Published on October 17, 2024 by Sreeja Roy Chowdhury , Debarati Dutta , Mahesh Agrawal , Jenil Mehta , Archana Anumula and Somya Dixit

Global market overview

Global market overview

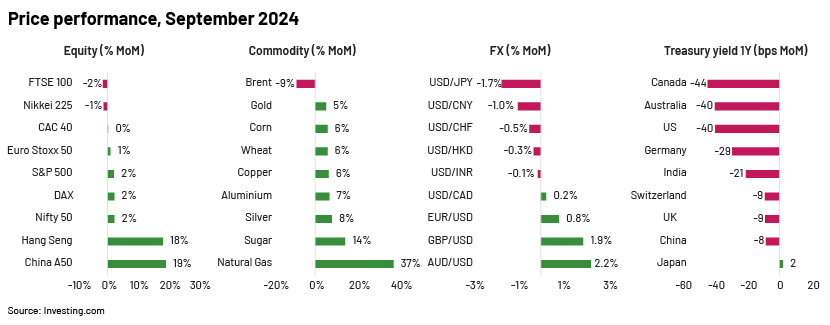

China’s equity market gained favour among investors last month as a surprise rate cut by the People's Bank of China, combined with other supportive measures, buoyed sentiment. The US and European markets also continued the positive run on investor optimism. However, the road ahead becomes tricky, as the conflict in the Middle East brings lofty valuations into the spotlight, with investment money flowing towards safe assets. Gold remains one of the preferred investments, with prices increasing by another 5% over the month. Supply disruptions due to Hurricane Helene in the US and risks to LNG supply-chain logistics due to the Iran-Israel conflict pushed natural gas prices higher. Energy prices could remain elevated in the short term until geopolitical tensions in the Middle East ease.

The Fed made its first rate cut last month of 50bps to combat concerns of an economic slowdown and maintained its dovish policy stance for its next meetings. We could see further cuts of around 75bps over the next two meetings, considering market uncertainty and the sell-off in the broader financial market, although jobs-market data and inflation readings before the meetings would lend more weight for deciding on the amount of the rate cut. The European Central Bank (ECB) could continue its rate-cut cycle due to subdued economic data and inflation being below 2%. The Fed’s actions have weighed on the USD over the past month, with the AUD and the GBP appreciating by around 2% against the USD over the month. Looking ahead, the autumn budget in the UK and presential elections in Japan and the US could keep the market volatile for the rest of the year.

Equity market

-

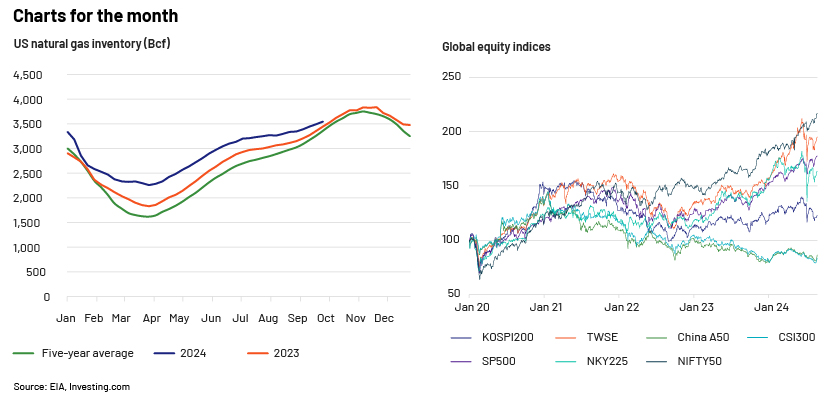

Review: Global equities closed September positively, defying the typical negative seasonality in the month. Many indices reached all-time highs, driven by optimism following a 50bps rate cut by the Fed and growing confidence in a soft landing for the global economy. However, China stole the spotlight as Beijing unveiled a comprehensive set of monetary and fiscal stimulus measures during its Politburo meeting, surprising the markets. This aggressive intervention sparked a significant bull market rally in the Chinese and Hong Kong indices. The CSI300 surged +21% m/m, the Hang Seng Index (HSI) gained +18% and the China A50 rose by +19%. Beijing’s measures included launching equity swap facilities and cutting rates across monetary instruments, aiming to revive growth and encourage investment. Despite the recent rally, Chinese indices remain underperformers compared to global equities, suggesting that the rally could extend further if China continues to use substantial fiscal and monetary stimulus to fuel an economic recovery.

-

Outlook: Investors are likely to focus on the US elections, which could signal potential policy shifts, especially concerning tariff wars that may affect global markets. China’s economic revival could be a key theme, potentially boosting the global commodities market and driving demand in European and Australian industrial sectors. Equities tied to chemicals, materials and industrials are likely to be on investors' radar as they weigh the impact of China’s recovery strategies. However, it remains uncertain whether Chinese equities can sustain a broad rally as the country awaits a full economic rebound. On the geopolitical front, rising tensions in the Middle East, with the increased likelihood of a full-scale conflict between Israel and Iran, pose a major risk that could lead to broad risk-off sentiment in equity markets globally. Investors would need to balance these evolving dynamics as they navigate the coming months.

Commodities market

-

Review: In the US, the Henry Hub natural gas contract rallied by more than 37% last month, primarily on rising supply risks due to Hurricane Helene in the Gulf of Mexico and lower-than-expected injections in US natural gas storage. Hurricane Helene is estimated to have disrupted around 11.2% of natural gas production in the Gulf of Mexico last month. Meanwhile, recent EIA weekly data shows that US gas storage increased by 55Bcf in the last week of September, less than the 57.5Bcf increase the market was expecting and also well below the five-year average increase of 98Bcf. ICE Brent sold off heavily last month, with prices falling almost 9% m/m due to concern over demand weakness, a soft oil balance for 2025 and the return of Libyan supply. Meanwhile, recent trade numbers from China suggest that apparent oil demand fell below 12.5m b/d, down more than 15% YoY and to its weakest level since August 2022. In precious metals, spot gold prices reached another record high while silver prices jumped to multi-year highs last month as the Fed lowered interest rates by 50bps as expected. Lastly, in agri commodities, sugar prices jumped over 18% m/m in September as the supply picture continued to worsen in Brazil following the outbreak of fires and dry weather conditions.

-

Outlook: Crude oil could witness some volatility this month, with risk skewed to the upside as tensions in the Middle East intensify. The market waits to see how Israel will respond to Iran’s recent missile attack. There have been suggestions that Israel could target Iranian oil facilities; this could push oil prices significantly higher, depending on the scale of the attack. Iran exports roughly 1.7m b/d of crude oil, so the impact could be meaningful. Meanwhile, gold prices could continue to benefit from heightened geopolitical tensions and optimism over further interest rate cuts in the US. Several policymakers at the Fed have supported making additional (potentially large) interest rate cuts for the year. Lastly, industrial metals could remain supportive, as Beijing has called for more measures to support its property sector (crucial for metals demand) and pledged to reach the country’s annual economic goals.

FX market

-

Review: Central bank meetings were the major events of focus in September. A well-priced-in 25bps Fed cut was surpassed by a bigger 50bps cut, downplaying market sentiment and adding further pressure on the USD. Traders turned less pessimistic about the medium term, as Fed Chair Powell’s speech indicated a higher neutral rate than during the pandemic, supporting the USD against a larger fall. The USD Index (DXY) fell by a smaller 0.9% by end-September, relative to the level in August. The GBP remained broadly stable against the USD, as the Bank of England (BoE) did not signal aggressive cuts this year, maintaining its cautious stance. The EUR/USD has enjoyed buoyancy due to USD weakness, despite the rate cut expected by the ECB in September. The USD/JPY declined after dovish statements from the Bank of Japan (BoJ) that signalled no rush for further rate hikes. The AUD/USD lost some steam, gaining lower than in August, as consumer prices eased, while the Reserve Bank of Australia (RBA) kept rates on hold, softening its hawkish stance. Asia currencies were lifted by the Fed’s larger-than-expected rate cut and China’s stimulus measures to boost its economy. The CNY retreated after the central bank cut rates and the government announced an economic stimulus package to help achieve its growth target. The INR appreciated slightly (USD/INR: 83.7 in September, from 83.9 in August), largely due to USD outflows.

-

Outlook: The Fed rate cuts at the remaining two meetings this year would depend largely on the labour-market situation. While Powell has hinted at a total of 50bps at the remaining meetings in 2024, there is anticipation of bigger cuts that could be triggered if jobs data weakens in the coming months. Japan’s presidential elections scheduled for late October will be in focus, and the BoJ will most probably stay put at the next MPM at end-October. The GBP will likely remain stable, but the 2024 autumn budget due on 30 October may lead to some volatility in the currency. With further rate cuts hinted at by the ECB against the backdrop of weak economic data, the EUR/USD may see some downward pressures. Fresh escalations of the Iran-Israel dispute have raised concerns over an already fragile geopolitical situation in the Middle East.

Debt market

-

Review: September witnessed a series of major central bank meetings. US Treasury yields rose even after the Fed slashed rates by 50bps, amid robust economic data, with the 10-year yield increasing by 7bps in the last week of September. In Europe, the 10-year OAT Bund spread widened by nearly 80bps amid reports of the budget deficit exceeding 6% and political uncertainty following Barnier’s appointment as prime minister in France. In the UK, gilts sold off owing to budget-related uncertainties. The government’s comment on the dire state of public finances ahead of the budget on 30 October added to the pessimism. In Japan, JPY rates steepened after dovish statements by Governor Ueda that signalled no rush for further rate hikes.

-

Outlook: US Treasuries are likely to remain volatile, supported by strong economic data, while markets anticipate a cooling labour market, pricing in up to 50bps of cuts by year-end. In Europe, EGBs may underperform, as the ECB is expected to lower rates further at the October meeting, following poor business survey results and a sub-2% September inflation print. Additionally, Fitch’s and Moody’s rating releases in October may not bode well for France, given its troubling fiscal and political climate; negative ratings could further pressure OATs. In Japan, JGB markets will likely remain influenced by developments relating to the snap elections at end-October and the BoJ meeting. The latest escalation in the Israel-Iran conflict could trigger heightened volatility in the global bond market.

Key data releases:

| Major macro indicators | Country | Release date | Consensus (actual) | Previous |

| CPI (% y/y, September, final) | US | 10-Oct-24 | - | 2.5% |

| Eurozone | 17-Oct-24 | - | 2.2% | |

| UK | 16-Oct-24 | - | 2.2% | |

| China | 13-Oct-24 | - | 0.6% | |

| Japan | 18-Oct-24 | - | 3.0% | |

| Manufacturing PMI (Index, October, flash) | US | 24-Oct-24 | - | 47.3 |

| Eurozone | 24-Oct-24 | - | 45.0 | |

| UK | 24-Oct-24 | - | 51.5 | |

| China | 31-Oct-24 | - | 49.8 | |

| Japan | 24-Oct-24 | - | 49.7 | |

| Retail sales (% m/m, September) | US | 17-Oct-24 | - | 0.1% |

| Eurozone* | 07-Oct-24 | - | 0.1% | |

| UK | 18-Oct-24 | - | 0.1% | |

| China^ | 18-Oct-24 | - | 2.1% | |

| Japan | 31-Oct-24 | - | 0.8% | |

| GDP (% q/q, 3Q, flash) | US | 30-Oct-24 | - | 3.0% |

| Eurozone | 30-Oct-24 | - | 0.2% | |

| China# | 18-Oct-24 | - | 0.7% | |

| Policy rate decisions (%, October) | Eurozone | 17-Oct-24 | - | 3.65% |

| China** | 21-Oct-24 | - | 3.35% | |

| Japan | 31-Oct-24 | - | 0.25% | |

| Major events due in October | ||||

| FOMC meeting minutes for September | US | 09-Oct-24 | ||

| ECB meeting minutes for September | Eurozone | 10-Oct-24 | ||

| ECB Economic Bulletin | Eurozone | 24-31 Oct 24 (tentative) | ||

| IMF/WB annual meeting | US | 25-27 Oct 24 | ||

| General election | Japan | 27-Oct-24 | ||

Notes: * August release; ^ % y/y; # final release; ** 1y LPR. Dates are reported in IST (UTC+05:30)

Source: National Statistical Offices, Central Banks, Trading Economics

How Acuity Knowledge Partners can help

Our large pool of macro experts are experienced in providing research and strategic support across the value chain. We have partnered with macro research firms, global investment banks, asset management firms and hedge funds over the years, working closely with their research, strategy and investment teams to provide them with the information and analysis required in the investment decision-making process.

We also provide tech-enabled data-management solutions and modelling and analytics services covering macroeconomics, FX and commodities forecasts [Macro Economic Research, FX and Commodities Analysis | Acuity Knowledge Partners (acuitykp.com)].

Tags:

What's your view?

About the Authors

Sreeja has over 5 years of experience in economics and equity research. She has been with Acuity Knowledge Partners (Acuity) since 2018, providing sell-side research support to a global investment bank. At Acuity, she is part of the Cross-Asset Research Support team, specializing in macroeconomics research, high-frequency data tracking and financial modelling. Prior to joining Acuity, she worked as an equity research analyst with Zacks Research. Sreeja holds a Master of Science (Economics) from the University of Calcutta, India.

A postgraduate in Economics with over 7 years of experience in economic research. Currently at Acuity Knowledge Partners, is Delivery Manager, supporting a leading investment bank specializing in macroeconomics research. Responsibilities broadly involve analyzing country-specific macroeconomic data, tracking macro indicator releases and their evolution. Debarati holds a Master of Arts (Economics) from Madras Christian College (Autonomous), India and Bachelor of Science (Economics) from the University of Calcutta, India.

Mahesh has over 14 years of experience in commodity and macroeconomic research and has been associated with Acuity Knowledge Partners (Acuity) since September 2012. At Acuity, he supports a leading European investment bank’s commodity research desk in analysing commodity markets, preparing research notes and creating presentations for conferences and client interactions. Mahesh holds a master’s degree in Science (Energy Trading) from the University of Petroleum and Energy Studies, Gurugram, and a Bachelor of Science from Bikaner University, Bikaner.

Jenil Mehta is part of the Specialized Solution team at Acuity Knowledge Partner. He is part of a team of Asian equity derivatives strategists at one of the leading Japanese investment banks. He contributes to highlighting and publishing trade ideas, bespoke reports, and idea back testing based on fundamental and quantitative analysis. Before working here, he was a fixed-income derivatives trader and research analyst for North American and Brazilian markets. Jenil holds a bachelor’s degree in computer engineering and has passed all three CFA Levels.

Archana has over 16 years of experience in economics research, with proficiency in areas such as writing country-specific economic reports, real-time macroeconomic indicator release coverage and building and maintenance of large datasets. She has been with Acuity Knowledge Partners since 2011 and currently manages the Macroeconomics Research teams for two top-tier global firms. She is responsible for hiring, client engagement and account management. She is also in charge of business development for the Macroeconomics Research sub-vertical under Quantitative Services. Archana holds a Master of Arts (Economics) from St Joseph‘s College (Autonomous), India and a Bachelor of Commerce from Bangalore University, India.

A management postgraduate with over 12 years of experience in the Commodities Market. Well conversant with the fundamental aspects, inter-market relationships and Geo-political issues impacting the market. Currently at Acuity Knowledge Partners as Delivery Manager responsible for providing market analysis and assisting the client in preparing research analysis for the commodities (Energy, Metals & Agri). Well-acquainted with the use of data sources such as Thomson Reuters and Bloomberg. Somya holds a postgraduate degree in finance and a bachelor's degree in electronics engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox