Published on March 20, 2023 by Rathnakala Kumaragurunathan , Sasitha Edirisinghe , Hamdhan Othman and Chathura Weerasooriya

Coming off a volatile year, markets are experiencing similar macro uncertainties in 2023 with continued rake hike cycle, recession fears and energy price shocks. In this back drop, asset allocators are poised to strategize their investments in pursuit of alpha return.

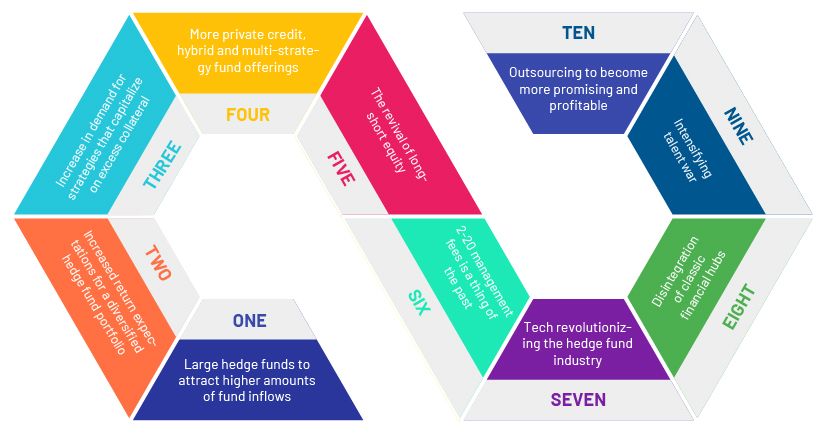

The following are key market trends we expect for hedge funds through 2023.

1. Large hedge funds to attract higher amounts of fund inflows

Competition within the hedge fund industry increases each year, with an estimated 15,000 hedge funds in the marketplace at the moment. Hedge fund allocators are overwhelmed with the sheer amount of pitches with only a fraction of the requests receiving a response from potential investors, unless they have a strong pre-existing relationship. As a result, a small number of larger hedge fund organizations, with the strongest brands and hedge fund solutions, are expected to attract the majority of net flows within the industry. Firms with the strongest brand include the largest managers in the industry and a limited group of small to mid-sized managers who excel by offering a high-quality investment product, clearly articulating their differential advantage, and implementing a best-in-class distribution strategy that deeply penetrates the market.

2. Increased return expectations for a diversified hedge fund portfolio

With the risk-free rate projected to rise above 4%, from close to 0% last year, investor return expectations for a diversified hedge fund portfolio will also increase from the mid-single digits to 7-9% during a period of continued headwinds for the capital markets. Higher rates will have a dramatic impact on the relative demand for some hedge fund strategies as investors focus on the expected returns above the risk-free rate for each strategy driven by beta (the underlying markets the strategy focuses on) and alpha (created through manager skill). This will reduce demand for those high-Sharpe Ratio, low-volatility strategies whose annualized returns fall below the required return minimum hurdle.

3.Increase in demand for strategies that capitalize on excess collateral

Rising interest rates are generally associated with declining asset values. Higher rates has an inverse relationship with bond values in fixed income markets, while it also affect equity valuations. In contrast, rising short-term rates can have a positive impact for hedge fund strategies that hold large cash/short-term fixed-income positions. This helps maintain consistent returns over the risk-free rate over time. Hedge fund strategies that hold a lot of cash/short-term fixed-income positions include Commodity Trading Advisors (CTAs), Reinsurance and Market Neutral Long Short Equity.

4. More private credit, hybrid and multi-strategy fund offerings

Private credit strategies have attracted investor demand during last two years, as fund managers take advantage of the gap left by banks that are no longer able to lend as they used to. Also industry is seeing more and more pure ESG (environmental, social and governance) funds launches, which may continue in to 2023. Multi strategy funds became popular in 2022 with higher inflows and are expected continue the momentum as investors are moving away from concentrated strategy approach. Hybrid strategy funds also attracted more fund flows in 2022, as the managers expanded their scope from traditional strategies. One key trend was fund managers with a long/ short equity adding private equity vehicle to help smooth out their liquidity and overall returns.

5. The revival of long-short equity

The hedge fund industry used to be dominated by long-short equity, reaching approximately 40% of all the industry assets. However, this strategy started to underperform in the past ten years, with investors shifting to other strategies, such as CTAs or other fixed income strategies which had better performance. One of the causes for the decreases in long-short equity was related to prominent tech names and passive S&P 500 index funds. This ballooned the large growth stocks and the index, negatively impact the relative valuation of small and large-cap stocks, value and growth stocks, and US and foreign stocks. Many investors spotted the opportunity to use fundamental research while relative valuations are still behind historical averages. This leads to the expectation of returning to wide adoption of long-short equity strategies.

6. 2-20 management fees is a thing of the past

The 2% base management fee on assets under management and 20% performance fee on realized gains was a longtime industry standard, which is no longer the case. According to Hedge Fund Research, in 2020, hedge funds on average charged a 1.3% management fee and 16.4% performance fee. That is down from an average 1.6% and 19.3% a decade ago, respectively. Increased level of competition among hedge funds has continuously put pressure on management fees, as investors are considering lower fees as an important prerequisites at the manager selection process. New regulation to drive up transparency in disclosures on strategies and leverage has further created a level playing field for fund managers, thus putting pressure on those funds with higher fees. Some of the larger funds are already moving away from the traditional fee structure and charging pass-through fees from investor that has the ability for larger funds to attract top traders. Such fees can cover everything from boosting pay to hiring, covering rent and even entertainment. However, fund managers with solid track records can still command higher fees, as some of the large sized, prominent brand funds are charging fees as much as 3.5% fixed fee and 40% performance fees.

7. Tech revolutionizing the hedge fund industry

While the current market environment presents challenges for institutional investors, it also offers hedge funds alpha opportunities unseen for years. This has resulted in increased demand for unconstrained investment strategies in general and for macro strategies specifically. That increased complexity is leading to a lot more data being generated and analyzed as fund managers seek alpha. As a result, hedge funds need technologies capable of more complex data analytics and fund managers who don't invest in such technology could get left behind. To maximize their return potential in this backdrop, hedge funds are investing in more data and further developing their tech stack to help scale their operations. In view of this, hedge funds are increasingly partnering with specialist third-party providers, enabling the funds to focus even more on their core activity of generating alpha.

8. Disintegration of classic financial hubs

Hedge funds were traditionally concentrated in geographies such as New York, London and Hong Kong. However, Dubai and Singapore have been attracting more hedge funds during last few years as the industry is focusing less on traditional financial centers in their future plans. Dubai has attracted many large size funds as London based managers were seeking new bases in the post-brexit environment. Also increased activity levels of sovereign wealth funds, reduced licensing fees & capital requirements, time zone advantage for firms investing in emerging markets and access to talent, have made it beneficial for those funds willing to relocate. Combination of remote working ability, tax incentives and a more 'user-friendly' living environment have also made professionals to relocate to Dubai as oppose to their current locations. Singapore has also seen an influx of both global funds and smaller regional managers, particularly those who wants to relocate from Hong Kong. Singapore is becoming increasingly popular with firms whose strategies aren't focused solely on China. Also Its treaty with India makes it a tax-efficient base for investments in the sub-continent, while it's also proving an effective gateway to neighboring Vietnam and Indonesia.

9. Intensifying talent war

Just as many sectors in the broader economy have been contending with the Great Resignation and struggles hiring workers, members of the hedge fund industry are predicting struggles of their own with respect to maintaining their pool of talent. According to research by Alternative Investment Management Association (AIMA), majority of fund managers are concerned with talent retention as traditional focus areas such as compensation is no longer the reasons to attract and hold on to prized workers. Non-financial benefits such as better work-life balance, supporting parental leave, and offering opportunities for personal development are some of the requirements of hedge fund talents. Besides, skill requirements for workers have also shifted during last few years. As investor demand is picking up for ESG products, workers who are skilled and versed in responsible investing are most in-demand hires. The near-ubiquitous need to have a technology-focused solution across functions within a hedge funds, is fueling a drive to lure data scientists and quantitative analysts, along with expectations of technology acumen among other roles within the firm’s operations.

10. Outsourcing to become more promising and profitable

The hedge fund industry is under transformation due to the increasing costs of operations while management fees decrease. As a result, more and more small- and medium-sized businesses will seek to outsource many activities to reduce expenses, including technology, accounting, compliance, marketing, and other research- and investment-related activities. Outsourcing these aspects of hedge fund businesses will offer lower fees, higher efficiency, and greater expertise. According to fund managers, the pandemic lockdown accelerated the trend towards outsourcing for hedge funds. Those funds with existing outsourcing support are capitalizing on the time zone differences as back office operations, other research and supportive functions are done overnight.

Acuity Knowledge Partners’ hedge fund research services handle time-consuming and non-core tasks, enabling clients to optimize capacity.. We have set up dedicated teams of analysts (with MBA, CFA and CA backgrounds) across equities, fixed income, private equity and data science to support hedge fund functions. These teams work as an extension of our clients’ internal teams and produce exclusive output customized to client requirements.

References:

-

Hedge Fund Outlook For 2023: What To Expect As Managers Face Increased Complexity

-

Other Voices: Top hedge fund industry trends for 2023 - Opalesque

-

With volatility a constant, hedge fund managers excited by alpha prospects in 2023 | Pensions &

-

Analysis: Global hedge funds plan 2023 around inflation risk | Reuters

-

Two and twenty is long dead. Hedge fund fees fall further below onetime industry standard

-

Why is Dubai the new hedge fund hotspot | Markets – Gulf News

-

Singapore cements position as a regional hedge fund hotspot (hedgeweek.com)>

-

Hedge fund firms are gearing up for a talent war | Wealth Professional

-

Press release: Gaining an edge: How hedge funds are navigating the new talent landscape

What's your view?

About the Authors

Rathnakala has 16 years of experience in providing offshore research and analytics services to the global financial and corporate sector. She is an IR SME based out of the London office responsible for driving new business development for the IR BU, in addition to driving growth of the global buyside alternatives business. She also oversees the equity buyside delivery team in Colombo. Rathnakala is a member of ACCA (UK), CIMA (UK) and CPA (Australia). She also holds a BSc. in Economics and Management from the London School of Economics, University of London.

Sasitha is a Chartered Management Accountant with over 5 years of work experience. Presently, he is supporting a large hedge fund, based in the USA, on work primarily in relation to investment research and financial model building and has gained exposure to the Consumer, Leisure, and Automotive sectors.

Hamdhan has over six years of work experience and is currently a Delivery Lead supporting a US based global hedge fund and has gained exposure to the Industrials, Healthcare, Utilities and REITs sectors. He is an Associate Member of the Chartered Institute of Management Accountants- UK, and holds a BSc.(Honours) Degree, specializing in Economics and Finance from University of London, International Programs. He is also a CFA Level 3 Passed Finalist.

Chathura has over 12 years of experience in investment research, investment operations and financial management, with seven years in investment research at Acuity Knowledge Partners Sri Lanka. He currently supports a European based buy-side client and has gained exposure in to range of sectors including metals & mining and real estate finance. Chathura is a Chartered Management Accountant and holds Bachelor’s degree in Finance from University of Sri Jayewardenepura.

Like the way we think?

Next time we post something new, we'll send it to your inbox