Published on November 27, 2020 by Ambika Kalyankar and Revathy Purushotaman

Overview

‘Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world’. — Franklin D. Roosevelt

It has been almost a year since the COVID-19 pandemic broke out. While continuing to absorb shocks, the stock market is striving to navigate the new normal. Most asset classes have underperformed in recent times, except for gold. Stock prices have oscillated widely, prompting investors to look for safe haven options. Globally, real estate is one of the most recognised sectors. Yet, worldwide, the sector (which includes the retail, office, hospitality and commercial subsectors) has been negatively impacted, with the amplitude varying across regions and asset classes. This has prompted investors to revisit their growth plans.

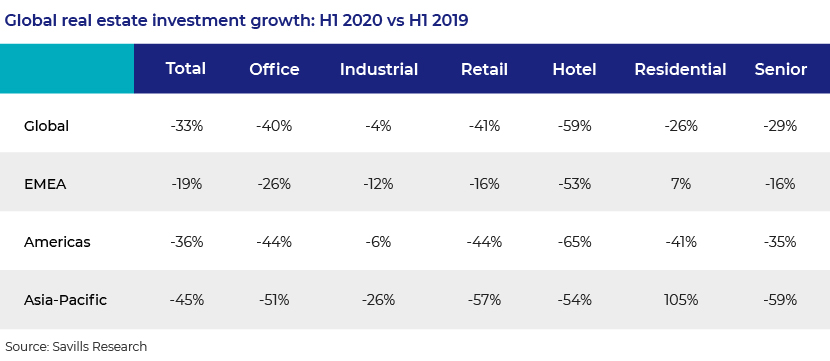

Global real estate investments slid 33% y/y in 1H20, led by Asia-Pacific and the US, whose volume slumped 45% and 36% y/y, respectively. 1H20 performance was pulled back predominantly by a higher unemployment rate, no let-up in lockdowns, disruption in logistics, reduced consumer spending, etc. Real estate investments, which increased to USD9.6tn in 2019 from USD8.9tn in 2018, has been falling since the beginning of 2020.

Closer look at different real estate asset classes

Among asset classes, hotels have been the hardest hit – the outcome of physical distancing and travel restrictions imposed by governments worldwide. They are unlikely to bounce back soon. Moreover, global businesses are adapting to newer forms of digital business communications, rapidly replacing traditional physical meetings, which has weighed on the hotel business.

So far, the pandemic has had its say on the way we live, work and play. It has also given birth to new trends. For example, the market-share trade-off in favour of online shopping vs offline shopping has led to a surge in demand for warehouses and industrial spaces. However, it remains to be seen whether customers continue their virtual shopping experience or revert to physical shopping in a post-COVID-19 era.

Similarly, the mass adoption of work from home is likely to bring about a change in the way offices function. Work from home will buoy the residential market, with people looking for home-office or garden properties. This is evident in the 80% increase in the search for garden apartments in the UK during the pandemic.

Residential

The residential sector (multi-family and student housing) has been more resilient to the pandemic than any of its counterparts. Although overall demand dropped initially after the COVID-19 outbreak, it is gaining momentum. As per the above table, EMEA and Asia-Pacific saw a ramp-up in investment in 1H20 (vs 1H19) compared to a global decline of 26%.

However, preference in terms of design and structure may change. Keeping in mind health and safety requirements, demand for quality products will accelerate. Occupancy is expected to shrink in student housing and co-living spaces in the short term. Nonetheless, with educational institutions re-opening, the occupancy level is expected to rally, with an emphasis on safety measures.

A significant change in the work environment has driven house owners to look for larger spaces, which is expected to prop up secondary demand.

Overall, the outlook for the residential segment appears positive, with 55% of countries expecting no impact on investor demand and 27% claiming a positive impact, as per Savills Sentiment Survey 2020.

Commercial

The pandemic has dealt a severe blow to the commercial real estate sector, with hotel and retail being the most impacted sub segments. On the other hand, preference for ecommerce has ratcheted up demand for industrial spaces and warehousing. While the recovery in the office segment has been slow, logistics demand has been relatively healthy, anchored by the resilience in medical supply, grocery and online sales.

Physical distancing, travel restrictions and lockdown have led to many hotels’ and retail outlets’ folding operations worldwide. Moreover, businesses have learned to sustain themselves without the need to travel, reducing the demand for business hotels. If this wasn’t enough, people are circumspect in their vacation plans, meaning a speedy recovery in the hotel industry looks remote. The revival of the retail sector is also expected to be slow in the short term, as customers look to shop online, eschewing brick-and-mortar stores.

A rebound in the office segment has yet to be seen; however, the demand for office space is not expected to subside soon. A structural change is imminent, though, as safety measures related to the pandemic become the new normal. In a post-pandemic world, organizations have two major options: (i) reopen offices while ensuring social distancing and safety by leasing a larger space or (ii) opt for co-working spaces. At this juncture, the likelihood of a shift towards co-working spaces is higher, as it provides flexible working space with all amenities, reducing high up-front costs that accompany leases.

Response of stakeholders

With COVID-19 wreaking havoc, many borrowers are finding it hard to meet their scheduled repayments owing to no or lower rental income. This has got lenders worried, as the possibility of growing NPAs loom.

To counter this, governments have stepped in, doling out financial assistance and offering relaxations. US Congress has announced anUSD2.2tn economic stimulus package under the CARES Act (larger than the USD832bn infused under the 2009 Recovery Act), the PPP Program, etc. The UK government has come up with a GBP30bn emergency stimulus and the Bounce Back Loan Scheme, among others. In addition, federal regulators are encouraging banks to work constructively with borrowers on loan modification and deferral agreements – the majority of deferrals are over 60, 90 or 120 days. Lenders have responded positively, allowing payment deferrals and resorting to debt restructuring to tackle the possibility of loans turning sour.

Outlook

Recent trends indicate signs of a recovery in both the residential and the commercial real estate market. While hotels are recording negative growth, industrial and warehouses have been on an upswing thanks to heightened e-commerce retail activities. The residential sector has been the most resilient to the pandemic. Once the economy comes back on track, the entire commercial real estate sector should start to see growth, which should kick-start activities in other sectors as well.

How Acuity can help

Acuity Knowledge Partners has multi-sector expertise in the areas of financial analytics, valuation and advisory services, with the commercial real estate sector being one of the major focus areas. We are the market leader in helping commercial real estate lending teams navigate challenges, aided by our considerable experience in working across the CRE deal life cycle – loan underwriting and valuation, origination, post-closing and asset management. In addition, our analysts have expertise in evaluating and underwriting CMBS deals, monitoring portfolios and restructuring distressed loans.

Sources

https://www.cbre.com/research-and-reports

https://www.cbre.com/research-and-reports

https://home.treasury.gov/policy-issues/cares

What's your view?

About the Authors

Ambika has 5 years of experience in financial services and commercial lending. She joined Acuity Knowledge Partners in October 2018 as Senior Associate and is part of the Commercial Real Estate team, underwriting US and UKCRE loans and CMBS deals. Previously, she worked in Genpact.

Ambika holds an MBA in Finance from PES Institute Technology, Bangalore.

Revathy is Senior Analyst in Acuity Knowledge Partners’ Commercial Lending team. She has significant experience in the real estate sector. Revathy has more than 5 years of experience in credit underwriting, asset management, due diligence and ad hoc research, among others.

She holds an MBA in Finance from MG University, Kerala.

Like the way we think?

Next time we post something new, we'll send it to your inbox