Published on March 21, 2025 by Nupoor Khatri and Sagar Nagpal

The Future of Impact Investing: Trends & Challenges

Impact investments are those where an investor aims to create social, environmental or economic benefits beyond financial returns. Impact investing is an investment strategy that focuses on the broader social and environmental trends influencing a given geography or issue area, rather than solely on financial performance. The idea is to harness the power of capital into investments that target a measurable positive social, economic or environmental impact alongside financial returns.

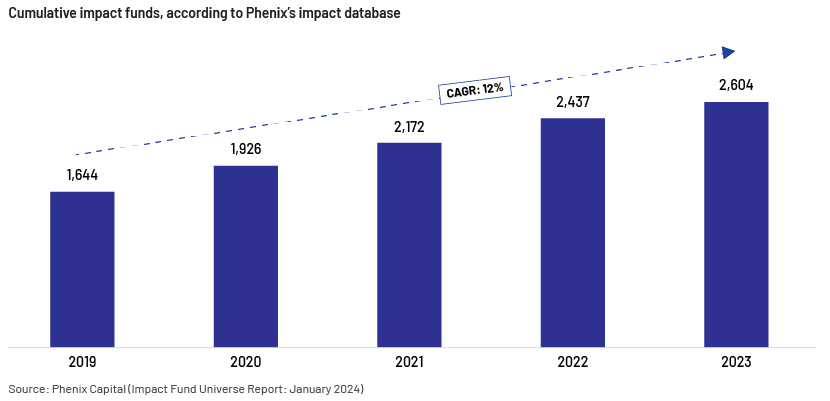

As investors increasingly seek investment opportunities that align completely with their social values and generate positive environmental outcomes while offering adequate financial returns, there has been a significant uptick in the integration of impact investing strategies and an increase in the deployment of capital for impact and sustainable solutions. Increasing incidence of environmental hazards and societal chaos, stemming primarily from political polarisation and increasing geopolitical instability, is a key factor catalysing demand for impact investing across the globe.

Impact investing gaining traction among investors to generate quantifiable benefits for the environment and society

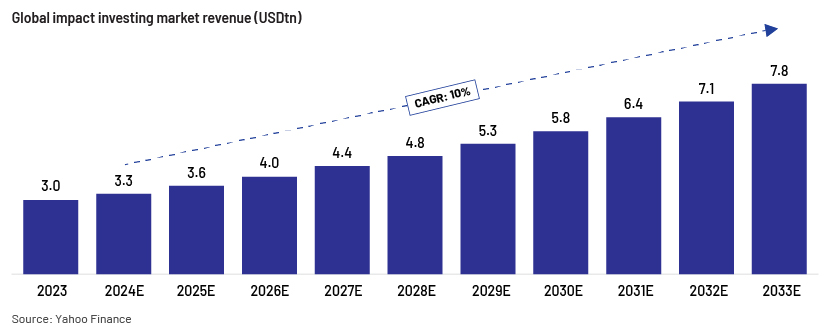

With governments setting clear regulations to improve societal and environmental conditions, investors across the globe are seeking impact investing opportunities that would significantly alleviate these hazards while producing potential financial returns for the investors. The global impact investing market is, therefore, forecast to reach c.USD7.8tn in 2033 from c.USD3.0tn in 2023, growing at a CAGR of c.10%.

Impact investments are increasingly being considered as a successful investment strategy; not as a trade-off between impact and financial returns but rather as an opportunity to generate both together; investors are, therefore, showing greater interest in allocating capital to such impactful opportunities. Initiatives supporting impact investing including grants, subsidies and tax incentives for impact investments, also attract a broad range of investors.

Emerging Trends in Impact Investing Amid Sustainability and Inclusive Growth

Investors are actively aligning their investments with their values to generate positive environmental and societal outcomes making impact investing an attractive inflection point and show no sign of slowing. Market dynamics focused on addressing environmental challenges and achieving sustainability goals such as climate change, infrastructure, energy, poverty or economic growth are expected to transform the investment landscape.

Key trends driving the popularity of impact investing:

-

Increased focus on sustainability:

Investors are increasingly prioritising deploying their capabilities in accelerating growth of sustainability, focused on driving resource efficiency, energy transition, cost savings and infrastructure, among others.

-

Energy transition and climate focus:

Renewable energy and climate focus of net-zero initiatives are attracting capital in these sectors; for instance, the California Public Employees’ Retirement System recently announced a USD100bn commitment towards climate solutions by 2030. Additionally, the New York State Common Retirement Fund announced in February that it would double its commitment to sustainable investments to USD40bn.

-

Shift in investor preferences:

Today’s investors (such as Millennials or Gen Z) are more socially conscious and mindful of values than previous generations. They continue to look for ways to invest that not only speak to earnings but also reflect the social good we all strive for, forcing financial institutions to offer products that meet both goals.

-

Corporate social responsibility:

Public firms face increased pressure to demonstrate corporate responsibility or a commitment to good environmental, social and governance (ESG) practices. Failure to consider these could put companies at risk of damage to their reputation and losing potential customers and investors.

Impact Investing Challenges

Although impact investing shows promise, it also has its challenges. Impact, despite all the advances, is still difficult to measure, and none of the metrics used for measurement are common or accepted without scepticism:

-

Establishing impact metrics:

There is no common methodology that can be used to ease the difficulty in measuring returns across investments.

-

Impact monetisation and investment returns:

Even when investing impact-oriented resources, being competitive in terms of financial returns is a challenge. There are situations where important social projects that are very expensive to fund do not offer sufficient financial gain to attract investors.

-

Data availability and transparency:

Apart from the other challenges, potential investors are concerned about the opportunities offered due to a lack of adequate information regarding the investments or even accountability.

-

Regulatory and policy barriers:

Differences in the regulatory frameworks of different countries or regions make impact investment difficult and may result in legal issues.

Impact Investing Opportunities

We list a number of opportunities for growth in impact investing below:

-

Growing market demand:

The market has expanded by up to a CAGR of 14% over the past five years, according to GIIN, indicating increasing investor interest in impact investing.

-

Healthcare sector:

Following a number of global health crises, the need for investment in healthcare infrastructure and medical technologies has increased. Private investment is critical for this segment to develop, according to WHO.

-

Global sustainability goals:

Investment in solar, wind or hydropower can yield high returns in this transformation period while having a positive impact. This sector can grow by over 60% by 2026, according to International Energy Agency (IEA) forecasts.

The future of impact investment:

Impact investing has a bright future; we believe it is the future of finance. It provides an opportunity to earn returns and obtain intangible benefits. The impact investing sector has significant growth potential owing to increasing investor appetite and global alignment with ESG expectations and UN SDGs.The emergence of new technologies would make it easier to measure the impact and targets more accurately and transparently. The Impact Investing opportunities space is set to make a difference, adding real social value while ensuring sustainable returns to investors and society.

How Acuity Knowledge Partners can help

Our customised ESG research solutions, driven by an in-depth understanding of sector- and country-specific ESG risks and opportunities, offer to extend a client’s team, helping them conduct ESG research and advisory. We are qualified to execute customised ESG, climate change and sustainable business development (UN SDG) mandates. We execute deep-dive ESG research while adopting a top-down, bottom-up or combined approach.

The ESG research solutions we provide include building databases at the company and country level, developing frameworks and models, analysis, writing reports and preparing presentations. Our ESG support on climate change solutions includes opportunity assessment, risk analysis, climate financing and support on disclosures and reporting. The SDG mandates capture impact assessment and company benchmarking. Our ESG support includes risk assessment, scoring, integrated analysis and audits.We are also expanding our ESG franchise using AI-/NLP-driven solutions, further enhancing our ability to align with impact investing objectives and drive measurable, sustainable outcomes.

Sources:

-

https://www.weforum.org/agenda/2024/05/4-trends-private-market-impact-funds-apg/

-

https://19884981.fs1.hubspotusercontent-na1.n/JanuaryReport.pdf

-

https://s3.amazonaws.com/giin-web-assets/giin/assets/publication/research/2023--c1.pdf

-

https://www.investmentbankingcouncil.org/blog/impact-investing-everything-you-need-to-know

-

https://thegiin.org/publication/research/2023-giinsight-series/

Tags:

What's your view?

About the Authors

Nupoor is a Chartered Accountant with c.6 years of experience in working with leading global banks & financial institutions. She has led various client engagements focusing on investment banking and commercial lending domain. She has expertise in a broad range of banking work products covering financial analysis, capital structure assessment, liquidity analysis, risk evaluation, business research, investment research, credit analysis, portfolio monitoring, and underwriting.

Sagar is a key member of Acuity's Investment Banking vertical, with c.3 years of experience in executing business consulting & advisory, and industry research-related projects across multiple sectors, including financial services, business services, healthcare, FMCG, retail, and information technology & telecommunication, and among others. Support clients in developing corporate strategy, along with assisting them in investment opportunity assessment through in-depth secondary research & data analysis.

Like the way we think?

Next time we post something new, we'll send it to your inbox