Published on December 20, 2024 by Amrita Baksi

Disruption to global trade

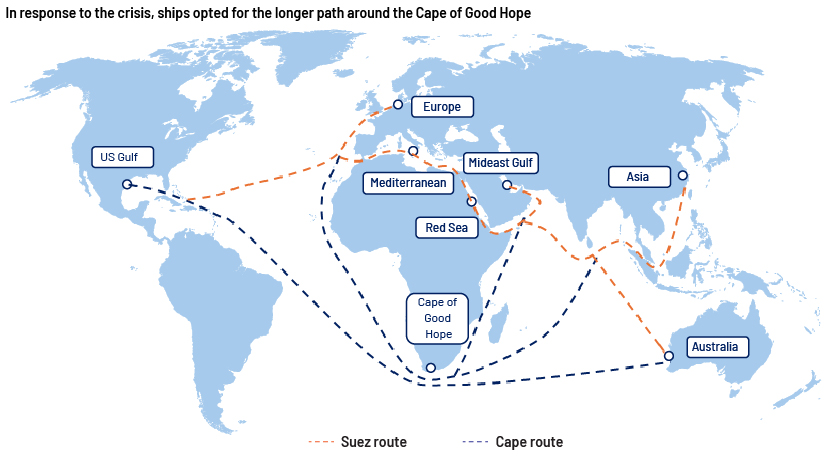

The unprecedented supply-chain crisis triggered by the pandemic in 2020-22, the Ukraine war since 2022 and the difficulties faced as fewer ships moved through the Panama Canal because of lower water levels caused by drought were followed by significant red sea shipping disruptions to global maritime trade in the final months of 2023 and the first quarter of 2024. This is when vessels entering the Gulf of Aden and navigating through the Red Sea and the Suez Canal faced Houthi attacks on shipping from Yemen-based Houthis.

The Red Sea plays a critical role in global trade

The Red Sea, located between Africa and Asia, is a body of saltwater connected to the Indian Ocean through the Bab-el-Mandeb Strait and the Gulf of Aden to the south; to the north, it is bordered by the Sinai Peninsula, the Gulf of Aqaba and the Gulf of Suez – which leads to the Suez Canal.

The Red Sea is one of the world’s busiest shipping lanes as the shortest route between Europe and Asia. It plays a crucial role in container shipping and global trade disruptions, connecting the Indian Ocean to the Mediterranean Sea through the Suez Canal.

Around 12% of global trade and 30% of the world’s container traffic passed through the Suez Canal in 2023, carrying more than USD1tn worth of goods – such as natural gas, petroleum, automobiles, raw materials and numerous other manufactured goods and parts – between the Indian Ocean, the Mediterranean Sea and the Atlantic Ocean.

Around 15% of global seaborne trade, including 8% of global grain trade, 12% of seaborne oil, and 8% of global liquefied natural gas (LNG) trade, was conducted via the Red Sea as of January 2024. The "red sea shipping disruptions" have had far-reaching impacts on these statistics. Efficiencies in terms of distance, time, and fuel consumption offered by this marine trade route make it an ideal choice for international shipping companies.

The red sea shipping crisis forced major shipping companies to divert routes.

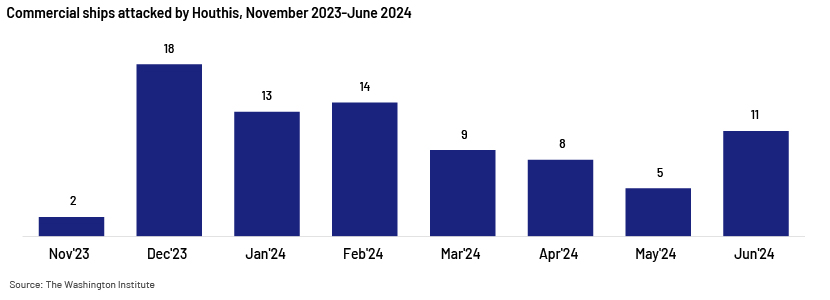

In the latter part of November 2023, a Houthi group in Yemen increased their attacks on commercial ships in the Bab-el-Mandeb Strait (between the Arabian Peninsula and the Horn of Africa), employing a variety of advanced weapons, including ballistic missiles and “kamikaze” drones.

The attacks began on 19 November 2023, when the group landed a helicopter on the Galaxy Leader cargo vessel while it was navigating through the southern part of the Red Sea. They rerouted the vessel towards Hodeidah port in Yemen, capturing the crew members, who remain detained.

Until March 2024, 43 more cargo vessels had been targeted in the region, with 21 of them hit directly by missiles or drones. These attacks led to at least three fatalities of seafarers and the sinking of a bulk carrier.

In response to Houthi threats increasing, major maritime transport companies diverted their ships from the Suez Canal towards the Cape of Good Hope – around the southern tip of Africa.

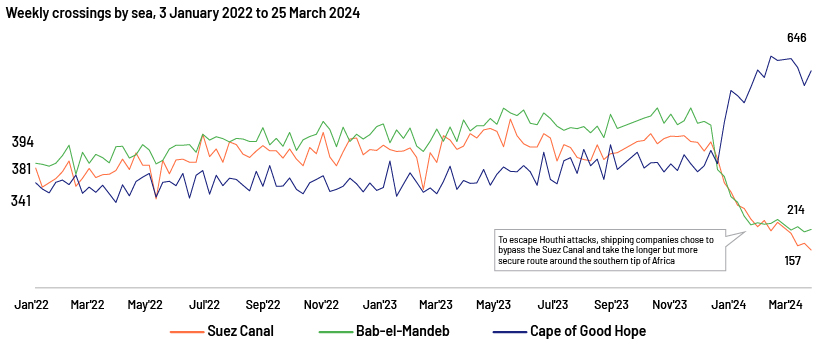

The number of ships travelling via the Cape of Good Hope increased while the flow of traffic through the Suez Canal saw a significant decline

By end-March 2024, maritime traffic passing through the Suez Canal and the Bab-el-Mandeb Strait had halved, while traffic via the Cape of Good Hope likely doubled.

Source:Office for National Statistics

Around 80% of marine cargo vessels were rerouted from the Suez Canal towards the Cape of Good Hope. 586 container ships had been redirected by the first half of February 2024; the amount of container tonnage passing through the Canal decreased by 82% from 1 December 2023 to 12 February 2024.

Impact of the rerouting on global shipping

The shift to this longer shipping route, around the Cape of Good Hope, increased the length of travel and shipping costs, exacerbating the red sea shipping crisis.

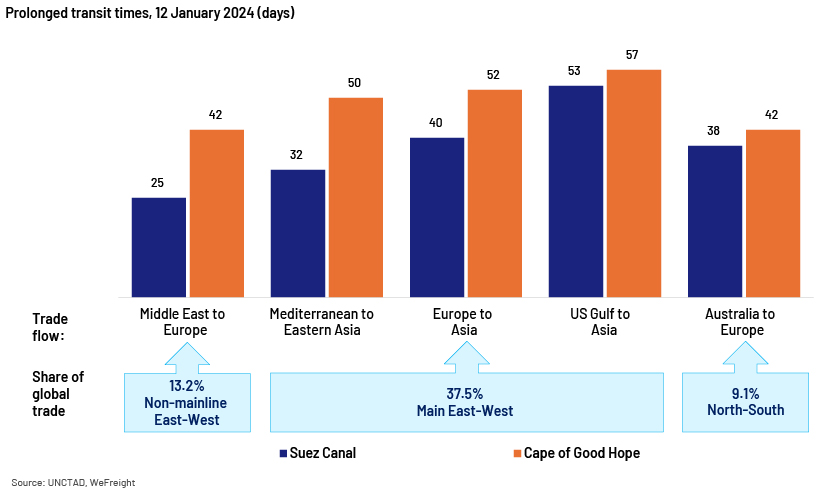

1. Transport time and distance increase

This route is about 53% longer. To reach Europe, cargo ships and vessels need to cover an additional 4,575 nautical miles (a 29% increase in sailing distance), and to reach North Atlantic and Northern European destinations, they need to spend an extra 12-14 days at sea.

Using the extended route, the journey from Shanghai to Rotterdam spans 13,800 nautical miles and takes approximately 35 days, as opposed to roughly 10,600 nautical miles and taking about 27 days via the Suez Canal route.

Similarly, using the route via the Cape of Good Hope, the journey from India to Europe covers 13,500 nautical miles and takes 34 days, as opposed to 10,000 nautical miles and taking 25.5 days via the Red Sea/Suez Canal. Around 60% of the world's containerised trade experienced longer transit times and delayed deliveries.

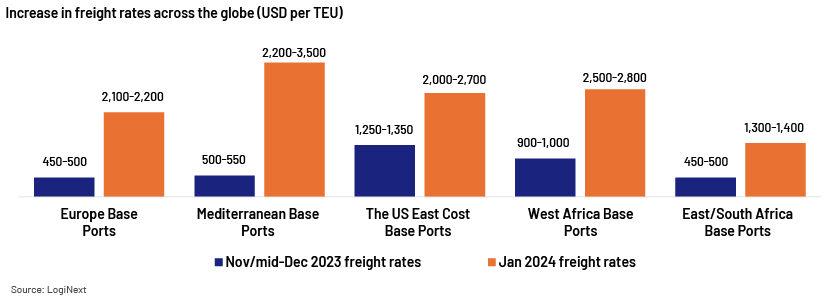

2. Costs rise

More days, coupled with more miles travelled, resulted in elevated shipping costs. This is because fuel consumption increases by 30% compared to the route via the Suez Canal, increasing fuel costs by USD1m in fuel costs for each journey from Asia to Europe and back.

Longer journeys lead to ships being at sea for extended periods, increasing crew wages, maintenance costs, insurance premiums and other operational expenses.

Increase in shipping costs and freight rates as of 15 February 2024

| China to the US East Coast | Asia to N Europe | Asia to Mediterranean |

| 193% rate increase since October 2023 Current rate: USD6,589 Average transit time: 37 days | 286% rate increase since October 2023 Current rate: USD5,758 Average transit time: 44 days | 412% rate increase since October 2023 Current rate: USD4,697 Average transit time: 45 days |

Source: Freightos

Freight rates increased due to higher operating expenses, elevated charges at ports and the escalating expenses associated with adhering to environmental regulations.

The rerouting of ships around the Cape of Good Hope resulted in a hike in freight rates of as much as USD1,000 per twenty-foot equivalent unit (TEU; a shipping container). Prices are expected to remain high until Red Sea container shipping activity returns to normal.

These additional costs of fuel and operations incurred by the ocean carriers are transferred to shippers via higher rates and extra surcharges. Freight rates, specifically for containers on the Asia Pacific-to-Europe shipping lane, have increased significantly since November 2023.

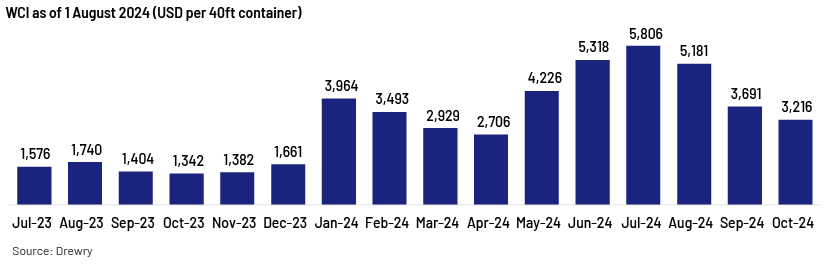

The Drewry World Container Index (WCI) is a combined indicator that offers a brief overview of container shipping rates on eight key routes to/from the US, Europe and Asia. It tracks weekly changes in freight rates for 40-foot shipping containers.

The usual expenses for transporting a 40-foot container have increased significantly due to the crisis. The WCI rose 197.8% from August 2023 to August 2024.

Before the conflict, the war risk insurance premium stood at approximately 0.05% of the value of the ship being insured; this increased to 0.75-1% in December 2023. Insurance premiums on ships have increased globally due to rising geopolitical tensions. The risk is considered to be higher for vessels heading to countries in Western Europe and the US. The war risk insurance premium increased to 20% in December 2023 from 15% in November 2023.

3. Soaring freight rates impact not only the global shipping industry but also global food and oil prices

-

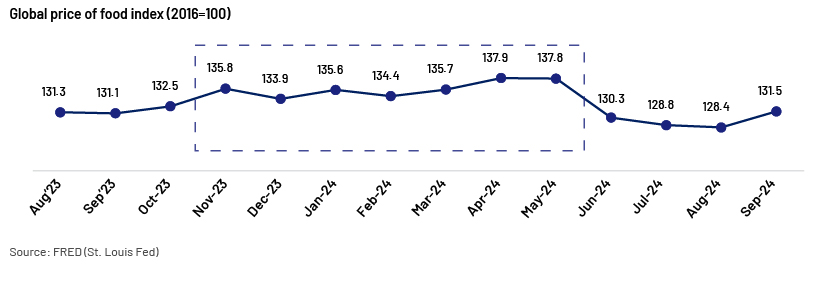

Impact of high shipping costs on global food prices

Rising transport costs cause a variety of economic disturbances. They elevate expenses and reduce demand, leading to lower prices for manufacturers in exporting countries. They also reduce the amount of trade, causing greater price fluctuations, as it becomes more difficult to buy products when prices are high and to sell products when prices are low. Countries heavily dependent on food imports are particularly vulnerable, and the precarious food-security situation in these nations worsens due to rising costs and potential shortages – the number of people suffering food insecurity increased to 282m in 2023 from 113m in 2018. Despite food prices decreasing from their peak at the beginning of the conflict, supply shocks caused moderate to high food prices from June to September. Food prices are expected to rise due to the ongoing crisis, which is increasing the distances that need to be travelled and freight rates and, thus, costs.

-

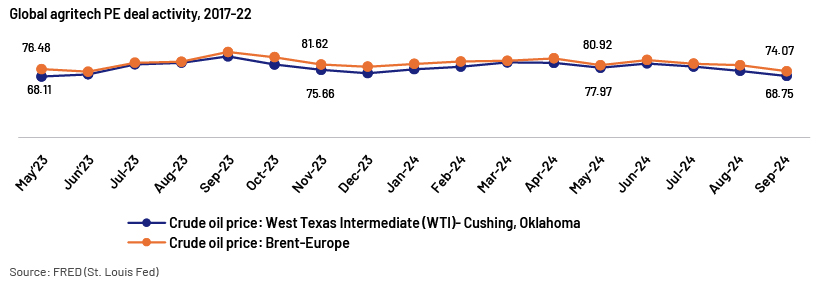

Elevated shipping costs drive global oil prices

Amid the Houthi attack, oil tanker transits through the Suez Canal decreased by 23% from November 2023 to December 2023, with LPG and LNG carrier transits falling by 65% and 73%, respectively. Tankers have been rerouted via the Cape of Good Hope; this longer route around Africa added 20-45 days to the journey, leading to an increase in tanker rates, fuel costs and delays in arrival and, thus, an increase in energy prices. The cost of oil supplied to Asia from the US increased by more than USD2 a barrel over a three-week period in January 2023.

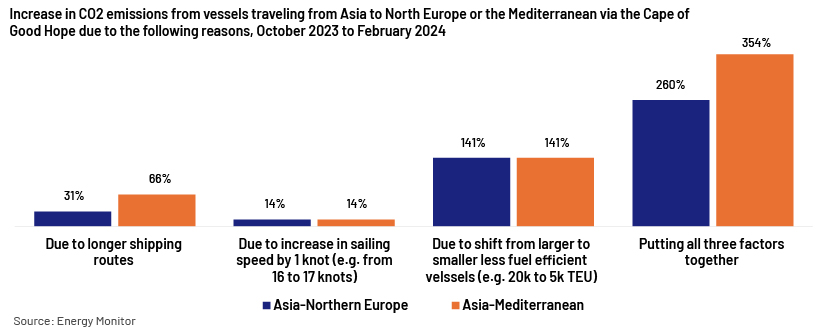

Rerouting via the Cape of Good Hope significantly increased CO2 emissions

Shipping accounts for almost 3% of global emissions. The Red Sea crisis impacted not only the global shipping industry but also the environment. The longer distances travelled by rerouted ships increased fuel consumption, leading to higher greenhouse gas emissions – from 210m tonnes in 2013 to 231m tonnes in 2023, with a dip to 205m tonnes in 2020.

-

Increase in CO2 emissions along critical shipping routes in January 2024 versus October 2023:

-

Singapore / Malaysia Europe: 40% increase in carbon emissions

-

Singapore / Malaysia US East Coast: 16% increase in CO2 discharge

-

China Europe: 30% rise in greenhouse gas emissions

-

China US East Coast: 12% rise in carbon emissions

We consider three major factors: (1) the 31% rise in emissions for Asia-Northern Europe and the 66% rise in emissions for Asia-Mediterranean owing to the longer distances travelled by rerouted vessels, (2) the likely 14% increase in emissions due to increased sailing speed (e.g., increase in speed by 1 knot, from 16 to 17 knots), (3) the shift towards less-fuel-efficient smaller vessels from large ones, while shipping companies race to add more capacity to accommodate the longer sailing distances, increasing emissions by 141% and (4) a combination of these three factors, leading to a 260% increase in CO2 emissions for Asia-Northern Europe and a 354% increase in CO2 emissions for Asia-Mediterranean.

Increased sailing distances result in a 1:1 increase in emissions if the shipping lines use the same vessels at the same speed.

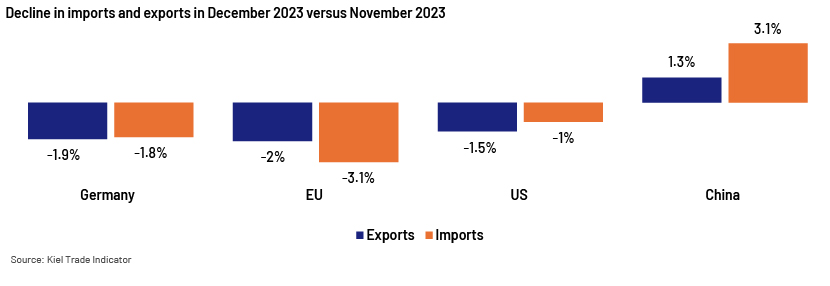

Immediate impact of the geopolitical crisis on the global import and export landscape

Because of the violence in the Red Sea and the need for ships to travel via the Cape of Good Hope in Africa, shipping costs and the time it takes to transport goods between East Asia and Europe have increased, keeping global trade and trade between major countries on a slightly downward path. The amount of goods being imported and exported from Germany, the EU and the US has dropped significantly compared to November 2023.

During this period, the rerouting of ships has not only increased the transit times between Asian production centres and European consumers by up to 20 days, but also reduced trade figures for Germany, the EU and the US, as transported goods were still at sea and were not unloaded at ports as planned.

Military action

Operation Prosperity Guardian, which involves more than 20 countries, is an international military coalition that the US announced in December 2023, aiming to defend the Red Sea from Houthi attacks.

In response to the Houthis' continued attacks on shipping, the US and UK carried out five joint naval and airstrikes from 11 January to 30 May 2024. Countries such as Australia, Bahrain, Canada, Denmark, the Netherlands and New Zealand supported the US/UK actions non-operationally.

According to US Lieutenant General Douglas Sims, 28 locations in Yemen were struck by more than 150 weapons. This was after the Houthis launched their anti-ship ballistic missile in the Gulf of Aden on 11 January 2024, their 27th attack.

The EU announced Aspides, its own maritime security operation. Its anti-piracy operation, Atalanta, has also been deployed to secure maritime routes and protect commercial vessels from attacks.

The Houthi attacks in the Red Sea have also negatively impacted India, a significant US partner. A number of ships with Indian crews on board or traveling towards India have been targeted. Consequently, the Indian Navy has stepped up its Red Sea patrols and deployed a maritime patrol aircraft along with five guided missile destroyers.

Global efforts to minimise the impact of the Red Sea crisis

Improving the Eastern Maritime Corridor (EMC). The EMC has the potential to significantly boost trade relations between Russia and India. It could expedite trade by up to 16 days and is a sustainable trade route because it minimises delays and optimises routes, reducing fuel consumption and emissions.

Enhancing ports and logistics infrastructure. To develop a “state-of-the-art” facility at Safaga Sea Port, strategically located in the Red Sea, AD Ports Group signed an agreement with the Red Sea Ports Authority for an investment of USD200m spread over three years. This port is set to become the first internationally operated port serving the Upper Egypt region.

Analysing the land corridor as a potential option. The US-backed transport corridor, known as the "Land Connectivity by Trucks" project, enables transporting cargo between the Gulf of Dubai, the United Arab Emirates and Israel's Haifa Port while saving a significant amount of money and time. This may be a viable alternative to the Bab-el-Mandeb–Red Sea route under attack from Houthi rebels.

China’s Belt and Road Initiative (BRI). Strengthening road networks and integrating them with ports can create a comprehensive infrastructure strategy, especially given Africa's extensive port developments. This strategy supports regional stability while being consistent with the overarching objective of building robust and interconnected trade routes.

Developing alternative shipping routes. Other options include direct shipping from Asian ports to the US West Coast via the Pacific, using inland routes to reach destinations across the country and circumnavigating the southern tip of Africa to avoid the turbulent waters of the Red Sea. Although this route is longer than the Red Sea passage, it offers a safer alternative.

Conclusion

The ongoing Houthi threat in the Red Sea, a vital artery for global trade, highlights the profound effect of a major geopolitical conflict on international trade and the global economy. The crisis has revealed the vulnerability of the global supply chain and forced major shipping companies to reroute and opt for longer shipping routes, resulting in a significant increase in shipping costs, delays in delivery of consumer goods and disruptions to the global supply chain. Inflated shipping costs have resulted in increased prices of consumer goods, affecting consumers globally. This crisis has affected not only the shipping industry and the global economy but also the environment, as extended shipping routes have resulted in higher CO2 emissions because of increased fuel consumption.

With attacks getting worse every day and the lack of an apparent end in sight, tensions in the Red Sea are likely to persist in 2025, significantly affecting global trade. Most commercial vessels will likely continue to stay away from the southern part of the Red Sea and the Gulf of Aden, and shipping companies will likely continue to prefer longer but safer routes around the Cape of Good Hope.

Increasing costs of shipping and insurance, along with delays in delivery of goods, are likely to continue to disrupt global value chains and reduce profit margins, and countries in Asia, Africa and Europe are expected to face the most challenges. Thus, the impact on global trade is likely to persist.

How Acuity Knowledge Partners can help

We provide customised research and analytical solutions and insight, helping clients understand how this geopolitical crisis is affecting industries and economies. We are experienced in tracking, reporting and analysing geopolitical and other events through newsletters, dashboards, industry studies and other ad hoc research and analysis. Our Competitive Intelligence Services further support clients in staying ahead of market trends and geopolitical risks. We also help clients capitalise on emerging investment opportunities in the infrastructure market, such as by devising alternate land and shipping routes, developing ports and logistical facilities, and enhancing trade routes.

Sources:-

https://unctad.org/publication/navigating-troubled-waters-impact-global-trade-disruption-

-

https://gcaptain.com/maersk-suspends-red-sea-voyages-for-foreseeable-future/

-

https://unctad.org/system/files/official-document/rmt2023_en.pdf

-

https://www.reuters.com/graphics/ISRAEL-PALESTINIANS/SHIPPING-ARMS/lgvdnngeyvo/

-

https://www.ons.gov.uk/businessindustryandtrade/internationaltrade/bulletins/shipcrossin

-

https://unctad.org/publication/navigating-troubled-waters-impact-global-trade-disruption

-

https://www.ifpri.org/blog/impacts-red-sea-shipping-disruptions-global-food-security/

-

https://www.loginextsolutions.com/blog/what-is-the-red-sea-conflict-and-its-impact-on-global-trade/

-

https://www.loginextsolutions.com/blog/what-is-the-red-sea-conflict-and-its-impact-on-global-trade/

-

https://www.freightos.com/freight-blog/shipping-delays-and-cost-increases/https://www.drewry.co.uk/supply-chain-advisors/supply-chain-expertise/world-

-

https://economictimes.indiatimes.com/news/economy/foreign-trade/as-tensions-mount-in-red

-

https://www.livemint.com/news/world/red-sea-attacks-rising-freight-rates-drive-shift-in-oil-

-

https://www.energymonitor.ai/sectors/transport/weekly-data-red-sea-crisis-could-quadrupl

-

https://www.allthingssupplychain.com/the-red-sea-dilemma-for-shippers-extended-transit-

-

https://www.reuters.com/sustainability/red-sea-crisis-forces-operators-use-more-container-

-

https://www.ifw-kiel.de/publications/news/cargo-volume-in-the-red-sea-collapses

-

https://www.washingtoninstitute.org/policy-analysis/houthi-ship-attacks-pose-longer-term-

-

https://commonslibrary.parliament.uk/research-briefings/cbp-9930/

-

https://www.atlanticcouncil.org/blogs/menasource/red-sea-attacks-houthis-biden

-

https://globalpolitics.in/view_cir_articles.php?url=Conflict%20Weekly&recordNo=1281

-

https://www.logisticsinsider.in/navigating-new-horizons-unveiling-the-transformative-potential

-

https://www.offshore-energy.biz/ad-ports-finalizes-deal-to-develop-new-red-sea-port-terminal/

-

https://www.india-briefing.com/news/red-sea-crisis-global-trade-alternative-land-corridor-uae-

-

https://news.cgtn.com/news/2023-12-20/Red-Sea-crisis-may-unlock-power-of-decentralized

-

https://usacustomsclearance.com/process/red-sea-shipping-alternatives/

Tags:

What's your view?

About the Author

Amrita has over 4 years of experience in Business Consulting & Advisory, and Market Research, has executed projects across multiple sectors. She is a part of Acuity's Private Market vertical, possess proficiency in providing support to clients' marketing and corporate strategy teams, along with assisting them in investment opportunity assessment through deep dive secondary research & data analysis. Amrita holds a PGDM in Finance from Pune Institute of Business Management.

Like the way we think?

Next time we post something new, we'll send it to your inbox