Published on April 1, 2025 by Namita Jain and Ridhi Chaudhary

Market overview

For the past two decades, the US has had to confront a housing rental crisis. Escalating rents and home prices have priced out many Americans of traditional living styles like single-family and multifamily rentals. Co-living spaces – a new trend – has emerged as a feasible solution. Popular in urban areas, it offers flexible living and a sense of community. Furthermore, co-living is reshaping the US real estate market amid changing lifestyle preferences, catering to diverse groups including students, professionals and small families.

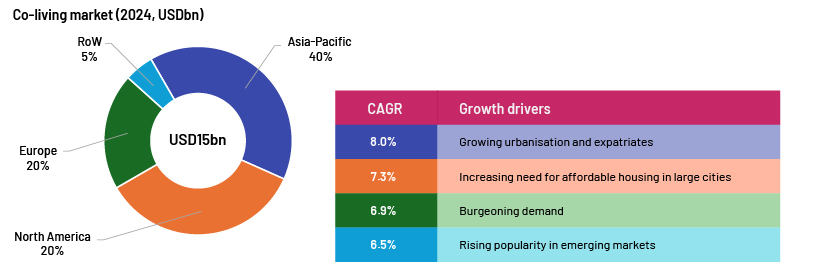

The co-living sector, estimated at c.USD15bn in 2024[1], continued to perform exceptionally well in 2024.

Co-living and its evolution, as well as differences with traditional living arrangements

This affordable arrangement encompasses shared common spaces including kitchens. Bedrooms are, however, exclusive.

| Multifamily | Hostels | Senior housing | Student housing | Co-living | |

| Flexible lease terms | No | No | No | No | Yes |

| Privacy | Yes | No | No | No | No |

| Open to any age | Yes | Yes | No | No | Yes |

| Affordable/shared space | No | Yes | Yes | Yes | Yes |

The evolution of residential spaces in the US reflects demographic, economic, cultural and policy changes. Rising home prices, urban displacement and changing lifestyles have made traditional living less feasible. Programmes like Section 8 and LIHTC aimed at addressing affordability have faced challenges. In the 2010s, high living costs led younger generations to seek flexible, community-focused housing. By the 2020s, co-living gained popularity, offering affordability and flexibility, especially with the rise in remote work and ongoing housing issues.

Growing housing cost crisis

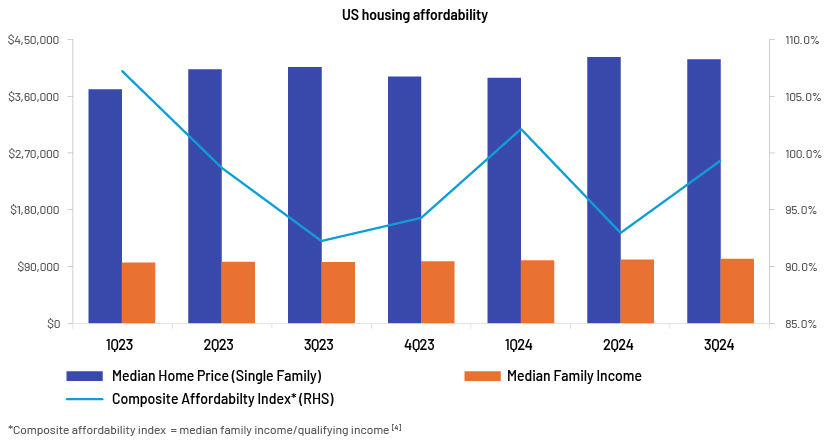

As per FRED[2], the median home price in the US stood at USD 419,200 during 4Q24. Higher interest rates and static wages have increasingly pushed conventional homeownership beyond the reach of many Americans.

About 63% of adults[3] in US towns see affordable housing as a significant issue, compared to 46% in suburban areas and 40% in rural locations. The current trend highlights various concerns about housing affordability in different living environments.

Urban residents, regardless of income, see affordable housing as a more pressing issue than suburban or rural area dwellers. Two-thirds (66%) of low-income urban adults identify it as a significant problem, compared to 56% in suburbs and 52% in rural areas. Among upper-income adults, 58% in urban areas view it as a major issue, while only 43% in suburbs and 25% in rural regions share this concern.

Co-living: a modern solution for occupiers

In the past five years, co-living has become popular in cities with elevated cost of living. Several factors have stoked demand for these spaces, which offer affordable housing without sacrificing on location or amenities:

-

Co-living offers a more budget-friendly option than traditional dwelling units. Individuals can save a lot of money (on rents, utilities, internet and other amenities) by sharing spaces and amenities..

-

Unlike traditional leases, which have a 1–5-year leasing term, co-living spaces offer flexible lease terms. This flexibility appeals to young professionals, digital nomads and those seeking short-term housing solutions.

-

Many co-living spaces organise community events and activities, encouraging social interaction and networking among residents – invaluable for newcomers to a city and those looking to expand their social circles.

Challenges in Co-Living Spaces

Despite its growth, co-living spaces face challenges. Key considerations include:

-

Privacy: Sharing spaces with others can lead to privacy concerns, particularly in co-living arrangements with small isolated areas.

-

Regulatory hurdles: Zoning laws and regulations can pose challenges for co-living operators, as some municipalities have specific requirements that affect the viability of these spaces.

-

Market saturation: The increasing popularity of co-living can lead to oversaturation in certain areas, which could impact pricing and demand.

-

Tenant turnover: Higher turnover rates can lead to increased maintenance costs and require continued marketing efforts to keep occupancy rates high.

-

Shared parenting and family dynamics: In co-living spaces, shared parenting challenges and complex family dynamics can arise. As multiple families live close to each other, coordinating childcare and adjusting parenting styles become crucial factors in maintaining harmonious living environments.

-

Financial challenges: Co-living spaces come with financial challenges including the management of shared costs, financial disparities and economic changes.

Why to invest in co-living?

Co-living caters to market trends, appealing to those who value flexibility, community and convenience. These properties maintain high occupancy rates, providing steady income for investors. Few benefits of investing in co-living spaces are as follows:

-

Increased revenue: Co-living spaces generate yield premiums of 20-30%, compared to traditional rental models, due to increased tenant density. Besides, co-living companies report higher rental income per square foot. For example, in New York, earnings for co-living units are 40-50% higher than traditional apartment rents.

-

High demand: There is an increased demand from millennials and gen Z for affordable and flexible housing which makes co-living a lucrative investment opportunity.

-

Operational efficiency: Centralised management through automated rent collection, utility bill management and economies of scale in services can reduce operational cost in the current inflationary period.

-

Differentiation: In such a saturated rental market, co-living provides a unique selling proposition that can set a property apart from conventional offerings.

Conclusion and outlook

Demand for co-living spaces is the output of preference for innovative, affordable living arrangements that foster a strong sense of community and flexibility. However, individuals must evaluate their privacy and preferences when considering communal environments.

The multiplier of invested capital in co-living can be higher than that in traditional rentals, due to higher yields (8-12%), optimised space use, 30-50% higher premiums for value-added services and reduced turnover rates.

As we move through 2025, co-living appears poised for continued growth. Industry experts estimate the co-living segment to expand at a 6.75% CAGR from 2024 to 2033 to c.USD27bn[1]. The sector is likely to diversify, catering to specific categories such as women-only spaces, family-oriented co-living and digital nomad units. Local governments may also explore policies to support economical housing and regulate new housing market trends like co-living. Partnerships with corporations, such as WeWork’s & We Live, would also drive demand.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners offers deep domain expertise in real estate investment research and analytics, enabling clients to expand their capabilities and concentrate on value-added tasks and critical decision-making. Our comprehensive and customised suite of services span the entire investment life cycle and all asset types including niche property types such as co-living, student housing and senior housing.

Sources

[1] https://www.businessresearchinsights.com/market-reports/co-living-market-117296

[2] https://fred.stlouisfed.org/series/MSPUS

[3] Affordable housing is a major local problem, more Americans now say | Pew Research Center

What's your view?

About the Authors

Namita has over 13 years of experience in Commercial Mortgage Loan Sizing, focusing on analyzing borrowers' financial statements and rent rolls. She has supported RE-focussed clients on due diligence, loan sizing, preliminary underwriting, and various ad-hoc tasks. Before joining Acuity, Namita was associated with a real estate servicing firm, where was involved in analyzing properties’ operating statements, creating financial mappings based on client-defined models, and conducting detailed rent roll analysis and data due diligence. Namita holds an MBA in Finance and a bachelor’s degree in commerce.

Ridhi possesses six years of experience in real estate sector, with a particular focus on investment research and asset management. Currently, at Acuity, she is supporting a large asset manager with various RE credit tasks, lease reviews, rent rolls, loan onboarding and monitoring, etc. Previously, she worked at JLL, where skillfully handled complex lease reviews. Ridhi holds an MBA in Finance and a bachelor’s degree in commerce.

Like the way we think?

Next time we post something new, we'll send it to your inbox