Published on July 26, 2024 by Huijuan Luo , Yue Zhang , Ying Liu and Liguo Xin

Regulation Overview

Government’s Purchase Subsidies: Phase 1: China has been implementing effective policies to promote NEVs and EVs since the launch of the ‘Ten Cities, One Thousand Vehicles Program’ in 2009. The programme aimed at the adoption of 1,000 NEVs (including commercial vehicles, buses and taxies) in each of the 10 cities over the next three years. However, the targets were not fully achieved by 2012, owing to technology constraints, limited model availability, lack of infrastructure, consumer attitude, etc.

Phase 2: Taking a cue from the programme over 2009-2012, China tweaked its national NEV policies, shifting the focus to improving technology and the industry and encouraging innovation in business and operational models. The government began to emphasise on battery range as one of the major eligibility criteria for subsidies.

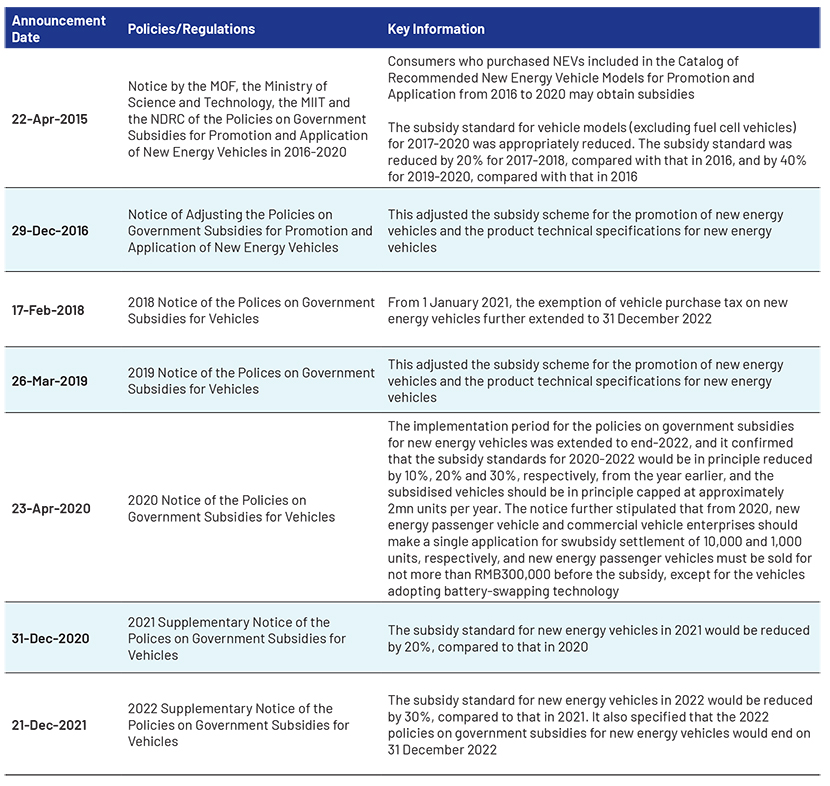

Phase 3: In 2015, the Chinese government announced a government-subsidy policy under which customers could avail subsidies while buying certain types of NEVs that were part of the Recommended New Energy Vehicle Models for Promotion and Application.

Exhibit: Major government subsidy policies, 2015-2021

Source: Acuity Knowledge Partners research

According to the latest data from the MIIT, the total subsidies to the NEV industry exceeded RMB22.2bn in 2021. Owing to a decline in subsidies, the average subsidy decreased from RMB84,000 per unit in 2017 to RMB14,000 per unit in 2021. It dropped further to c.RMB10,000 per unit in 2022, given that the 2022 NEV purchase subsidy standard reduced 30% YoY.

Growth Driver Analysis

Upbeat Consumer Demand on Government Support Measures: The Chinese government has introduced some NEV-industry-focused development plans and incentive measures as a major strategic mandate to achieve ‘peak CO2 emissions’ by 2030 and ‘carbon neutrality’ by 2060. In October 2021, the State Council of China set a target of increasing the proportion of incremental vehicles fuelled by new and clean energy to 40% by 2030 under the Action Plan for Carbon Dioxide Peaking Before 2030.

Intelligentisation Trend to Create Competitive Advantages: EVs apply more advanced power and smart technologies than traditional vehicles, such as more advanced autonomous driving technologies and smart cockpits, which significantly enhance mobility experience. Most EV manufacturers are offering ADAS, autonomous driving and smart cockpits to differentiate themselves from traditional OEMs as they seek to create a competitive edge.

