Published on November 22, 2024 by Shubham Chaudhary

Introduction

Private equity infrastructure firms invest in critical physical assets vital for the operation of economies and societies. These assets encompass transport systems, energy grids, and communication networks. Keeping pace with private infrastructure trends enables PE firms to make informed investment decisions and capitalize on evolving market opportunities. (such as toll roads, bridges and railways), digital infrastructure (including data centres and communication towers), energy infrastructure (encompassing renewable energy initiatives and utilities) and social infrastructure (such as healthcare and education)[1].

Key characteristics of infrastructure investments made by PE firms include the following:

-

Essential services: These investments are crucial for supporting services essential for daily life and economic activity.

-

Extended cashflow: Infrastructure assets able to provide consistent and foreseeable cashflow over extended periods.

-

Regulated assets: Infrastructure assets subject to regulation, ensuring a level of revenue predictability.

-

Providing a hedge against inflation: Investment in assets that frequently includes measures to align revenue with inflation, serving as a safeguard against inflation.

-

Financial stability against systemic risk: Infrastructure assets that can generally exhibit lower sensitivity to economic fluctuations, providing stability amid economic downturns.

Trends in Infrastructure Private Equity Investment

PE firms are increasingly focusing on specific private infrastructure trends to capitalise on emerging opportunities and drive sustained growth. Through pursuing such trends, PE firms can leverage their expertise and resources, and play a key role in addressing critical infrastructure needs and driving positive economic and social impact within communities.

Increasing focus on renewable infrastructure projects

The global shift towards clean renewable energy solutions is swiftly gaining momentum, as they hold great promise in combating the severe impacts of climate change and paving the way for a brighter future for our planet. PE firms play a crucial role in funding and supporting renewable energy projects. These investments not only help accelerate the transition to cleaner energy sources but also provide financial returns for investors[2]. In efforts to mitigate the effects of climate change, PE firms are significantly increasing their investment in renewable infrastructure projects such as solar, wind and biomass. Global PE and venture capital (VC) deal value in the renewable energy sector amounted to USD14.6bn from 1 January 2023 to 28 November 2023, the most in the past five years[3].

Average deal value increased from USD59.0m in 2019 to USD140.2m in 2022, with staggering y/y growth of 75.9% in 2022 and 25.4% in 2023, indicating the possibility that renewable energy projects delivered good returns to investors in the past and, therefore, made such assets attractive for new investors.

The following are some significant PE-backed renewable energy transactions in 2023[4]:

| Year | Target | Buyer | Transaction value | Investment rationale |

| June 2023 | Duke Energy’s wind and solar business | Brookfield Asset Management | USD2.8bn | Acquisition significantly enhanced Brookfield’s renewable energy portfolio, making it one of the largest renewable energy businesses in the US[5] |

| October 2023 | Duke Energy’s commercial distributed generation business | ArcLight Capital | USD364m | Leveraged ArcLight’s experience in the renewables infrastructure sector to drive asset optimisation and brownfield development opportunities[6] |

| September 2023 | Broad Reach Power’s energy storage assets | Engie | USD1.0bn | The acquisition is a significant step towards ENGIE’s goal of reaching 10GW of battery capacity by 2030[7] |

| July 2023 | American Electric Power’s solar and wind assets | Invenergy | USD1.5bn | The acquisition enhances Invenergy’s renewable energy portfolio with the addition of 1,365MW of renewable assets[8] |

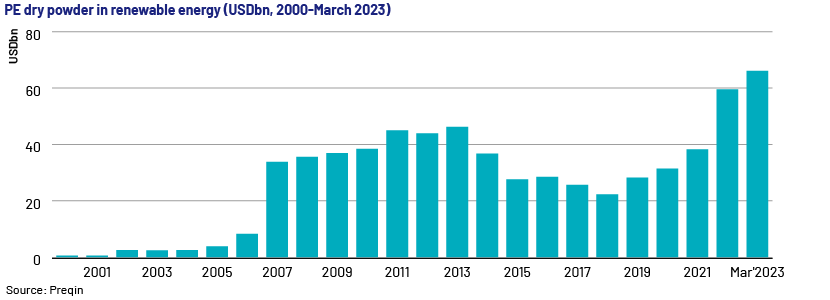

PE dry powder for renewable energy projects reached a record high USD66.1bn as of 31 March 2023, the highest in more than two decades, according to Preqin [9].

This significant increase in available capital for renewable energy projects indicates growing interest and confidence in the sector among PE investors. S&P Global Commodity Insights expects PE firms to further boost their investments in renewable energy, with a yearly investment forecast of USD700bn through 2050; investments are expected to be particularly strong in the US, China and the EU[10].

Government policy frameworks and incentives

| Economic bloc | Policy | Incentive type | Focus areas |

| China | 14th Five-Year Plan | Various soft incentives (such as cheap financing and land) | Utility-scale renewables, grid expansion, storage |

| EU | REPower EU | State-backed loans | Renewables |

| Fit for 55 | State-backed loans | Renewables, hydrogen, efficiency | |

| US | Inflation Reduction Act of 2022 | Tax credits, loan guarantees | Renewables |

| CHIPS Act of 2022; American Jobs Plan of 2021 | Tax credits | Energy-transition assets | |

| Source: S&P Global | |||

ESG in Private Equity Infrastructure Strategies

PE firms are developing ESG-focused investment strategies that align with their values and long-term goals and are implementing ESG criteria as part of their due diligence process. ESG investing is gaining traction, according to Acuity Knowledge Partners’ Global Private Markets Outlook 2024, as evidenced by the increasing number of private-markets participants committing to the United Nations’ Principles for Responsible Investment (UN PRI), which were established with the aim to incorporate ESG factors into investment strategies[11]. The increase in participation is driven by benefits that signatories experience, such as public affirmation for responsible investing, access to resources and support from the UN PRI. The number of global signatories to the UN PRI reached 5,327 as of 8 September 2024, marking a 5.1% increase since January 2024[12].

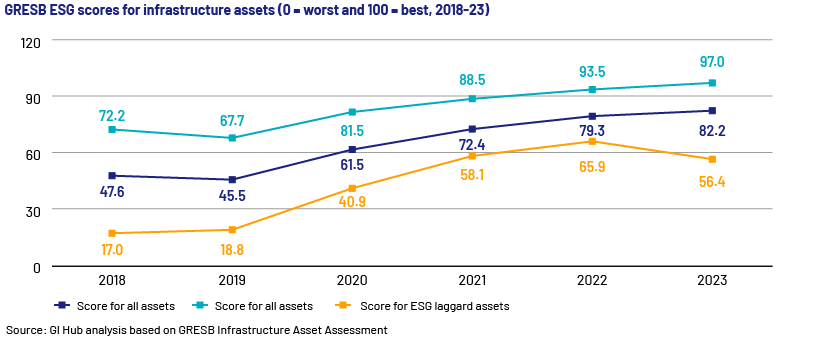

Data from Global Real Estate Sustainability Benchmark (GRESB), an independent organisation providing validated ESG performance data and peer benchmarks for investors, indicates that the average ESG score (which provides quantitative insight on an organisation’s ESG performance in absolute terms, over time and relative to peers’) for infrastructure assets increased steadily from 2019 to 2023, rising from 79.3 in 2022 to 82.8 in 2023[13].

Additionally, the recent ESG reporting requirements in developed countries, as outlined below, are expected to increase the significance of ESG factors in PE firms’ future approach to investment[14].

-

EU: The EU has implemented the Corporate Sustainability Reporting Directive (CSRD), which requires large companies and listed companies to publish regular reports on social and environmental risks and impacts. The CSRD was adopted on 5 January 2023; it was implemented in phases from 1 January 2024 and will apply to all in-scope companies by 1 January 2028[15].

-

US: In March 2024, the US Securities and Exchange Commission (SEC) adopted rules to enhance and standardise climate-related disclosures. These rules require companies to report on their climate-related risks, governance and impact.

-

Japan: In March 2023, Japan’s Financial Services Agency (FSA) introduced guidelines for ESG disclosure, mandating companies to report on their sustainability practices and impacts with the creation of a new section for sustainability-related information in the annual securities report[16].

Increasing number of public-private partnerships (PPPs) to fund large-scale infrastructure projects

PPPs benefit PE firms and governments by enabling joint investment in infrastructure development, reducing governments’ reliance on public funds and offering long-term concessions for PE firms’ earnings growth. Moreover, PPP projects have long-term attractive concession mechanisms that support earnings growth and future cashflow. For instance, Chicago Skywalk, a notable PPP project in the US, is a 7.8-mile toll road operated under a 99-year-long operating lease agreement that ensures long-term cashflow to its investors such as OMERS Infrastructure, CPP Investment Board, Ontario Teachers’ Pension Plan and Atlas Arteria Group[17].

Additionally, ageing infrastructure such as roads, bridges, water systems and power grids in several economies presents a considerable challenge for governments and organisations globally. Ageing infrastructure is a multifaceted issue that impacts sectors, stakeholders and investors[18]. The US needs to allocate an extra USD150bn annually by 2030 to maintain economic growth via infrastructure renewal, according to McKinsey Global Institute[19]. Meanwhile, Japan will likely require investment of c.JPY12.9tn a year to renew existing infrastructure[20]. These factors are anticipated to play a crucial role in shaping the evolution of PPP agreements in the infrastructure sector.

Conclusion

PE firms are increasingly focusing on private equity infrastructure investments, particularly in renewable energy projects, to drive sustained growth and address critical infrastructure needs, as evidenced by increasing aggregate transaction value and average deal value. In addition, the rise of ESG considerations in investment strategies, driven by the ESG reporting requirements of governments and global authorities, is gaining significance in infrastructure investing. The increasing importance of PPPs for large-scale infrastructure projects is also shaping the future of PE firms’ infrastructure investing due to attractive earnings growth and future returns.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners provide tailored solutions, leveraging our capabilities in in-depth industry research and trend analysis including of the infrastructure sector, so clients can make informed decisions. Our services include the following:

-

Deal origination support: Detailed analysis of industry and target companies, thematic research and trend analysis

-

Live deal support: Deep-dive industry analysis, competitive landscaping and benchmarking, research as part of ongoing deals, and industry trends and challenges

-

Post-deal support: Peer-group benchmarking, portfolio monitoring and market sizing

Sources

-

[1] https://www.kkr.com/alternatives-unlocked/private-infrastructure

-

[2] https://news.sap.com/2024/04/private-equity-renewable-energy-digital-transformation-success/

-

[3] https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/value-of-private-equity-backed-renewable-investments-hits-5-year-high-of

-

[4] https://www.pehub.com/top-pe-backed-renewable-energy-utility-deals-of-2023/

-

[5] https://news.duke-energy.com/releases/duke-energy-to-sell-utility-scale-commercial-renewables-business-to-brookfield-for-2-8-billion

-

[6] https://investors.duke-energy.com/news/news-details/2023/Duke-Energy-to-sell-commercial-distributed-generation-business-to-ArcLight-for-364-million/default.aspx

-

[8] https://invenergy.com/news/invenergy-led-consortium-completes-purchase-of-american-electric-power-s-unregulated-renewables-portfolio

-

[9] https://www.spglobal.com/marketintelligence/en/news-insights/latest-news-headlines/value-of-private-equity-backed-renewable-investments-hits-5-year-high-of-14-6b-79595438

-

[10] https://www.spglobal.com/en/research-insights/special-reports/renewable-energy-funding-in-2023-a-capital-transition-unleashed

-

[11] https://www.acuitykp.com/global-private-markets-outlook-2024/

-

[12] https://www.unpri.org/signatories/signatory-resources/signatory-directory

-

[13] https://cdn.gihub.org/umbraco/media/5465/gih_infrastructuremonitor_2023_esg.pdf

-

[14] https://www.azeusconvene.com/esg/articles/the-global-state-of-mandatory-esg-disclosures

-

[15] https://corpgov.law.harvard.edu/2023/01/30/eu-finalizes-esg-reporting-rules-with-international-impacts/

-

[16] https://www.ey.com/en_jp/sustainability/whats-next-for-japanese-sustainability-disclosure-standards

-

[18] https://fastercapital.com/content/Aging-infrastructure--The-Cost-of-Progress--Replacing-Aging-Infrastructure.html#Understanding-the-Economic-Impact-of-Aging-Infrastructure

-

[19] https://www.mckinsey.com/industries/travel-logistics-and-infrastructure/our-insights/the-road-to-renewal-how-to-rebuild-americas-infrastructure

-

[20] https://www.mof.go.jp/english/pri/publication/pp_review/ppr18_02_03.pdf

Tags:

What's your view?

About the Author

Shubham Chaudhary is a part of Acuity Knowledge Partners – Private Markets team with experience of more than 3 years in Private Equity and Investment Banking. He has worked on various research projects and assisted private equity clients with their research requirements at different stages of deal. Shubham holds an MBA in Finance and Business Analytics and has a bachelor’s degree in civil engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox