Published on July 11, 2024 by Sreeja Roy Chowdhury , Debarati Dutta , Mahesh Agrawal , Jenil Mehta , Archana Anumula and Somya Dixit

Global market overview

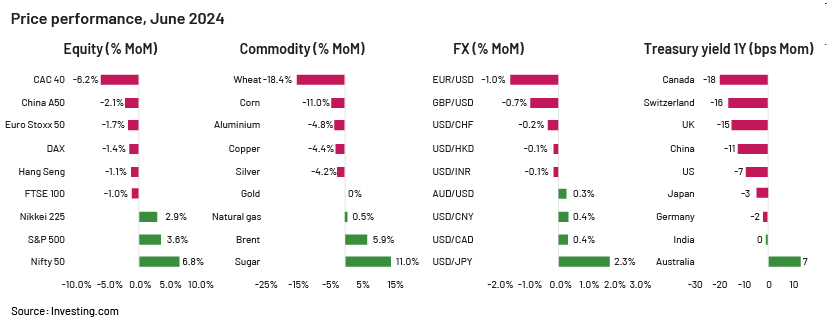

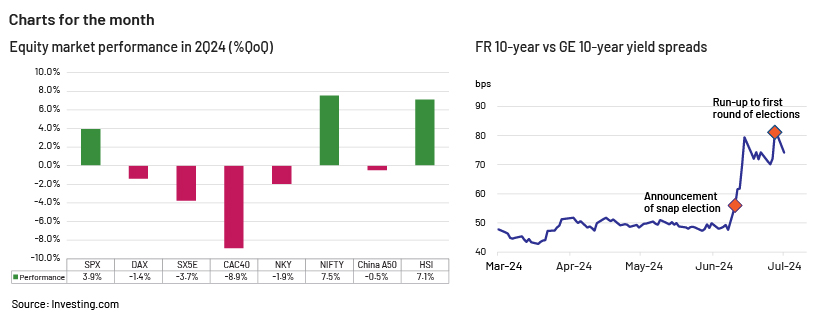

Election-related uncertainty was a major driver of equity-market prices in June 2024. The European market traded negatively on such uncertainty in France and the UK while the Indian market rebounded strongly on the back of the current government’s third term in power. Elections in Europe, presidential elections in the US and ongoing geopolitical tensions could keep both equity and commodity markets volatile over the coming months. Gold could see higher investment flows as interest rate cuts are implemented; however, central-bank purchases could slow, keeping gold prices stable.

French government bonds weakened significantly in June, after the announcement of a snap election. Debt investment moved towards safer German bonds, increasing their premium to other European bonds. The timing of the US rate cuts remains debatable and could keep US Treasury yields elevated, at least in the near term. The JPY was one of the worst performers last month, with the USDJPY rising above 160, increasing the likelihood of the Bank of Japan (BoJ) intervening in the market to support the JPY and the local economy over the coming weeks. The USD traded strongly against the EUR and the GBP due to election-related uncertainty in Europe. The European Central Bank maintains its stance of easy monetary policy, which may continue to pressure the EUR for the rest of the year.

Equity market

-

Review: Sentiment towards global equities was mixed in June. In the Eurozone, increasing risk due to the upcoming elections in France, where the ruling party faces a tough fight from the National Rally and the New Popular Front (NPF), led to declines. As a result, the CAC 40 fell by 6.2% m/m, with major Eurozone indices also adjusting due to the heightened election-related risk. Conversely, in India, the National Democratic Alliance (NDA) secured its third term, forming a coalition government and maintaining policy continuity with a focus on fiscal prudence. Investors rewarded this stability, with the Nifty 50 rallying by 6.8% over the month. In the US, the rally continued to be led by the tech sector, with the NASDAQ gaining 6.3% m/m in June.

-

Outlook: Looking ahead, investors will likely focus on developments relating to the French elections. Attention would also be on the Indian budget, to be presented at the end of July. In the US, there is speculation about whether the tech rally is losing steam, especially with NVIDIA losing nearly 12% from its all-time highs. Additionally, investors could monitor geopolitical themes, particularly the tariff wars in the auto sector between the West and China that continue to impact the global supply-chain landscape.

Commodities market

-

Review: In agri commodities, the performance of grains was the worst in June, with wheat and corn trading on the Chicago Board of Trade (CBOT) falling over 18% m/m and 11% m/m, respectively. Expectations of better supplies, favourable weather conditions and higher inventories in the major producing nations have been weighing on prices. Meanwhile, in other commodities, crude oil performed better following the OPEC+ announcement to extend additional voluntary supply cuts into 3Q24, leaving the market in a deficit in 3Q. The group, in its monthly update, also expects global oil demand to grow by 2.25m b/d in 2024 and by a further 1.85m b/d in 2025. In contrast, industrial metals underperformed last month, following higher refined output from China, sluggish demand and seasonally-higher-than-usual exchange inventories.

