Published on September 13, 2024 by Sreeja Roy Chowdhury , Debarati Dutta , Mahesh Agrawal , Jenil Mehta , Archana Anumula and Somya Dixit

Global market overview

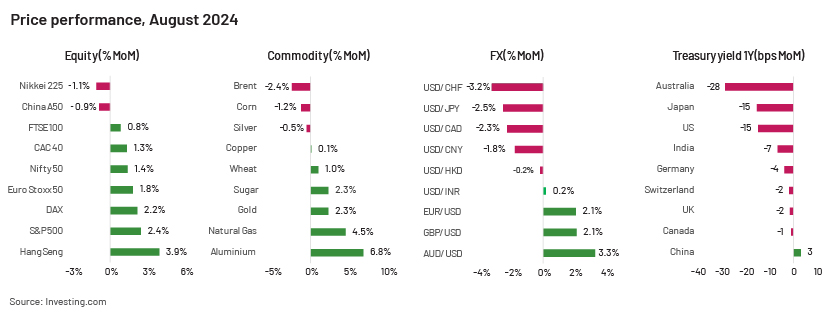

It was a volatile month for global equity markets, although most indices overcame the initial fears and ended the month on a positive note. The European market reached a new record high while the US and Asian markets also recovered strongly from the early-August lows. The market will be watching earnings guidance closely over the next few weeks, as the relatively rich valuations of equity markets, especially those of tech majors, pose a risk of another sell-off if they fall short of expectations. Gold could continue the positive momentum in the immediate term as geopolitical risks and expectations of Fed rate cuts remain supportive of safe-haven demand. On the other hand, energy prices remain under pressure due to concerns about demand from China, although concerns about supply from the Middle East are likely to provide a floor for crude oil prices.

The USD weakened sharply last month as the market started pricing in Fed rate cuts. The Fed is widely expected to announce the first rate cut later this month, while the ECB could also continue to lower rates. This could support the JPY and the CHF. While the market expects the Fed to continue rate cuts over the next three meetings this year, the quantum of rate cuts is likely to be data-driven, and the possibility of a larger 50bps cut at one of the meetings cannot be ruled out. The ECB could closely follow suit. Recessionary fears in the US and Europe are likely to keep their respective central banks on an accommodative stance; however, inflationary pressure remains and is likely to restrain the Fed from going overboard with rate cuts.

Equity market

-

Review: Global equities experienced heightened volatility in the first week of August due to macroeconomic factors, including the unwinding of the JPY carry trade, rising fears of a US recession following weak economic indicators and weak earnings guidance of major tech companies. This led to a significant sell-off in global markets, although most of the losses were recovered over the following weeks. Notably, the initial downturn proved to be just a minor blip in the context of the entire month, as major indices closed positively. European markets in particular reached record highs, driven by sharply lower inflation that fuelled expectations of further interest rate cuts by the ECB. Similarly, the Fed confirmed its trajectory towards rate cuts during the Jackson Hole speech, further supporting the rally in global equities. Among the major indices, the Hang Seng Index (HSI) stood out as a significant outperformer, rising approximately 4% m/m as investors concentrated on big tech and internet stocks, drawn to the index’s relative undervaluation in the global equity landscape.

-

Outlook: Investors are expected to closely monitor US economic data in the coming month, as these indicators will likely influence the Fed's decisions on rate cuts, which could further bolster global equities. China's record stimulus for the property market would also be a key focus for investors, potentially impacting sentiment as the month progresses. However, September has historically been a challenging month for global equities, with seasonal trends often leading to negative performance. In Europe, the German regional elections could weigh on investor sentiment, raising the equity market's risk premium. Beyond these factors, geopolitical concerns, including the ongoing conflicts in the Middle East and the Russia-Ukraine war, will remain critical elements for investors to watch as they continue to influence global market dynamics.

Commodities market

-

Review: Industrial metals performed relatively well in August after witnessing an immense sell-off at the start of the month. Prices of most metals trading on the LME increased last month, with aluminium and zinc the best performers in the metals complex. LME zinc prices gained over 8% last month following the tight supply conditions, while aluminium rose over 6% m/m as a hike in fees at a warehouse operator raised costs. Turning to precious metals, gold continued its upward trend last month, with spot prices reaching yet another record high, as the market digested Fed Chair Powell’s Jackson Hole speech. The persistent geopolitical risks, broader weakness in the USD and lower Treasury yields remain supportive. Meanwhile, crude oil extended the weakness and ended lower last month following continued concerns about demand, especially from China, and higher supply estimates from major producers globally. Lastly, in agri commodities, sugar prices rose by 2.3% m/m in August, following growing concerns over the CS Brazil sugar harvest due to an outbreak of fires and dry weather conditions. Meanwhile, the latest decision by the Indian government to lift restrictions on sugar mills and distillers using cane juice to make ethanol raised concerns about prolonged curbs on sugar exports. The International Sugar Organization (ISO) expects the global sugar balance to remain in a supply deficit of 3.6mt in 2024/25, primarily due to lower output.

-

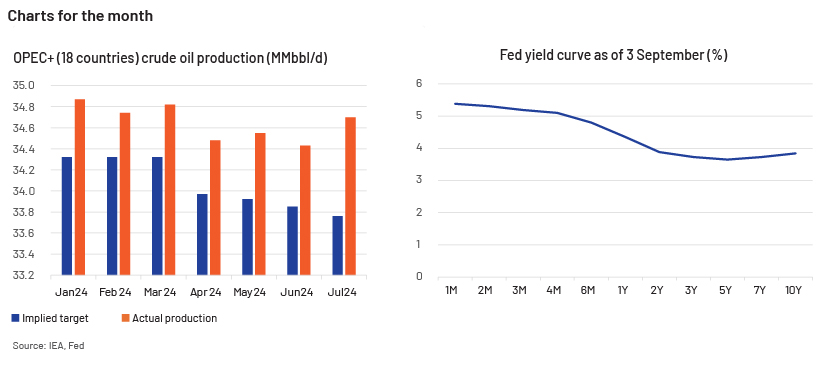

Outlook: Industrial metals could witness some volatility this month as the market awaits the Fed’s first interest rate cut for the year. However, concerns about demand from China due to persistent weakness in the manufacturing and housing sectors would continue to weigh on the metals complex. Meanwhile, gold prices will likely continue to benefit from heightened geopolitical tensions, together with expectations of the Fed’s interest rate cuts next month. In contrast, crude oil prices could remain under pressure, following demand concerns (especially from China) and expectations that OPEC+ members would stick to their plan to gradually unwind supply cuts from October.

FX market

-

Review: The USD rally hit a pause in August, as several factors pointed towards the market pricing in the start of the Fed’s easing cycle in September. While strong retail sales lifted the currency briefly, market sentiment due to softer inflation offset its strength. Furthermore, Fed Chair Powell at the Jackson Hole (JH) Symposium stated that “the time has come for policy to adjust”, implying that rate cuts could begin in September and reaffirming market sentiment that remains divided on a 25-50bps cut at the upcoming Fed meeting. Consequently, the US Dollar Index (DXY) dropped close to a 13-month low at end-August. The EUR/USD pair gained from the drop in the USD, offsetting the effects of a softer German inflation print and expectations of an ECB rate cut in September. The GBP strengthened after the JH Symposium as markets deemed the Bank of England’s (BoE’s) views to be hawkish relative to the Fed’s, as the BoE signalled no rush to cut rates despite easing inflation. As a result, GBP/USD climbed over 2% by end-August. The JPY strengthened in August, staying below 150, buoyed primarily by USD weakness and policy tightening by the Bank of Japan (BoJ). Asian currencies rallied on USD weakness. USD/INR remained steady at around 83, as the Reserve Bank of India intervened in the FX markets to contain volatility in the INR. The CNY recovered from depreciation pressures in August, owing to the USD slump, gaining the most against the USD since November 2023.

