Published on January 17, 2022 by Shashank Jain

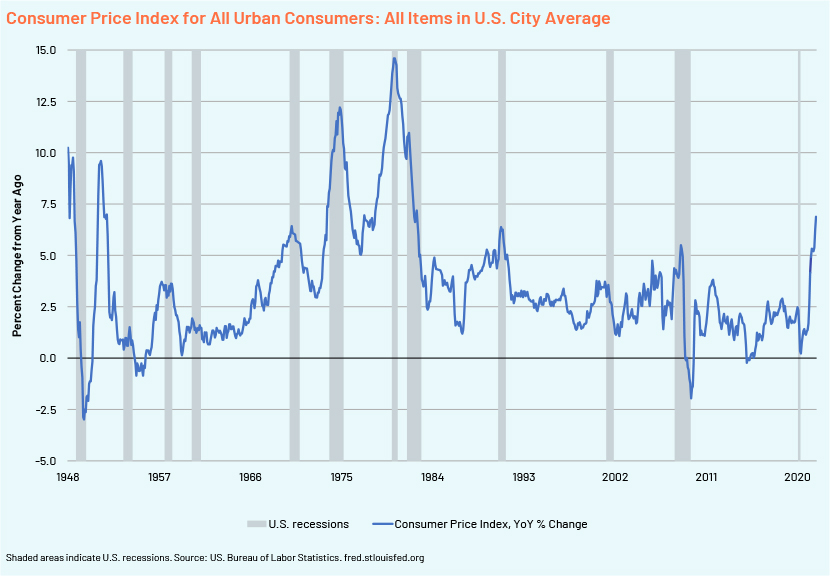

In November 2021, the consumer price index jumped 6.8% from a year earlier, the highest in nearly four decades. This persistently high inflation led to the Federal Reserve (Fed) doubling the rate at which it reduced monthly asset purchases, a process known as tapering. It will now stop adding to its balance sheet by March 2022 rather than by mid-2022, as previously expected.

Here are a few trends that have led to recessions in the past.

Inflation and consumer confidence

Inflation has been moving higher since March 2021, with prices broadly increasing in the energy, housing, food, used/new cars and recreation markets. Supply-chain bottlenecks caused by COVID-19-related worker absences at factories/ports and microchip/auto part shortages have led to low supply and higher prices of cars, consumer electronics, appliances and other products.

Although wages have been on the rise owing to worker shortages, they have not kept pace with soaring prices, resulting in lower purchasing power of consumers. The consumption of fewer goods and services would, in turn, curtail inflation over time.

High inflation persisted during 8 of the past 12 recessions, indicating that consumers consumed less due to higher prices, leading to economic contraction

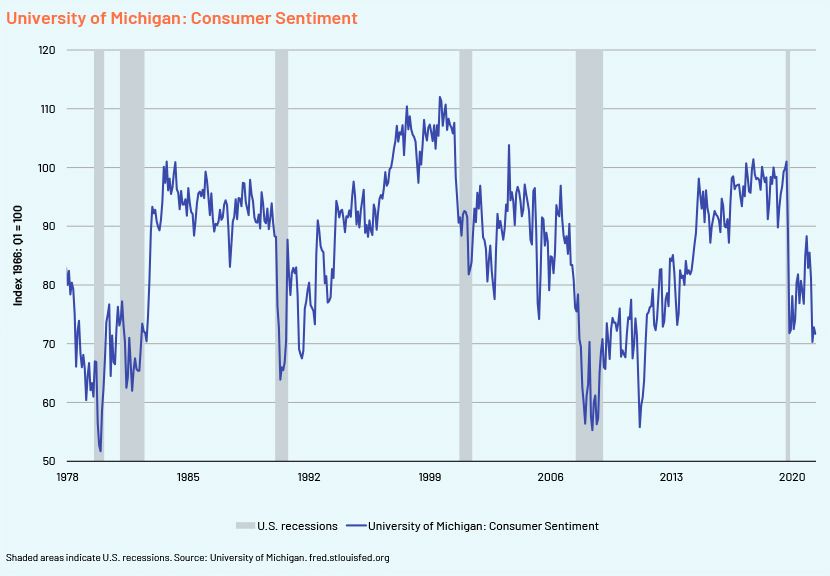

Consumer sentiment in the US remains well below pre-COVID-19 levels and near-pandemic lows

Fed taper and interest rate hikes

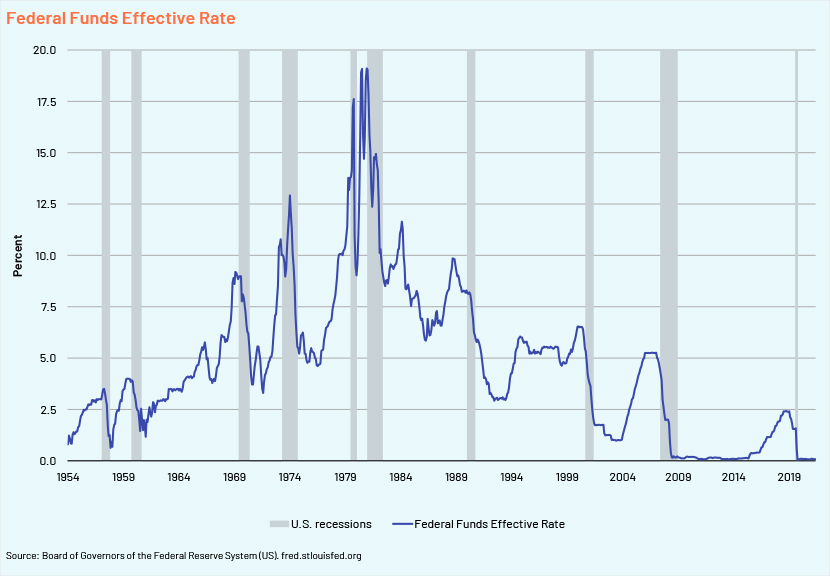

After speeding up the tapering of the asset purchase programme, the Fed hinted at three rate hikes by the end of 2022, with interest rate futures traders pricing a first rate hike in May 2022. In the past two instances of Fed tightening (the 2013 taper tantrum and 2018 quantitative tightening), equities were volatile and produced low returns for the subsequent 18-24 months.

One of the primary reasons for the tightening this time is inflation. However, the current inflation is more driven by supply-side constraints – over which central banks have no control – than monetary policy. It remains to be seen if the current tightening cycle can bring down aggregate demand and cause a recession.

Higher interest rates are accompanied by a recession most of the time

Labour market

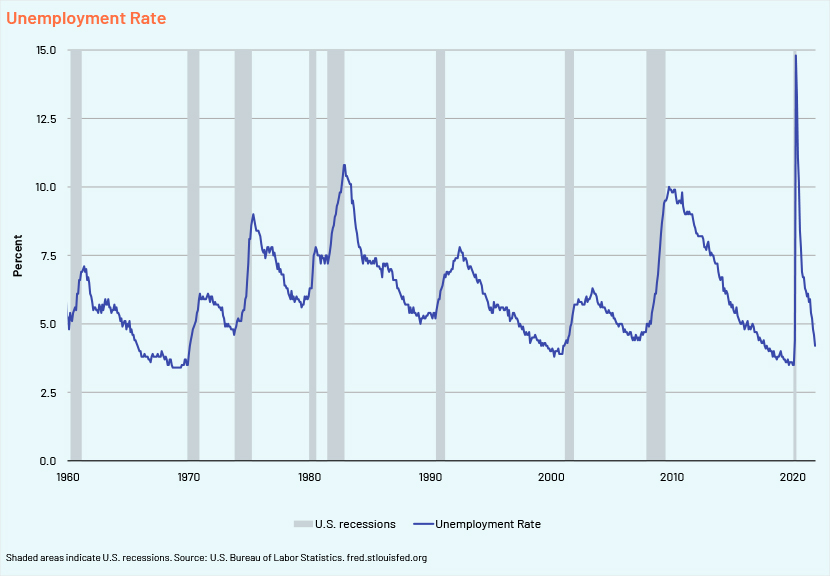

The four-week moving average of initial claims – considered a better measure of labour market trends, as it irons out week-to-week volatility – fell by 16,000 to 203,750 on 16 December 2021, hitting its lowest since November 1969. Economists expect claims to remain around these levels heading into 2022 because of the scarcity of labour. The US reported a record 11.0m job openings by end-October, with the unemployment rate at a 21-month low of 4.2%.

The near-full-employment figures tighten the labour market in an already high inflationary scenario, leaving even less scope for labour supply to ease.

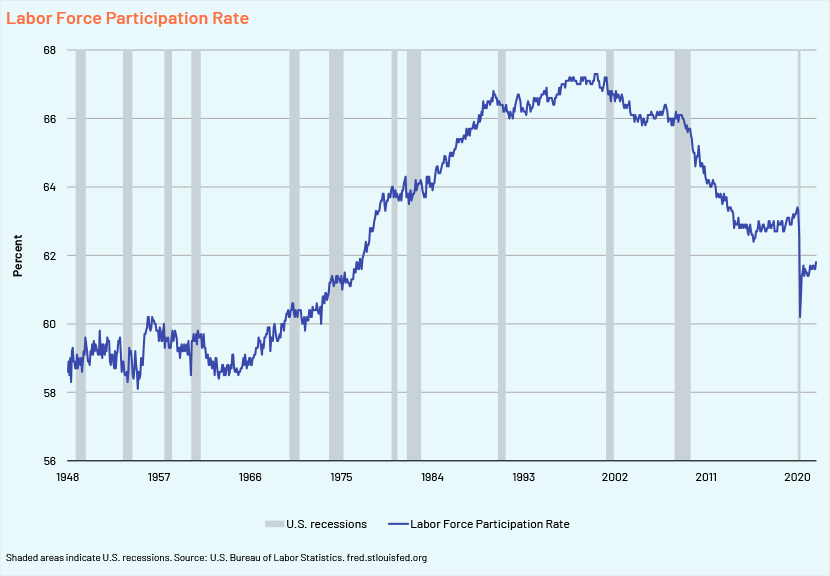

The declining unemployment rate should not be seen in isolation…

tandem with the Labour Force Participation Rate, which remains below pre-COVID-19 levels, implying that millions of Americans still choose not to work

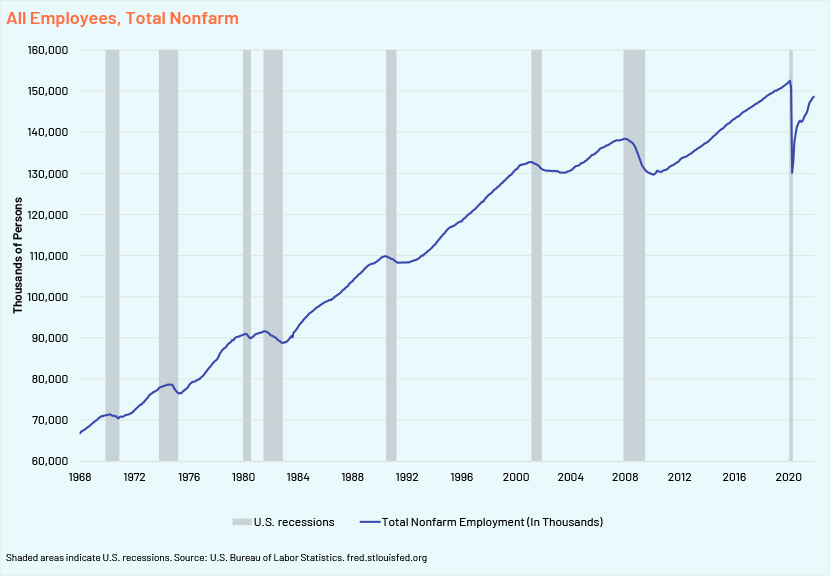

Absolute total employment is still c.4m lower than pre-COVID-19 levels

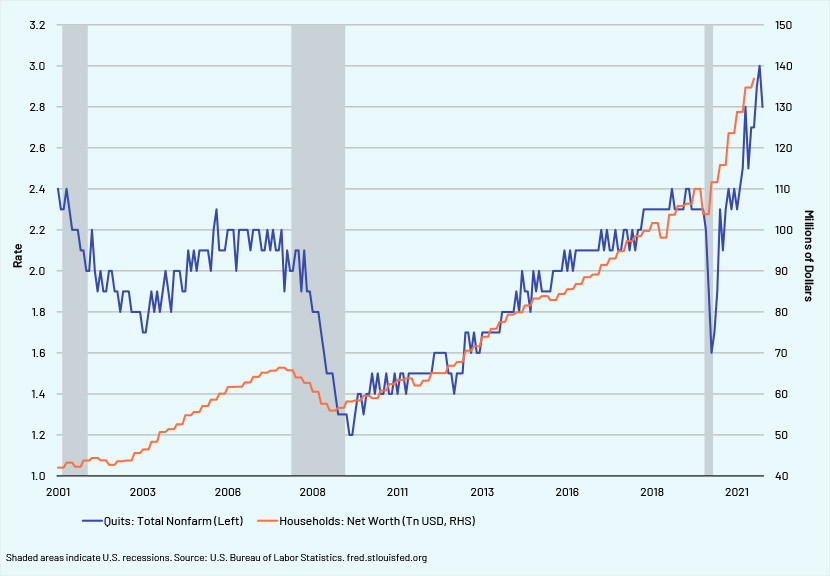

Massive wealth creation following the COVID-19-induced dip in March 2020 has given employees the confidence to quit their jobs and pursue their interests, further adding to supply-side constraints

Conclusion

In the Fed’s current tightening path, one major fear is an overreaction to the high inflation numbers. Interestingly, bond markets are not too concerned about the inflation. The 10-year treasury rate stood at c.1.4%, down from 1.7% in mid-October. While the supply side remains out of the control of central banks, a policy error that goes too far, too fast could hurt the demand side and throw the US economy into a slowdown or a recession. History suggests that this is a possibility.

How Acuity Knowledge Partners can help

We provide research on industry- and country-specific topics to global organisations and research houses and help them make sound decisions. We support our clients in a wide range of areas, including mergers and acquisitions, investment research, industry profiling, financial analysis, thematic research, and macroeconomic and FX research. We also help clients build databases and provide regular sector coverage. Each output is customised based on the client’s requirement. By leveraging dedicated teams of experienced analysts at our offshore delivery centres, our clients benefit in terms of operational efficiency and cost optimisation.

References:

https://edition.cnn.com/2021/12/15/economy/inflation-fed-meeting/index.html

https://www.investopedia.com/fed-will-double-pace-of-tapering-5213346

What's your view?

About the Author

Shashank has over 10 years of experience as an equity research analyst. He has worked with leading global organisations across domains; his sector expertise includes non-bank financial institutions (such as lenders, asset managers, brokers, exchanges, life insurers and general insurers), telecom, real estate (including REITs), IT services, software (including SaaS) and oil and gas. At Acuity Knowledge Partners, Shashank supports a global investment bank, assisting non-bank financial analysts. He is a CFA charterholder.

Like the way we think?

Next time we post something new, we'll send it to your inbox