Published on September 15, 2023 by Siddhartha Chabria, CFA®

Introduction

Environmental, social and governance (ESG) factors are an additional set of considerations that investors apply when evaluating whether to invest in financial markets, including in municipal bonds (munis).

They help investors decide based on their own objectives and subsequently align their portfolios with targeted goals and outcomes and evaluate the long-term risks of their investments.

vAs ESG bond issuance grows globally, investors in the muni market are demanding more paper and creating investment vehicles tailored to ESG debt, as they believe ESG factors are now inherent to the public finance sector. They view munis as meeting environmental or social requirements, such as mass transit, education, healthcare or renewable energy.

The public finance sector can play a crucial role in supporting the ESG agendas of public finance issuers. A growing number of issuers are becoming more proactive and transparent in providing information on initiatives and actions to promote ESG issues.

Issuing ESG-labelled bonds facilitates alignment with ESG policy agendas. In addition to developing the ESG segment of the public finance bond market and meeting high levels of investor demand, it also helps diversify the investor base. However, ESG-labelled bond issuance also raises several challenges for public finance issuers, as it requires expertise and information they currently lack.

Navigating ESG bonds

The main categories of ESG bonds that continue to emerge within the already diverse categories of ESG bonds are “green bonds”, “social bonds”, “sustainability bonds” and “sustainability-linked bonds”. These four main categories of bonds combined are also referred to as “GSSS bonds”.

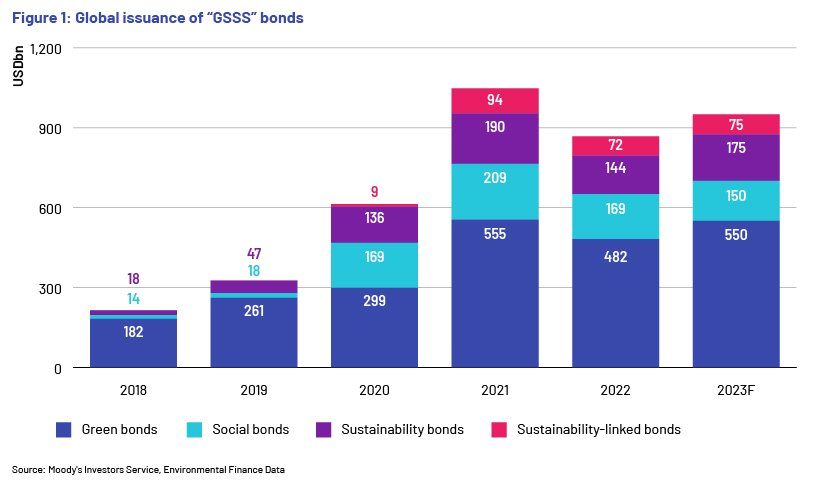

Global GSSS bond issuance soared to around USD1,048bn in 2021 from around USD200bn in 2018 (Figure 1), driven by more issuers seeking to finance their ESG strategies and exploring diverse use of proceeds, including for water, nature, biodiversity and climate change-mitigation projects.

However, 2022 saw a decline in issuance volume to USD867bn due to a challenging macroeconomic and geopolitical environment.

Issuance growth is expected to bounce back to register USD950bn in 2023 as market conditions improve.

Three main factors could facilitate growth: (1) governments’ policy initiatives, (2) level of investment in climate adaptation and resilience and (3) issuers’ ability to address concerns about the credibility of the bonds being issued.

New issuance is expected to be driven by carbon transition sectors such as oil and gas, coal mining, chemicals, auto manufacture, utility companies and transport and logistics.

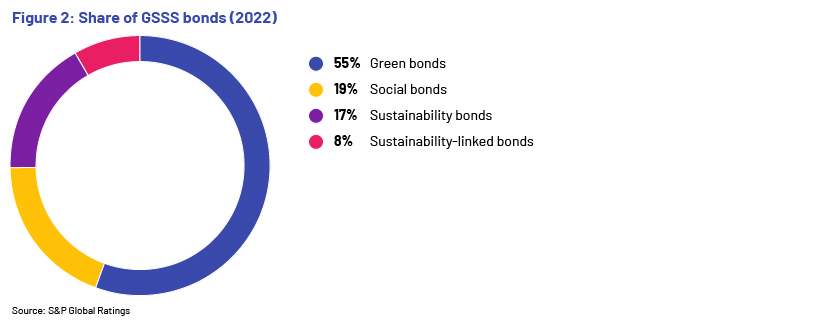

Green bond volumes continued to account for most of the GSSS bond market at 55%, up from 52% in 2021, while the other categories saw their shares drop by 1-2%.

Green bonds will likely continue to dominate the mix while sustainability bond issuance may gain in popularity. The share of sustainability-linked bonds has dropped and is likely to reach an inflection point as market participants flag their credibility, such as questioning the ambitions of the issuer and the issuer’s focus on incentives to achieve sustainability targets.

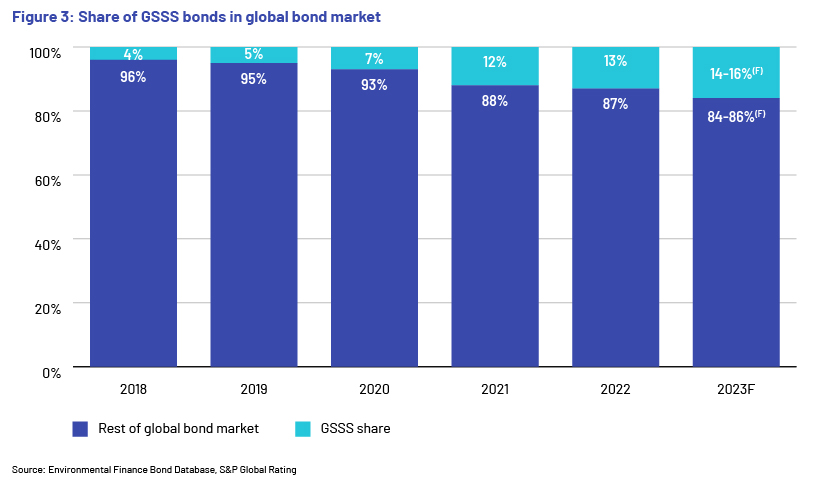

GSSS bonds grew their share of the global bond market to 13% in 2022 from 4% in 2018; this is expected to reach 14-16% in 2023 (Figure 3), indicating long-term market growth.

Fundamental drivers of long-term growth in sustainable bonds expected to keep issuance growth solid include financing for climate change mitigation and adaptation financing, efforts to accelerate decarbonisation to achieve net zero goals, growing regulatory attention on sustainability and focus connecting environmental and social objectives.

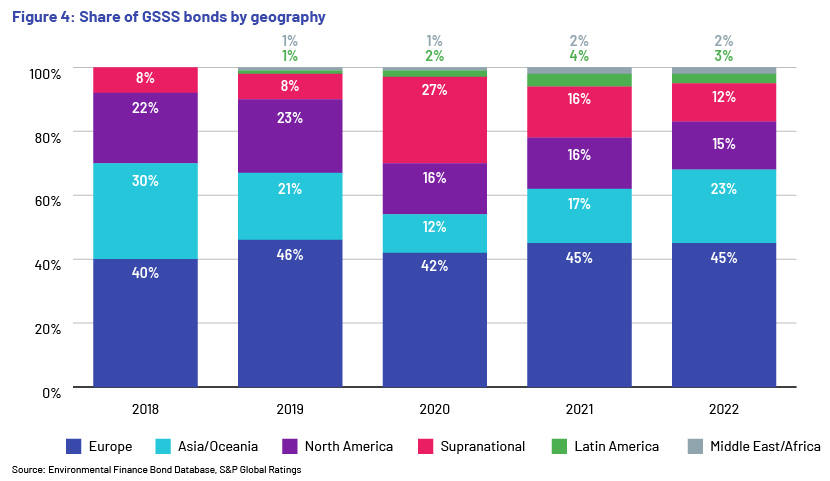

By geography, Europe dominates issuance, accounting for 45% of the global total in 2022. However, Asia Pacific and Latin America are likely to expand their share of global issuance, continuing the trend in recent years. Issuance from the Middle East, Africa and Latin America did not pick up significantly to account for a material share of the global market (Figure 4).

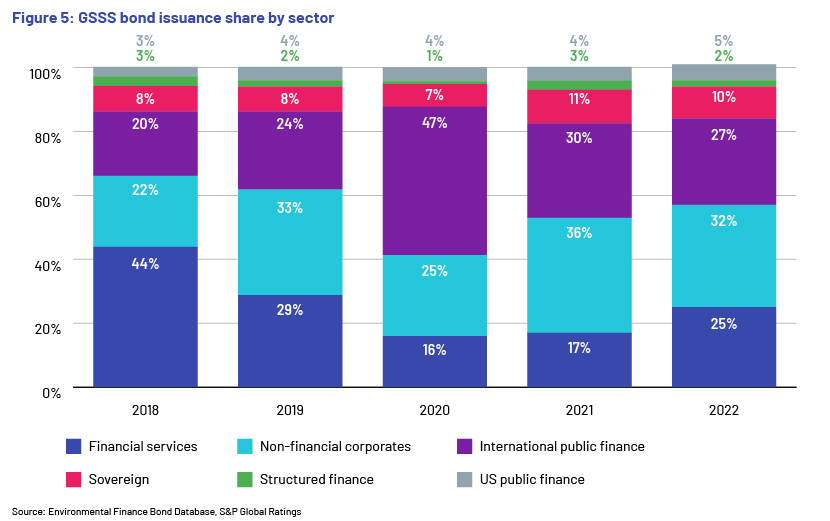

By sector, non-financial corporates accounted for 32% of total issuance in 2022, followed by financial services with 25% (Figure 5). Non-financial corporates are expected to remain the main source of GSSS bond issuance and the financial services sector to grow the fastest and continue to increase its share.

The international public finance sector mainly comprises supranational agencies, multilateral lending institutions (MLIs) and government-related entities. GSSS bond issuance will likely see minimal growth in the international public finance sector, unlikely to reach 2021 levels, as social and sustainability bonds led record issuance, driven by the health problems and economic fallout associated with the pandemic, in 2020 and 2021. The need for financing pandemic relief receded in 2022.

On the other hand, the US public finance market is expected to grow its share of GSSS bond issuance, driven by the following:

-

Public finance issuers serve the public; hence, as a matter of course, they align their activities with environmental and social purposes

-

A large number of issuers are coming to the bond market with GSSS bond issuance, increasing momentum for the asset class

However, the following challenges need to be faced:

-

The US muni market is smaller and more fragmented, making it difficult to measure any pricing advantage of GSSS bond issuance

-

Issuers may be burdened by additional financing costs or disclosure expectations as a result of increasing post-issuance regulatory guidance

Incorporating ESG into the muni markets

Incorporating ESG factors into the muni sector remains convoluted, and how to incorporate or whether to incorporate varies to a large degree on participants in the sector, although ESG is inextricably linked to the muni market and the infrastructure it helps to build. In terms of the muni market, ESG factors may include the following:

An evaluation of the three factors indicates environmental factors have the strongest impact on public finance. The most important is the carbon intensity emissions variable, clearly linked to other variables in this category.

Evolving standards in the ESG bond market

GSSS bonds are also called “labelled bonds”, as they carry an ESG label, whether “green bond”, “social bond”, “sustainable bond” or “sustainably-linked bond”. There are a number of other bonds in the market that carry no ESG label but may meet certain ESG criteria. The decision not to label a bond is based on the costs associated with having an independent third party verify and certify the label.

Bonds that carry a label may or may not follow internationally recognised standards and certification frameworks.

ESG bonds need to follow certain standards, as set by the International Capital Markets Association and the Climate Bonds Initiative. ESG-labelled bonds that do not follow a recognised framework are known as self-designated bonds. A brief discussion of the two standards follows:

1. International Capital Markets Association (ICMA):

Green Bond Principles (GBP) and standards was introduced in 2014, followed by Social Bond Principles (SBP) and the Sustainability Bond Guidelines (SBG).

Green bonds allow capital-raising for new and existing projects with environmental benefits. The GBP support issuers in financing environmentally friendly and sustainable projects that promote a net-zero emissions economy and protect the environment. GBP are voluntary process guidelines.

2. Climate Bonds Initiative (CBI)

The CBI is an international non-profit organisation established in 2009 to facilitate climate change solutions in the global bond market. The CBI is managed by the Climate Bonds Standard Board that comprises large institutional investors and environmental non-governmental organisations (NGOs) that provide oversight of the Climate Bonds Standard, approved verifiers and the certification process.

ESG bonds to see positive momentum

Issuance of global GSSS bonds is seeing an uptrend, recording extraordinary growth to around USD1,048bn in 2022 from around USD200bn in 2018. Issuance fell to around USD867bn in 2022, driven mainly by a more challenging macroeconomic and geopolitical environment. Global GSSS bond issuance is likely to resume growth in 2023 at around USD950bn and outpace growth of the overall global bond market.

GSSS bonds as an asset class are important tools to drive investment to meet climate and sustainability goals. However, there are concerns as to how meaningfully these bonds help issuers achieve sustainability outcomes. Growth will, therefore, likely depend on how sufficiently they address these concerns.

Sovereign governments, especially those in emerging markets, are expected to launch major financing initiatives that can support sustainable development while ensuring a just transition. Government policy can provide guidance and standardisation of best practices that are socially inclusive.

How Acuity Knowledge Partners can help

We help investment banking teams scale up their public finance underwriting practices and drive value for their clients. By leveraging dedicated teams of experienced analysts in our offshore delivery centres, clients benefit from operational efficiency and cost optimisation. Our team of public finance experts are well versed in covering municipal financing and public sectors and are vested with state-of-the-art modelling capabilities. Many of our clients working with our specialised public finance investment banking teams have benefited from our integrated suite of services along the investment banking advisory value chain.Public finance advisory support

References:

-

https://www.msrb.org/Making-Impact-ESG-Investing-and-Municipal-Bonds

-

https://www.spglobal.com/_assets/documents/ratings/research/101572346.pdf

-

https://www.msci.com/esg-101-what-is-esg/navigating-complexities-of-esg-bonds

-

https://www.researchgate.net/publication/public_Financial_System_Perspectives

-

https://iclg.com/practice-areas/environmental-social-and-governance-law/usa

Tags:

What's your view?

About the Author

Siddhartha is an Investing Banking Senior Associate at Acuity Knowledge Partners, having around 2.5 years of experience working with one of the leading credit-rating agencies in India and around 7 years of capital market experience. He is skilled in investment research, financial modelling, report writing, investment recommendations. His areas of interest are equity, fixed income, derivatives, portfolio-management along with keeping a track of the global-macro scenario. He has also made notable submissions in CFA Asia Pacific Research Exchange. He is currently a CFA Charter holder and has completed his Masters from the University of Calcutta, he is also certified by NSE as a Capital Market Professional.

Like the way we think?

Next time we post something new, we'll send it to your inbox