-

Outlook: There are important central-bank meetings scheduled for September that would significantly influence the FX markets and currency pairs. While the employment report due in the first week of September will be closely watched, market reaction to the USD would depend primarily on the outcome of the Fed meeting on 18 September, as benign personal consumption expenditure (PCE) figures released at end-August pointed to inflation under control. The ECB is expected to deliver another rate cut, its second since the start of the easing cycle in June, likely adding some downward pressure on the EUR. The JPY will likely continue to gain support from a weak USD and a hawkish BoJ. The AUD’s trajectory will likely be driven largely by the central bank’s monetary policy stance going forward, as sticky core inflation may compel it to retain a hawkish stance for the rest of the year. Political unrest in the Middle East remains a concern for global markets, as tensions have not eased.

Debt market

-

Review: August saw a whirlwind in the markets as investors quickly embraced and then dismissed fears of a US recession within a matter of weeks. Early in the month, an unexpected rise in US unemployment fuelled such fears, prompting speculation of an emergency Fed meeting and driving 10y yields lower by almost 35bps from end-July. In the following weeks, markets quickly dismissed the initial alarm, comforted by favourable jobless claims and ISM services and retail sales data. The yield on the benchmark US 10y Treasury note had gained almost 4bps at the end of the month. Across the Atlantic, in early August, Bund yields fell in response to unfavourable US data, but increased thereafter as Europe continues to navigate through economic and political instability. The far right’s victory at two German state elections worried the ruling coalition, while France remains in a deadlock over forming a new government. The 10y Bund yield increased in response to this uncertainty. UK 10y gilt yields increased on the anticipation that the BoE will hold rates for longer. In Japan, JGB yields dropped significantly due to a global sell-off in early August and BoJ Governor Ueda indicating that the BoJ remains committed to its rate-hiking path.

-

Outlook: The August payroll report is crucial in shaping market perceptions about the direction of the US economy. Another weak result would lead to the market aggressively pricing in a 50bps rate cut in September instead of the 25bps cut already priced in. Treasuries are likely to remain volatile, depending on the extent of the Fed’s rate cut. Political uncertainty in Europe, combined with key US economic data and the anticipated ECB rate cut in September, would continue to influence EUR yields. In the UK, gilt yields are expected to remain high, with the BoE expected to hold rates steady at the September meeting. In Japan, JGB markets will likely remain more influenced by developments in the US and the upcoming LDP presidential election, together with the current pressure from the BoJ’s rate-hiking path and quantitative tightening.

Key data releases:

| Major macro indicators | Country | Release date | Consensus (actual) | Previous |

| CPI (% y/y, August, final) | US | 11-Sep-24 | - | 2.9% |

| Eurozone | 18-Sep-24 | 2.2% | 2.6% | |

| UK | 18-Sep-24 | - | 2.2% | |

| China | 9-Sep-24 | - | 0.5% | |

| Japan | 20-Sep-24 | - | 2.8% | |

| Manufacturing PMI (Index, September, flash) | US | 23-Sep-24 | - | 47.9 |

| Eurozone | 23-Sep-24 | - | 45.8 | |

| UK | 23-Sep-24 | - | 52.5 | |

| China | 30-Sep-24 | - | 49.1 | |

| Japan | 24-Sep-24 | - | 49.5 | |

| Retail sales (% m/m, August) | US | 17-Sep-24 | - | 1.0% |

| Eurozone* | 5-Sep-24 | 0.1% | -0.3% | |

| UK | 20-Sep-24 | - | 0.5% | |

| China^ | 14-Sep-24 | - | 2.7% | |

| Japan | 28-Sep-24 | - | 4.5% | |

| GDP (% q/q, 2Q, final) | US | 26-Sep-24 | - | 0.7% |

| Eurozone | 6-Sep-24 | 0.3% | 0.3% | |

| UK | 30-Sep-24 | - | 0.6% | |

| Japan | 9-Sep-24 | - | 0.8% | |

| Policy rate decisions (%, September) | US | 18-Sep-24 | - | 5.50% |

| Eurozone | 12-Sep-24 | - | 4.25% | |

| UK | 19-Sep-24 | - | 5.00% | |

| China** | 20-Sep-24 | - | 3.35% | |

| Japan | 20-Sep-24 | - | 0.25% | |

| Major events due in September | ||||

| BoJ meeting minutes for September | Japan | 26-Sep-24 | ||

| Fed Chair Powell’s speech at the NABE | US | 30-Sep-24 | ||

Notes: *July release; ^% y/y; **1y LPR. Dates are reported in IST (UTC+05:30)

Source: National Statistical Offices, Trading Economics

How Acuity Knowledge Partners can help

Our large pool of macro experts are experienced in providing research and strategic support across the value chain. We have partnered with macro research firms, global investment banks, asset management firms and hedge funds over the years, working closely with their research, strategy and investment teams to provide them with the information and analysis required in the investment decision-making process.

We also provide tech-enabled data-management solutions and modelling and analytics services covering macroeconomics, FX and commodities forecasts [Macro Economic Research, FX and Commodities Analysis | Acuity Knowledge Partners (acuitykp.com)].

Tags:

What's your view?

About the Authors

Sreeja has over 5 years of experience in economics and equity research. She has been with Acuity Knowledge Partners (Acuity) since 2018, providing sell-side research support to a global investment bank. At Acuity, she is part of the Cross-Asset Research Support team, specializing in macroeconomics research, high-frequency data tracking and financial modelling. Prior to joining Acuity, she worked as an equity research analyst with Zacks Research. Sreeja holds a Master of Science (Economics) from the University of Calcutta, India.

A postgraduate in Economics with over 7 years of experience in economic research. Currently at Acuity Knowledge Partners, is Delivery Manager, supporting a leading investment bank specializing in macroeconomics research. Responsibilities broadly involve analyzing country-specific macroeconomic data, tracking macro indicator releases and their evolution. Debarati holds a Master of Arts (Economics) from Madras Christian College (Autonomous), India and Bachelor of Science (Economics) from the University of Calcutta, India.

Mahesh has over 14 years of experience in commodity and macroeconomic research and has been associated with Acuity Knowledge Partners (Acuity) since September 2012. At Acuity, he supports a leading European investment bank’s commodity research desk in analysing commodity markets, preparing research notes and creating presentations for conferences and client interactions. Mahesh holds a master’s degree in Science (Energy Trading) from the University of Petroleum and Energy Studies, Gurugram, and a Bachelor of Science from Bikaner University, Bikaner.

Jenil Mehta is part of the Specialized Solution team at Acuity Knowledge Partner. He is part of a team of Asian equity derivatives strategists at one of the leading Japanese investment banks. He contributes to highlighting and publishing trade ideas, bespoke reports, and idea back testing based on fundamental and quantitative analysis. Before working here, he was a fixed-income derivatives trader and research analyst for North American and Brazilian markets. Jenil holds a bachelor’s degree in computer engineering and has passed all three CFA Levels.

Archana has over 16 years of experience in economics research, with proficiency in areas such as writing country-specific economic reports, real-time macroeconomic indicator release coverage and building and maintenance of large datasets. She has been with Acuity Knowledge Partners since 2011 and currently manages the Macroeconomics Research teams for two top-tier global firms. She is responsible for hiring, client engagement and account management. She is also in charge of business development for the Macroeconomics Research sub-vertical under Quantitative Services. Archana holds a Master of Arts (Economics) from St Joseph‘s College (Autonomous), India and a Bachelor of Commerce from Bangalore University, India.

A management postgraduate with over 12 years of experience in the Commodities Market. Well conversant with the fundamental aspects, inter-market relationships and Geo-political issues impacting the market. Currently at Acuity Knowledge Partners as Delivery Manager responsible for providing market analysis and assisting the client in preparing research analysis for the commodities (Energy, Metals & Agri). Well-acquainted with the use of data sources such as Thomson Reuters and Bloomberg. Somya holds a postgraduate degree in finance and a bachelor's degree in electronics engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox