Published on February 24, 2025 by Nitin Gupta

A housing market is the economic system where residential properties are bought and sold. It is a central feature in a fixed community model, enabling the financing of local public services through property taxes. In contrast to frontier models, the housing market significantly influences how housing resources are distributed.

Housing-market trends

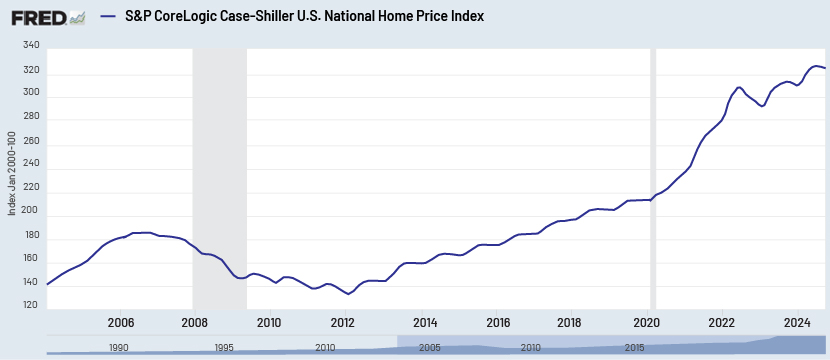

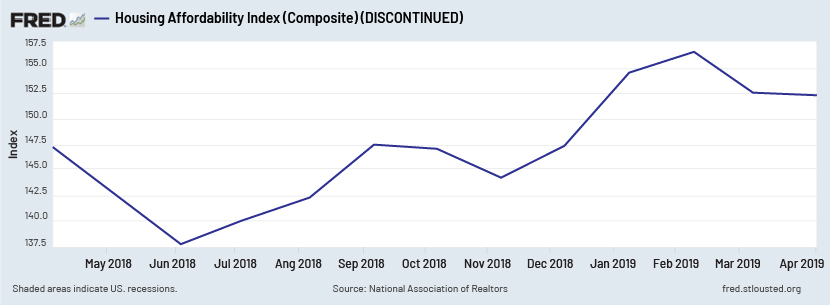

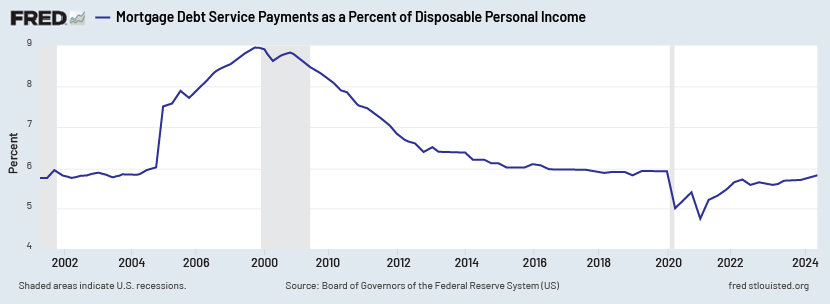

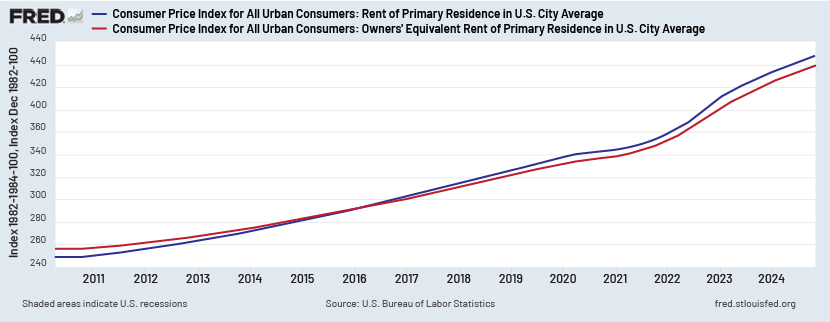

Before the pandemic and the spike in demand for living space in suburbs and smaller towns, the US housing market was stable. Approximately 22% of monthly per capita homeowner income was allocated to mortgage payments in early 2020. However, the average tenant was allocating a significant 33% of their monthly individual earnings to rent, with a strong motivation to pursue homeownership.

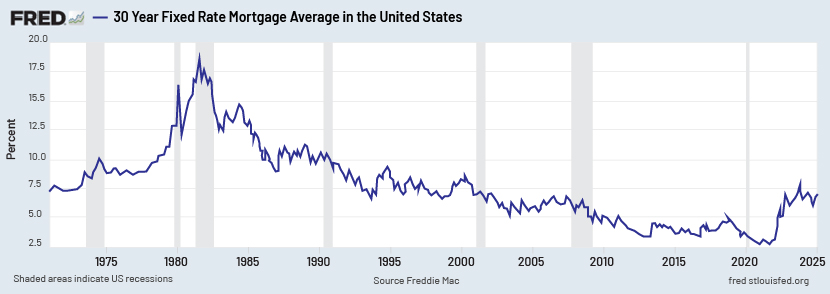

This increased by just over 1ppt to 34.4% by mid-2024, while for homeowners, it jumped to nearly 40%. This was due to a spike in housing prices and mortgage rates temporarily soaring to close to 7.8% in 2023.

These are US statistics, and the ratios may differ across markets. With many property holders and renters paying well in excess of average US per capita income, several metropolitan statistical areas appear to be overpriced, according to local income levels.

Global housing-market trends are generally positive in 2025, according to a recent report by Fitch Ratings. Almost all the countries in its Global Housing and Mortgage Outlook 2025 will see rising housing prices and low mortgage arrears given declining or stable mortgage rates, limited but positive economic growth, low or stable unemployment, and resilient demand.

Insufficient supply remains the main driver of nominal housing price growth forecasts for 2025 and 2026. Nominal housing prices are expected to increase by low- to mid-single digits in most countries over the next two years, following double-digit housing price increases cumulatively over the past three years for almost half of the countries listed in the report.

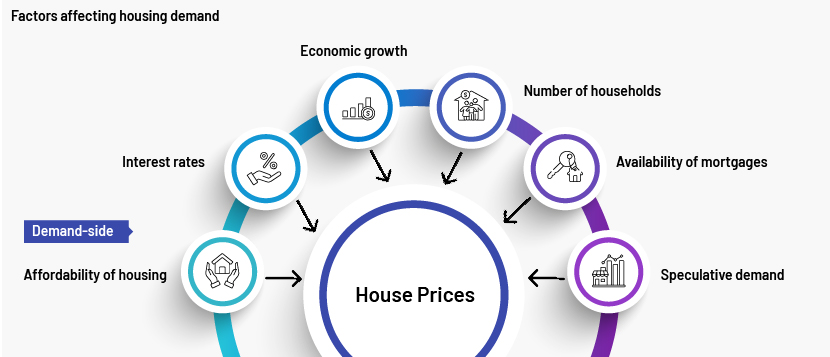

Factors affecting housing demand

1. Affordability: Increasing incomes enable individuals to spend more on housing. In times of economic expansion, housing demand usually increases, as housing is perceived as a luxury item.

2. Interest rates: Interest rates play an important role in determining housing prices and, therefore, demand. The lower the interest rate, the higher the demand for home ownership.

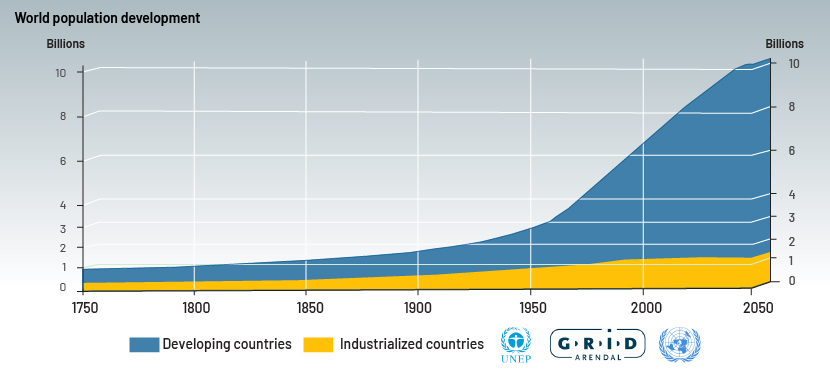

3. Population: This is a critical factor, not relating solely to numbers, but also to demographic changes such as an increase in the number of individuals choosing to live independently. A number of social and demographic factors have led to an increase in the number of households (growing faster than the increase in population).

4. Confidence: Housing demand is driven by consumer confidence in the future of the economy and the real estate market. When prices are expected to increase, demand increases as people seek to benefit from growing wealth. This results in housing demand increasing more rapidly than income.

5. Mortgage availability: Another factor that influences actual housing demand is the readiness of banks to provide mortgage loans. If banks offer mortgages with larger income multiples, effective housing demand increases. Banks’ willingness to increase availability of mortgage finance can fluctuate based on the robustness of the interbank lending market. This also impacts demand for housing.

6. Cost of renting: With housing prices increasing, rents have also increased in many parts of the US, with many renters now considering buying a home to reduce their housing costs. For some, purchasing a home becomes a more appealing financial option, as mortgage payments could be more predictable than rent prices.

7. Tax incentives: Incentives such as deductions for mortgage interest have made home ownership more attractive, reflected in increased demand for housing.

Impact of high housing demand on the economy:

-

Housing prices and banking sector: Housing prices can impact the borrowing strategies of financial institutions. As housing prices increase swiftly, banks observe a rise in value of their assets. They become more confident about increasing bank loans and cutting their reserve ratios. Building societies such as Northern Rock and Bradford & Bingley were eager to lend in the past, taking loans from money markets to be able to offer even more housing loans. Such bank lending became unviable amid the credit crisis.

-

Construction sector: The construction sector is very unstable, and a decline in housing prices could deter investment in and construction of new residences, reducing economic growth.

-

Inflation: If an economy is nearing full capacity and expanding robustly, an increase in consumer expenditure due to escalating housing costs may lead to inflationary pressures.

Challenges faced by lenders due to high housing demand

-

High loan-to-value (LTV) ratios: As housing demand grows, property values rise. This results in elevated LTV ratios, placing lenders at greater risk of default or loss should property values decrease.

-

Increased loan-processing time: Increased demand may result in more loan applications, straining lenders' systems, leading to prolonged approval times and possibly frustrating borrowers.

-

Underwriting complexity: In a market with high demand, lenders need to find a balance between securing loans and managing the complexities of underwriting an increasing volume of applications. Larger loan amounts, more intricate borrower profiles and fluctuations in the market add to the challenges of underwriting, increasing operating costs and risk.

-

Pressure on inventory: Supply of residential properties may fall short of demand, resulting in increased competition among buyers; this could drive housing prices higher and make it challenging for lenders to determine the actual market value of a property.

-

Regulatory scrutiny: Although regulators may have once permitted stress-testing at the portfolio level, they now insist on reporting stress-testing at the individual loan level. To achieve meaningful results, lenders need sophisticated economic forecasts and trustworthy, validated data on the markets in which they operate.

Conclusion

Robust demand in the housing market has benefits and drawbacks. While elevated demand indicates a growing economy, it also aggravates issues related to accessibility, affordability and social equity. Effective planning, creative policies and sustained investment are essential for tackling these challenges. If managed appropriately, the housing market can flourish and provide lasting opportunities for both purchasers and tenants.

How Acuity Knowledge Partners can help

We have cross-sector knowledge in the areas of financial analytics, valuation and advisory services. Our team of credit analysts support the mortgage sector – banks and other financial institutions – in financial analysis, risk rating and business and management analysis. Periodic determination of borrowing bases and covenant compliance monitoring help retain clients. Our technology-enhanced services combine domain knowledge with data analytics expertise and technology accelerators to make your processes more accurate and efficient. Our proprietary Business Excellence and Automation Tools (BEAT) gives clients leverage as we provide them with bespoke products and services customised to their requirements.

Sources:

-

Global Housing Market Trends to Be Generally Positive in 2025

-

Most Overvalued U.S. Housing Markets | The U.S. News Housing Market Index compares the health

-

https://www.economicshelp.org/blog/15390/housing/factors-affecting-supply-and-demand-of-housing/

-

Factors affecting supply and demand of housing – Economics Help

-

S&P CoreLogic Case-Shiller U.S. National Home Price Index | FRED | St. Louis Fed

Tags:

What's your view?

About the Author

Nitin Gupta has over 14 years of overall experience in Lending Services. His expertise spans a broad range of analysis, client management, portfolio monitoring and market research.

Like the way we think?

Next time we post something new, we'll send it to your inbox