-

Outlook: Crude oil prices could continue to witness a recovery in July, as the oil balance sheet will remain tight and lower inventories would also support the upward rally. In precious metals, gold prices are expected to remain stable amid the ongoing geopolitical uncertainty. In its mid-year outlook, the World Gold Council (WGC) expects gold to remain range-bound over the second half of 2024. It expects falling interest rates in the developed markets to continue supporting gold prices as more investment flows to gold as an inflation hedge. Meanwhile, industrial metals could continue to trade sideways, primarily due to not-so-impressive fundamentals.

FX market

-

Review: In June, the JPY weakened further to a 38-year low, with the USDJPY crossing the psychological 160 level. The weakness has triggered Japanese authorities to signal the likelihood of intervention to control the falling currency and support the economy. The USD slid slightly on softer personal consumption expenditure (PCE) inflation data but inched higher after the first US presidential debate (held on 28 June) as markets assessed former President Trump won the debate with President Biden. The INR strengthened somewhat on a dip in the USD but retracted later in the month, remaining broadly balanced, as the Reserve Bank of India remains vigilant about volatility and focused on maintaining the currency’s stability. The EUR depreciated against the USD during the month on political uncertainty, ahead of France’s surprise snap elections in early July. The GBP strengthened closer to the elections, on expectations that the Labour Party would gain victory, as suggested by opinion polls.

-

Outlook: The French elections and related political uncertainty will likely keep movement in the EUR in check. With the UK general election scheduled for 4 July, the GBP is likely to see some volatility during the month. To curb JPY weakness, the BoJ’s monetary policy meeting in July will be a key event for the markets.

Debt market

Review: Political uncertainty took centre stage in Europe in June due to the sudden snap parliamentary elections announced by President Macron in France. French bonds witnessed a massive sell-off, with the OAT-bund spread the widest since the European debt crisis. This had a contagion effect on other European bonds. The spread between Italian and German 10-year bonds widened more than 150bps. In the UK, the gilts market seems unfazed by opinion polls suggesting a Labour Party victory. The muted reaction could be due to markets disclosing Britain’s daunting fiscal deficit situation, with limited options for any government. Nonetheless, short-term bond yields fell in June in anticipation of a rate cut rather than due to political uncertainty. In the US, 2-year and 10-year Treasury yields remained elevated as of end-June as the PCE price index showed a gain for May. On the political front, the US presidential debate also led to yields marching higher, with the odds of a Trump administration gaining ground. In India, IGBs were included in the JP Morgan EM Bond Index in June as anticipated. In Japan, JGBs witnessed a sell-off amid a sharp depreciation in the JPY, with markets now expecting the BoJ to hike rates in July.

Outlook: Political ambiguity will likely continue to weigh on Europe. In addition to France’s already high debt, the National Rally gaining an absolute majority becoming more likely after the first round could lead to further widening of the OATs spreads. In the UK, markets will likely watch for May inflation data, which would better indicate the Bank of England’s stance at the August meeting. US yields are expected to remain elevated given strong economic fundamentals, leading to a less aggressive easing cycle. In India, the inclusion of IGBs in the JP Morgan EM Bond Index is expected to result in a substantial amount of foreign capital inflow. JGB yields are likely to remain under upward pressure, driven by the BoJ’s rate-hiking path and plan for gradual quantitative tightening.

Key data releases:

| Indicator | Country | Release date | Consensus (actual) | Previous |

| CPI (% y/y, June, final) | US | 11-Jul-24 | - | 3.3% |

| Eurozone | 17-Jul-24 | - | 2.6% | |

| UK | 17-Jul-24 | - | 2.0% | |

| China | 10-Jul-24 | - | 0.3% | |

| Japan | 18-Jul-24 | - | 2.8% | |

| Manufacturing PMI (Index, July, flash) | US | 24-Jul-24 | - | 51.6 |

| Eurozone | 24-Jul-24 | - | 45.8 | |

| UK | 24-Jul-24 | - | 50.9 | |

| China | 31-Jul-24 | - | 49.5 | |

| Japan | 24-Jul-24 | - | 50.0 | |

| Retail sales (% m/m, June) | US | 16-Jul-24 | - | 0.1% |

| Eurozone* | 4-Jul-24 | 0.2% | -0.5% | |

| UK | 19-Jul-24 | - | 2.9% | |

| China^ | 15-Jul-24 | - | 3.7% | |

| Japan | 31-Jul-24 | - | 0.3% | |

| GDP (% q/q, 2Q, flash) | US | 25-Jul-24 | - | 1.4% |

| Eurozone | 30-Jul-24 | - | 0.3% | |

| China# | 15-Jul-24 | - | 1.6% | |

| Policy rate decisions (%, July) | US | 31-Jul-24 | - | 5.50% |

| Eurozone | 18-Jul-24 | - | 4.25% | |

| China** | 22-Jul-24 | - | 3.45% | |

| Japan | 31-Jul-24 | - | 0.10% | |

| Major events due in July | ||||

| ECB Forum on Central Banking, Sintra | Eurozone | 1-3 Jul 24 | ||

| FOMC minutes for June | US | 3-Jul-24 | ||

| ECB meeting minutes for June | Eurozone | 3-Jul-24 | ||

| General election | UK | 4-Jul-24 | ||

| Parliamentary election (2nd round) | France | 7-Jul-24 | ||

| BoJ quarterly outlook report | Japan | 31-Jul-24 | ||

Note: *May release; ^% y/y; **1y LPR; #Final release. Dates are reported in local time zone

Source: National Statistical Offices, Trading Economics

How Acuity Knowledge Partners can help

Our large pool of macro experts are experienced in providing research and strategic support across the value chain. We have partnered with macro research firms, global investment banks, asset management firms and hedge funds over the years, working closely with their research, strategy and investment teams to provide them with the information and analysis required in the investment decision-making process.

We also provide tech-enabled data management solutions and modelling and analytics services covering macroeconomics, FX and commodities forecasts [Macro Economic Research, FX and Commodities Analysis | Acuity Knowledge Partners (acuitykp.com)].

What's your view?

About the Authors

Sreeja has over 5 years of experience in economics and equity research. She has been with Acuity Knowledge Partners (Acuity) since 2018, providing sell-side research support to a global investment bank. At Acuity, she is part of the Cross-Asset Research Support team, specializing in macroeconomics research, high-frequency data tracking and financial modelling. Prior to joining Acuity, she worked as an equity research analyst with Zacks Research. Sreeja holds a Master of Science (Economics) from the University of Calcutta, India.

A postgraduate in Economics with over 7 years of experience in economic research. Currently at Acuity Knowledge Partners, is Delivery Manager, supporting a leading investment bank specializing in macroeconomics research. Responsibilities broadly involve analyzing country-specific macroeconomic data, tracking macro indicator releases and their evolution. Debarati holds a Master of Arts (Economics) from Madras Christian College (Autonomous), India and Bachelor of Science (Economics) from the University of Calcutta, India.

Mahesh has over 14 years of experience in commodity and macroeconomic research and has been associated with Acuity Knowledge Partners (Acuity) since September 2012. At Acuity, he supports a leading European investment bank’s commodity research desk in analysing commodity markets, preparing research notes and creating presentations for conferences and client interactions. Mahesh holds a master’s degree in Science (Energy Trading) from the University of Petroleum and Energy Studies, Gurugram, and a Bachelor of Science from Bikaner University, Bikaner.

Jenil Mehta is part of the Specialized Solution team at Acuity Knowledge Partner. He is part of a team of Asian equity derivatives strategists at one of the leading Japanese investment banks. He contributes to highlighting and publishing trade ideas, bespoke reports, and idea back testing based on fundamental and quantitative analysis. Before working here, he was a fixed-income derivatives trader and research analyst for North American and Brazilian markets. Jenil holds a bachelor’s degree in computer engineering and has passed all three CFA Levels.

Archana has over 16 years of experience in economics research, with proficiency in areas such as writing country-specific economic reports, real-time macroeconomic indicator release coverage and building and maintenance of large datasets. She has been with Acuity Knowledge Partners since 2011 and currently manages the Macroeconomics Research teams for two top-tier global firms. She is responsible for hiring, client engagement and account management. She is also in charge of business development for the Macroeconomics Research sub-vertical under Quantitative Services. Archana holds a Master of Arts (Economics) from St Joseph‘s College (Autonomous), India and a Bachelor of Commerce from Bangalore University, India.

A management postgraduate with over 12 years of experience in the Commodities Market. Well conversant with the fundamental aspects, inter-market relationships and Geo-political issues impacting the market. Currently at Acuity Knowledge Partners as Delivery Manager responsible for providing market analysis and assisting the client in preparing research analysis for the commodities (Energy, Metals & Agri). Well-acquainted with the use of data sources such as Thomson Reuters and Bloomberg. Somya holds a postgraduate degree in finance and a bachelor's degree in electronics engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox