Published on October 4, 2023 by Ahana Mohan

Credit ratings indicate an opinion on an entity's ability to meet its financial commitments. Credit rating agencies evaluate the underlying loans and tranches of the collateralised loan obligation (CLO) securitisation structure. The Credit Rating Agency Reform Act regulates the rating firms and prevents them from publishing favourable ed ratings. Rating agencies assign rating codes to provide their view on risk and returns.

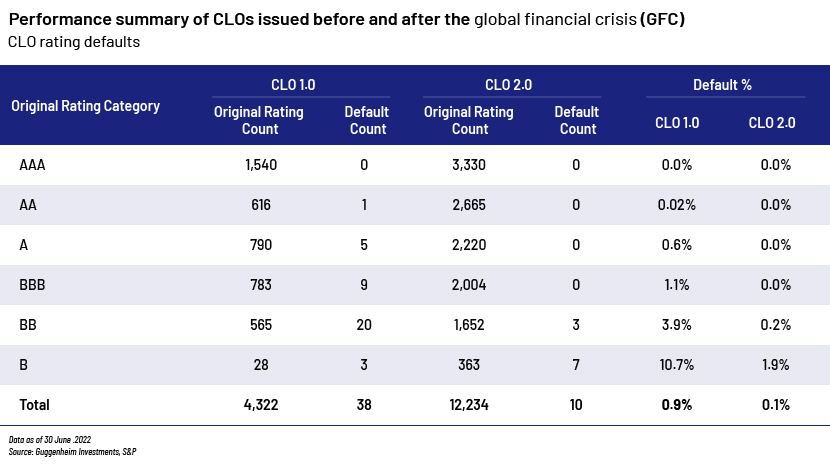

The combination of diverse, carefully managed senior-secured loan collateral and good securitisation arrangements has resulted in positive historical ratings performance. CLO 1.0s (CLOs issued prior to the GFC) displayed outstanding credit performance during the financial crisis, with just a small percentage of lifetime defaults, according to S&P.

CLO 2.0s (CLOs issued after the GFC) have many more credit improvements than their pre-crisis counterparts. For starters, rating agencies now require CLOs to have significantly higher overcollateralization than their pre-crisis counterparts.

Second, whereas pre-crisis CLOs may make significant investments in subordinated bonds and other structured credit instruments, post-crisis CLOs are virtually entirely collateralised by senior secured bank loans.

Third, post-crisis CLO documentation is significantly more investor friendly, for example, by reducing the trading period during which the manager can actively manage the loan portfolio and restricting CLO securities' extension risk. CLO 2.0s performed significantly better than CLO 1.0s due to improved collateral and structural enhancements.

Fourth, CLO rating defaults are lower on 2.0 compared to 1.0 due to increased governance clauses after the GFC.

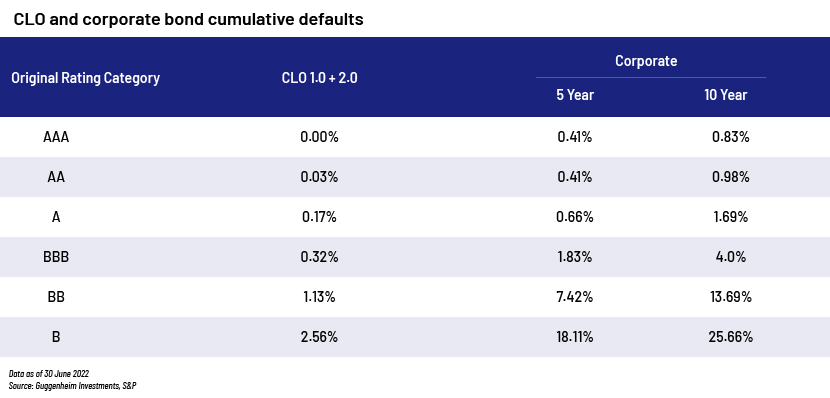

CLOs are designed to help limit risk due to the strength of their underlying collateral and built-in features such as coverage tests to remedy collateral deterioration. Amid the GFC and the pandemic, the asset class saw substantially fewer defaults than corporate bonds of the same rating.

Moody's forecasts that speculative-grade corporate loan defaults will rise to 4.6% by end-2023, up from 2.9% in March, due to a combination of increasing borrowing costs and weakening global growth during the pandemic.

Speculative-grade debt is a riskier sort of corporate bond – often known as "junk bonds" – where the borrower has a reasonable to high likelihood of defaulting.

Commercial real estate is one of the most susceptible sectors. The sharp drop in the value of US office buildings last year, caused by the prevalence of remote working, could compel developers to default on their debts, resulting in bank losses.

Because CLO designs can defer interest payments on junior tranches, CLO defaults tend to trail corporate defaults. While these deferrals operate as temporary shock absorbers and allow CLOs to navigate market turmoil, the deferred payments accumulate to the principal balance of the notes, making it more difficult to fully repay the deferring notes before maturity. CLO tranches may be rated in the CCC or CC categories in certain instances but will not be downgraded to D until there is a payment default on the CLO tranche.

However, over longer time horizons, CLOs have shown lower default rates than corporate issuers. For example, following the GFC, the three-year-trailing speculative-grade corporate default rate reached a high of 14.7% in September 2011, whereas the three-year-trailing speculative-grade CLO default rate reached a lower high of 2.3% in November 2011. The corporate 36-month-trailing speculative-grade default rate peaked in November 2020 at 8.8% before dropping during the 2020 credit stress. The 36-month trailing speculative-grade CLO default rate has begun to rise, with the rate expected to reach 1.1% by the end of 2023.

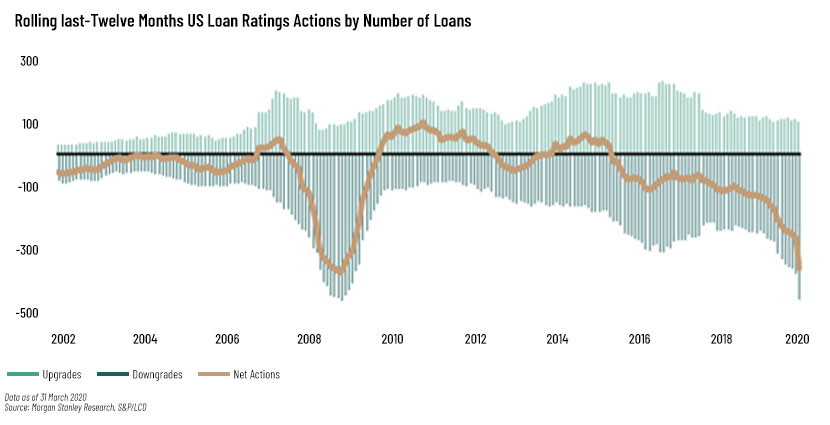

Impact of upgrades and downgrades amid the GFC and the pandemic on US and European CLOs and our interpretation

Rating agencies began downgrading US loan and high-yield issuers in earnest in early March, owing to deteriorating fundamentals, primarily significant decreases in revenue growth. As expected, most rating actions were in sectors affected by the pandemic. The travel, auto and transport sectors saw the most downgrades, followed by metals and retail.

Despite these failures, credit conditions for CLOs improved overall in 2021, with several sectors recovering from the pandemic-related credit shocks of 2020. The number of upgrades increased to their highest in four years, outpacing downgrades.

In the US, the downgrade/upgrade ratio for the S&P/LSTA Leveraged Loan Index reached 11:1.

The share of the Index graded B- and lower by S&P increased to a record high of 28% at end-March 2022, and the number of US firms with Moody's ratings of B3 and lower increased 52% quarter over quarter.

Loans rated B3 and below now account for 19% of the US loan universe, representing USD270bn in par value outstanding. The trend has been similar in Europe. S&P, Moody's and Fitch have jointly downgraded nearly 17% of all rated European loans now outstanding.

It is worth mentioning that the rating deterioration began in 2015, falling gradually and accelerating with the start of the pandemic. This pattern differs significantly from the one preceding the 2008-09 GFC, when ratings started to decline only after the crisis began and deteriorated completely over six quarters (October 2008 to July 2009).

The post-pandemic environment, the military conflict between Russia and Ukraine, rising inflation and interest rates, and fiscal policies have all contributed to increased volatility in Europe’s CLO market to an extent not seen since the pandemic, when asset prices recovered after falling sharply. Price movements fluctuated during short periods of time in 2022, EURIBOR rates rose and spreads widened, giving collateral managers the opportunity to improve par and/or other significant benchmarks in a number of transactions.

Impact of the credit outlook amid the GFC and pandemic on US and European CLOs and our interpretation

Ratings actions had an impact on 1,600 CLO transactions amid the GFC.

Moody's and S&P recently placed 857 and 356 widely syndicated loan US CLO tranches on negative watch or outlook assessment, respectively, as a result of underlying rating pressure on CLO collateral and forecast fundamental borrower stress. In Europe, Fitch and Moody's have placed 304 and 117 CLO tranches on negative watch or outlook assessment, respectively. S&P has acted only on 18 European CLO tranches, with the majority being placed on negative watch and the remainder on negative outlook.

Recent rating actions have had a broader impact on CLO collateral pools than at any point since the GFC, and at a faster pace. CLO collateral pools also changed more swiftly in the last month and a half of 2022 than at any other time in the CLO market's history.

In the interim, we have seen new-issue CLO structures adapt to the volatile market environment. New CLOs issued after April 2020 have higher credit enhancement levels and shorter reinvestment periods, or no reinvestment period in the case of static CLOs.

Taking advantage of market conditions, xx was the first to issue its first static CLO and the first US BSL CLO to price since the market was shut due to the pandemic.

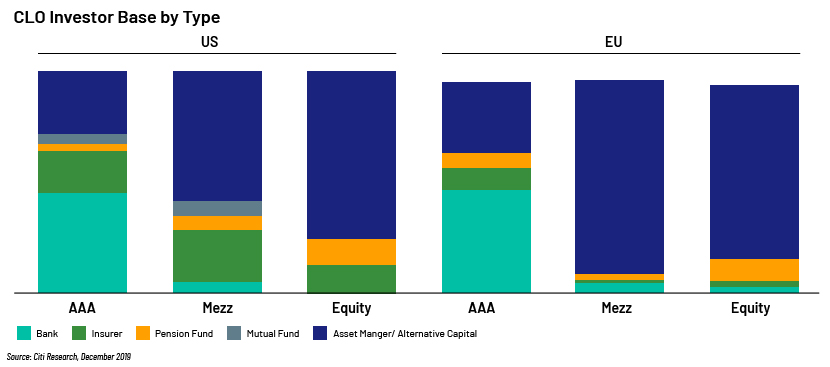

The CLO investor base is varied, and we expected the majority will not be forced sellers in the event of tranche downgrades,. A small fraction of tranches held by inexperienced individuals, investment-grade funds or insurance company portfolios may be forced to sell, presenting unusual purchasing opportunities in a dislocated market. CLOs are held primarily by banks and insurers.

Insurers account for a sizeable share of the CLO investor base, with exposure across the capital stack, and life insurers have increased their exposure to CLOs in recent years. Selling activity for lower-rated tranches may increase as insurers work through reserve needs and capital allocation plans.

The majority of investors in below-investment-grade CLO debt and equity are opportunistic funds such as hedge funds and private equity funds. Given the large amounts of cash these firms deploy in dislocation strategies and the current wide spreads of junior CLO tranches, we expect these buyers to expand their allocation to these assets in the near future. There are attractive entry points for investors who can differentiate the tranches supported by higher-quality portfolios and managers from the rest of the group.

However, for investors interested primarily in high degrees of subordination, the senior-most tranches would remain appealing. Subordination and other favourable structural characteristics contribute to the durability of AAA, AA and A-rated tranches, which may absorb relatively large asset defaults before incurring principal losses.rating advisory services

How Acuity Knowledge Partners can help

We help identify safe possibilities to develop or repair lost par in existing CLOs. They will have to do so in an environment where more selling pressure on CCC-rated loans may emerge as investors seek higher-quality assets. In this uncertain environment, CLO structures will likely remain resilient and offer an appealing risk-reward proposition for experienced investors in what is proving to be a historically tumultuous moment in the leveraged loan market.

Sources:

-

Credit rating agencies: Mohammed Hemraj (Springer Books)

- www.alliancebernstein.com

What's your view?

About the Author

Experienced Senior Associate with demonstrated history in working in the structured finance domain and investment banking. Have worked on various products like CLO, CDO,CBO,ABS, syndicate loans. Holding a master’s degree in business administration. Enjoys reading, writing poems/stories and art works. Believes in the mantra "when you focus on the good, good gets better"

Like the way we think?

Next time we post something new, we'll send it to your inbox