Published on April 30, 2019 by Hitesh Acharya

A large number of commercial real estate (CRE) transactions, including property development, acquisitions, and refinance, are being financed with a capital structure that includes subordinate mezzanine debt, along with senior debt and promoters’ equity. This has led to financial institutions, including Wells Fargo, Natixis, Capital One, Morgan Stanley, and Barclays, establishing their CRE mezzanine lending desks.

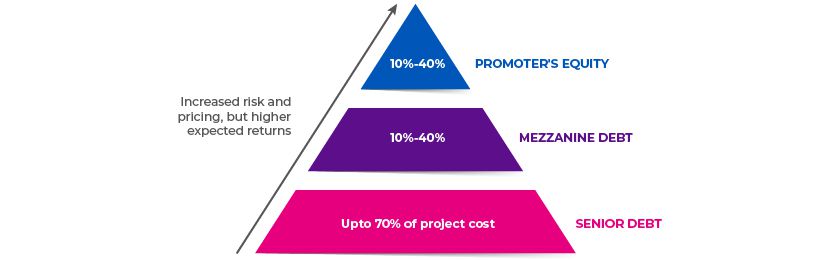

The prevalence of mezzanine CRE debt is mainly due to the reluctance of traditional lenders to finance real estate transactions at a loan-to-value (LTV) ratio exceeding 70%, due to either regulatory requirements or the CRE sector’s inherent cyclicality. Despite its high cost (interest rates between 7% and 20%), promoters view mezzanine financing favorably as it allows for improved cash flow by reducing the promoter’s equity contribution in a project (without ownership dilution to another equity investor) and through benefits such as bullet repayments and higher LTV. Generally, mezzanine lenders allow an LTV of up to 85% and may contribute between 10% and 40% of a project’s capital.

The security for a CRE mezzanine loan is not a lien on the property (which is already pledged to the senior lender), but rather the assignment of the borrower’s equity (generally 100%) in its property-owning subsidiary. Consequently, it follows that the lender’s remedy in case of a default will not be foreclosure of the property, but foreclosure of the pledge of the mezzanine borrower's (i.e. parent’s) equity interest in the property-owning subsidiary.

Additional security in a CRE mezzanine loan can be in the form of clauses, such as

-

Assignment of partnership interest – Gives the mezzanine lender the option to become the property owner in case of a default and to assume the obligation to service the debt of the senior lender. Has to be agreed in the inter-creditor agreement

-

Cash flow note (colloquially known as “soft second”) – Instructs the assignment of all residual cash flows from the property, after servicing the senior debt, to the mezzanine loan, and, in the event of a sale, applies the leftover property sale proceeds to the mezzanine loan. This arrangement need not be backed by the inter-creditor agreement

-

Second deed of trust – Provides the most tangible form of security by allowing the mezzanine lender to also foreclose on the property alongside the senior lender in the event of a default. However, the senior lender generally would not allow such an arrangement

In case of development projects, the mezzanine loan is drawn down before the senior construction loan and is repaid only after the senior loan is fully repaid. However, for property acquisitions, all loans are generally drawn down simultaneously, although the mezzanine loan is repaid on a residual basis after the senior loan repayment.

The capital stack of a company that availed mezzanine financing would typically look like the below illustration.

Lenders need an in-depth understanding of the credit underwriting process to adeptly evaluate capital structures with mezzanine loans to avoid concerns, such as excessively leveraged borrowers, very low equity stake of the promoter, and high interest servicing burden.

Commercial lending solutions by Acuity Knowledge Partners, backed by its vast experience in the field, enable lenders to accurately underwrite deals having a mezzanine financing element.

Sources:

Commercial Observer

Stern School of Business, New York University

The Emerging Markets Private Equity Association (EMPEA)

White and Williams LLP

Tags:

What's your view?

About the Author

Hitesh has over 14 years of experience in working with leading global organizations in the banking and commercial lending domains. His expertise spans a broad range of analyses, including credit appraisal, leveraged lending, stressed assets, industry reports, cash flow modelling, and client pitch presentations. At Acuity Knowledge Partners, he has led sector and product-specialist pilot teams in Commercial Lending, focusing on diverse sectors such as real estate, manufacturing, aerospace and defense, transport and logistics, and business services.

Hitesh holds a Masters in Management Studies from K.J. Somaiya Institute of Management Studies and Research, University of Mumbai, and a B.Com from University of Mumbai.

Like the way we think?

Next time we post something new, we'll send it to your inbox