Published on July 2, 2024 by Pradeesh Thirupathy

IFRS 18 brings significant changes to the way the statement of profit and loss (income statement) is presented; it introduces three main categories of income and expenses (in line with the presentation of the cashflow statement), restricts clubbing expense/income items into “Other”, enhances income/expense aggregation and disaggregation, and standardises disclosure of certain non-IFRS (non-GAAP) performance measures. Overall, the changes should present equity analysts with more information around core business profitability, a better understanding of cost breakdown and comparability with peers’, cleaner cash conversions and more accurate return calculations. However, much remains left to management judgement, leading to diversity in application of the standard and some room for bad-faith presentation.

IFRS 18 – “Presentation and disclosure in financial statements” will replace IAS 1 – “Presentation of financial statements” for periods beginning on or after 1 January 2027 (with comparative restatement). In this blog, we aim to summarise the changes introduced and their potential benefits (and challenges) to analysts.

The changes

The key changes introduced in IFRS 18 can be divided into three broad categories:

-

Structure of statement of profit and loss

-

Minimum disclosure requirement on earnings-related performance measures/metrices [(i.e., management-defined performance measures (MPMs)]

-

Enhanced principles on aggregation and disaggregation in financial statements and notes

Structure of statement of profit and loss

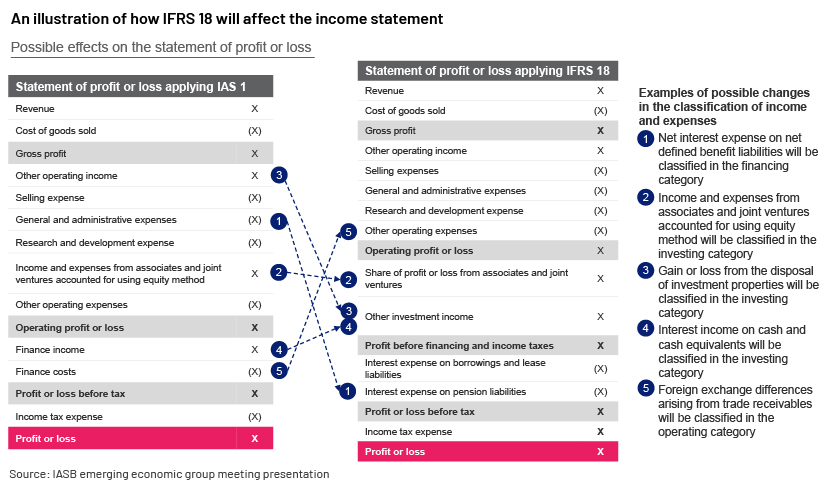

Income and expenses need to be classified into one of the three new major categories, with the respective total/subtotal calculated. The key change here is that for the first time in IFRS reporting, companies are required to provide a measure of operating profit (a new subtotal) and profit before financing (another subtotal similar to the current commonly used EBIT).

| IFRS 18 – income and expenses are categorised into three major categories | ||

| Category of income/expenses | Total/subtotal | Description – line items included |

| Operating | Operating profit or loss – in most instances, different from the current EBIT | Income/expenses from

a. Main business activity b. Residual items not classified under any other category (e.g., forex on trade receivables) |

| Investing | Profit or loss before financing and income taxes – in most instances, similar to the current EBIT | Income/expenses from a. Equity accounted investments (EAIs) and unconsolidated subsidiaries b. Cash and cash equivalents c. Assets that independently generate a return (e.g., investment property) |

| Financing | Profit or loss before tax | Income/expenses originating from

a. Liabilities recognised from raising finances (e.g., interest expenses on borrowings) b. All other liabilities, including changes to interest rates (e.g., unwinding of discounts on pensions liability) |

Source: IASBEmergingEconomiesGroupmeeting.p.14

Management-defined performance measures (MPMs)

IFRS 18 defines MPMs as totals/subtotals a company uses in its public communications outside of the financial statements (e.g., EBITDA, non-IFRS/non-GAAP adjusted EBITDA). In notes to the financial statement, companies should

-

Show the method of calculation and explain why it is useful to readers

-

Reconcile MPMs with the closest IFRS total/subtotals and show their tax and non-controlling interest impacts

-

Explain changes, if any, to the MPM calculation methodology

Aggregation and disaggregation

The principle behind this is that information should be aggregated based on “shared characteristics” (such as geography, nature and function) and disaggregated based on “characteristics that are not shared”.

IFRS 18 attempts to fit/group material items of income/expenses into related categories and to discourage the extensive use of the category “Other” by including guidance on how to provide meaningful descriptions, labels and aggregation/disaggregation on each line item and mandates certain additional disclosures to be provided around items labelled “Other” (source: Illustrative Examples on Presentation and Disclosure in Financial Statements.p37).

Impact on cashflow statement

Operating profit is the starting point for the indirect method of presenting the cashflow statement (the option to start with net income, profit before tax or any other measure of profit has been taken out), and the option to classify interest and dividends (both received and paid) as operating cashflow is eliminated (except for companies that have financing as their primary business activity).

Impact on balance sheet

Goodwill is presented as a new line item on the face of the balance sheet.

What all this means for analysts

The positives

Better inputs to financial modelling – The income statement and the cashflow statement in their new form are now better aligned to derive enterprise value (EV) and unlevered/enterprise free cashflow (FCFF), assisting analysts with their EV multiple and DCF computations.

Moreover, key ratios such as ROCE, ROA, operating profit margin, leverage and EV/EBITDA are now cleaner and less distorted by non-core income/expenses.

Under the new structure, we could expect (in most instances) a dip in the reported core business performance (i.e., operating profit) in the short term, but from a long-term perspective, the new structure would yield a more accurate representation of an entity’s actual performance in terms of core business operations.

Cleaner core profits enhance comparability – Core business (or operating) items on the cashflow and income statements will likely be “cleaner” and better aligned with each other due to clear guidance on excluding investing and financing items (e.g., dividends, interest and the results of EAIs).

This will likely lead to

Better peer comparisons – increase comparability of financials across companies, especially within the same sector

Better measure of cash conversions – Aligning operating cash to operating profit should ideally help analysts derive true operating cashflow and cash conversion (actual cash earnings versus paper profits) from operations, to ultimately determine an entity’s true cash-generating ability

Reliable MPMs – Making MPMs a part of statutory financial statements results in them being subject to some form of audit, bringing in more credibility.

The requirement to provide a reconciliation of non-IFRS/non-GAAP metrices/MPMs with their closest IFRS totals introduces transparency and limits management’s ability to make selective adjustments.

IFRS 18 also mandates that the tax and non-controlling interest impact of each adjustment item (in an MPM) be disclosed in the notes.

All this should help analysts derive a more accurate figure for recurring earnings and help improve the quality of forecasts in financial models.

Slimmer chances for manipulating MPMs to boost payouts – Following from the point above, better disclosure on MPMs translates into greater confidence in the underlying non-GAAP performance measures used to derive performance-based incentives/compensation of key management personnel.

Less chance of items being clubbed together in bad faith – By limiting the use of the expense category “Other” and by increasing the disclosures surrounding this category, the standard seems to have, to a certain extent, mitigated concerns around the category “Other” being used as a dumping ground for expenses meant to be hidden from scrutiny.

The negatives

May provide a false sense of comfort – Classifying income/expenses into relevant categories and the process of aggregation/disaggregation require extensive management judgement – anything left to management judgement is likely to result in diverse outcomes, likely limiting comparability with peers’ and subject to manipulation.

Furthermore, the “Operating items” category still acts as the one for all unusual, volatile and unclassifiable income/expenses.

MPMs are not defined by IFRS – IFRS does not prescribe a set standard/method to be used to compute key MPMs; on the face of it, this would continue to result in diversity in methods of calculation and possible manipulation. Hence, analysts should not/cannot rely solely on the face value of MPMs.

Choices/options enable circumventing changes – Businesses with a financing arm and other related business activities may still be able to circumvent most IFRS 18 changes by simply arguing that their financing arm is an integral part of core business.

How Acuity Knowledge Partners can help

Forensic analysis has emerged as a very useful niche tool for analysts. The role of forensic analysis differs based on whether an analyst is bullish or bearish. For bearish analysts, forensic analysis is important because accounting-related anomalies can be a strong catalyst for short positions. For bullish analysts, forensic analysis provides an important layer of investment validation. It analyses whether a company’s historical results are sustainable and support projected results, or whether these results are tainted by factors such as questionable accounting. It also analyses companies’ strategic and operating choices and their impact on financials.

Our Forensic Analysis team helps clients navigate complex accounting treatment in financial statements and its impact on earnings, cashflow and the balance sheet. The team has more than 10 years of experience in catering to this niche market, with hands-on experience in dealing with securities in diverse geographies and sectors.

Sources:

-

https://www.footnotesanalyst.com/why-ifrs-18-is-good-news-for-investors/

-

https://www.efrag.org/Assets/Download?assetUrl=%2Fsites%2Fwebpublishing

What's your view?

About the Author

Pradeesh has been a part of Acuity Knowledge Partners’ (Acuity’s) Forensic Analysis team for close to 7 years and has 9 years of total work experience. He currently supports a US-based hedge fund firm in their investment due diligence process by reviewing US and European companies for accounting shenanigans and red flags to identify sustainability of their performance. Previously supported a European hedge fund firm in a similar role and a UK-based global asset management firm where he produced accounting diagnostic reviews that helped identify the true earnings potential of investments, mainly in emerging markets. Prior to joining Acuity Knowledge Partners, worked as an Analyst for Accounting Advisory services..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox