Published on March 15, 2022 by Youqi Chen

HR software-as-a-service (SaaS) is a completely innovative software application available on the increasingly mature internet. HR SaaS providers set up the application software on their own servers, so that enterprises can purchase on demand the HR management (HRM) services offered by software providers over the internet. With the rapidly increasing need for companies to navigate complex HR tasks including talent management, recruitment management, performance management and administrative work, HR leaders looking for new technology solutions are finding HR SaaS an attractive option.

China’s HR SaaS market is poised to grow

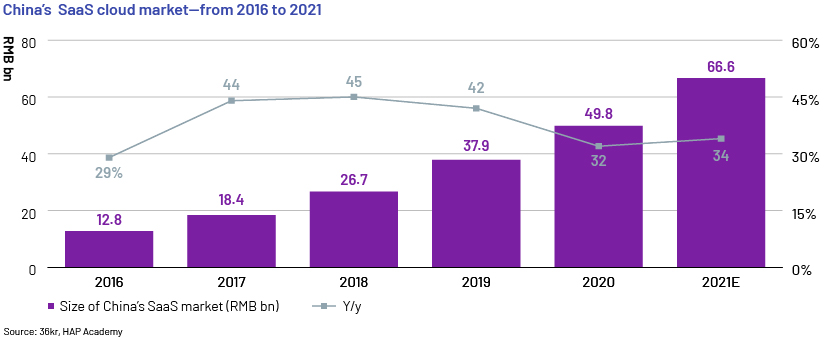

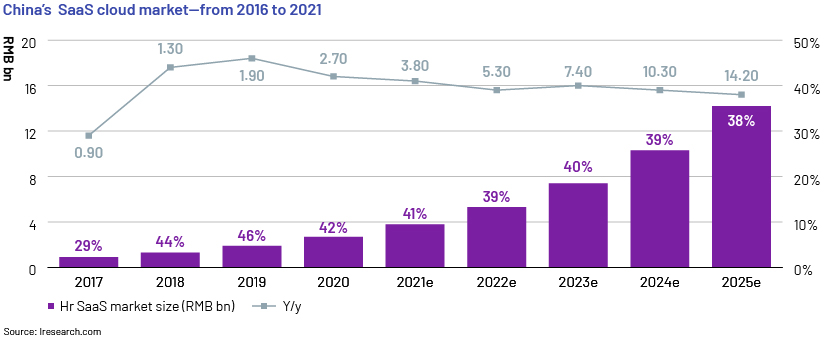

China’s SaaS cloud market grew 31.6% to RMB49.82bn in 2020, according to HAP Academy. It is expected to have expanded to RMB66.6bn by 2021. China’s HR SaaS market has been growing steadily since 2017, according to iRresearch.com, reaching RMB2.7bn in 2020 and accounting for 5.4% of the total SaaS market, indicating the HR SaaS market remains underpenetrated and has a lot of room for growth. iResearch expects the HR SaaS market to reach RMB14.2bn in 2025.

Recent investment trends in China’s HR SaaS sector

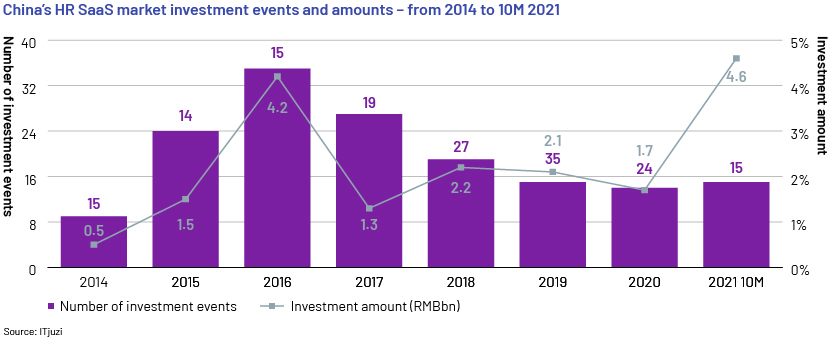

China's HR SaaS sector saw 158 financing events from 2014 to October 2021, according to ITjuzi.com. The number of events fell gradually after reaching a peak in 2016, but rose again in 2021. It was steady in 2020 due to the pandemic’s impact and macroeconomic factors. However, investment and financing during the first 10 months of 2021 totalled RMB4.6bn, reversing the trend. Amid the pandemic, investors seemed to be favouring companies with stable cash inflow, such as HR SaaS companies with subscription fee income. The HR SaaS market is likely gaining in popularity and investor confidence, resulting in further funding rounds that could take the HR SaaS sector to the next level.

This growth is expected to be driven by both the demand and supply sides.

-

On the demand side

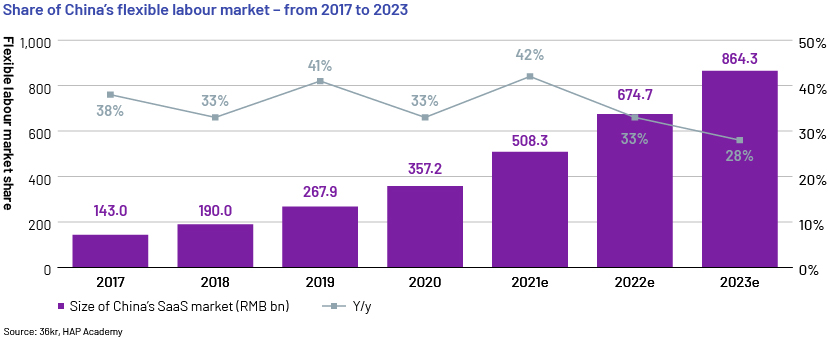

The flexible labour market continues to boom in China, according to iResearch.com. Talent acquisition and online recruitment processes have also gradually recovered from the pandemic’s impact, increasing demand for HRM services.

With the advent of digitalisation, a large number of Chinese enterprises have embarked on digital management of human resources, meaning that an increasing number of enterprises are able to buy digital services or products. Enterprises now tend to have a clearer understanding of their needs, for example, relating to recruiting and employee training, and are, therefore, increasingly looking for more agile SaaS-based solutions that can deliver a better user experience. They are willing to pay for premium solutions to meet these needs, and providers who focus on providing all-in-one HR SaaS solutions for large and medium-size customers tend to be stickier with their customers and have more business value as well as investment value.

Moreover, the state has now placed cloud computing at the centre of the National Informatization Development Strategy, for the first time since 2016. It has also continued to introduce favourable policies in recent years to drive development of the sector. For instance, the Three-year Action Plan for the Development of Cloud Computing (2017-19) and the Guidelines for Promoting the Implementation of Enterprise Cloud Computing (2018-20) have been further strengthened to speed up the construction of a Digital China. In the future, under the premise of accelerated cloud migration in China, enterprises will be more aware of the importance of using information systems, all indicating potential for substantial sector growth.

-

On the supply side

the penetration rate of HR SaaS in China is less than 50%, lower than in Europe and the US, but it has been growing rapidly in recent years and will likely continue to address the market’s pain points. HR SaaS software companies are divided into three categories, based on business model:

All-in-one HR SaaS software, which has comprehensive functions such as recruitment, training and performance reviews, able to meet the different needs of large, medium-size and small enterprises in the long term. All-in-one HR SaaS companies tend to build an integrated HRM ecosystem and have more potential for further development.

Single-module HR SaaS software providers focus on one vertical module in the field of HRM and have a deep understanding of customer requirements.

Self-developed HR SaaS. Some large enterprise clients build their HR SaaS systems on their own or collaborate with a third party to do so.

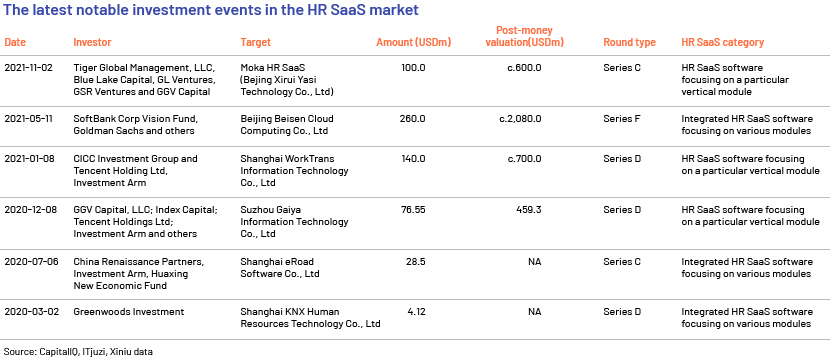

The supply market has gradually formed a competitive pattern: (1) all-in-one HR SaaS software providers offering services for various modules, led by Beisen and KNX, as the first echelon, (2) HR SaaS software providers focusing on a particular vertical module, such as Moka and Gaia Works, as the second echelon and (3) HR SaaS start-up companies whose influence and capital are limited, as the third echelon.

Conclusion

Although some large enterprises in China are still conservative when it comes to HR SaaS software, the outlook for China’s HR SaaS market seems to be positive, based on increasing opportunities as a result of changes in sector policies, market conditions and business models adopted by key participants in the sector. Investment funds tend to focus on key all-in-one HR SaaS software companies and single-module HR SaaS software companies.

How Acuity Knowledge Partners can help

Our dedicated China-based TMT sector teams have an in-depth understanding of China’s HR SaaS sector, enabling them to offer end-to-end support in identifying HR SaaS companies as targets, providing in-depth HR SaaS sector research, evaluating pre-investment opportunities and formulating post-investment value-added strategies.

References:

36kr.com and HAP Academy – size of software-as-a-service (SaaS) cloud market https://www.36kr.com/p/1380801020395913

iResearch.com – China’s flexible labour market share from 2017 to 2023 and China’s HR SaaS market size from 2017 to 2025

https://www.jiemian.com/article/6646286.html

ITjuzi.com – investment events in China’s HR SaaS sector from 2014 to 10M 2021

https://www.itjuzi.com/investevent

Xiniu Data, ITjuzi and Capital IQ – latest notable investment events in China’s HR SaaS sector

https://www.xiniudata.com/project/event/lib/invest

https://www.itjuzi.com/investevent

An outline of the National Informatization Development Strategy

https://www.edu.cn/info/focus/zc/201607/t20160728_1434665.shtml

The Three-year Action Plan for the Development of Cloud Computing (2017-19)

http://www.e-gov.org.cn/article-163317.html

Guidelines for Promoting the Implementation of Enterprise Cloud Computing (2018-20)

https://gxj.hebi.gov.cn/gongxinwei/zcfg30/3004651/index.html

What's your view?

About the Author

Youqi Chen has 2 years of experience in private equity investment analysis with a focus on China market. At Acuity Knowledge Partners Beijing office, Youqi helps to support both pre-investment research and post-investment management for a large private equity fund, covering a wide spectrum of industries such as TMT sector. Youqi holds a master degree in Accounting from University of Maryland, College Park.

Like the way we think?

Next time we post something new, we'll send it to your inbox