Published on July 24, 2023 by Utkarsh Choudhary

In the quest for a sustainable net-zero-emission economy and to mitigate the effects of climate change, hydrogen has emerged as a key solution. As a versatile and clean energy carrier, it has the potential to play a significant role in achieving net zero emissions, according to the International Energy Agency’s (IEA’s) Net-Zero Emissions by 2050 Roadmap. Demand for hydrogen is predicted to grow sixfold by 2050 and its use to extend to areas such as long-distance transport, delivery and flight, with new applications in the industry and power sectors.

Introduction

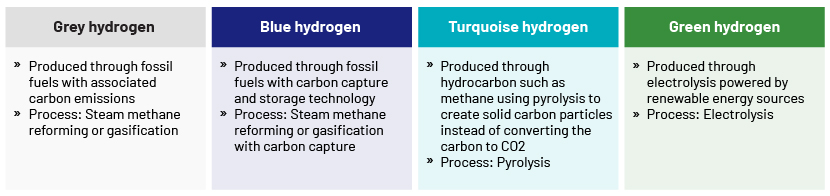

Hydrogen, the most abundant element in the universe, holds great promise as a clean and versatile energy carrier. The hydrogen colour spectrum includes the following:

Most of the hydrogen currently produced is “grey”, meaning it comes from fossil fuels and is created via a process known as steam methane reforming (SMR). Without a price on carbon emissions, grey hydrogen costs USD1-2/kg, but it compounds the challenge of improving environmental sustainability, as grey hydrogen emits CO2 as a by-product. Green hydrogen, in contrast, is produced by converting water (H2O) molecules into hydrogen and oxygen using electricity generated by sustainable sources of energy. Green hydrogen currently costs USD3-8/kg in some regions, more expensive than grey hydrogen.

However, there has been a spike in interest in green hydrogen-manufacturing techniques, with increasing applications for hydrogen, such as in electricity generation, manufacturing procedures in the steel and cement sectors, fuel-cell technology for electric vehicles, heavy transport such as shipping, production of green ammonia for fertilisers, cleaning products, refrigeration and grid stabilisation.

Importance

Green hydrogen is significant in the pursuit of a sustainable and low-carbon future, for the following reasons:

-

Decarbonisation: Green hydrogen has the potential to decarbonise sectors that are difficult to electrify, directly, such as heavy-duty transport, industrial processes and heating. By replacing the fossil fuels used in these sectors, green hydrogen could significantly reduce the release of greenhouse gases and mitigate the impact of climate change.

-

Energy storage: One of the key advantages of green hydrogen is its potential as a long-term energy storage solution. Green hydrogen could be created using surplus renewable energy amid a lack of demand, stored and then converted back into electricity when needed. This helps steady the system and addresses the sporadic nature of renewable energy sources.

-

Versatility: Green hydrogen can be used as a fuel cell to produce electricity, with water as the only by-product. It can be directly combusted or used in various industrial processes as a clean substitute for fossil fuels. Moreover, hydrogen can be blended with natural gas pipelines, reducing carbon emissions from existing infrastructure.

Global investment in and emerging market for green hydrogen

Private-sector investment of around USD13tn would be required in hydrogen and carbon capture, usage and storage (CCUS) to achieve the IEA’s goal of “net zero emissions by 2050”, according to a Bloomberg report.

