Published on September 7, 2022 by Aniket Mathur and Chithra Krishnan

Climate risk is a primary concern in the asset management sector, particularly in fixed income asset management. Managers have recently been screening and reducing the weightage of issuers with exposure to businesses such as fossil fuel, thermal coal, tobacco, controversial weapons and small arms that do not meet environmental standards. They use similar procedures to calibrate social and governance characteristics in managing fixed income indices, leading to major index providers investing heavily in building good-quality environmental, social and governance (ESG) data.

Why ESG?

Sustainable investment has had a large impact on companies over the years, encouraging them to act responsibly in terms of ESG considerations. One of the resulting products is ESG bonds, which encourage investment based on ESG standards and sustainability-specific project-based ideas. Investors were especially financially rewarded for their investments in businesses that included ESG in their financial instruments. Since the European Investment Bank issued these bonds in 2007, the market has experienced only expansion. The move towards carbon neutrality, electric vehicles, gender equality and other issues has contributed to the recent increase in popularity of these bonds.

What are ESG bonds?

A range of entities, including sovereigns, financial institutions/banks, non-financial corporates and supranational bodies have been the main issuers of ESG bonds, in their own or different currencies. The issuance procedure is identical to the current bond issuance method; this starts with hiring banks and underwriters, followed by the announcement of the bond, initial price guidance, invitations for bids, final price guidance and bond pricing.

The four types of ESG bonds:

1. Green bonds:

Bonds specifically issued to finance environmentally friendly initiatives such as wastewater treatment, sustainable water use, carbon neutrality and clean transportation. These securities have historically been the largest contributor to all green, social, sustainability and sustainability-linked (GSSS) bonds

2. Social bonds:

Bonds specifically created to support ongoing or new socially beneficial enterprises, including the development of affordable housing, diversity in the workforce and fundamental infrastructure

3. Sustainability bonds:

Proceeds from these bonds are used to finance or re-finance a combination of green and social bonds. These bonds adhere to all components of Green Bond Principles (GBP) and Social Bond Principles (SBP)

4. Sustainability-linked bonds (SLBs):

These bonds, which should not be confused with sustainability bonds, derive their name from the issuer’s commitment to ESG objectives and targets rather than the intended use of proceeds. The issuer may use profits from these bonds for any purpose but must meet the stated objectives. In the event the issuer does not meet the target(s), SLBs have coupon step-ups in place to penalise the issuer

Although the majority of ESG bonds fall into one of the four categories mentioned above, there are less common ESG bond types such as transition bonds, sustainability re-linked bonds, blue bonds and rhino bonds. The majority of ESG bonds also adhere to a global standard such as the International Capital Market Association’s green/social/sustainability bond principles and the UN’s Sustainable Development Goals, which provide credibility.

Key trends and the road ahead

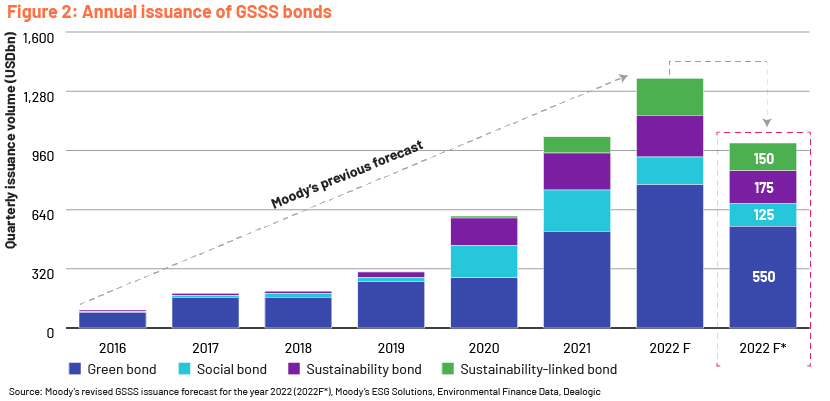

The ESG debt market has expanded rapidly not only in terms of size, but also in terms of financial products and services. The growing importance of ESG as an international agenda has enabled investors to tap the debt market's potential. Green bonds have historically played a pivotal role in the issuance of ESG-labelled bonds; however, the emergence of sustainability-linked bonds opened new avenues to the market and new opportunities for investors. USD1.03tn worth of GSSS bonds were issued in 2021, three times the USD326bn worth of bonds issued in 2019 and up 69% from the USD606bn issued in 2020.

Global market disruptions impact the ESG bonds ecosystem

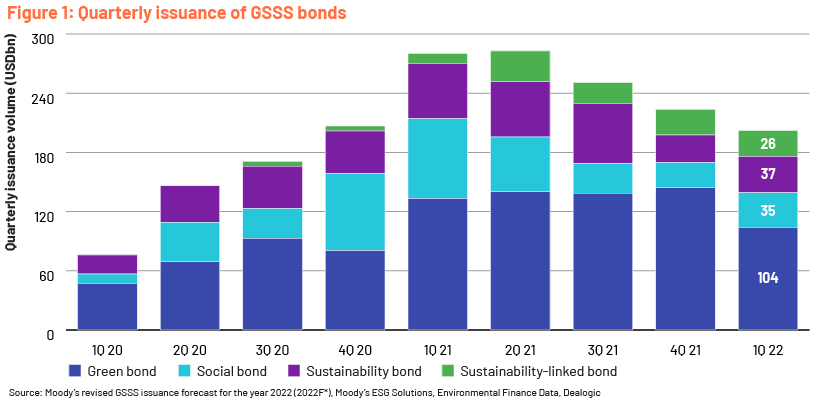

The debt market has undergone significant changes amid the uncertainty in 2022. While global issuance of GSSS bonds totalled USD203bn in 1Q 2022, it was down 11% and 28% from 4Q 2021 and 1Q 2021, respectively. Sustainability bonds were the main bonds issued in 2021, but their issuance was moderate in 1Q 2022 (see Figure 1). Volumes fell as market volatility was higher than expected due to the prolonged geopolitical tensions between Russia and Ukraine, increased inflationary pressure and the prospect of quantitative tightening (see Figure 2).

Global GSSS bond issuance overview

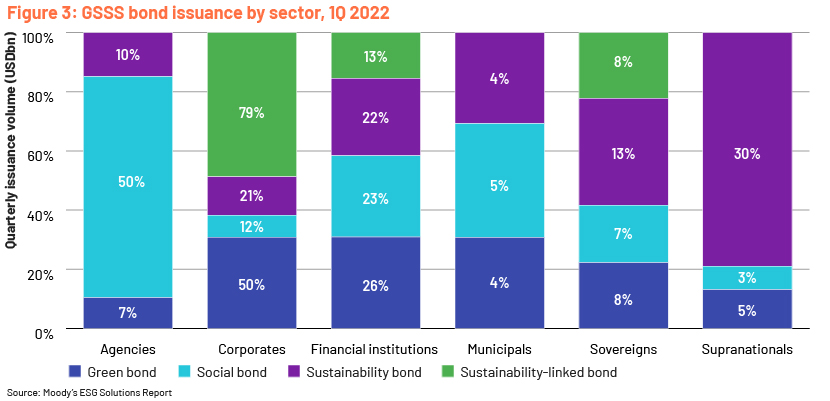

Global green bond issuance fell by 29% in 4Q 2021 to USD104bn, the lowest since 4Q 2020 (see Figure 1). European issuers accounted for more than 45% of global green bond issuance in 1Q 2022. Corporate issuance dominated the sector in 1Q, accounting for half of the total share (see Figure 3), with the remaining half divided among financial institutions (26%), sovereigns (8%), agencies (7%), supranationals (5%) and municipals (4%).

Figure 3: GSSS bond issuance by sector, 1Q 2022

Social bond issuance increased to USD35bn in 1Q (see Figure 1), accounting for 18% of the total GSSS bond market. French public agency Caisse d'Amortissement de la Dette Sociale (CADES) contributed USD12.4bn to 1Q 2022 issuance. Europe led the way, with USD22bn in issuance, followed by North America and Asia Pacific. Agencies accounted for half of all issuance from a sectoral perspective, followed by financial institutions (23%), corporates (12%), sovereigns (7%), municipals (5%) and supranationals (3%) (see Figure 3).

Sustainability bond issuance totalled USD37bn (see Figure 1), up from 33% in 4Q 2021 but down 29% from 1Q 2021. One possible explanation for the rise was increased emphasis on environmental and social initiatives. Supranational issuers dominated 1Q 2022, accounting for USD11bn or 30% of total issuance (see Figure 3). Asia Pacific led the way, with USD8bn in market issuance followed by Europe, with USD7bn.

Volumes issued under the sustainability-linked bonds category stood at USD26bn in 1Q 2022 (see Figure 1), down 15% from 4Q 2021. Issuance was roughly in line with the volumes reached over the previous quarters. Regionally, European issuers dominated volumes, accounting for 69% of issuance in the quarter, followed by Latin American issuers that contributed USD4bn.

Outlook and revisiting the forecast

Long-term ESG bond issuance remains strong despite market headwinds. However, after factoring in the recent stressed geopolitical and economic scenarios, Moody's forecasts that the volume of GSSS bond issuance will remain flat at USD1tn in 2022 (see Figure 2, 2022 F*) compared to its previous forecast of USD1.35tn (see Figure 2, 2022 F). GSSS bonds totalling USD1tn would be broken down as follows: green bonds: USD550bn, social bonds: USD125bn, sustainability bonds: USD175bn and sustainability-linked bonds: USD150bn.

How Acuity Knowledge Partners can help

Over the years, investors and financial institutions have expressed concern about incorporating ESG data into mainstream operations. Criticism has grown, especially in the area of fixed income. Subtle requirements such as incorporating a variety of ESG risks into different fixed income securities have alarmed investors and financial institutions.

Due to a lack of reliable and high-quality ESG data, they have had to conduct their own research. Nonetheless, data providers, corporations and international financial institutions have prioritised improving data provision and data integration by ensuring coverage of the investable universe of debt and assessing the direct impact of ESG-based project financing.

We assist clients with data analysis and data cleansing, and coordinate with vendors on missing data and map them accordingly. We have conducted quality analysis, captured ESG exposures and researched around 1,800 issuers in the past six months using data vendors such as Refinitiv Eikon for Business Classification and Sustainalytics data to determine the involvement of issuers in any of the permissible categories of business in line with ESG standards. We also have experience in working with several other ESG rating providers.

To expedite the process of data analysis and quality control of ESG bond indices, we apply our technical expertise to create automated templates using Excel VBA. We generate reports such as factsheets, ESG reports and index reports for ESG bond indices using technical methods such as Power Pivot, Power Query and Excel charts, enabling clients to decide on ESG index management in a consistent and transparent manner by excluding instruments that do not adhere to the established ESG standards.

Sources:

627a63842127ead24222a2fb_BX12811_SF report draft – 5.9.2022.pdf (website-files.com)

$500bn Green Issuance 2021: social and sustainable acceleration: Annual green $1tn in sight:

The Rise of ESG Bonds in Corporate Financing | Bennett Jones LLP – JDSupra

The ESG data files – part four: fixed income data – Environmental Finance (environmental)

sustainable-bond-insight-2022.pdf (environmental-finance.com)

What's your view?

About the Authors

Aniket Mathur is an associate at Acuity Knowledge Partners. He works for Fontana Fixed Income team in Specialized Solutions Department. He completed his PGDM in Finance Analytics from Great Lakes Institute of Management, Gurgaon and B.Com (Hons) from Acharya Narendra Dev College, University of Delhi.

Chithra Krishnan is a Senior Associate at Acuity Knowledge Partners. She works for Fontana Fixed Income team in Specialized Solutions department. She holds an MBA in Finance from Coimbatore Institute of Management and Technology, and a B-Tech in Information Technology from Amrita School of Engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox