Published on August 19, 2024 by Julie Koshy Sam and Sunil Tammannavar

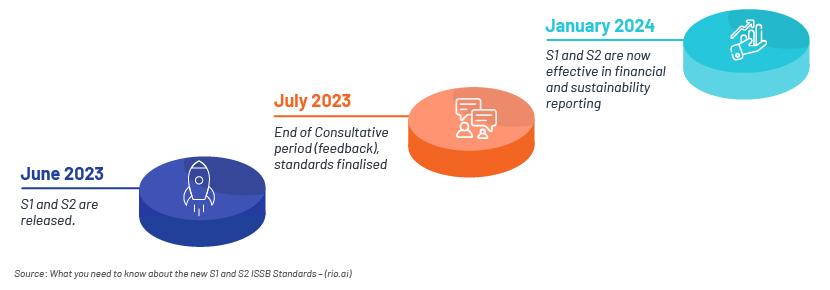

The International Sustainability Standards Board’s (ISSB’s) first environmental, social and governance (ESG) standards – S1 and S2 – are in effect since the start of this year.

The standards are investor-focused, encouraging companies to enhance the transparency, comparability and consistency of sustainability reporting for primary users – investors, auditors, government regulators and other relevant stakeholders globally.

A background

The International Financial Reporting Standards (IFRS) Foundation created a new board at the United Nations Climate Change Conference, Glasgow (COP26) in 2021 – the ISSB – to create global sustainability standards, aiming to improve the quality and consistency of sustainability reporting worldwide.

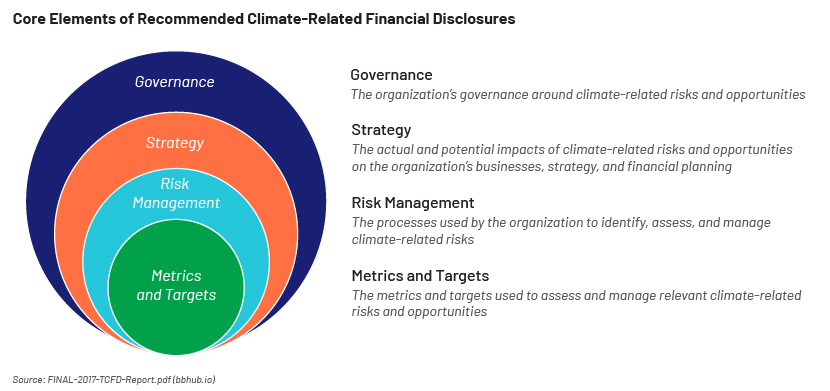

The IFRS standards are based on the four pillars of the Task Force on Climate-Related Financial Disclosures (TCFD), a global organisation that sets guidelines on voluntary climate-related disclosures. These include governance, strategy, risk management and metrics and targets.

A deep dive

IFRS S1: General Requirements for Disclosure of Sustainability-related Financial Information (IFRS S1) and IFRS S2: Climate-related Disclosures (IFRS S2) came into effect on 1 January 2024. However, individual jurisdictions can decide whether, when and how to adopt these standards after evaluating the associated costs and challenges.

By implementing them together, companies can recognise and report information relating to sustainability. This promotes informed decision-making among investors.

IFRS S1: General Requirements for Disclosure of Sustainability-related Financial Information

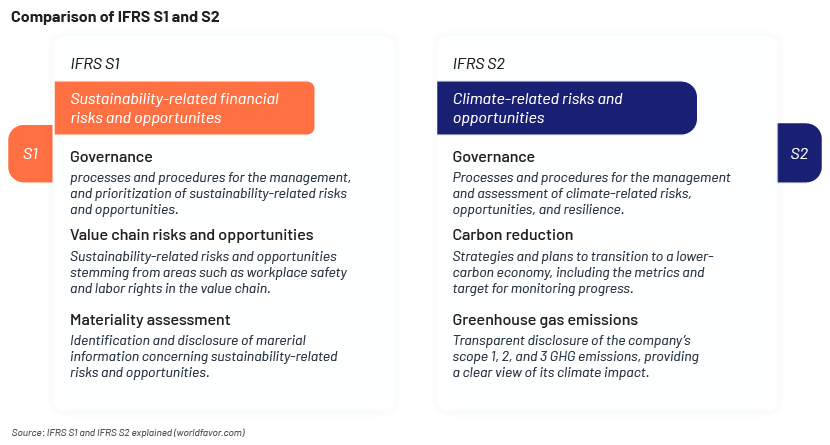

IFRS S1 requires a company to inform primary users about sustainability-related risks and opportunities that could impact the business (e.g., cashflow, access to funding, and value-chain resources).

Companies are required to provide information on the following:

-

Governance: Processes and procedures for monitoring, managing and overseeing their sustainability-related risks and opportunities

-

Strategy: Plan of action for managing sustainability-related risks and opportunities and how it fits into overall business dynamics

-

Risk management: Disclosures on process of identification, assessment and prioritisation of sustainability-related risks and opportunities

-

Metrics and targets: Metrics used to evaluate risks and opportunities pertaining to sustainability. Performance updates against targets the entity has set or is required to meet by law or regulation

IFRS S2: Climate-related disclosures

IFRS S2 requires identifying, measuring and disclosing information on climate-related risks and opportunities that would help stakeholders make decisions about a company. IFRS S2 applies to both physical and transitional climate-related risks to which the company is exposed.

-

Governance: Details on the controls and procedures for managing climate-related risks and opportunities

-

Strategy: Disclosures on how climate-related risks and opportunities have been integrated into the overall business strategy

-

Risk management: Physical risks refer to risks and damage from climate-related events, such as extreme weather conditions, including floods, storms and wildfires. Transitional risks result from changing regulations and policy actions taken to shift the economy away from fossil fuels. This includes details on the methodology of identifying, evaluating and mitigating climate-related risks

-

Metrics and targets: Metrics used to assess and manage greenhouse gas emissions and performance updates against set climate-related targets

Comparison

IFRS S1 provides the basic requirements for sustainability disclosures that should be used with IFRS S2 and future standards that the ISSB may release.

Reliefs

The ISSB has extended certain reliefs to help companies transition to the new reporting requirements. Companies can opt for a phased approach. In the first year of disclosure, they are allowed to provide simplified and fewer disclosures on climate-related risks and opportunities and gradually move towards full compliance. This provides them with an additional year to identify and evaluate sustainability-related risks. However, this cannot override the local jurisdiction’s mandate on sustainability reporting.

Additional exemptions in the first period of reporting:

-

Simplified reporting for small companies

-

Replication of existing reports to scale to new requirements

-

Reporting after financial statements, providing additional time for sustainability reporting

-

IFRS S1 exemptions: comparative information and quantitative information

-

IFRS S2 exemptions: Scope 3 greenhouse gas (GHG) emissions and comparative information

Countries adopting the ISSB’s standards

Governments are expected to incorporate IFRS S1 and S2 standards into their regulatory frameworks by 2025. Australia, Japan and the UK have announced that they will adopt the standards, while several other major countries, including Canada, New Zealand, Nigeria, Singapore and Malaysia, have shown interest. European countries have not shown interest in IFRS, as the European Union has its own mandatory sustainability standards – the European Sustainability Reporting Standards (ESRS) – which are more stringent.

Organisations that follow IFRS S1 and S2 would have an edge over others and enjoy the benefits of access to capital and better credit ratings, enabling maintaining positive relationships with clients. Adopting robust ESG reporting standards would make an organisation more efficient, reduce unnecessary travel and excessive waste and lead to countless other potential benefits. It would also help investors make profitable and ethical investment decisions, which could reduce greenwashing in reporting.

How Acuity Knowledge Partners can help

We have been supporting global financial institutions for over two decades. We work as an extension of a client’s onshore research team, providing end-to-end support across ESG-specific RFPs/DDQs/RFIs, ESG validation, client reporting and content management. To help institutions communicate their ESG themes better, we leverage our extensive marketing experience, built over the years through collaboration with leading organisations.

Sources:

-

https://www.rio.ai/blog/ifrs-releases-s1-and-s2-sustainability-reporting-standards

-

https://visuallease.com/esg-reporting-simplified-your-top-questions-answered/

-

https://www.ey.com/en_gl/ifrs/what-you-need-to-know-about-new-issb-standard-ifrs-s2

What's your view?

About the Authors

Julie is a Delivery Lead with Acuity Knowledge Partners’ (Acuity). As part of the Research Publishing team, she is a content manager for an asset management corporation. Before Acuity, Julie worked as a copy editor for a business and fintech newsletter, The Signal. Early in her career, she worked as a feature writer and eventually went on to lead a five-member team at The Asian Age. Julie holds a degree in journalism from the Xavier Institute of Communications.

Sunil is a Delivery Manager at Acuity Knowledge Partners, having around 15 years of experience working with one of the leading Investment banks in the US. He is skilled in investment research, financial modelling, report writing and ESG. His areas of interest are equity, fixed income and ESG. Has completed his Master's from Karnatak University, Dharwad.

Like the way we think?

Next time we post something new, we'll send it to your inbox