japan (BoJ) raised interest rates to 0.25% from 0-0.1%. Weaker economic data from the US, including the employment report, has weighed further on the USD as the probability of a rate cut at the Fed’s September meeting increases significantly. The CME FedWatch currently indicates a 100% probability of a rate cut at the September meeting, with a 62.5% probability of a larger 50bps cut. Other central banks could follow the Fed if economic sentiment remains low and concerns of a recession intensify.

Equity market

Review: Global equities experienced increasing volatility in July, making it a mixed month for global markets. Major indices such as the SPX, NDX, Nikkei 225 (NKY) and SOX reached new highs but also faced significant corrections. Sector rotation emerged as the major theme, with small-cap indices performing strongly. This was influenced by the AI theme losing momentum, expectations of Fed rate cuts and positive forward guidance from tech companies for earnings growth. As a result, growth stocks and small-cap indices were rerated, as evidenced by the Russell 2000 rising 10% m/m while the NDX declined -1.5% m/m. Japan saw a similar pattern, with the NKY peaking before correcting up to -7%. A hawkish BoJ stance and a tech stock correction contributed to the NKY's decline after its historic run. India stood out among Asian indices, gaining 4% m/m and continuing its seasonality trend, where July has been positive in 9 of the past 10 years. This growth was driven by India’s budget, which emphasised capex, fiscal prudence and employment-boosting policies, attracting both DII and FII inflow. Overall, while some markets corrected, others showed resilience, highlighting the varying impact of sector rotations, fiscal policies and economic expectations on global equities.

Early-August sell-off: In the US, corporate earnings guidance from major tech companies was weaker than the market expected. The US non-farm payroll (NFP) report and ISM manufacturing index came in weak, triggering concerns of a recession. Markets were caught off guard, resulting in a risk-off move in equities. The S&P 500 (SPX) was down 6.8% m/m, and the Nasdaq 100 (NDX) dropped 11.7% m/m. The USD/JPY downside saw a 600-pips move, creating a chain reaction that capitulated the JPY carry trade, leading to JPY appreciation. This hurt the earnings momentum of companies with USD exposure and heightened concerns of a recession. As a result, the NKY experienced its biggest daily drop since 1987, closing approximately 12.5% lower.

-

Outlook: Investors should focus on risk-off moves continuing due to a slowdown in the US economy, rerating of tech stocks and JPY appreciation. They should also watch the US presidential landscape, especially with Vice President Kamala Harris joining the race after President Joe Biden dropped out of the upcoming election. Additionally, they should be cautious due to the tensions re-emerging on the back of the escalating Israel-Hamas conflict. Another key focus would be on policy support from the Chinese government, which could help undervalued Chinese indices take the main stage.

Commodities market

-

Review: The performance of the commodity complex remained mixed last month, with energy prices falling the most, followed by industrial metals. In contrast, precious metals performed well on heightened geopolitical tensions, strong purchases by Asian central banks and rising expectations of interest rate cuts in the US. In energy, US natural gas prices turned out to be the biggest loser, with the most active Henry Hub futures declining by almost 22% m/m in July, following unfavourable weather conditions, increasing storage levels and higher output levels. Recent Energy Information Association (EIA) storage data showed that total US storage totalled 3.25tcf as of 1 August 2024, 15.7% more than the five-year average. Meanwhile, crude oil also ended lower last month, following persistent concerns surrounding demand, especially from China, and higher supply estimates from major producers globally. Turning to base metals, the most-awaited Politburo meeting in China somewhat downplayed market hopes of more support for the advanced industrial sectors. Meanwhile, refined production of base metals is also rising in China, following the ongoing smelting capacity expansions, while domestic demand remains subdued, adding pressure to the metals complex. In agri commodities, grain prices extended the weakness. A recent report by the International Grains Council (IGC) raised global grain production estimates from 2,312mt to 2,321mt for the 2024/25 season. Additionally, favourable weather conditions in the US pushed grain prices lower last month.

-

Early-August sell-off: The commodities complex came under immense pressure at the start of August as a weaker-than-expected US jobs report released in the first week of the month suggested that the US economy is slowing more rapidly than expected, raising concerns of a recession. Commodities have been unable to escape the broader sell-off in risk assets, with prices falling to multi-month lows at the beginning of the month. Crude oil prices were seen trading at around USD75/bbl (the lowest since February) while copper fell to trade just above USD8,700/t (the lowest since March) as of 5 August 2024. Meanwhile, concerns surrounding demand from China, along with exchange inventories sitting at comfortable levels, have also been weighing on prices lately. In precious metals, silver declined more than 4.5% while gold (usually a safe haven during such uncertainty) fell more than 1.3% on an intraday basis as of 5 August 2024, amid likely liquidation to cover margin calls on other assets.

-

Outlook: Industrial metals could remain under pressure in the near term. The main headwind for metals would be China, where subdued manufacturing and a grim housing market would continue to reduce market participants’ confidence. New concerns seem to be emerging about a hard landing for the US economy, which could further weigh on risk assets. Meanwhile, crude oil will likely continue to extend its weakness, primarily on prolonged concerns surrounding demand from China and rising concerns of a recession in the US. However, heightened geopolitical tensions in the Middle East, with Israel bracing for an attack from Iran and regional militias, could keep a cap on the downside. In contrast, we believe gold should regain its footing amid the geopolitical uncertainty and expectations of Fed interest rate cuts.

FX market

-

Review: The USDJPY currency pair was fairly volatile in July, with strong movements seen in both the JPY and the USD; the JPY surged around 7% against the USD. Three main factors determined the USDJPY in the month – intervention by the Japanese authorities to support the JPY, the BoJ’s policy rate hike and the Fed policy meeting. At the July FOMC meeting, although the Fed continued to signal that policy decisions will be data-dependent, Chair Powell mentioned that a September cut “could be on the table”, leading the USD to weaken. The GBP shot up in July, after the election results, and was later buoyed by market reaction to higher inflation in June, speculating against a broadly anticipated rate cut in August. The AUDUSD currency pair lost steam, falling to its lowest level since January 2024, on the back of slightly lower core inflation, triggering market expectation that the Reserve Bank of Australia (RBA) will avoid a further rate hike. While the EUR was slightly weak, given the European Central Bank’s (ECB’s) switch to easing monetary policy ahead of the Fed and the Bank of England (BoE), the EURUSD remained broadly higher (about 1% over June), supported by a softer USD. In emerging economies, China’s surprise rate cuts in July had little impact on the CNY; the CNY remained largely muted against the USD. Elsewhere in the region, the Brazilian government’s fiscal deficit worries and policies, along with the challenges faced by the central bank, continued to put pressure on the Brazilian real (BRL), which weakened further in July.

-

Early-August sell-off: The USD sold off at the beginning of August, after a softer employment report, coupled with a weak ISM manufacturing print, triggered concerns of a recession in the US. Due to USD losses and hawkish BoJ policy meeting minutes, the JPY gained further – the USDJPY slid more than 1% on 5 August 2024. The GBP slid after an August rate cut. The markets are pricing in more rate cuts this year, even as the BoE signals that further action would be data-dependent. The CNY gained strength against an already-weak USD as the central bank intervened to fix the currency at a higher mid-point. Hit by the global equity sell-off, the Indian rupee (INR) slid to an all-time low of 84.1 on 5 August 2024, even as the Reserve Bank of India (RBI) sold USD to support the currency.

-

Outlook: The USD’s path will likely remain broadly data-dependent in the coming months, given a Fed cut in September is largely priced in by the markets. The JPY would remain exposed to intervention by the authorities, both on the FX and monetary policy fronts, for further support against the USD. The EUR will likely be weighed down by expectations of two more rate cuts by the ECB this year. The RBA’s policy meeting in August would be watched closely, as a data-driven decision could reverse market expectations of an earlier hike. The Brazilian Central Bank (BCB) may consider its policy decision, depending on heightened weakness in the currency. Political unrest in the Middle East remains a key driver in the global markets, as sentiment turns negative due to a possible Iran-Israel war.

Debt market

-

Review: In the US, yields slipped in July as markets repriced a Republican victory after a change in the Democratic presidential candidate to Vice President Kamala Harris. In India, the 10-year bond yield dropped in July, after the fiscal deficit target was reduced to 4.9% of GDP from 5.1% announced in the interim budget. In Europe, the OAT-bund spread remained elevated as France remained unsuccessful in stabilising formation of government.

-

Early-August sell-off: The 10-year US Treasury yield dropped after an unexpected weak employment report intensified concerns about the US economy slowing and its implications for global growth. In addition, the FOMC kept rates unchanged at the latest policy meeting but suggested a possible rate cut in September, which pushed yields even lower. The impact of soft US data spilled over to Europe, pushing German 10-year bund yields to their lowest since December 2023. In the UK, the BoE delivered a 25bps rate cut, as expected. UK bonds rallied, and the markets now price in more cuts in 2024. In Japan, bond yields fell sharply as the BoJ delivered a rate hike and concerns of a recession in the US took centre stage. Notably, the large drop in the Nikkei index led to a bond rally as investors rushed to the safe haven.

-

Outlook: Markets have significantly increased expectations of policy easing by the major central banks. Yields are expected to remain low in the US, with the markets now pricing in an aggressive easing cycle in 2024. Political uncertainty will likely continue to weigh on Europe along with the impact of a possible economic slowdown in the US and expectations of two more rate cuts by the ECB in 2024, driving yields lower. JGBs are likely to face upside risks in the event of a faster BoJ hiking cycle.

How Acuity Knowledge Partners can help

Our large pool of macro experts are experienced in providing research and strategic support across the value chain. We have partnered with macro research firms, global investment banks, asset management firms and hedge funds over the years, working closely with their research, strategy and investment teams to provide them with the information and analysis required in the investment decision-making process.

We also provide tech-enabled data management solutions and modelling and analytics services covering macroeconomics, FX and commodities forecasts [Macro Economic Research, FX and Commodities Analysis | Acuity Knowledge Partners (acuitykp.com)].

Tags:

What's your view?

About the Authors

Sreeja has over 5 years of experience in economics and equity research. She has been with Acuity Knowledge Partners (Acuity) since 2018, providing sell-side research support to a global investment bank. At Acuity, she is part of the Cross-Asset Research Support team, specializing in macroeconomics research, high-frequency data tracking and financial modelling. Prior to joining Acuity, she worked as an equity research analyst with Zacks Research. Sreeja holds a Master of Science (Economics) from the University of Calcutta, India.

A postgraduate in Economics with over 7 years of experience in economic research. Currently at Acuity Knowledge Partners, is Delivery Manager, supporting a leading investment bank specializing in macroeconomics research. Responsibilities broadly involve analyzing country-specific macroeconomic data, tracking macro indicator releases and their evolution. Debarati holds a Master of Arts (Economics) from Madras Christian College (Autonomous), India and Bachelor of Science (Economics) from the University of Calcutta, India.

Mahesh has over 14 years of experience in commodity and macroeconomic research and has been associated with Acuity Knowledge Partners (Acuity) since September 2012. At Acuity, he supports a leading European investment bank’s commodity research desk in analysing commodity markets, preparing research notes and creating presentations for conferences and client interactions. Mahesh holds a master’s degree in Science (Energy Trading) from the University of Petroleum and Energy Studies, Gurugram, and a Bachelor of Science from Bikaner University, Bikaner.

Jenil Mehta is part of the Specialized Solution team at Acuity Knowledge Partner. He is part of a team of Asian equity derivatives strategists at one of the leading Japanese investment banks. He contributes to highlighting and publishing trade ideas, bespoke reports, and idea back testing based on fundamental and quantitative analysis. Before working here, he was a fixed-income derivatives trader and research analyst for North American and Brazilian markets. Jenil holds a bachelor’s degree in computer engineering and has passed all three CFA Levels.

Archana has over 16 years of experience in economics research, with proficiency in areas such as writing country-specific economic reports, real-time macroeconomic indicator release coverage and building and maintenance of large datasets. She has been with Acuity Knowledge Partners since 2011 and currently manages the Macroeconomics Research teams for two top-tier global firms. She is responsible for hiring, client engagement and account management. She is also in charge of business development for the Macroeconomics Research sub-vertical under Quantitative Services. Archana holds a Master of Arts (Economics) from St Joseph‘s College (Autonomous), India and a Bachelor of Commerce from Bangalore University, India.

A management postgraduate with over 12 years of experience in the Commodities Market. Well conversant with the fundamental aspects, inter-market relationships and Geo-political issues impacting the market. Currently at Acuity Knowledge Partners as Delivery Manager responsible for providing market analysis and assisting the client in preparing research analysis for the commodities (Energy, Metals & Agri). Well-acquainted with the use of data sources such as Thomson Reuters and Bloomberg. Somya holds a postgraduate degree in finance and a bachelor's degree in electronics engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox