Published on March 11, 2024 by Nayantara de Mel , Sadma Umagiliya , Pulasthi Abeywardena and Mihindu Samarasinghe

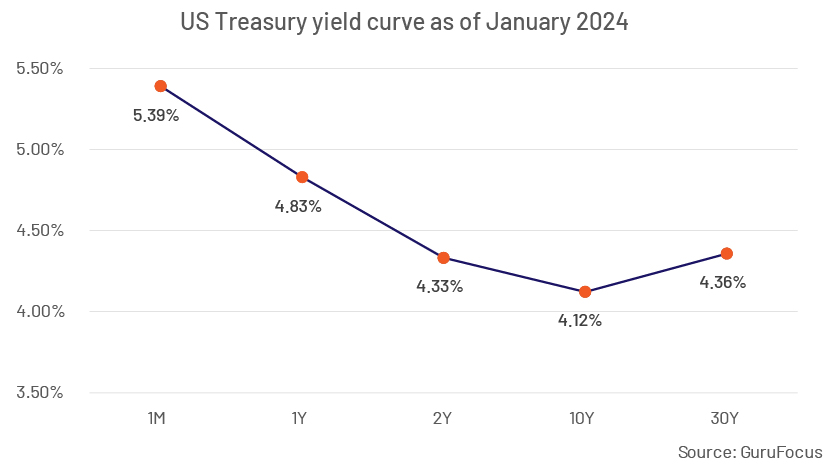

The hedge fund (HF) space remains plagued by volatility and unpredictability (as indicated by the inverted yield curve), aggravated now by a rapidly changing technology landscape. The following are some of the key trends we expect this year.

1. Building on generative AI

2023 was the year of generative AI, and we expect HFs to use it primarily to automate grunt work (and cut costs), and those HFs with a fundamental tilt to use it to streamline research processes. Many HFs are trialling proof of concept (POC) using application programming interface (API) connections to large language models (LLMs) to help them explore the possibilities. Fifty-six percent of the respondents to BarclayHedge’s Hedge Fund Survey used AI to inform their investment decisions. While HFs have been using AI for years, primarily on the trading front, the rise of generative AI is making an impact in terms of automating admin work. Managers expect generative AI to disrupt the quant and coding market and shrink the workforce over the next six months. Broadridge expects managers to increase spending on AI and machine learning by 20% over the next two years.

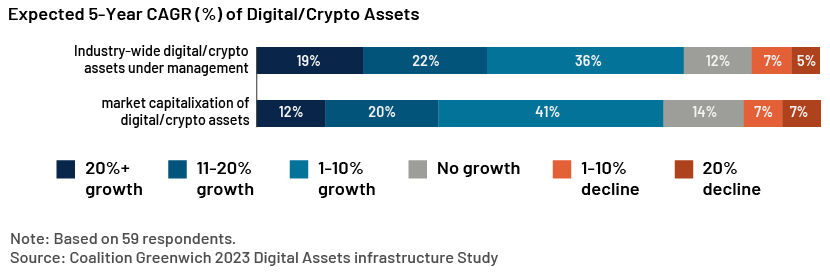

2. Exploring digital assets

2022-23 was difficult for the traditional cryptocurrency world, but significantly helped separate the wheat from the chaff and bring focus to real-world blockchain infrastructure plays. A growing number of HFs are starting to envision asset-class allocation to these products. Of the HFs surveyed by Laser Digital, 98% consider digital assets to be a diversification opportunity while 88% are positive about digital assets in 1H 2024. Forty-seven percent say that their exposure to digital assets would be 5-10% in the next three years. This interest would be fuelled by the Securities and Exchange Commission’s (SEC) recent approval of exchange traded funds (ETFs) to track Bitcoin, providing digital assets with more legitimacy. However, HFs now need to conduct specialised due diligence (types of due diligence that they have not conducted before) to avoid exposure to financial crime.

3. Potential alpha, but with difference in strategy

The HF sector is currently in a period of transition as multiple factors contribute to uncertainty in global economic policy. However, there is still potential for alpha generation. HFs with global macro strategies are finding their footing, while event-driven strategies have differed significantly in terms of performance at the sub-strategy level. In general, quant funds have not performed well due to the redundancy of most historical trading models, which were built amid a more predictable bull market, but tactical trading funds are expected to benefit in the medium term. The return of volatility and higher yields have created opportunities for robust alpha generation, particularly in non-correlated strategies. Additionally, the difference in returns among HF strategies has increased, indicating varying performance among the different strategies.

4. UAE as a global HF hotspot

The UAE’s tax environment, pro-business culture, presence of high-net-worth investors and easy visa process make it attractive for HFs. This is enhanced by the ease of access it affords to EMEA and APAC and a time zone that overlaps Western working hours. Twenty percent of the top 100 HFs and two-thirds of the top 15 multi-strategy HFs already have a presence in Dubai and smaller players continue to explore their move into the country.

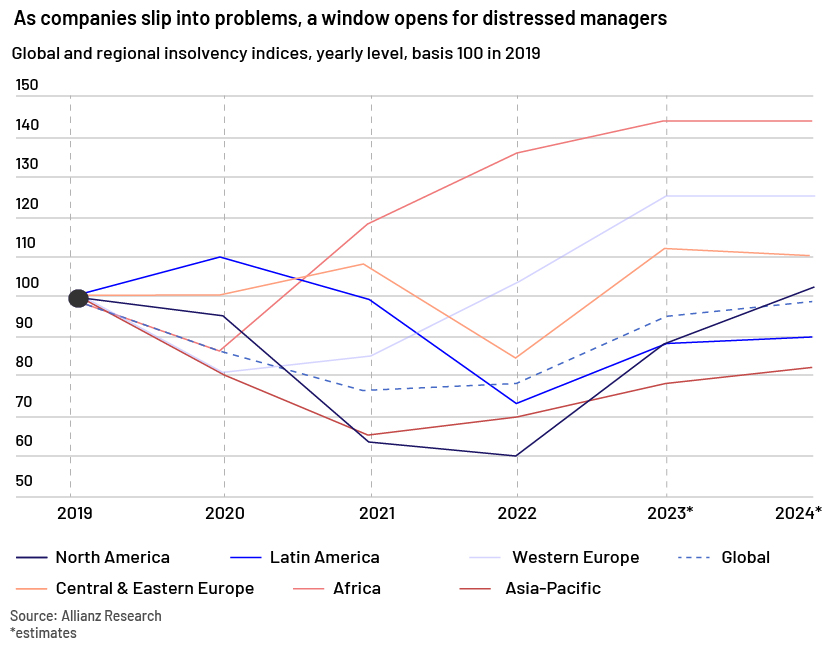

5. Distressed debt: capitalising on market challenges

Opportunities for distressed debt are abundant in 2024, especially as we cycle out of short-term debt from the heavy borrowing during the pandemic. Credit downgrades are now exceeding the highs amid that crisis. Allianz Trade forecasts that global insolvencies will climb 4% YoY in 2024. The pipelines of turnaround-private equity managers are growing – 49% of the respondents to Preqin’s investor survey expect distressed debt to be a high-performing segment of private debt strategies.

6. Emergence of insurance-linked securities (ILS)

ILS have created an opportunity to diversify risk primarily due to the low correlation between reinsurance strategies and financial markets. ILS returns are expected to be >2x in 2024, similar to 2023, according to Swiss Re's Alternative Capital Partners. Moreover, Artemis Directory says that ILS are attracting large institutional investors such as pension and sovereign wealth funds, with their fund managers increasingly adding ILS, catastrophe bonds and other reinsurance-linked assets to their portfolios. For example, Bristow Group Inc.’s Employee Savings and Retirement Plan has allocated 5% of its total assets to ILS.

How Acuity Knowledge Partners can help

Acuity provides its clients with unique assistance to innovate, implement transformation programmes, increase operational efficiency and manage costs. To that end, we offer a flexible and multilingual global delivery model. We understand that each client is unique and, hence, we are open to different engagement models, including dedicated staff models, block-of-hours models and ad hoc project-based models to suit our clients’ requirements.

We have set up dedicated teams of analysts across equities, fixed income and quants to support hedge fund research services. Our analysts come with backgrounds in finance (MBAs, Chartered Accountants, CFA charterholders), economics, technology and math, and they work as an extension of our clients’ internal teams to support them across the entire investment research lifecycle – from idea generation to portfolio monitoring to exit. All output we produce is customised for a client and is for their exclusive use. In a number of instances, such teams tend to be multi-functional across domains and asset classes. By leveraging our services, our clients are able to drive a proprietary investment research process at scale.

This provides a client with a unique edge that is also sustainable. Incidentally, some of our hedge fund clients use soft dollars to pay for our services.

Sources:

-

Adapting to Change: How Hedge Funds May Benefit in a New Volatility Regime (gsam.com)

-

As default rates rise, private equity eyes distressed investments | Moonfare

-

Asset Management Professionals Maintain Crypto Optimism, Survey Finds (coindesk.com)

-

Dalio’s Abu Dhabi Penthouse Shows Rise of New Hedge Fund Hubs – Bloomberg

-

Distressed debt investors prepare for 2024 opportunities | PitchBook

-

Distressed debt players seek opportunity as recession fears fade (markssattin.co.uk)

-

Dollar steadies as economic data muddies Fed expectations | Reuters

-

Hedge Fund Strategy Outlook: Fourth quarter 2023 | Franklin Templeton

-

Hedge Funds Leveraging Innovative Technology for Growth | Broadridge

-

Hedge funds positive about digital/crypto asset markets, says new study – Hedgeweek

-

Institutional Money Managers Agree With The SECs Regulation By Enforcement Of Crypto (forbes.com)

-

Investors bank on alternatives, generative AI for 2024 (funds-europe.com)

-

Market Insight: Distressed Assets on the Horizon for 2024 – NAI Global

-

Navigating global hedge fund trends in an uncertain 2024 environment – Enfusion

-

Pension funds investing in insurance-linked securities (ILS) – Artemis.bm

-

United States Fed Funds Interest Rate (tradingeconomics.com)

-

US SEC approves bitcoin ETFs in watershed for crypto market | Reuters

-

What Wall Street banks, analysts hedge funds think about next gold rush in AI | Fortune

-

Why Go Long When Short-Term Bonds Yield More? | Charles Schwab

Tags:

What's your view?

About the Authors

Nayantara has over 16 years of experience in banking, corporate planning, strategy formulation and capital market research in both local and global financial markets, including 6 years of providing offshore research & analytics services to the global financial and corporate sector within Acuity. She oversees the hedge fund buyside delivery team in Colombo. Nayantara is an Associate Member of CIMA (UK) and holds a Post Graduate Diploma in Applied Finance from the University of Sri Jayewardenepura Sri Lanka.

Sadma is a Financial Analyst with over 5 years of work experience in investment research, accounting, capital markets and asset management. She is currently supporting a large investment management firm based in the US engaged in financial model building and equity valuations. She has experience in covering industrial, consumer, media & entertainment sectors. She holds an MBA in International Business from University of the West of Scotland (UK). She is an affiliate of ACCA (UK) and holds a Bachelor’s degree in Accounting (Special) from University of Sri Jayewardenepura.

Pulasthi has over 2 years of work experience in investment research and financial services. He is currently supporting a large investment management firm based in the US, on financial model building, earnings support and industry research. He has gained exposure to the consumer, healthcare and semi-conductor sectors, with a coverage universe spread across both developed and emerging markets. He holds a bachelor’s degree in Business Administration from the University of Sri Jayewardenepura and currently pursuing the strategic level in Chartered Institute of Management Accountants of the UK.

Mihindu has 2 years of experience in investment research and financial services at Acuity Knowledge Partners Sri Lanka. He currently supporting a large US based asset manager with financial model building, earnings support, and industry research covering the Industrial sector. Mihindu holds a BSc. Honors degree in Economics with a first class from the University of Exeter, UK.

Like the way we think?

Next time we post something new, we'll send it to your inbox