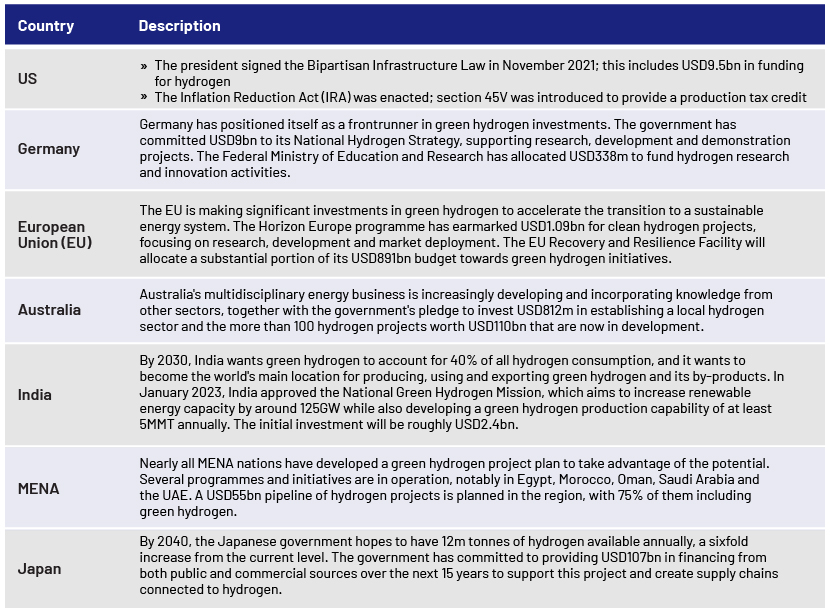

Global investment in green hydrogen has been growing rapidly as countries and sectors recognise its potential in the transition to low carbon. There has been a significant increase in funding and commitments in recent years:

Existing and emerging offtake structures across the globe

Hydrogen has no commercial market. A hydrogen project needs a bankable offtake plan in order to be financed. Because the offtake scenario is already obvious and will be simpler to predict, existing use cases for hydrogen that currently rely almost completely on grey hydrogen may be among the first green or blue hydrogen projects to be financeable.

Hydrogen is used widely in sectors such as petrochemicals, refining and metallurgy. It serves as a key feedstock and reducing agent in the production of ammonia, methanol and other chemicals. Current offtake of hydrogen in these sectors is significant, and transitioning to clean hydrogen could significantly reduce carbon emissions associated with these processes.

It is also gaining momentum as a clean fuel for transport. Fuel-cell electric vehicles (FCEVs) use hydrogen to generate electricity, offering zero-emission mobility with longer ranges and shorter refuelling time than battery electric vehicles. While the adoption of FCEVs is still limited compared to conventional vehicles’, the offtake of hydrogen is increasing as governments and automakers invest in the development of hydrogen refuelling infrastructure and promote the use of zero-emission vehicles. Additionally, hydrogen is used in other modes of transport, such as buses, trains and even drones, where its quick refuelling time and longer driving ranges are advantageous.

Hydrogen plays a crucial role in energy storage, particularly for renewable energy integration. Electrolysis can be used to create hydrogen from surplus power produced by renewable energy sources during times of low demand. This hydrogen can be stored and later converted back into electricity or used as a fuel when renewable energy production is limited. Although hydrogen energy storage offtake is still in the nascent stages, it has gained attention as a potential solution for addressing the intermittency and variability of renewable energy sources.

Hydrogen is being explored as a potential low-carbon alternative for residential and commercial heating. By using hydrogen in heating systems, emissions associated with traditional natural gas-based heating can be reduced. Hydrogen boilers and fuel cells are being developed and tested to evaluate their efficiency, safety and feasibility for widespread adoption. While offtake of hydrogen for heating purposes is currently limited, it holds potential as part of efforts to decarbonise buildings and reduce emissions from heating systems.

Project financing and related risks

To successfully replace fossil fuels, the green hydrogen revolution will depend in large part on project finance. A long-term, fixed-price offtake agreement with a utility or another public or semi-public purchaser is the gold standard for project finance. The strongest early chances for contract signing for hydrogen project developers may be in the electricity and public transport sectors. Many offtake schemes, however, will rely on corporate offtakers. The area where an electrolyser is situated on-site or close to the client’s site that the hydrogen project is intended to service would have the highest level of corporate counterparty credit risk.

Banks are hesitant to finance hydrogen projects, even though there are many being developed globally, as there are still many difficulties with hydrogen. A clean hydrogen economy is constrained by factors such as the high cost of generating hydrogen using low-carbon energy, the delayed development of infrastructure and broad acceptance. Banks want the projects they lend money to, to meet the following criteria:

-

Have long-term offtake agreements with reliable counterparties (offtake risk)

-

Use established technologies (technology risk)

-

Comply with established industry rules and laws (policy risk)

-

Be able to sell in well-established marketplaces (merchant risk)

Producing hydrogen from low-carbon energy has the following limitations:

-

High costs: Despite advancements, green hydrogen production, storage and transport still involve higher costs than do conventional energy sources. The capital-intensive nature of green hydrogen projects could limit their scalability and widespread adoption. However, as technology progresses and economies of scale are achieved, costs are expected to decrease.

-

Infrastructure requirements: Establishing a robust green hydrogen infrastructure is a critical challenge for the implementation of projects. Building renewable energy facilities, integrating electrolysers and developing storage and distribution networks require significant investment and long-term planning. The lack of a comprehensive infrastructure could impede growth of green hydrogen projects, limiting accessibility and availability.

-

Limited market demand: Market demand for green hydrogen as an energy carrier is still developing, especially in sectors such as transport and industry. Although green hydrogen offers environmental benefits and versatility, its adoption depends on factors such as policy support, technological advancements and cost competitiveness. Without sufficiently large and stable market demand, green hydrogen projects may face limitations in achieving economies of scale and cost reductions.

-

Technological challenges: Green hydrogen projects rely on technologies such as renewable energy generation, electrolysis for hydrogen production and fuel cells for energy conversion. These technologies are still evolving, and their scalability, efficiency and cost-effectiveness require further development. Technological limitations may impact the overall performance and economic viability of green hydrogen projects.

Projects financed to date include the following:

-

Centrale Electrique de l’Ouest Guyanais: A green hydrogen power project in French Guiana with a 25-year power purchase agreement with France’s state-owned utility EDF.

-

NEOM: A green hydrogen project in Saudi Arabia that has benefited from a 25-year offtake agreement with US chemicals and gases company Air Products. The project, at a total value of USD8.4bn, is being financed with USD6.1bn of non-recourse financing from 23 local, regional and international banks and financial institutions.

Conclusion

Green hydrogen has significant potential as a clean and sustainable energy carrier, playing a crucial role in the transition towards a low-carbon future. The production of green hydrogen through renewable energy sources could decarbonise a number of sectors, including transport, industry and energy generation. However, the widespread adoption of green hydrogen is heavily reliant on adequate project financing.

Project financing plays a major role in the development and implementation of green hydrogen projects. Given the scale and complexity of these projects, substantial investment is required to establish the necessary infrastructure, such as renewable energy facilities and electrolysers, as well as distribution networks for hydrogen.

Financing for green hydrogen projects can be challenging due to several factors. Upfront capital costs, technological uncertainties and long payback periods often deter traditional investors. Therefore, innovative financing mechanisms, such as green lending services, are essential to attract private investments, government support and collaboration between various stakeholders.

One effective financing mechanism is public-private partnerships (PPPs), where governments work alongside private entities to fund and implement green hydrogen projects. Governments can provide financial incentives, grants and favourable policies to encourage private investments. Simultaneously, private investors can leverage their expertise and financial capabilities to accelerate project development and drive technological advancements.

Furthermore, international collaboration and cooperation are crucial for large-scale deployment of green hydrogen projects. Multilateral organisations, such as the International Renewable Energy Agency (IRENA) and the Green Climate Fund (GCF), can facilitate the flow of capital and technical expertise across borders, enabling the development of global green hydrogen infrastructure.

How Acuity Knowledge Partners can help

Our skills and knowledge are used by global investment banks and financial advisors to quickly boost internal analyst bandwidth and broaden coverage of project financing. We have established specialised teams of analysts (CAs, MBAs and CFAs) to assist our clients with a variety of tasks, including project feasibility analysis, financial modelling, financial due diligence, funding strategy, negotiation and structuring of contracts and financing documents, and bid management. Each output is customised to the client's requirements.

Sources:

-

PFI Yearbook 2023: https://edition.pagesuite-professional.co.uk/html5/reader/production/default.aspx?pubname=&edid=d52cec3b-4894-4d4c-99ea-d9d93e5bdb53

-

PFI Global Energy Special Report: https://edition.pagesuite-professional.co.uk/html5/reader/production/default.aspx?pubname=&edid=14236774-0084-46de-a0a3-e18d4827bd91

-

Breaking the Finance Barrier for Hydrogen and Carbon Capture (BCG): https://www.bcg.com/publications/2023/breaking-the-barriers-in-financing-hydrogen-and-carbon-capture

-

https://www.dw.com/en/germany-and-hydrogen-9-billion-to-spend-as-strategy-is-revealed/a-53719746

What's your view?

About the Author

Utkarsh joined Acuity in September 2022 and has more than six years of experience in project financing, transaction advisory, M&A, bid advisory, and financial modelling in the infrastructure sector, including transportation, logistics, and renewable energy sources like solar, wind, and green hydrogen. He holds a Btech in Computer Science and an MBA in Finance

Like the way we think?

Next time we post something new, we'll send it to your inbox