Published on August 5, 2020 by Navneet Kumar

A pandemic is a “once in a century” incident. The loss of hundreds of thousands of lives and the adverse impact on the global economy are the unforgettable and inevitable price the world pays, but as we know, every problem brings with it an eye opener. The COVID-19 crisis has proved that not only developing nations but also developed ones are miles away from perfection. Although the current environment has been challenging and disruptive across industries, it has at the same time led to the emergence or ramp-up of previously barely known industries and shown up those that have survived. It has also changed the way we work and look at things

Situation factoids

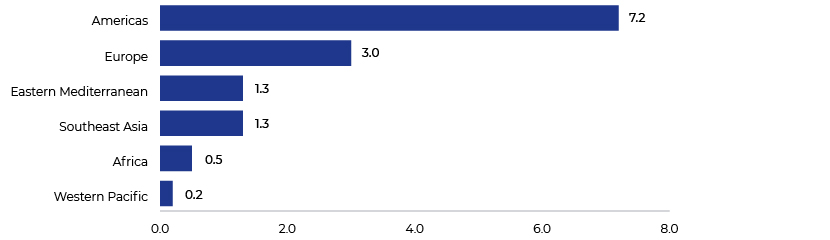

The World Health Organization (WHO) reported 13.4m active, confirmed cases of infection and around 0.6m deaths in 216 countries, areas or territories as of 16 July 2020. In the Americas, the US accounts for almost half of the cases (3.4m), followed by Brazil, with almost 1.9m. In Southeast Asia, India is the major contributor, with approximately 0.9m cases of the total 1.3m.

Source: Acuity Knowledge Partners

The world reports more than 100,000 new positive cases a day, and states in the US and India are reinforcing lockdowns.

To stop transmission, WHO recommends wide-ranging measures including wearing face masks and social distancing, but these are just temporary solutions, and the number of cases will likely keep increasing until a vaccine is developed.

Economic conditions amid the COVID-19 pandemic:

Prospects of an even weaker outlook and prolonged destruction of potential output, productivity growth

Economies worldwide have started assessing the damage and easing lockdowns to prevent the damage worsening, but the real adverse effect will likely be reduced only in the second half of 2020. In a downward scenario, global growth could shrink by almost 8% this year.

A global recession on the heels of the COVID-19 crisis:

The World Bank confirms this will be the deepest recession since World War II, with the output of emerging-market and developing economies (EMDEs) expected to drop significantly in 2020. The following factors indicate how deep the recession will be:

-

-

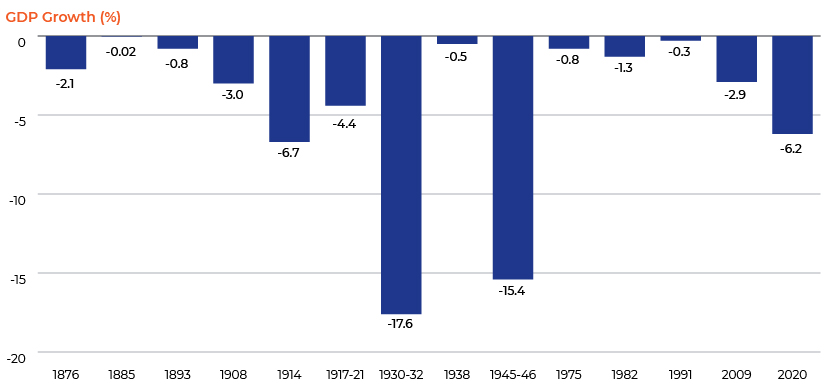

Drop in global GDP growth

-

Advanced economies are forecast to shrink by 7%. Almost every region will be subject to a substantial drop in growth. East Asia and the Pacific are forecast to grow by just 0.5%. South Asia is forecast to contract by 2.7%, sub-Saharan Africa by 2.8%, the Middle East and North Africa by 4.2%, Europe and Central Asia by 4.7%, and Latin America by 7.2%, according to the World Bank, pushing millions into poverty.

Note: For multi-year periods, we show the cumulative contraction. Data for 2020 is a forecast.

Source: World Bank

-

-

Steepest decline in oil demand

-

Oil consumption generally declines in weak economic conditions. The global lockdowns and social distancing have led to an unprecedented collapse in oil demand and a surge in oil inventories; the steepest one-month decline in oil prices on record was reported in March.

-

-

Contraction in per capita GDP growth

-

Most economies are forecast to report the largest drop in per capita GDP since 1870.

-

-

Decline in activity

-

Global activity indicators are expected to register their largest declines in the past 60 years. The drop in human interaction has hampered the service sector, global trade and oil consumption. The world is suffering from the highest job-loss rate since 1965. India experienced 27.11% unemployment amid the lockdown in May 2020; the rate currently stands at 7.8%, according to the Centre for Monitoring Indian Economy (CMIE).

-

-

Decline in per capita output in all EMDEs

-

Although the impact will vary across EMDEs, current projections indicate that five of six economies will fall into complete recession. The majority will experience the lowest growth in the past 60 years, and all of them will see a decline in regional per capita output for the first time during a global recession since 1960.

-

-

Earnings stumble and poverty spikes

-

Emerging-market and developing economies are forecast to shrink by 2.5%, the first contraction as a group in at least the past 60 years. Per capita income, meanwhile, is forecast to fall by 3.6%, pushing millions into extreme poverty. The countries hit the hardest are those that experienced the pandemic most severely and that rely heavily on global trade, tourism, commodity exports and external financing. It is forecast that 71m will go into extreme poverty in 2020 in a baseline scenario and almost 100m in a downside scenario, increasing the global extreme poverty rate to 8.82% and 9.18%, respectively, the first spike in poverty since 1998.

-

-

Mounting debt and a low servicing ratio

-

Businesses have lost momentum, face a labour crisis, and are experiencing low top lines because of low consumer demand. They are, therefore, unable to service debt and are increasing their debt burdens. Cash-constrained start-ups are heading towards bankruptcy, eventually leading to unemployment. Developing economies’ fiscal balance-to-GDP ratios are projected to rise, on average, to 9.1% from 4.8%, significantly increasing their debt burdens and raising the likelihood of default or debt rescheduling.

Note: The fiscal balance-to-GDP ratio is a government’s budget balance. It is calculated as the difference between a government’s revenue (taxes and proceeds from asset sales) and expenditure, and is used to measure a government’s ability to meet its financing needs and ensure good management of public finances.

-

-

A vicious circle of events

-

Global work stoppage hits earnings, low earnings impact demand, low demand leads to low sales, and the drop in sales results in losses to businesses, eventually forcing them to lay off employees to reduce costs. The lack of liquidity kills a company. Consumer behaviour could also be impacted for a prolonged period. For example, demand for travel, tourism, eating out, entertainment, and other activities involving human interaction would reduce, increasing savings.

Impact on industrial production and manufacturing

Lower- and upper-middle-income countries have been significantly impacted by COVID-19, according to data recently released by the United Nations Industrial Development Organization (UNIDO), as the following table shows.

Source: UNIDO

However, the economic impact is not correlated with the health impact. A low COVID-19 impact in terms of fewer cases and deaths does not necessarily translate into a low economic impact. The value chains of businesses across the globe are disrupted because of globalisation.

-

-

Industrial production and trade

-

UNIDO’s Index of Industrial Production (IIP) analysis for March 2020 vs December 2019 shows that approximately 81% of all countries experienced a 6% decrease in industrial production, on average. A comparison of data for April 2020 vs December 2019 reveals that industrial production fell by 20%, on average, in 93% of countries. A comparison of data for April 2020 vs March 2019 and for March 2020 vs March 2019 shows similar results. Industrial production across the globe deteriorated more in April 2020 than in March 2020. It continued to decline in 90% of the countries in our sample, with an average drop of 15% in one month. We observed m/m reductions in India (-55%), North Macedonia (-35%), Malaysia (-34%), Turkey (-33%) and Slovakia (-32%). Countries that registered an increase in industrial production were Senegal (+9%), Canada (+7%) and Singapore (+4%).

-

-

Manufacturing crisis in many countries

-

The manufacturing industries of all countries suffered during lockdown, albeit to different degrees: 55% of all countries experienced a decrease in manufacturing in the pharma sector and 94% of all countries experienced a decrease in manufacturing in the auto sector. The auto sector has been one of the hardest-hit sectors, while pharma has been less impacted than others.

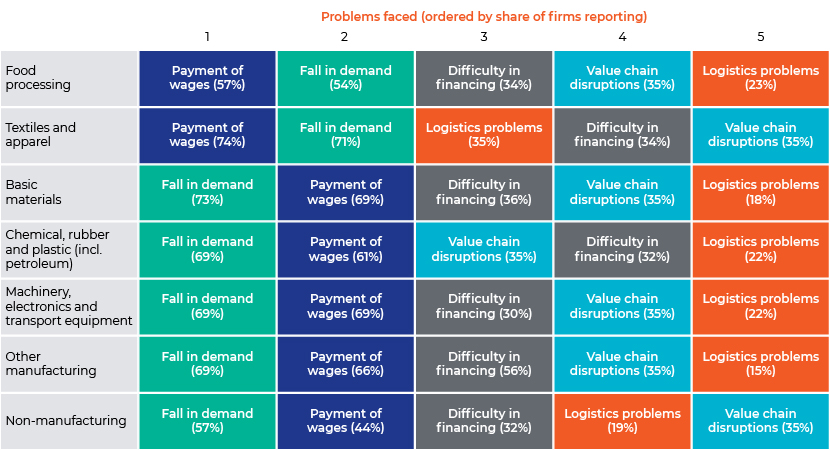

Problems faced by industries in Asia

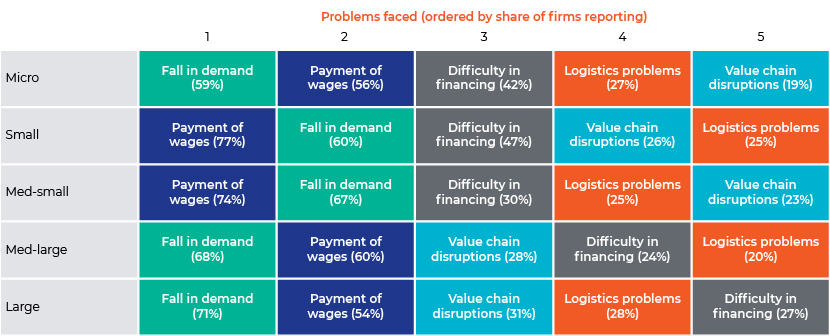

Two widely accepted challenges are (1) a steep decline in demand and (2) paying salaries. The following chart lists the problems firms in different industries face.

Note: The values in brackets indicate the share of firms in the industry that reported this particular problem.

Source: UNIDO

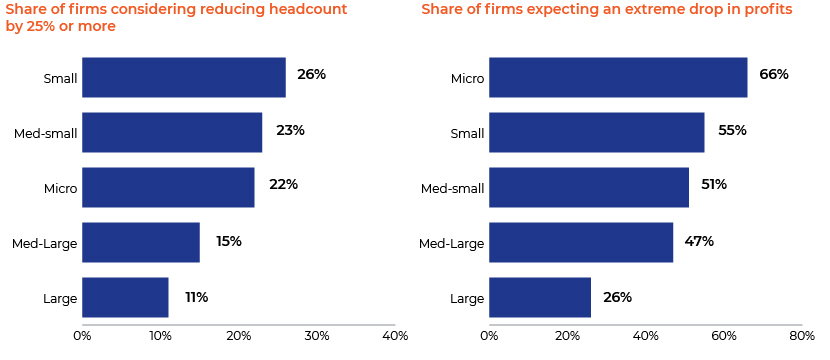

Businesses are closing across industries; SMEs estimate larger profit reductions and job cuts than big firms

-

-

Impact by size

-

Smaller firms are likely to face larger reductions in profit than the bigger ones. Similarly, micro firms are likely to cut fewer jobs than small and medium-size firms

Expected COVID-19 impact on profits and employment, by size of firm

Note: Thickness of bars varies according to size of firm. Only manufacturing firms are considered.

Source: UNIDO

-

-

Problems by size

-

Paying salaries is major challenge for smaller firms, while finances are not a concern for medium-size and larger ones that struggle with COVID-19-induced value chain disruptions.

Top five problems by size of firm

Note: The values in brackets indicate the share of firms in the industry that reported this particular problem. Only manufacturing firms are considered.

Source: UNIDO

Who can help these firms get back on track and how?

Consulting and advisory firms can help these firms find solutions and build resilience. Advisory firms are working with businesses and central and state governments to assess the damage and face the challenges. Giant firms such as McKinsey, Boston Consulting Group (BCG), Bain and AT Kearney are assisting central and state government policymakers in India with resource planning, economic modelling and exit strategies. BCG is working with the central health ministry, and AT Kearney is providing the government with guidance on infrastructure. Ernst & Young is working directly with 9 states and more than 15 central ministries and in 210 districts.

Despite the unfavourable economic conditions, some industries have proven to be more resilient than others and could help the global economy get back on track. We also show below how consulting firms are helping them to recover.

-

-

Internet and technology

-

Social-distancing measures have necessitated handling business remotely, and the world now needs improved internet services with better bandwidth and advanced technology. Accenture specialises in management consulting, technology and outsourcing, and has joined hands with Microsoft to build a platform that will provide real-time advice to governments to manage supply of resources, including critical equipment to fight the pandemic. They have provided tech-based solutions to government authorities in the US and Canada to handle pressure on call centres.

-

-

Warehousing and logistics

-

With more and more opting to get goods delivered to their doors and favouring ecommerce-enabled transactions, the need for warehousing, logistics, and distribution channel services has increased significantly. Consultants are working with firms to automate and digitalise logistics and warehousing services for speedy delivery with less human intervention.

-

-

Education and training

-

More than 1.5bn students are in need of online schooling, with almost 90% of the world’s enrolled learners forced to study from home. The pandemic has also caused the USD600bn-worth higher education industry to go online. Consulting firms are working with universities and professional education institutions to run their operations. Companies and start-ups that provide online education and training (through virtual classrooms) will increase, with access to highly qualified teachers. Growth in this sector would reduce transportation costs and traveling time. Education could be focused on vocational training. In particular, students outside major cities would be able to access quality education, earlier reserved for urban hubs. We expect a rise in private and more practical training services.

-

-

Healthcare and pharmaceutical

-

Given the clear association between obesity and respiratory ailments and COVID-19, innovative business models of the healthcare and pharmaceutical industries should increase. This includes online exercise regimens and safe/sanitary and specialised medical procedures. The UK’s Department of Health and Social Care has commissioned Deloitte to help it enhance testing capacity up to 50 testing facilities. Other consulting firms are assisting government and private-sector hospitals to deal with the spike in the number of patients on a clinical and operational level, financial challenges and the risk of physician attrition.

-

-

Regional supply chain

-

To reduce their dependence on China, developed economies are thinking of options for supporting local industries.

-

-

Regional agribusiness chain

-

We expect local producers and supply chains to flourish as economies regionalise their supply chains. In addition to reducing waste, traceability and resilience would be important. Federal and state governments globally are seeking solutions from advisory firms for maintain food supply. They are also digitalising their agricultural sectors to increase transparency and help producers.

-

-

Energy and power

-

Distributed solar energy should also do well in most emerging-market countries that do not produce fossil fuels, reducing energy volatility.

-

-

Banking and finance

-

Governments are refinancing companies via banking instruments. To ensure safe and quick services, retail banking systems are also automating their processes.

How Acuity Knowledge Partners can help

Our industry experts and tech-based solutions support these consulting firms. Our services – ranging from research for business unit strategy to tactical opportunities and due diligence for strategic transformation – would bolster the capabilities of consultants, introducing flexibility to the current consulting environment. Our subject-matter experts provide customised solutions to help you deliver projects swiftly and with improved output. In addition, our flexible working models can help you improve margins and revenue. We currently serve the world’s top five management consulting firms, and have delivered more than 180,000 hours of project work and saved our clients USD9m in annualised costs.

We have around 16 years of experience in supporting the world’s leading and largest consulting firms. Our unique set of proprietary automation and workflow management tools help you spend more time on what really matters to you.

Sources:

World Bank

https://openknowledge.worldbank.org/bitstream/handle/10986/33748/211553-Ch01.pdf

United Nations World Health Organization (WHO) https://news.un.org/en/story/2020/06/1065902

CNNhttps://edition.cnn.com/2020/06/29/health/us-coronavirus-monday/index.html

International Labour Organizationhttps://www.ilo.org/global/topics/coronavirus/sectoral/lang--en/index.htm

World Bankhttps://www.worldbank.org/en/topic/poverty/brief/projected-poverty-impacts-of-COVID-19

United Nations Development Organizationhttps://www.unido.org/stories/coronavirus-economic-impact-10-july-2020

https://medium.com/@bert_83056/why-a-post-covid-19-world-needs-impact-investment-eec69e778a6c

World Trade Organization https://www.wto.org/english/news_e/pres20_e/pr855_e.htm

https://fas.org/sgp/crs/row/R46270.pdf

What's your view?

About the Author

Navneet Kumar joined Acuity Knowledge Partners in April 2010. During his tenure with Acuity, he has supported and managed several research engagement for investment banking and consulting clients across varied geographies. He is part of the consulting practice for past 7 years, supporting an industry dedicated consulting client focusing on Metals & Mining sector.

Previously, he has supported various investment banking clients in financial & operational analysis, valuation analysis, investment screening and M&A Analysis. Navneet has worked on diverse industries including TMT, Energy and Power, Oil & gas, Retail, and Metal & Mining.

Prior to Acuity, he has worked with a boutique investment-banking firm, where he was involved..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox