Published on February 8, 2021 by Ankit Agrawal and Laksh Arora

-

India’s budget for the fiscal year 2022 is positive, as it aims to support economic recovery through higher government expenditure

-

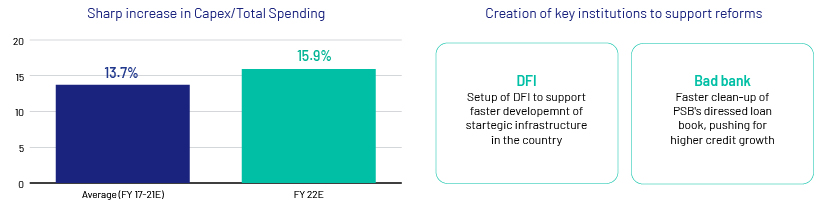

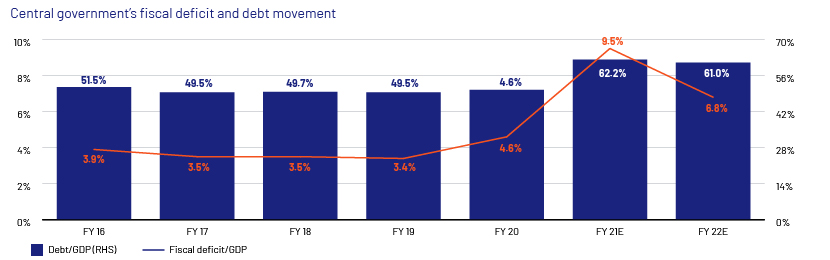

The fiscal deficit is estimated at 6.8% of GDP in FY22 (vs 9.5% in FY21). The government intends to narrow this to below 4.5% of GDP by FY26

-

The revenue growth assumption remains prudent, as tax revenue is expected to grow broadly in line with nominal GDP growth (+14% y/y); however, divestment targets remain an overhang

-

Other important reforms include INR200bn (USD2.8bn) allocated towards recapitalisation of public-sector banks and setting up a development finance institution (DFI) with INR200bn (USD2.8bn) of initial capital

-

The establishment of an agency to purchase investment-grade (IG) corporate bonds is expected to boost confidence among investors and enhance liquidity in the secondary market, bolstering investment in the corporate bond market

Economic growth outweighs fiscal austerity

The budget for 2021-22 provides a good foundation to support the V-shaped recovery envisioned in the Economic Survey for 2020-21, as GDP is expected to grow by 15% y/y next fiscal year vs a contraction of 7.7% in the current fiscal year. The government’s plan to boost investor confidence by increasing expenditure is in line with expectations for economic growth. Expenditure is set to increase by 14.6% against the budget estimates for FY21 (+1% compared with the revised estimates). It is comforting that expenditure is allocated towards infrastructure spending (+18% y/y) rather than subsidies.

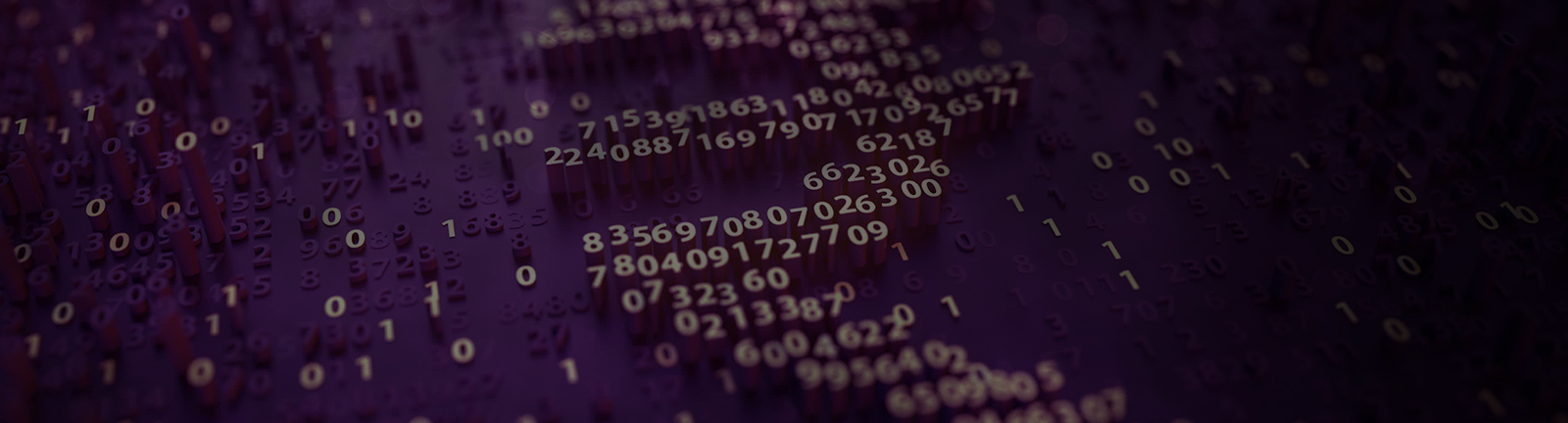

The other important announcements were the setting up of a DFI with initial capital of INR200bn (USD2.8bn) to finance capex, supporting the “Make in India” initiative through production-linked incentive (PLI) schemes and the setting up of an asset reconstruction company to resolve asset-quality issues in the banking sector.

No bad news is good news

The budget does not contain adverse tax-related measures, although many market participants had expected this given the lagging revenue on the back of the pandemic-related disruptions in 2020. However, market reaction was mixed, as a sell-off in government bonds (yields up 15bps) and a depreciation of the Indian rupee were masked by a sharp 5% increase in the benchmark equity indices on the budget day.

The fiscal math is more realistic

The government expects a fiscal deficit of 9.5% of GDP in FY21 (vs consensus estimates of ca 7.0%), narrowing to 6.8% by FY22. Given the weak economic situation, the government now intends to achieve a fiscal deficit of less than 4.5% of GDP by FY26 (vs its previous target of 3.0% by FY24). For the current fiscal year, the government intends to borrow INR800bn over the next two months. The budget also provides breathing space to the state’s fiscal accounts as it increases the state’s borrowing limit to 4% of GSDP (vs 3% earlier). We expect further issuances from municipalities and state bodies over the next year.

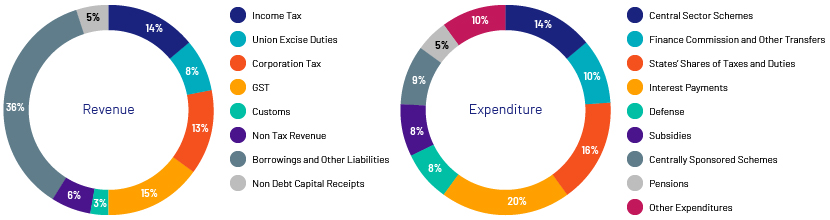

Revenue

Central government revenue is estimated to grow 15% y/y, broadly in line with nominal GDP growth. As such, its ability to meet its fiscal deficit target would depend on the economy achieving double-digit growth.

Revenue estimates are supported by corporate income and goods and services tax revenue (+22% y/y each), dividends (+7% y/y), and disinvestments (4.5x y/y). The revenue estimate seems somewhat aggressive given the poor track record of disinvestment and high reliance on dividends of the Reserve Bank of India (RBI) and public-sector enterprises (PSEs).

Expenditure

The budget focuses on infrastructure spending (roads, railways and urban infrastructure), a INR640bn (ca USD9bn) boost to healthcare spending (over the next six years) and INR350bn (ca USD5bn) for the COVID-19 vaccination programme. The spending remains skewed towards revenue expenditure, which accounts for ca 84.1% of total expenditure. However, we view positively the increase in capital spending as a share of total spending to 16% from 12% in FY21.

Deficit funding

For FY22, the improvement in the fiscal deficit results in a gross debt assumption of INR12tn (ca USD170bn), translating into a debt/GDP ratio of 61.0% (vs 62% in FY21 and 50% in FY20). The government would very likely have to resort to higher borrowing in the event divestment targets are not met, as it has in the past.

Bond-market support

The budget also proposes a permanent institutional framework to purchase IG bonds during stress scenarios. This could increase secondary-market liquidity, deepen the corporate bond market and support faster debt resolution.

How Acuity Knowledge Partners can help

The positive developments in the Indian economy and the gradual deepening of the corporate bond market make it more attractive for foreign players keen on investing in local-currency bonds for higher returns. Asset managers globally have leveraged our credit research services given our experience in covering emerging-market (EM) issuers, deep understanding of the nuances in analysing local- and hard-currency EM bonds and on-the-ground presence in India, China and Sri Lanka.

Sources:

1. Union Budget document

2. Economic Survey of India

3. Ministry of Statistics and Programme Implementation

4. Reserve Bank of India

Tags:

What's your view?

About the Authors

Ankit has over 11 years of experience in fixed income credit research, focusing on bank, sovereign and corporate credit reviews. He has worked with three of the largest buy-side asset managers, based in Europe and the US, assisting with investment decisions. He is actively involved in discussing themes and issuer updates and is adept at writing detailed credit reviews and building in-depth financial models to present his investment case. Ankit holds a Master of Business Administration (Finance) from Symbiosis International University.

Laksh is management post-graduate with over 7 years of experience in Fixed Income Research. He has experience in building and maintaining credit models, credit report writing, capital structure and covenant analysis. Laksh holds Post Graduate Management Diploma (Finance), CFA Level 3 Candidate and Bachelor in Technology (Computer Science).

Like the way we think?

Next time we post something new, we'll send it to your inbox