Published on June 17, 2024 by Sreeja Roy Chowdhury , Debarati Dutta , Mahesh Agrawal , Jenil Mehta , Archana Anumula and Somya Dixit

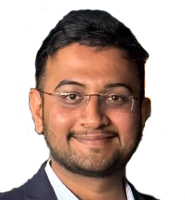

Price performance, May 2024

Global market overview

The equity market rebounded sharply in May as higher earnings and expectations of rate cuts in Europe and the US buoyed market sentiment. Asian markets were largely muted on account of election uncertainty in India, concerns of an economic slowdown in China and a rate hike in Japan. Among commodities, crude oil traded weak last month as demand concerns continued to weigh on prices even as the Organization of the Petroleum Exporting Countries and its allies (OPEC+) maintained production cuts. Gold could continue to trade volatile due to a fair amount of uncertainty on rate cuts and tensions in the Middle East, although the broader trend remains positive.

The USD softened against major currencies last month on subdued inflation, weaker manufacturing data and soft economic activity. The European Central Bank (ECB) and the Bank of Canada (BoC) have started to cut rates; this could offer some support to the USD in the coming months if the US Federal Reserve (Fed) maintains its rates. The election announcement in the UK is likely to keep the GBP volatile this month. Yields in the US remain elevated as rate-cut expectations ease, and the market is pricing in fewer cuts than initially estimated. The ECB made one rate cut but did not provide guidance on further action.

Charts for the month

Source: Investing.com

Equity market

-

Review: May was a positive month for global equities, marked by significant rallies in major indices across the US, Europe and the UK. US tech stocks were the standout performers, with the Nasdaq climbing 6.4%; the S&P 500 also gained around 5% for the month. This surge in positive sentiment was driven by a dovish monetary policy outlook and strong earnings results. In the US, the earnings season is nearly complete, with almost 78% of the companies reporting better-than-expected results. The EPS growth rate is at 5.9% for the quarter, the highest growth y/y since 1Q 2022. The “Magnificent Seven” stocks, especially Nvidia, were key contributors to earnings growth. The European market also rallied strongly on expectations of a rate cut. On the other hand, the Indian equity market was largely stable on account of election-related uncertainty.

-

Outlook: Market participants are likely to focus on changing sentiment towards the Fed's outlook. Attention will also be on the upcoming UK elections and the ECB’s decisions at its future meetings. In emerging markets, investors will likely closely follow policy decisions and assess whether supportive policies will continue. They are also likely to monitor geopolitical themes that continue to impact the global supply-chain landscape.

Commodities market

-

Review: Crude oil remained the worst performer, with prices falling over 7% m/m in May, primarily due to a broader risk-off move after the latest Fed minutes supported the higher-for-longer narrative when it comes to monetary policy. Meanwhile, oil prices weakened further, with the market somewhat disappointed with OPEC+'s latest plans to gradually ease supply cuts from the fourth quarter until end-September 2025. In contrast, natural gas prices in the US jumped sharply as supportive weather conditions raised demand prospects. Meanwhile, the return of all three trains at the Freeport liquefied natural gas (LNG) export facility further supported demand for natural gas in the US. In metals, gold prices broke above USD2,400/oz last month and reached new highs as softer US data raised expectations of rate cuts while strong central-bank purchases also supported the price gains. Meanwhile, London Metal Exchange (LME) copper prices surged to record highs, driven largely by speculative buying in the market. However, prices gave back some of the gains towards the end of the month, as short-term fundamentals were not supportive and exchange inventories continue to hover at higher levels.

-

Outlook: Gold prices will likely continue to trade volatile amid mixed expectations for US interest rate cuts while geopolitical uncertainty supports prices at lower levels. Industrial metals could continue to trade sideways due to higher refined output from China, sluggish demand and seasonally higher-than-usual exchange inventories. Meanwhile, crude oil prices may witness some recovery over the coming weeks, as the oil balance sheet is expected to tighten over the third quarter of the year, following the latest decision by OPEC+ to extend output cuts.

FX market

-

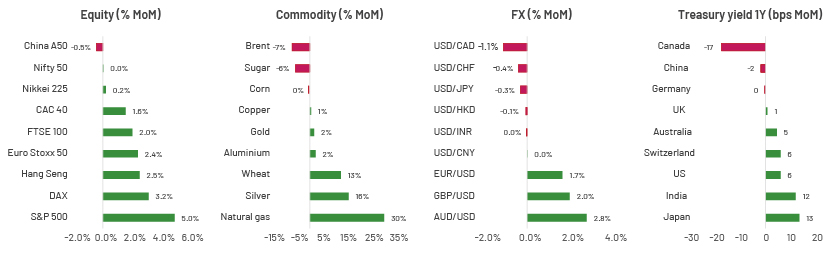

Review: After traders going long the USD in April, May saw some dips in the currency. Data outcomes during the month – subdued inflation events, weak manufacturing data and a decline in construction spending – resulted in a relatively weak USD. Despite intervention by the Japanese authorities in the markets during May, the JPY strengthened temporarily and the USDJPY currency pair sustained its high levels (>150). The INR reached a two-month high by end-May, amid mixed movement in the USD. While the currency saw some volatility on the days of the exit polls and election results, it stabilised eventually. The GBPUSD reached a two-month high on a surprise announcement of a snap election by PM Rishi Sunak and held steady against the USD. The AUDUSD had mixed reactions from higher-than-expected inflation and concerns over an economic slowdown in the country; overall, the currency ended stronger in May. The Indonesian government intends to continue intervening in the markets to support the rupiah. The Canadian dollar saw sell-offs after the BoC cut rates, well before the Fed. The EURUSD rallied significantly due to a relatively weak USD in the last week of May. The currency held steady ahead of the ECB meeting, as markets had priced in a cut at the June meeting. However, the EUR shot up after the ECB meeting, driven by a lack of forward guidance on further rate cuts.

-

Outlook: The USD will likely continue to rally and hold its position, as interest rates are expected to stay high and as differentials between the ECB and BoC widen. The People’s Bank of China (PBoC) will likely maintain a soft position on the CNY. For the JPY, the Japanese authorities will likely intervene again to try to alleviate import inflation. The Bank of Japan (BoJ) meeting in June is crucial. The GBP will likely remain steady against the USD, as the focus will mainly be on the elections in July and less on the central-bank decision. The Bank of England (BoE) is unlikely to make a policy move in the run-up to the elections.

Debt market

-

Review: US 10y Treasury yields remained elevated in May, reaching a four-week high on 30 May owing to a weak debt auction. Minneapolis Fed President Kashkari’s comment that it should take more months of positive data for the Fed to cut rates contributed to the rally. In India, the 10y yield fell to a one-year low in May owing to a surplus dividend transfer by the Reserve Bank of India (RBI) to the government. Indian Government Bonds (IGBs) reacted negatively to the election results on 4 June, which were in sharp contrast to market expectations and exit-poll predictions. IGB yields initially surged intraday but eventually stabilised as markets came to terms with the election results. The ECB cut rates on 6 June as expected. Germany's two-year bond yield, which is more sensitive to rate expectations, remained steady. UK gilt yields also remained stable as markets reacted calmly to the surprise announcement of a snap election. In Japan, Japanese Government Bond (JGB) yields rose across the curve in May due to a rise in US and European yields and increased expectation of BoJ normalisation.

-

Outlook: The US economy remains resilient, as evidenced by strong economic data, and yields are expected to remain elevated in June. The Fed kept rates unchanged at the May meeting, and markets are now pricing in fewer rate cuts than before. IGBs are expected to remain volatile in the near term. IGBs are scheduled to be added to JPMorgan's emerging-market debt index in June, which should help stabilise yields. The path of EUR yields remains uncertain, with the ECB refraining from pre-committing to further interest rate cuts this year. UK gilts are also expected to remain elevated, with the possibility of a summer cut by the BoE reduced and as the focus shifts to the announcement of a snap election. JGB yields are expected to remain under upward pressure, driven by the BoJ’s rate-hike path and the pace of quantitative tightening. Markets will also closely watch the BoJ’s Rinban operations and JGB auctions.

Key data releases:

| Indicator | Country | Release date | Consensus (actual) | Previous | ||||||

| CPI (% y/y, May, final) | US | 12-Jun-24 | - | 3.4% | ||||||

| Eurozone | 18-Jun-24 | 2.6% | 2.4% | |||||||

| UK | 19-Jun-24 | - | 2.3% | |||||||

| China | 12-Jun-24 | - | 0.3% | |||||||

| Japan | 21-Jun-24 | - | 2.5% | |||||||

| Manufacturing PMI (Index, June, flash) | US | 21-Jun-24 | - | 51.3 | ||||||

| Eurozone | 21-Jun-24 | - | 47.3 | |||||||

| UK | 21-Jun-24 | - | 51.2 | |||||||

| China | 30-Jun-24 | - | 49.5 | |||||||

| Japan | 20-Jun-24 | - | 50.4 | |||||||

| Retail sales (% m/m, May) | US | 17-Jun-24 | - | 0.0% | ||||||

| Eurozone* | 05-Jun-24 | -0.3% | 0.8% | |||||||

| UK | 21-Jun-24 | - | -2.3% | |||||||

| China^ | 17-Jun-24 | - | 2.3% | |||||||

| Japan | 27-Jun-24 | - | 1.2% | |||||||

| GDP (% q/q, 1Q, final) | US | 27-Jun-24 | - | 3.4% | ||||||

| Eurozone | 07-Jun-24 | 0.3% | -0.1% | |||||||

| UK | 28-Jun-24 | - | -0.3% | |||||||

| Japan | 10-Jun-24 | - | 0.0% | |||||||

| Policy rate decisions (%, June) | US | 12-Jun-24 | - | 5.50% | ||||||

| Eurozone | 06-Jun-24 | 4.25% | 4.50% | |||||||

| UK | 20-Jun-24 | - | 5.25% | |||||||

| China** | 20-Jun-24 | - | 3.45% | |||||||

| Japan | 14-Jun-24 | - | 0.10% | |||||||

| Major events due in June | ||||||||||

| BoJ MPC minutes for June | Japan | 18-Jun-24 | ||||||||

| General elections (Phase 7 and results day) | India | 01 and 04 June | ||||||||

| G7 Summit | Italy | 13-15 June | ||||||||

*April release; ^ % y/y; **1y LPR. Dates are reported in local time zone

Source: National Statistical Offices, Trading economics

How Acuity Knowledge Partners can help

Our large pool of macro experts are experienced in providing research and strategic support across the value chain. We have partnered with macro research firms, global investment banks, asset management firms and hedge funds over the years, working closely with their research, strategy and investment teams to provide them with the information and analysis required in the investment decision-making process.

We also provide tech-enabled data management solutions and modelling and analytics services covering macroeconomics, FX and commodities forecasts [Macro Economic Research, FX and Commodities Analysis | Acuity Knowledge Partners (acuitykp.com)].

What's your view?

About the Authors

Sreeja has over 5 years of experience in economics and equity research. She has been with Acuity Knowledge Partners (Acuity) since 2018, providing sell-side research support to a global investment bank. At Acuity, she is part of the Cross-Asset Research Support team, specializing in macroeconomics research, high-frequency data tracking and financial modelling. Prior to joining Acuity, she worked as an equity research analyst with Zacks Research. Sreeja holds a Master of Science (Economics) from the University of Calcutta, India.

A postgraduate in Economics with over 7 years of experience in economic research. Currently at Acuity Knowledge Partners, is Delivery Manager, supporting a leading investment bank specializing in macroeconomics research. Responsibilities broadly involve analyzing country-specific macroeconomic data, tracking macro indicator releases and their evolution. Debarati holds a Master of Arts (Economics) from Madras Christian College (Autonomous), India and Bachelor of Science (Economics) from the University of Calcutta, India.

Mahesh has over 14 years of experience in commodity and macroeconomic research and has been associated with Acuity Knowledge Partners (Acuity) since September 2012. At Acuity, he supports a leading European investment bank’s commodity research desk in analysing commodity markets, preparing research notes and creating presentations for conferences and client interactions. Mahesh holds a master’s degree in Science (Energy Trading) from the University of Petroleum and Energy Studies, Gurugram, and a Bachelor of Science from Bikaner University, Bikaner.

Jenil Mehta is part of the Specialized Solution team at Acuity Knowledge Partner. He is part of a team of Asian equity derivatives strategists at one of the leading Japanese investment banks. He contributes to highlighting and publishing trade ideas, bespoke reports, and idea back testing based on fundamental and quantitative analysis. Before working here, he was a fixed-income derivatives trader and research analyst for North American and Brazilian markets. Jenil holds a bachelor’s degree in computer engineering and has passed all three CFA Levels.

Archana has over 16 years of experience in economics research, with proficiency in areas such as writing country-specific economic reports, real-time macroeconomic indicator release coverage and building and maintenance of large datasets. She has been with Acuity Knowledge Partners since 2011 and currently manages the Macroeconomics Research teams for two top-tier global firms. She is responsible for hiring, client engagement and account management. She is also in charge of business development for the Macroeconomics Research sub-vertical under Quantitative Services. Archana holds a Master of Arts (Economics) from St Joseph‘s College (Autonomous), India and a Bachelor of Commerce from Bangalore University, India.

A management postgraduate with over 12 years of experience in the Commodities Market. Well conversant with the fundamental aspects, inter-market relationships and Geo-political issues impacting the market. Currently at Acuity Knowledge Partners as Delivery Manager responsible for providing market analysis and assisting the client in preparing research analysis for the commodities (Energy, Metals & Agri). Well-acquainted with the use of data sources such as Thomson Reuters and Bloomberg. Somya holds a postgraduate degree in finance and a bachelor's degree in electronics engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox