Published on March 21, 2023 by Shreedhar Mohta and Bimalendu Deb

The evolution of business in the global asset management sector has led to an increasing number of challenges on the environmental, social and governance (ESG) front, and the measures managers must adopt to address these challenges would set the tone for the coming decades. Such a dynamic landscape has transformed the course of global political agendas. ESG asset management and sustainable finance are at the forefront of efforts to meet heightened regulatory requirements, the needs of sustainability-conscious investors and society’s expectations in general. With investors putting special emphasis on ESG issues, the message is clear: asset managers who want to stand out cannot afford to undermine the power of ESG.

Increasing investor focus on embedding sustainability considerations in investment decision making – an edge for sales enablement

The growing emphasis on embedding ESG considerations into investment decision making processes has become a defining factor in ESG asset management, providing investors with an overarching lens from both a risk-mitigation and a value-creation perspective.

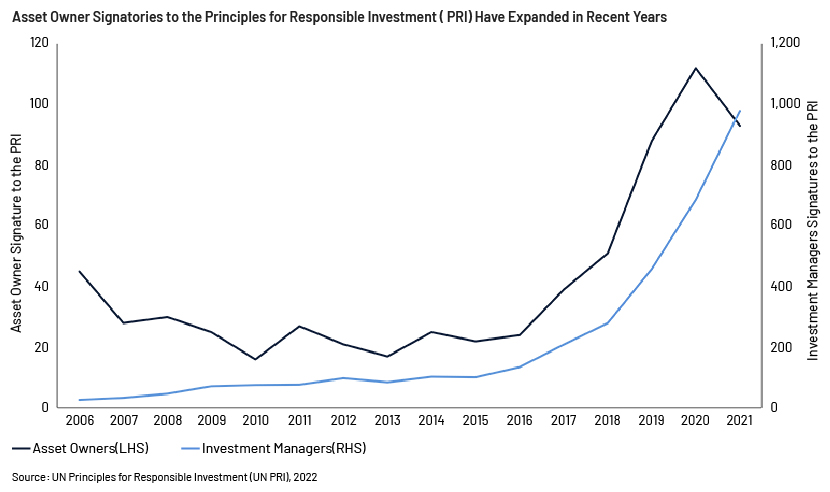

The following data shows that the number of signatories to the UN Principles for Responsible Investment (PRI; a set of principles reflecting investors’ commitment to integrating ESG issues into investment practices) has increased rapidly in the past three years.

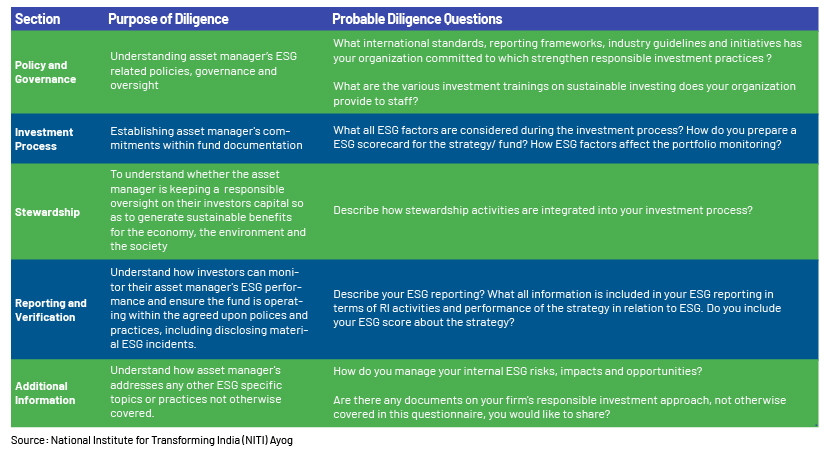

The following is an example of a UN PRI investment due diligence questionnaire.

Source: UN Principles for Responsible Investment (UN PRI), Acuity Knowledge Partners

An increasing number of investors have been signalling the importance of impact investing in their organisations and proceeding with fund manager selection with an affinity for managers in line with their sustainability commitments.

ESG investing has gained significant traction over the past decade, with investors increasingly accepting the materiality of such risks beyond traditional accounting-based and financial analysis. The need to move away from short-term risk-return perspectives has filtered through to the markets. Institutional investors’ stakeholders are also increasingly requesting them to incorporate sustainability into investment allocations, with many such investors then turning to asset managers, requiring ESG integration in their portfolio decisions.

ESG investing – a critical focus among asset management participants

Systematic incorporation of ESG considerations alongside traditional financial analysis has become central to ESG asset management, serving as both a risk-mitigation tool and a catalyst for long-term value creation. Integrating ESG considerations will be a must for managers seeking to future-proof their operations and attract investors, failing which they may face grave consequences in terms of increased operational and financial risk and, most importantly, loss of market share.

A number of institutional investors and asset managers have incorporated ESG into their investment process. This has helped introduce new ideas and identify emerging investment opportunities.

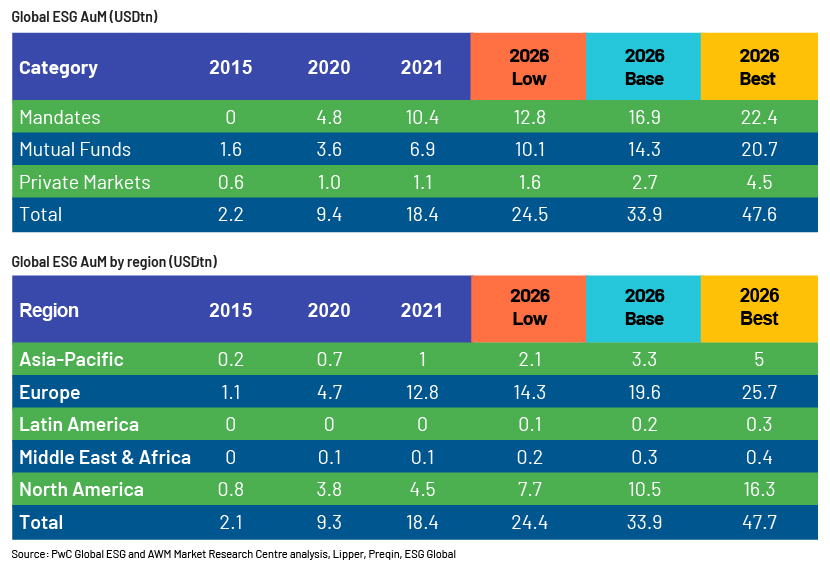

AuM of ESG-oriented investments has been growing rapidly and is expected to grow faster than AuM of the overall asset and wealth management market, with the proportion of ESG-oriented assets likely to increase to more than 22% of total industry AUM by 2026 from 14% in 2021, according to a PwC report on asset and wealth management revolution in 2022.

Sustainability-focused investing is emerging as an important driver of growth, with trends showing a marked increase in thematic funds focused on healthcare, education, climate and financial inclusion. Improvements around governance have also long been a key driver of returns in this market, and we see significant opportunity for capital markets to drive positive environmental and social outcomes.

Regulators’ view on sustainable investing is also evolving, with the European Commission's Sustainable Finance Disclosure Regulation (SFDR) influencing global ESG asset management practices by pushing asset managers to clearly disclose how they address sustainability and ESG factors. While the SFDR applies to firms operating in Europe, it is supposed to have a domino effect on fund managers operating in the US, especially those with exposure to Europe.

The next big step is expected from the US, with the Securities and Exchange Commission (SEC) continuing to broaden its focus on sustainability investing by advocating more clarity for investors to address potential greenwashing, through established ways recommended for public markets, which could also attract investors in private markets.

Asia Pacific firms are not far behind, with Singapore and Hong Kong dominating Asia. Regulatory authorities in Asia continue to guide the sector towards improving ESG risk and reporting practices. An idea involving the development of ASEAN taxonomy, if it materialises, should go a long way towards improving progress on the ESG front in the region.

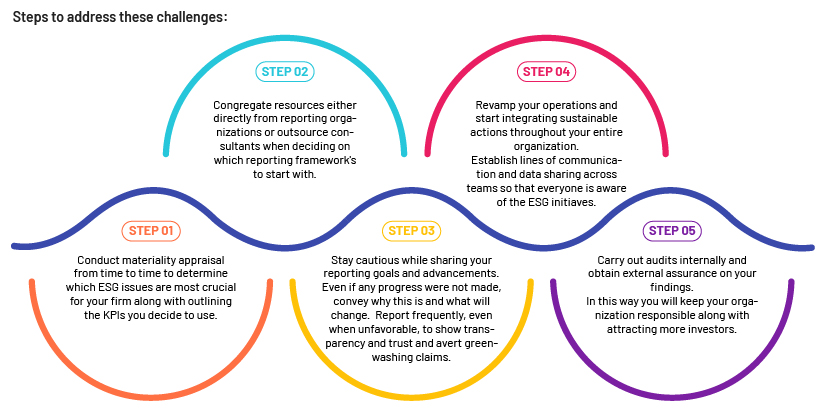

How to tackle challenges and limitations in ESG reporting

Conclusion

Growing emphasis on ESG investments is changing the asset management sector. It is influencing all segments of the value chain – due diligence, fund selection, investment analysis and product distribution – but is also critical for risk mitigation, asset pricing and enhancing shareholder returns. As regulatory restrictions become more stringent and investors and asset managers assess the value-creation potential of ESG considerations, there is significant opportunity for capital markets participants to play a pivotal role in driving social and environmental outcomes, paving the way towards a more equitable and inclusive society.

How Acuity Knowledge Partners can help

We have been supporting global clients in advancing their ESG asset management strategies for over two decades. Our team works as an extension of their onshore investor relations and pre-sales teams, providing end-to-end support across ESG-specific RFPs/DDQs/RFIs, ESG reporting, client reporting and content management. To help asset managers communicate their ESG themes better, we leverage our extensive fund-marketing experience, built over the years through collaboration with leading private equity and credit firms.

Sources:

-

https://www.pwc.com/gx/en/financial-services/assets/pdf/pwc-awm-revolution-2022.pdf

-

https://www.unpri.org/signatories/signatory-resources/signatory-directory

-

https://www.pwc.lu/en/sustainable-finance/docs/pwc-eu-private-markets-esg-reboot.pdf

-

https://watchwire.ai/5-esg-reporting-challenges-and-how-to-address-them/

-

https://www.broadridge.com/_assets/pdf/broadridge_esg_white_paper_march_2021.pdf

-

https://www.pionline.com/special-report/esg-rules-frameworks-private-markets-sprouting

What's your view?

About the Authors

Shreedhar has been with Acuity Knowledge Partners (Acuity) since 2021. He has over 11 years of experience in the financial services industry including over 11 years in RFP writing, content management, sales enablement, and over 5 years in team management. At Acuity, he is responsible for managing RFP teams, and client engagements. He has worked with several asset managers to streamline their processes, helping them implement industry best practices, content database migration, and process automation. Prior to joining Acuity, he worked with Invesco, Bank of New York Mellon, and Tata Consultancy Services. He holds a master’s degree in management from ICFAI Business School.

Bimalendu has been with Acuity Knowledge Partners (Acuity) since 2021. He has over 4 years of experience in RFP writing, sales enablement, investment advisory, client reporting, and content management. At Acuity, he is responsible for handling RFP/RFI/DDQs, client reporting, and content management projects. Prior to joining Acuity, he worked as an Investment Specialist at ICICI Prudential Life Insurance Co Ltd. He holds a master’s degree in management from ICFAI Business School.

Like the way we think?

Next time we post something new, we'll send it to your inbox