Published on March 13, 2024 by Sandeep Dhingra

M&A Current Scenario

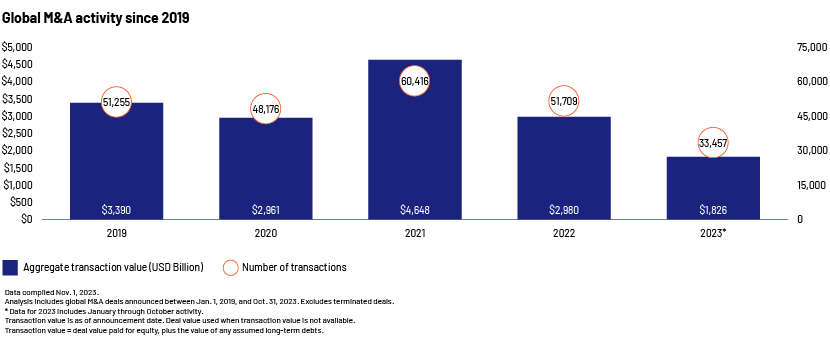

After a sluggish 2022, M&A markets continue to struggle in 2023 too. The slowdown could greatly be attributed to rise in inflation and increased interest rates globally and other factors like geopolitical tensions. With USD 1,826 billion in deal volume, the number of M&A transactions also touched lowest in 2023 since 2019. This clearly shows the gloomy M&A scenario this year has witnessed. The year 2024 may witness an improved M&A activity owing to several factors. An expected end to Federal Bank’s rate hiking cycle by end of 2023 could act as a positive catalyst leading to more M&A deals in 2024. The small number of transactions in current year would be easy to surpass and could make 2024 a better year for M&A market. With M&A sector gaining pace it becomes significant for the corporates to lay greater emphasis on factors like sustainability, energy efficiency and adherence to Environmental, Social Corporate Governance (ESG) regulations.

Source: S&P Global Report

What is ESG?

ESG aims to provide a holistic view of a particular organization by taking into consideration the non - economic parameters and evaluate the associated risks. ESG for corporates constitutes the evaluation of measures taken in environmental, social and governance space for controlling and reducing the pollution and emission of greenhouse gases. Additionally, the companies are also evaluated on steps taken for the benefits of employees and welfare of society in general and promoting fair and transparent governance by protecting the rights of every stakeholder involved.

Why ESG is gaining prominence and how is it becoming a key driver in M&A deals?

With SEC planning to finalize ESG related rules and EU enforcing Corporate Sustainability Corporate Directive in 2023 highlights the importance ESG has gained globally.

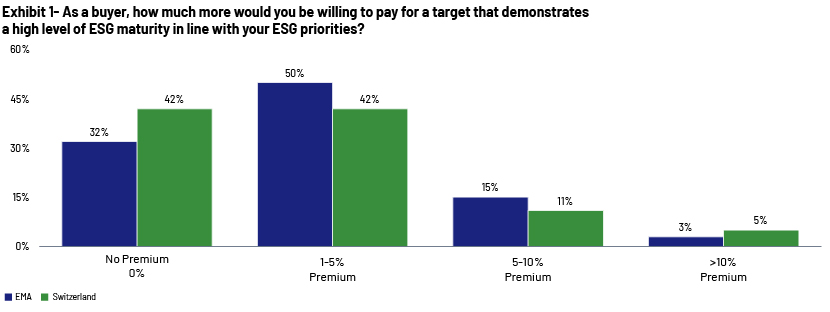

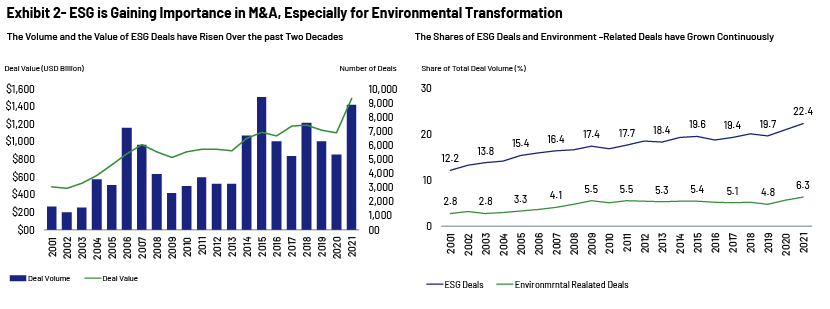

Enforcing Corporate Sustainability Directive would make it mandatory for approximately 50,000 organizations to report their ESG initiatives. All these developments would have a great impact on the functioning of the corporates and the forthcoming business deals like the proposed M&As. Implementation of these stringent regulations is also one of the reasons as why the corporates have started laying greater emphasis on ESG guidelines. As per the KPMG report, more than 60% of respondents in Europe, the Middle East and Africa (EMA) region are willing to pay the premium price for highly ESG compliant targets while assessing the acquisition prospects indicating the prominence ESG has gained in the recent years. The corporates in recent years are showing eagerness to acquire the ESG compliant targets. As per BCG, 2021 reported an all-time high of almost 9,200 green deals in M&A in comparison to 5,700 in 2011 which has resulted in increased valuations. This shows a heightened inclination towards acquiring green targets and it has put sellers in a commanding position asking for the premium price. The surge in the number can also be attributed to the fact that the ESG compliant targets have better goodwill and attracts bids from larger organisation which are ESG compliant or dedicated to contribute to the cause.

Source: KPMG report

Trends in ESG deals

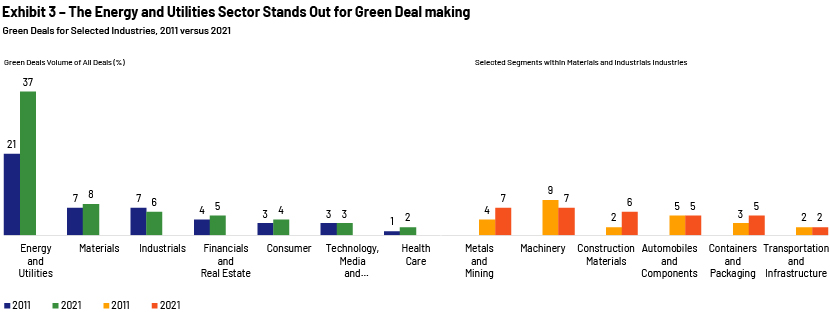

With corporates showing a firm resolve in promoting the green M&A deals, let us have a look at the industrial and regional trends for ESG deals in M&A market as per report by BCG.

source: Green Deals Gain Steam | BCG

The share of the green M&A deals has shown significant upward movement in carbon intensive industries looking to reduce their footprint. Leading the M&A market with the highest share of green deals is energy and utilities sector. It has witnessed a growth in share of green deals in total deal volume with 20% in 2011 to 40% in 2021 which also highlights the efforts the industry is putting in to push the energy transition. Many corporates in this sector adopt M&A as the most preferred medium to do this. This makes it easy for them to embrace the environmental friendly alternative sources of energy. An interesting observation is that industries with low carbon footprint have had a constant number of green deals over a without any significant jump.

Source: Green Deals Gain Steam | BCG

Middle East has shown an upward trajectory and is a global leader when it comes to green deals with more than 10% deals being accounted as green deals. This could also be attributed to the fact that the region has proportionately large number of industries that are highly carbon extensive like oil and gas. The share of domestic and intra-regional green deals is approximately 55% in the region. An interesting fact to note here is that the companies based in the Middle East are increasingly looking for green targets in Western Europe and North America as both the regions have a share of 23% & 12% green deals related M&A respectively. China in Asia Pacific is the Asian leader and claims the second place globally for Green deals with 8% of the total deals classified as “green”. The Chinese markets replicate the same trend like their Middle Eastern counterpart with energy and utilities leading the green deals segment with 50% of the total being green deals. European markets have not seen any growth in green deals since 2009. The percentage has been stagnant at around 5-6% and since 2009 and did not see any growth even during pandemic as per the BCG report. The percentage remained same even in 2021 which is opposite to the trend seen at other places like China and Middle East which have shown a considerable growing curve in industry specific green deals. North America has witnessed very slight growth and this could be due to the prevailing administration prioritizing and promoting the environmental regulations aggressively.

Valuation impact in green deals

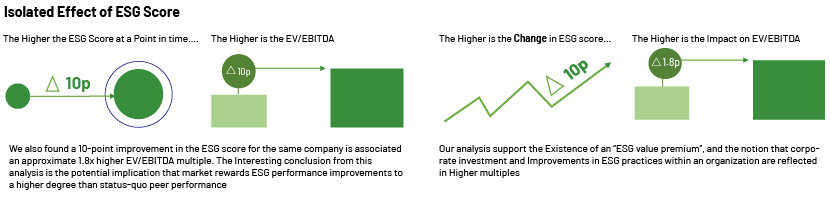

A greater emphasis is being laid upon green deals for supporting environmental causes. An important question that arises is if promoting these deals in any manner help the organization in terms of valuation? The reports by BCG and Deloitte confirm that the corporates involved in green deals in particular sectors create a better valuation for themselves over the period of time and reap benefits gradually in long term. To create better value companies however need to adopt a systematic process to execute the deals to be able to command premium. A study by Deloitte in 2022 suggests that companies demonstrate a direct correlation in terms of EV/EBITDA multiples being higher in the cases where they have a higher ESG scores, this pattern was demonstrated in four industries while using regression analysis. Result of their analysis shows, on average 10-points difference in an ESG score is associated with an approximate 1.2x higher EV/EBITDA multiple. Also improving the ESG score by 10 points leads to 1.8x growth in EV/EBITDA multiples for the same company. This trend firmly justifies the fact as to sellers commanding high premium and buyers complying by it does not solely rely on the ESG scores but the potential growth it shows in terms of EV/EBITDA multiples.

Source: Does a company’s ESG score have a measurable impact on its market value, Deloitte 2022 Report

Challenges

Though gaining pace rapidly, implementing ESG has its own share of challenges. The biggest hurdle that companies face is of the ambiguity with regards to the benchmarks and standards used to measure and evaluate the ESG performance. Lack of clarity with this regard leads to confusion among the dealmakers and the change in standards from region to region adds to the complexities of comparing the ESG performance. Another cause of concern is integrating information with financial data. The data presented during the course of discussion is often incomplete or provides very little information and involves a high chance of double counting or places high emphasis on qualitative aspects. All this makes it difficult to identify the ESG related risk involved in a particular deal. The different regulatory standards also add to the issue as the multiple sources of information prevent from establishing a direct correlation between several factors and make it difficult to arrive at any conclusion.

Conclusion

ESG definitely is gaining prominence in M&A space and is emerging as an important factor being considered by corporates while considering any prospective M&A deal. An interesting observation is that ESG is being given due importance by both the parties i.e. the buyer and the seller. The upward trend of ESG related deals is primarily witnessed in the sectors with higher carbon footprint like companies into power generation, oil and other related sectors. There is a need to create greater awareness and promote the ESG across sectors irrespective of the nature of business. This would help in achieving the ESG related goals in a comprehensive manner and provide fruitful results.

How Acuity can help?

At acuity we aim to provide solution to all your ESG related needs. Our dedicated team of in-house specialists are qualified to handle the complex mandates like climate change and sustainable development goal solutions. Looking at the ambiguity and lack of clarity on ESG regulations based on various demographics our team provides customized solutions after conducting a detailed research and evaluating the sectoral and geographical threats and opportunities helping the corporates make a well informed decision.

Sources:

-

The SEC Plans to Finalize ESG-Related Rules in 2023 | ACA Group (acaglobal.com)

-

Does a company’s ESG score have a measurable impact on its market value? (deloitte.com)

What's your view?

About the Author

CFA Charterholder with over 13 years of work experience with Acuity in information services support. He brings rich experience across M&A, sector coverage and capital markets to enhance the information service offering across multiple sectors with strength and flair for client relationship building and management

Extensive exposure of working on complex information requirements and PIBs, newsletters, news run, corporate document extraction, financial projections from market data sources, target and peer identification, deal information, credit and broker report search, share price data, financials from market data sources etc

Like the way we think?

Next time we post something new, we'll send it to your inbox