Published on December 3, 2018 by

We love jargon in the financial services industry, and new waves of technology always create new enthusiasm, where we can all get caught up, discuss new technology, and bandy names around. Artificial intelligence, or AI, seems to be riding the wave of enthusiasm that big data enjoyed, which, at the beginning, meant very little, with very few firms actually achieving useful application of big data. AI is a great example of the next wave, following on from big data, blockchain, and cryptocurrency – currently, the hype is actually greater than its applications within financial services firms.

What I mean by this is, the term AI gets bandied around a lot, without the understanding of what it is, how it can be applied, or how it is relevant? In fact, when someone says “We are investigating AI for investment banking, research, or asset management,” what they often mean is, “We would like to bring more ‘tech-based solutions’ to our business to free up staff or reduce costs or inefficiencies.” The “artificial” part of the hype, you could argue, is because it gets discussed a lot, but the number of applications and useful business programs are only just emerging. It is also worth bearing in mind that although AI certainly is brilliant and can be transformative, it is not cheap to explore. Furthermore, it is difficult to find great technical expertise on AI with an understanding of financial markets, and there will always be an element of continued maintenance to ensure the ROI on the machine keeps improving.

Lastly, it should not be forgotten that although this is at the top of the agenda for most financial services board members, with significant spend being unleashed in this area (much like the hype that surrounds it), there are also many corpses on the AI battlefield of failed projects or innovation – the ideas might have been great, but poor implementation is likely to have led these projects down the cul-de-sac, only to then be stopped and killed. That, in itself, is alright in the context of general innovation and exploration, but most businesses do not have the luxury to fail in such projects. There is also the hidden danger for many banks and asset managers that even if their implementations were to be successful, they would be investing purely to serve their own needs rather than leveraging varied data sets that could be broader or deeper, where the return on investment could be greater if its delivery or investment costs were to be shared.

Myths and facts

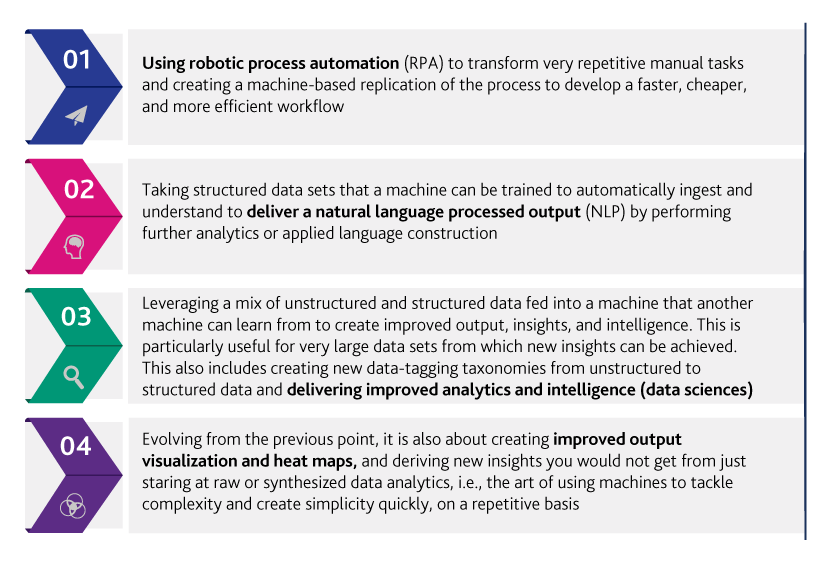

So, what is AI – from a business perspective rather than a purely technical one? We like to bucket this into four core areas.

MA Knowledge Services’ LABs

So, how does Acuity Knowledge Partners get involved in AI?

Well, the first thing to note is that we have over 2,700 financial services domain experts, with knowledge of front- and middle-office processes of banks, asset managers, private equity, and corporates. First, our subject matter experts allow us to have the “expert staff” needed to tackle problems that can be looked at by machines. Second, they allow us to gain an in-depth understanding of the workflow at financial institutions and offer appropriate solutions. This is critical for any AI project because, at a fundamental level, any project really has to achieve these three key things:

Understand the data set on which machine-based learning can be applied – i.e., experts know the process and data set intimately and are aware of the improved output they would like to see

Feed a machine with data sets – i.e., more importantly, experts can retrain a machine to detect quality control issues, conduct checks, and detect areas where inefficiencies may occur, which could allow/train it to use the improved pattern recognition algorithms to enhance both, the processing and recognition of the input data set and the output quality, each time it passes through the machine

Have an agile technical team that has AI and data expertise and understands data-based rules, unstructured data mining, and data sciences – i.e., having technical experts that understand the domain they are working on within the financial services spectrum

Real examples

So, moving from myth to reality, what are the types of applications MA Knowledge Services helps its clients with, which broadly assist them across the whole AI and data sciences spectrum?

-

Credit spreading for SME to large corporate lending – taking the raw input data into machine-based algorithms that feed a cloud-based data lake from which the credit-data machine learns. This data set is continually being improved, and learning is based on both input and output. This helps relationship managers and underwriters get their base data set for lending decisions or annual reviews, so their time can be better invested in client-based lending face time vs administration. We have a service called “QUIK” that allows for this to be done quickly and efficiently. This service can be purely software-based or be taken as a managed solution, where the MA Knowledge Services team not only performs a quality control on both, the input and the output data set, but also goes a step further and assists with underwriting reviews and covenant-based risk analysis and maintenance.

-

Taking a highly structured data set and allowing the machine to write applied language output – this refers to inputting of a data set or model that always follows a certain format, and allowing the machine to write the majority of the report or commentary before the expert adds the finishing touches. This can be applied to client newsletters, fund factsheets, investment research commentaries, economic calendars, credit memos, or improved internal reporting.

-

Creating new ideation for banks and asset managers to develop new analytics and insights beyond that which is traditional. I call this “fuzzy fundamentals” – the art of taking further data in the market and mining this using web scraping and applied data science techniques to enrich new data sets or create new insights and improved intelligence. The applications of this are broad – from assisting hedge funds in the creation of improved short positions and helping asset managers or hedge funds deliver improved visualization of trading or investing positions, to enabling banks to create new data sets that can be applied to traditional fundamental methods to bring new ideation or insights to customers and decision making. In these cases, we work with the clients in two ways – either by only assisting at the web crawling, web scraping, and data mining stage, with the client taking the final “recipe” to conclusion, or by taking the data set onward and adding a data science- and taxonomy-based understanding to new realms of decision ideation.

In the end, whichever problem you are trying to solve, whether it requires true AI or a true tech-enabled domain project/transformation team to solve and improve a business process, it is often cheaper and safer to use experts who understand such transformation and change, and can work for your organization on a dedicated basis. We know that often, it is not the technology or the use of a machine that is the real problem. It is usually the culture, the adoption of change, and even communication that can slowdown or block success. We have come to realize that human bias and the reluctance to change can often be solved by being clearer about the real benefits to employees rather than letting them be afraid of losing their jobs.

So, if you feel you have an idea or project, please do engage with us at MA Knowledge Services, as we have a focused set of experts that can assist with, navigate, deploy, and maintain a new, improved process for your organization on a dedicated basis. While helping clients embrace technology and change, the real joy for us comes from seeing how it improves the customer and stakeholder experience. This is a bigger drive than the use of machines for tech efficiency or the money – i.e., achieving the art of the possible through focused transformation.

What's your view?

Like the way we think?

Next time we post something new, we'll send it to your inbox