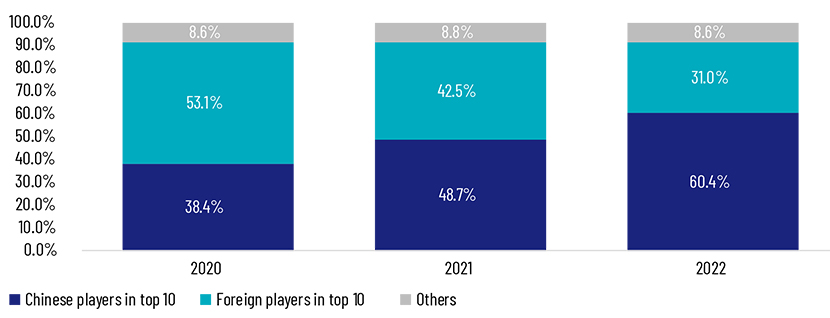

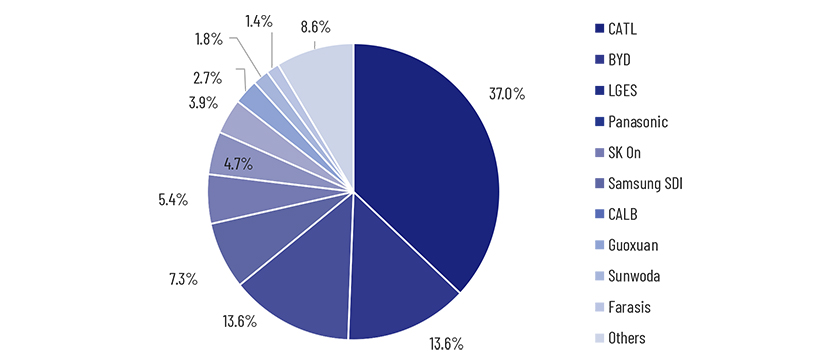

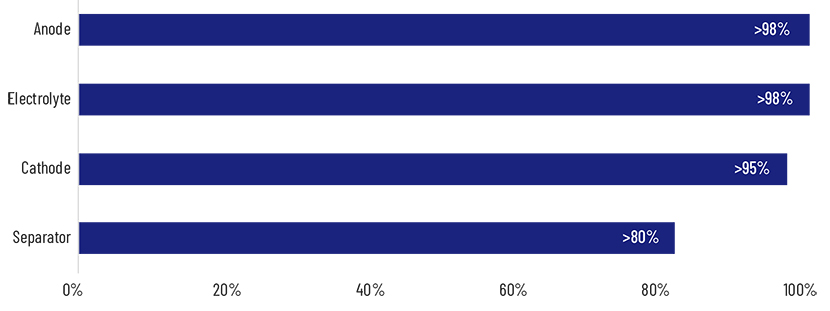

Cost Reduction Throughout EV Value Chain Owing to Localisation: China boasts a fully developed and robust EV supply chain, with almost 100% localisation of core EV components, which has reduced costs and improved efficiency. Local EV makers and battery manufacturers compete alongside foreign players. This competition has driven innovation and technological advancements in the industry.

Exhibit: Market share of global EV battery installation capacity

Source: SNE research, Acuity Knowledge Partners research

Exhibit: Top 10 global players by installed power battery capacity, 2022

Source: SNE research, Acuity Knowledge Partners research

Exhibit: Localisation rate of four key battery materials

Source: GGII, Acuity Knowledge Partners research

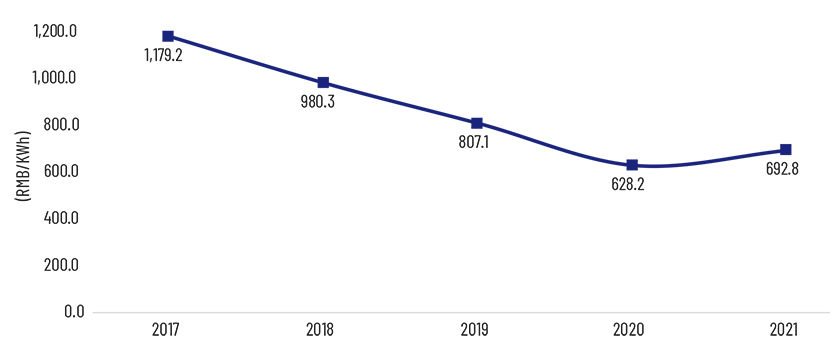

Thanks to the increasing localisation of the EV battery supply chain, the average cost of Chinese EV battery has dropped significantly in the past few years. According to CALB’s prospectus, the average price of EV battery packs in China fell 41% between 2017 and 2021, from RMB1,179/kWh to RMB693/kWh. This was also due mainly to technological advancements, supply chain improvements and greater economies of scale. We believe the trend will likely continue as the industry grows and matures.

Exhibit: Average cost of EV battery

Source: CALB’s prospectus, Acuity Knowledge Partners research

Tags:

What's your view?

About the Authors

Huijuan is an Associate Director in Acuity Beijing’s Investment Research team. She supervises buy-side teams at Acuity Beijing that serve hedge funds, mutual funds, asset management firms and private equity firms in countries and regions such as Hong Kong, Japan, Singapore, Europe and the US. She has 13 years of investment research experience at Acuity, covering China and Japan markets by leveraging her trilingual capabilities and a total of 17 years of working experience. Huijuan holds a master’s degree in Finance from the University of International Business and Economics, China.

Yue is an Assistant Director in Acuity Beijing’s Investment Research team. She has over 10 years of working experience at Acuity including over 5 years in a management role. She supervises Acuity Beijing’s sell-side equity research teams in Mandarin, Japanese and English. Yue previously supported multiple equity research teams at a Europe-based global investment bank, most notably in China’s internet and Japan’s precision machine sectors. She holds a master’s degree in Finance from the University of Sydney, Australia. Yue is an ACCA Affiliate.

Ying is an Associate in Acuity Beijing’s Investment Research team. She has over five years of working experience in investment research, focusing on China’s TMT and industrial sectors. She currently supports a global sell-side equity research client, covering China’s internet sector. Prior to Acuity, she worked as a research analyst with an asset management firm in Hong Kong. Ying holds a master’s degree in Social Work from the Chinese University of Hong Kong. She has passed CFA Level 2.

Liguo is an Associate in Acuity Beijing’s Investment Research team. He currently supports an international sell-side equity research client, covering China’s financials sector. He previously supported equity research teams of multiple top-tier global investment banks, covering Asia’s commodity and China’s EV sectors. He holds a master’s degree in Finance from the University of Iowa (US). Liguo has passed CFA Level 2.

Like the way we think?

Next time we post something new, we'll send it to your inbox