Published on August 5, 2024 by Vikas Jha

Introduction

Sustainable development in tandem with economic growth presents a significant challenge globally. With increasing awareness of the environment, it is imperative that the financial sector acknowledge its responsibility in addressing environmental concerns. Investment of USD1.6-3.8tn in the energy system is needed to limit the annual increase in global temperature to 1.5° Celsius, according to the Intergovernmental Panel on Climate Change’s (IPCC’s) 2018 report. To achieve its 2030 climate objectives, the European Union must invest an additional EUR180bn annually in energy efficiency and renewable energy. Asia requires funding of USD1.7tn per annum for sustainable infrastructure development. Hence, the role of the financial sector will be pivotal in fostering sustainable development in the foreseeable future.

The idea of green finance plays a vital role in promoting balanced and rational growth, encompassing financial instruments such as green bonds, establishments such as green banks and funds such as sustainability-linked loans (SLLs). Green financing, or climate-smart financing, facilitates a reduction of carbon emissions and promotes eco-friendly outcomes in the long run. Market-driven revolutions are propelling the expansion of sustainable finance, with projections indicating annual investment of USD5tn in green infrastructure until 2030, with a significant portion earmarked for the developing world. India, for instance, anticipates infrastructure funding of approximately USD4.5tn by 2040, directed towards national renewable energy targets, electric vehicles and eco-friendly housing. Institutional investors have the potential to bolster green financing by enhancing market liquidity through mobilisation efforts.

Green loans and SLLs are distinct financial products, but the term “green loans” is occasionally used to refer to both.

A genuine green loan is characterised by proceeds earmarked for green initiatives. In contrast, the classification of an SLL is not contingent on the use of proceeds; instead, its defining aspect is the correlation between pricing and the borrower's adherence to specific sustainability benchmarks.

Initially, the absence of established market norms hindered the identification of criteria for distinguishing green loans or SLLs. Although the green bond theory, introduced by the International Capital Markets Association in January 2014, provided valuable guidance to capital markets, it primarily addressed bonds and the use of proceeds to benefit the environment rather than loans and broader sustainability considerations. While financial institutions have historically relied on the Equator Principles to manage environmental, social and governance risks in project finance, their applicability in the broader loan markets was limited. The absence of recognised industry standards risked divergent interpretations of what constituted a green or sustainability-linked loan, with some loans falsely marketed as such, a practice often termed “greenwashing”.

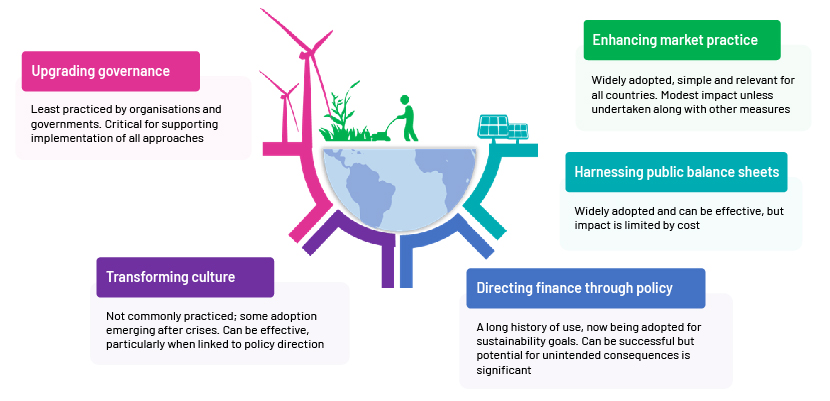

Five essential approaches to aligning a financial system with sustainable development

Understanding green loans and their characteristics

A green loan is a type of loan specifically designed to finance projects that have a positive environmental impact. These projects can be new initiatives or relate to refinancing existing ones, and they aim to support and promote sustainable development. The Green Loan Principles (GLPs) were developed by the Loan Market Association (LMA), Asia Pacific Loan Market Association (APLMA) and Loan Syndications and Trading Association (LSTA) with support of the International Capital Market Association (ICMA). They were created to provide a clear and consistent definition of green loans, ensuring that the funds are used for projects with genuine environmental benefits.

The GLPs aim to standardise the criteria for green loans, enhance transparency and prevent greenwashing by requiring rigorous reporting and accountability from borrowers. This initiative began in 2017, driven by the Global Green Finance Council, to promote sustainable finance and align with global standards such as the ICMA's Green Bond Principles. By establishing these principles, the financial sector aims to encourage investments in environmentally sustainable projects and support global efforts to combat climate change and the challenges of green washing.

The four components of the GLP framework:

1. Use of proceeds

Definition: The proceeds from green loans must be used exclusively to finance or refinance projects that provide clear environmental benefits.

Eligible categories: Examples of eligible projects include renewable energy, energy efficiency, pollution prevention, sustainable water management, biodiversity conservation, and environmentally sustainable buildings.

Disclosure: Borrowers must clearly disclose the intended use of proceeds, outlining the specific projects and expected environmental impacts.

2. Process of project evaluation and selection

Criteria: Borrowers should establish clear criteria for selecting eligible green projects, ensuring that they align with the intended environmental benefits.

Evaluation: A thorough evaluation process should be in place to assess the potential environmental impact of the projects.

Transparency: Borrowers should communicate the decision-making process and criteria used for project selection to lenders and other stakeholders.

3. Management of proceeds

Tracking: The proceeds from green loans should be credited to a dedicated account or otherwise tracked by the borrower to ensure they are used exclusively for eligible projects.

Auditing: Borrowers should implement internal processes to track and monitor the allocation of funds, ensuring transparency and accountability.

Reporting: Regular updates on the allocation of proceeds should be provided to lenders, highlighting the status and progress of the funded projects.

4. Reporting

Frequency: Borrowers should report on the use of proceeds and the environmental impact of the funded projects at least annually.

Content: Reports should include qualitative and quantitative performance indicators, metrics and the methodologies used to calculate environmental benefits.

Impact measurement: Where feasible, borrowers should provide details on the actual or expected environmental impact, such as energy savings, reduced emissions or improved water quality.

Global market trends in green loans and SLLs

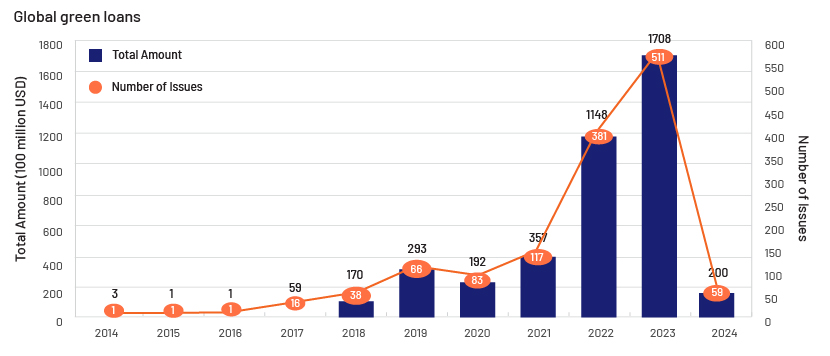

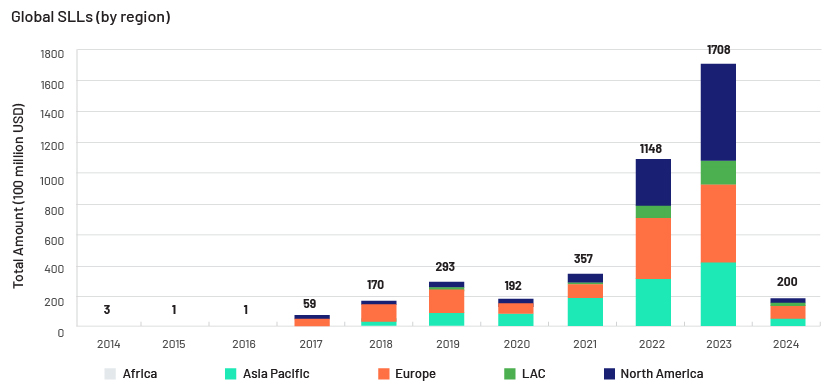

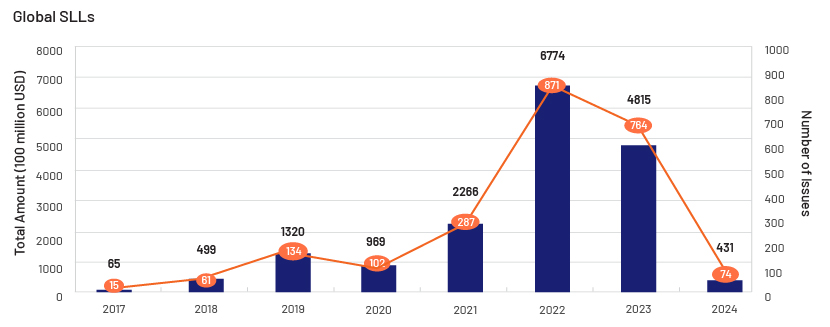

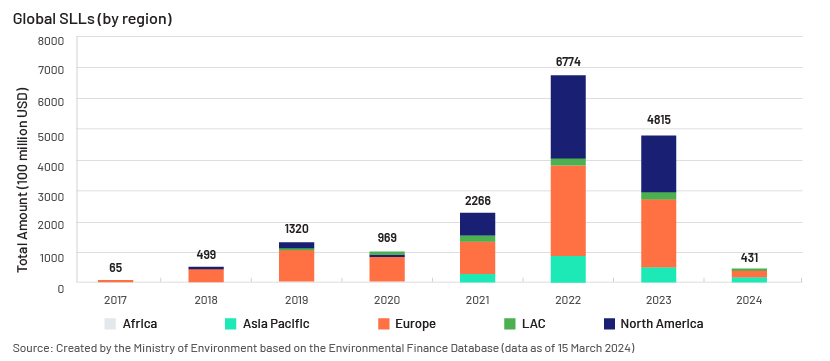

Green loans and SLLs have over the past decade emerged as pivotal instruments in driving global sustainability agendas. Initially niche, they rapidly gained traction, reflecting heightened environmental consciousness and regulatory pressure. SLLs have witnessed similar exponential growth, buoyed by demand for holistic sustainability integration in financial practices. These trends underscore a fundamental shift in financial paradigms, with institutions worldwide increasingly prioritising environmental and social impact. Such loans not only offer financial incentives but also foster a more sustainable future for generations to come.

The following charts show growth of green loans and SLLs:

* The value of green loans totals the value of loans labelled as such in the Environmental Finance Database. Environmental Finance does not have its own screening criteria but rather aims to track and include all self-labelled loans.

Source: Created by the Ministry of Environment based on the Environmental Finance Database (data as of 15 March 2024)

Key differences between Green Loan and SLL Principles

| Green Loan Principles | SLL Principles | |

| Aim | To promote and facilitate eco-friendly activity. | To promote and facilitate environmentally and socially sustainable economic activity. |

| Definition | Available exclusively for financing or refinancing new or existing “green projects”. | Loan instruments and/or contingent facilities (such as guarantee lines, bonding lines or letters of credit) designed to incentivise the borrower to meet predetermined sustainability performance goals. |

| Restrictions on purpose | The primary use is for "green projects".The principles specify 10 classifications, encompassing renewable energy, energy efficiency and pollution prevention and control. It is recommended that loan proceeds be deposited into a designated account or monitored meticulously. | No specific purpose outlined for the use of proceeds – a loan could serve the debtor’s general commercial purposes. |

| Impact on pricing of borrower performance | The principles do not anticipate an impact pricing. The green tranche receives reduced pricing compared to other purposes’. In some cases, facilities are divided into tranches for green purposes and other objectives. | The debtor's performance against predetermined sustainability principles affects the interest rate, incentivising improved performance over time. The hallmark of an SLL is that the borrower's performance against these objects determines the interest rate.The principles outline a non-exhaustive list of 10 common classifications of objectives, including reduction of greenhouse gases, reduced water consumption and increased consumption of renewable energy. |

| Review/reporting | Borrowers are recommended to maintain records of use of proceeds from green loans and the expected impact of the green projects to which earnings have been billed, along with a list of the projects and the amounts allocated. External evaluation is recommended but not mandatory. | The need for external evaluation of the borrower's performance against its predetermined sustainability intentions varies depending on the circumstances.In the case of public companies, public disclosure may be adequate to assess performance for loan purposes. |

Conclusion

Green and sustainable finance practices are critical for addressing climate change and building a more sustainable and resilient global economy. By supporting environmentally friendly projects, integrating ESG considerations into investment-related decision-making and promoting long-term economic growth, green and sustainable finance can help create a better future for all.

How Acuity Knowledge Partners can help

We aim to provide solutions to all your ESG-related needs. Our dedicated team of in-house specialists are qualified to handle complex mandates such as climate change and solutions for achieving Sustainable Development Goals. Considering the ambiguity and lack of clarity on ESG regulations in certain regions, we provide customised solutions after conducting detailed research and evaluating sectoral and geographical threats and opportunities to enables our clients to make well-informed decisions.

References:

-

Organization for Economic Co-operation and development (OECD) Centre on Green Finance and Investment

Tags:

What's your view?

About the Author

Vikas Jha has over 14 years of experience in working with leading global organizations in the banking and commercial lending domains. His expertise spans a broad range of credit analysis, financial statement spreading, covenant testing and monitoring, annual review report writing, audit, risk management & consulting.

At Acuity Knowledge Partners, he leads a team for a mid-size US bank. He has previously worked in spreading automation team and lending credit analysis team covering diverse industries. Vikas holds a Post Graduate degree in finance, also, went to The Institute of Chartered Accountants (ICAI) and The Institute of Company Secretaries (ICSI) with specialization in Finance, Accounting and Companies Law.

Like the way we think?

Next time we post something new, we'll send it to your inbox