Published on March 23, 2021 by Manjunath Deshpande and Senthil Kumar Sekar

Highlights:

-

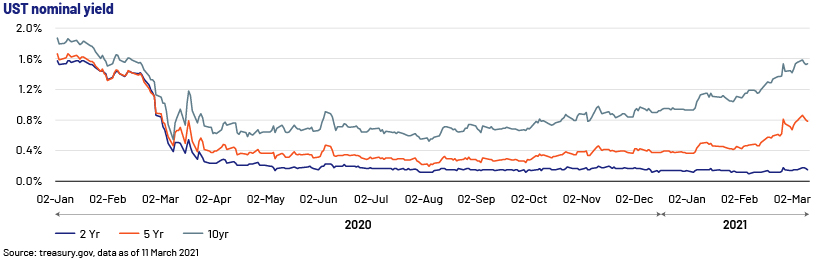

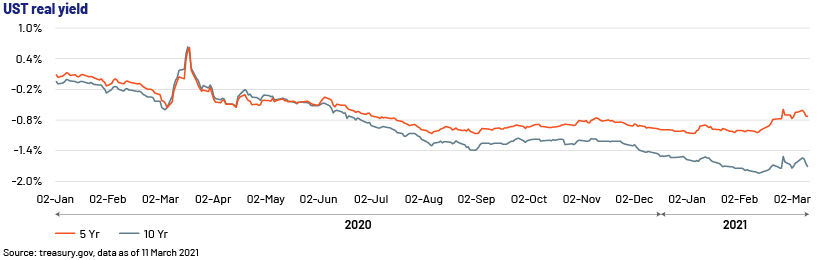

Long-term US Treasury yields have been rising since late 2020, as the extraordinary monetary and fiscal stimulus have made investors jittery about a potential inflationary shock. Although real yields are edging higher, they are still in negative territory.

-

The fast-paced vaccination programme, coupled with strong economic recovery and government stimulus package, is expected to prop up consumption and investment. A spike in growth fuel consumption adds inflationary pressure. Hence, investors believe Fed to intervene earlier than anticipated in response to rising yield and inflation.

-

Cyclical sectors of the economy and Asia remain attractive opportunities in the fixed income market. Furthermore, pockets of opportunity remain in the broader investment grade and HY fixed income market.

Long-term US Treasury yields have increased ca 60bps in 2021, indicating investors are pricing in an optimistic global economic outlook plus inflation concerns. However, investors were caught off-guard on 25 February 2021, when US Treasuries saw a sharp sell-off as 10-year Treasury yields rose 22bps to 1.52%. Consequently, the bid-to-cover ratio, measure of demand, fell to a record low of 2.04 times. Primary dealers were forced to buy nearly 40% of the sale, the highest share in the last seven years, as per Jefferies.

Although the sell-off was triggered by weak demand for US Treasuries, the rise in Treasury yields is broadly attributable to:

-

USD1.9trn fiscal package (including USD1trn direct aid to individuals and USD440bn to businesses)

-

Successful vaccine rollout (ca 21% of the US population received the first shot of the vaccine and ca 11% population was fully vaccinated as of mid-March)

-

Strong economic data – Unemployment rate has been consistently declining, from the peak 14.8% in April 2020 to 6.2% in February 2021, Q4 2020 GDP grew 4.1% and personal income and consumer spending increased 10.0% and 2.4%, respectively, in January 2021.

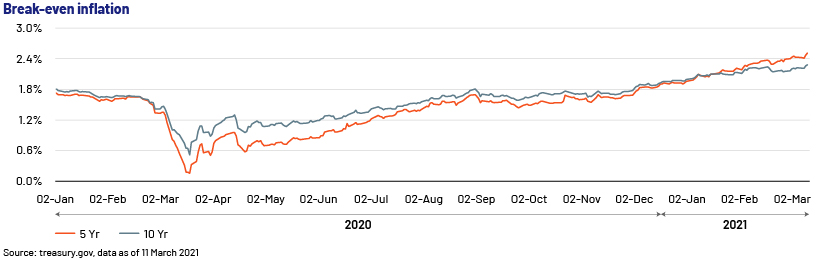

Case for inflation

The 61bps rise in 10-year nominal yield (as of 11 March 2021) explained by 34bps increase in US Treasury (UST) real yield and 27bps due to expected inflation. Break-even inflation (BEI) rate, the spread between nominal UST and real UST, comprises two components: expected inflation plus premium for the uncertainty surrounding future inflation. The graph below shows rising BEI rate, which indicates investors’ expectation (BEI rate - 2.2% in February 2021) of inflation is higher than actual inflation (1.7% in February 2021). We believe this is due to, higher household savings (US households currently holds USD1.4trn in excess savings), resulting in a higher demand post vaccination and strong monetary and fiscal support reviving business growth.

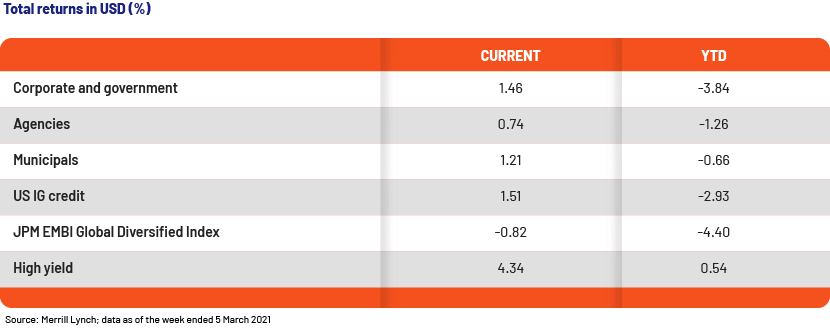

Fixed income asset performance

Higher bond yields have varied implications on asset classes. While HY bonds are negatively correlated to rising Treasury yields, IG bonds remains highly correlated to the treasuries. Regardless, the cyclical sectors of the economy look prime to benefit from improving economic sentiments. Furthermore, global asset managers remain neutral to positive on Emerging Market debt, particularly Asia, which has fared better than other economies in rolling out vaccines and restarting the economy.

Back to fundamentals

Rising yield is an indicator of an increase in investors’ higher expectation on term premium, which is not an allegory to the taper tantrum of 2013. Overall, we believe after enduring a volatile 2020 and a relatively weak start to 2021, debt investors have several positive things to look forward to in 2021. Valuations, bottom-up fundamentals and top-down factors remain attractive for multiple assets classes in the broader fixed income universe, signalling potential strong returns in 2021.

How Acuity Knowledge Partners can help

The volatile market over the past year has forced asset managers to reallocate their portfolios and revaluate their risks. The debt market will likely remain volatile in the near future, and asset managers are switching back to deep fundamental reviews of issuers to understand their risks and opportunities. Acuity Knowledge Partners supports some of the largest asset managers globally, which have leveraged our credit research expertise over the years. Our time-bound scalable solutions have helped asset managers of all scale to develop their proprietary solutions.

Sources:

https://www.bls.gov/charts/employment-situation/civilian-unemployment-rate.htm

https://www.cnbc.com/2021/02/25/us-gdp-q4-2020.html

https://www.reuters.com/article/us-usa-economy-idUSKBN2AQ24B

https://www.nytimes.com/2021/03/07/us/politics/whats-in-the-stimulus-bill.html

What's your view?

About the Authors

Manjunath has over 15 years of experience in fixed income credit research, with a focus on HY and IG issuers. At Acuity Knowledge Partners, he supports a leading European investment bank’s HY desk, preparing financial models, tracking the portfolio and updating charts and earnings summaries. Earlier, he supported a sell-side research team of Europe’s leading investment bank through a wide range of research on EM issuers. Manjunath holds an MBA (Finance) from Shivaji University, Kolhapur and a Bachelor of Commerce from Karnataka University, Dharwad.

Senthil has above 5 years of experience in investment research and has been associated with Acuity Knowledge Partners since June 2018. In his current role, he covers HY issuers for a sell-side desk analyst. Prior to joining Acuity Knowledge Partners, he was the lead analyst at WNS Global Services. Senthil holds a PGPM from ICFAI Business School Bangalore, and Bachelor of Technology (Chemical Engineering) from ACT, Anna University. He is also a CFA Level II candidate.

Like the way we think?

Next time we post something new, we'll send it to your inbox