Published on June 29, 2022 by Arnab Banerjee and Prithvi Hegde

The global economy had just set itself on track for recovery from the pandemic; however, bigger concerns seem to be impeding its path – a spike in crude prices amid the Russia-Ukraine conflict, a post-pandemic surge in demand and supply chain disruptions. As a result, consumer prices have been rising at a rapid pace.

Too much inflation can be damaging to any economy. The US Federal Reserve (the Fed) views a 2.0% rate of inflation as desirable or as a “sweet spot” for the economy. Prolonged interest rate cuts implemented to boost the economy have spurred more inflation. If inflation stays elevated for too long, it can lead to hyperinflation – i.e., prices will keep rising, leading to further inflation. Such a situation reduces the real value of every dollar in reserve. To avert this risk, the Fed has been forced to raise interest rates too quickly. Most recently, it raised the main interest rate by 75bps on 15 June 2022, indicating at the possibility of more such hikes. This, however, can slow down the economy, resulting in higher unemployment and subsequently causing a recession.

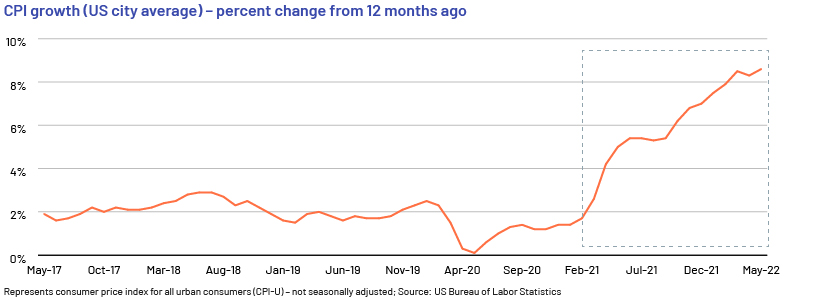

Is the current level of inflation concerning?

As per the most recent Consumer Price Index (CPI) data (May 2022) released by the US Bureau of Labor Statistics, consumer price inflation reached a 40-year high in May. During the 12 months ended May 2022, the all items index showed an increase of 8.6% before seasonal adjustments. This was the biggest 12-month increase for the comparable period since December 1981. As per the latest May release, the largest contributors to this seasonally adjusted increase in the all items index were related to shelter, airline fares, food, used cars and trucks, gasoline and new vehicles. A broad set of other indexes also saw similar increases in May, including those for household furnishing, operations, medical care and apparel. Moreover, the risk of oil and energy shocks remain owing to the ongoing turbulence in Eastern Europe, particularly given the tensions between the European Union (EU) and Russia; if the EU chooses to cut off natural gas and oil imports from Russia or impose stricter sanctions, global oil prices will see significantly higher increases.

Represents consumer price index for all urban consumers (CPI-U) – not seasonally adjusted; Source:

Fed action and possible outcome

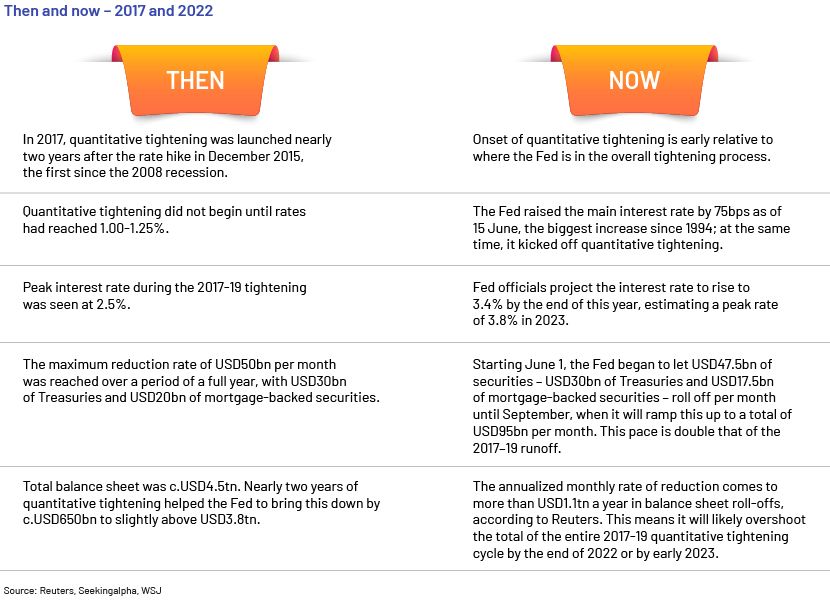

The Fed has been taking steps to tighten monetary policy and end the stimulus programme it had initiated amid the pandemic. On 15 June 2022, it raised the interest rate by 75bps – its biggest increase in the past 28 years. The Fed’s policy-making body projects inflation will decrease to 5.2% by the end of the year, following a series of such rate hikes. In addition, the Fed has already started trimming assets from its USD9tn balance sheet. This trimming is expected to be at nearly twice the pace of what was observed in its previous quantitative tightening, in 2017. Given the statistics, we can expect a “rate shock” from the Fed to handle this “out-of-control” inflation. According to Deloitte, many past recessions were due to excessive tightening by the Fed.

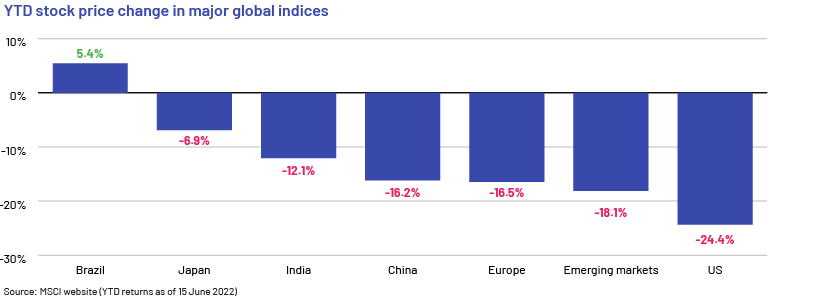

In 2013, the Fed’s decision to taper led to a rush of funds out of emerging markets. Currently, it appears that investors are keeping away from more risky assets such as distressed debt. Therefore, we can expect similar trends going forward. Moreover, global stock markets, which are viewed as a leading indicator of economic conditions, are showing signs in that direction too. For instance, we saw a brutal plunge in stock markets globally after the Fed’s most recent rate hike of 75bps on 15 June.

North Island’s Chairman Glenn Hutchins stated at the May 2022 World Economic Forum that the “E” of P/E has gone down, which is alarming. This trend indicates that equity prices currently characterise a speculative bubble that can pop when monetary policy changes. If we were to look at future P/E, expected future earnings have actually declined owing to rising commodity prices and labour costs and the expected increase in investments towards supply chains. On the other hand, if managements and business leaders foresee a recession as imminent, they may cut back on investment spending. This will negatively impact overall economic activity.

The global picture

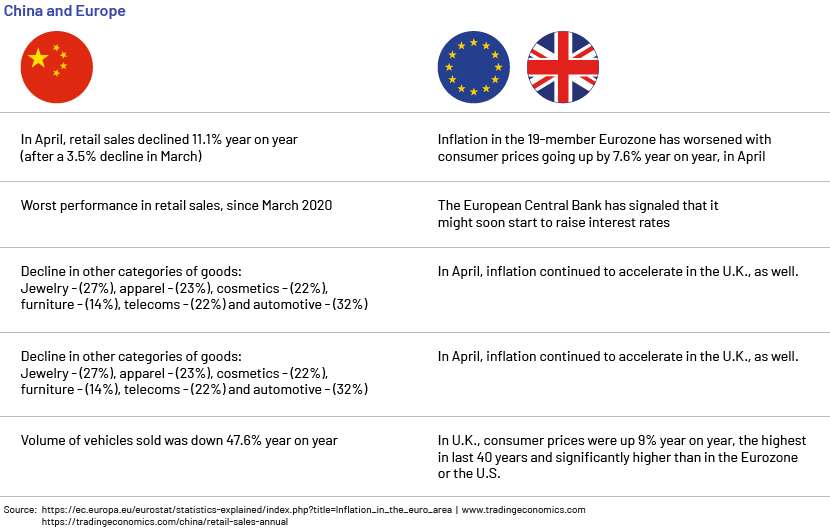

Real GDP declined in 1Q22 in the US. Other key economies also showed major signs of weakness. The global manufacturing industry saw activity shrink in April, according to the latest Purchasing Managers’ Index (PMI) data from IHS Markit; PMIs are forward-looking indicators. In April 2022, activity in the global industry hit its lowest levels since August 2020. This was mainly due to the renewed lockdown restrictions imposed in China and the consequent economic slowdown.

Source:

https://ec.europa.eu/eurostat/statistics-explained/index.php?itle=Inflation_in_the_euro_area

https://tradingeconomics.com/china/retail-sales-annual

Conclusion

Although there are still some positive economic indicators, the challenges or risks far outweigh the growth factors. For instance, in the US, unemployment was at a low of 3.6% in April 2022; more than 400,000 people rejoined the labour force in March owing to the decline in COVID-19 cases. However, this pace of job growth is unsustainable in the long term. Fed officials forecast that unemployment could rise to 4.4% by end-2024. The Fed plans to curb aggressive hiring and demand for homes and cars but not by so much that employers start cutting jobs – this, however, is a tricky balance to achieve. The Federal aid programmes, initiated early on in the pandemic, have mostly ended, and many families have drawn down their savings amid the ongoing inflation. At the same time, the rising interest rates are making borrowing more expensive. These factors could bring down demand. Moreover, according to a World Bank report, global economic growth is expected to slow down to 2.9% this year from 5.7% in 2021. Given all of these factors, the risk of a global recession seems considerably high, although it may not have as much an impact as the 2008 crisis.

As stated by the Boston Consulting Group, “downturns are a better time for deal hunting”. According to a report published by the group, deals that are made in a weak economy or during a weak economic cycle or phase have proved to create more value for buyers than those made in a strong economy or during favourable economic cycles. Historically, we have observed a rise in market consolidation of smaller players across industries during such challenging times, including more M&A deals and higher activity in the private equity/venture capital and restructuring space.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners (Acuity) provides financial research services on industry- and country-specific topics to global organisations and research houses, enabling them to make sound decisions. We support our clients in a wide range of areas, including M&A, restructuring, investment research, industry profiling, financial analysis, thematic research and macroeconomic and FX research. We also help clients build databases and provide regular sector coverage. Each output is customised based on the client’s requirement. By leveraging dedicated teams of experienced analysts at our offshore delivery centres, our clients benefit in terms of operational efficiency and cost optimisation.

Sources

https://www.bls.gov/news.release/cpi.nr0.htm

https://edition.cnn.com/2022/04/12/economy/consumer-price-inflation-march/index.html

https://www.reuters.com/business/feds-qt-plan-then-now-2022-04-06/

https://tradingeconomics.com/china/retail-sales-annual

https://ihsmarkit.com/research-analysis/pmi.html

https://seekingalpha.com/article/4517638-what-to-expect-from-the-feds-quantitative-tightening

https://www.worldbank.org/en/publication/global-economic-prospects

https://www.thebalance.com/fed-funds-rate-history-highs-lows-3306135

https://www2.deloitte.com/xe/en/insights/economy/global-economic-outlook/weekly-update.html

https://www.wsj.com/livecoverage/federal-reserve-meeting-interest-rates-june-2022

Tags:

What's your view?

About the Authors

Arnab Banerjee has ten years of experience in investment banking and equity research. In his current role, he supports a mid-market investment bank based out of the US. Arnab has expertise in areas including M&A, equity capital markets (ECM) and debt capital markets (DCM) and plays an active role in the development and training of team members. Prior to joining Acuity, he worked as Equity Research Analyst at Guggenheim Partners. Arnab holds a Master of Business Administration in Finance from ICFAI Business School, Hyderabad, India.

Prithvi Hegde started her career with Acuity Knowledge Partners in 2018 and has more than three years of experience in investment banking, valuation, financial research, industry research and company profiling. In her current role, she supports a US-based mid-market investment bank. Prithvi holds a Master of Business Administration in Finance from Bangalore Institute of Technology and a Bachelor of Commerce from Karnatak University, Dharwad.

Like the way we think?

Next time we post something new, we'll send it to your inbox