Published on August 8, 2018 by Rahul Kajla

Blockchain has been garnering significant attention across industries, with venture capitalists investing over USD1.4bn in the technology in the past three years. The World Economic Forum estimates 10% of the global GDP to be stored using blockchain by 2027.

The use of blockchain in cross border remittances is witnessing huge traction. Over 90 central banks along with financial service firms, technology companies, trade associations and regulators are either investing or partnering with fintech firms to explore platforms such as Ripple and R3.

Blockchain is bringing cost and efficiency benefits in cross border remittances, as it removes the multiple intermediaries involved in the traditional process. The technology refines the processes across all the phases of remittance - first mile, money transfer processing and settlement and the last mile.

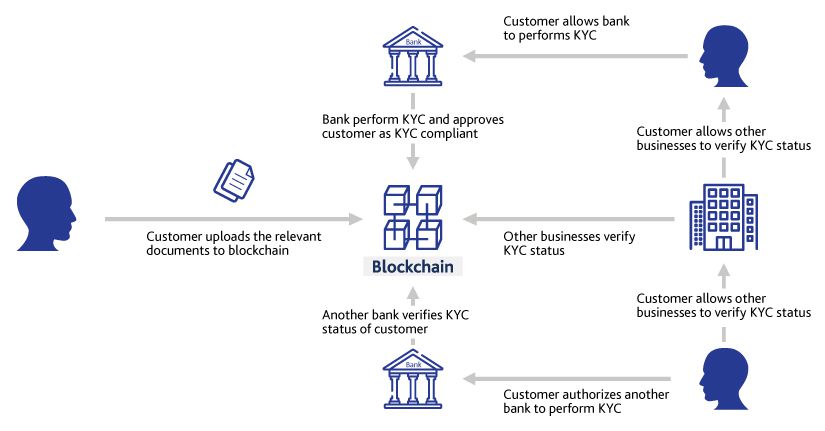

First Mile: Financial institutions perform the KYC (Know Your Customer) process before funds enter the payment system

The traditional KYC process, with substantial duplication of efforts, can take up to 30-50 days. Blockchain, however, facilitates financial institutions to add the KYC statement on the blockchain platform, which serves as a common, shared platform to store, retrieve and access the documents. This helps to complete the KYC process instantly.

First Mile – Blockchain-enabled KYC process

Source: Blockchain Council

In June 2018, network partners of R3 consortium completed over 300 transactions through its KYC application, enabling banks to request access to customer KYC data and clients to grant or revoke the access.

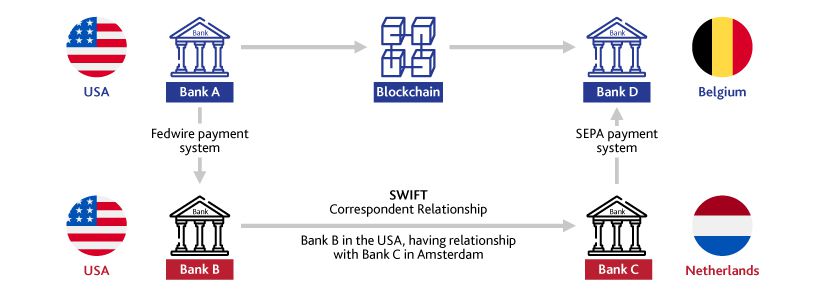

Money Transfer Processing and Settlement: Funds are transferred from sender to recipient

In case of traditional cross border remittances with SWIFT, the payment passes through several intermediaries, leading to delays and higher costs.

Money transfer from Bank A in the US to Bank D in Belgium through blockchain, leading to the elimination of intermediaries (highlighted) such as Bank B and C

Source: Infosys

Fintech firms such as Bitspark, CoinPip, and Coins.ph use blockchain for direct transaction between the parties, leading to instant transfers and at costs 250x cheaper than SWIFT.

Last Mile: Reaching the underserved recipient of funds

In 2017, remittances to emerging markets accounted for USD450bn with an average cost of 9.3%, compared with the global average cost of 7.1%. Costs are higher in emerging markets because of their large unbanked population and the lack of payments infrastructure.

As per the World Bank, 68% of the adult population in Middle East and North Africa (MENA) and 66% in Sub-Saharan Africa are unbanked. However by 2025, smartphone adoption (as a percentage of total mobile connections) in MENA and Sub-Saharan Africa is expected to increase to 73% (52% in 2017) and 68% (34% in 2017), respectively

Leveraging the usage of smartphones, geeRemit offers a blockchain-based mobile remittance app in Sub-Saharan Africa that facilitates unbanked recipients to receive funds directly as mobile money on their phones. Philippines-based Coins.ph also offers a blockchain-based mobile app that facilitates transfer of funds without relying on banks, reducing costs by 1% to 3%.

Thus, with its increasing presence across the process of remittance, blockchain is expected to achieve the World Bank’s target of average remittance cost of 5%. However, its successful implementation is dependent on collaboration among industry participants.

Acuity Knowledge Partners is an experienced research and consulting partner that has been supporting corporates, consulting firms and PE firms across the globe in their strategic research assignments, and keeping them abreast with the latest trends and developments across various business practices.

Sourceshttp://www3.weforum.org/docs/WEF_The_future_of_financial_infrastructure.pdf

https://cointelegraph.com/news/canada-s-large-credit-union-coalition-joins-blockchain-consortium-r3

What's your view?

About the Author

Rahul Kajla has over 11 years of experience in the research and consulting industry. He currently works in the Strategy Research and Consulting practice at Acuity Knowledge Partners and supports consulting and corporate clients in their research assignments. He is experienced in customized research related to market & competitive intelligence, market assessment, benchmarking, competitive landscape, market entry, partner identification, M&A opportunity in addition to others along with sales support

Like the way we think?

Next time we post something new, we'll send it to your inbox