Published on August 4, 2022 by Ashutosh Pandey

Key takeaways

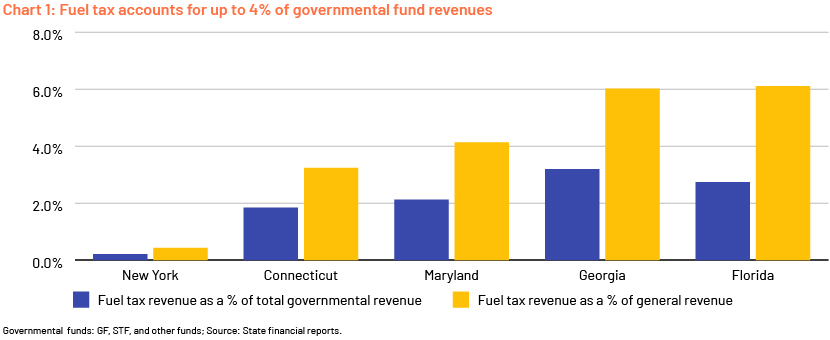

The fuel tax suspension would not have a material impact on the debt-service coverage ratio (DSCR) or the credit ratings of state general obligation (GO) bonds, as transportation-related revenues are not allocated to state general funds (GFs) directly

The suspension would have the most impact on the financing of road transport infrastructure projects (maintenance and development)

In the first half of 2022, five states in the US – Connecticut, Maryland, New York, Florida, and Georgia – suspended fuel tax from June through December 2022. Other states (Kentucky, Illinois, Colorado, and Tennessee) and the federal government are also looking to suspend or have suspended similar taxes or fees for varying durations. This would help their populations (particularly those in the lower-income segment) currently dealing with the highest level of inflation in 40 years.

States project a negligible impact on the DSCR of transport revenue bonds

This projection is bolstered by the fact that fuel tax revenues are only one component of pledged state transportation fund (STF) revenues, and bonds secured by these revenues generally have high DSCRs, well above bond covenant requirements. The STF comprises fuel tax revenues and other revenue sources to fund long-term capital projects (such as maintenance and construction of roads and bridges).

Governments have the flexibility to alter rates and the composition of STF revenues to meet infrastructure-related requirements and manage inflationary pressure. Other sources of STF revenues include taxes on vehicle sales and motor vehicle registration fees. Since the current suspension is temporary and applies only to one component of STF revenues, it is unlikely to affect debt-service coverage of STF bonds.

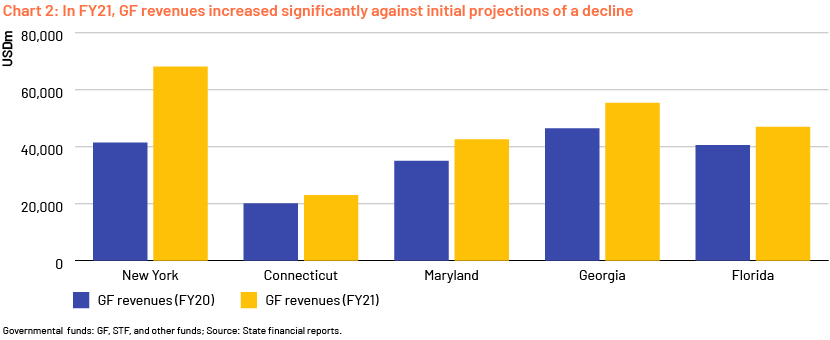

GO bond ratings would not be pressured, as GF revenues continue to increase

State governments’ primary tax revenue sources are income tax and sales tax (most of which are allocated to state GFs); these recorded meaningful increases in FY21, in contrast to initial estimates of reduced tax collection. GO bonds are paid from state GFs, and not the STF, which pays transportation revenue-secured debt. However, state GFs are supposed to cover any shortfall in the STF due to lost tax revenues, if applicable. Still, these reimbursements (0.5-1% of GF revenues) would not be significant compared with total GF revenues and, therefore, have limited to no impact on GO bonds’ credit quality.

Fuel tax suspension to result in c.USD200bn funding shortfall for highway infrastructure

Fuel taxes are a major source of revenues for highway infrastructure financing. Revenues from federal excise taxes on gasoline and diesel fuel account for over 80% of total federal Highway Trust Fund (HTF) revenues, according to the Urban Institute (a Washington, D.C.-based think tank). Consequently, suspension of this tax could result in higher borrowings to fund maintenance and construction. Another issue that weighs on this is the accelerated adoption of electric vehicles (EVs; not contributing to the HTF under current law), resulting in lower revenue accumulation in the HTF for infrastructure funding. If spending levels since the 2021 bipartisan Infrastructure Investment and Jobs Act are maintained, dedicated revenues coming into the HTF over the coming decade would be sufficient to cover only about half of the spending, according to the Committee for a Responsible Federal Budget, and the HTF fund would face a USD215bn cumulative shortfall through 2031.

Tax cuts would save money for consumers, but the amount saved would be nominal

Suspending the federal fuel tax from March to December 2022 would lower average fuel spending per capita by USD16-47, depending on geographic location and assumptions, but would lower federal tax revenues by about USD20bn over the period, according to a study by the University of Pennsylvania (Wharton).

Other challenges and possible solutions

The real pressure on GO bonds and transport revenue bonds would come from the increasing adoption of EVs. EV owners are currently enjoying no or lower tax rates and other charges compared to fossil-fuel vehicles. The EV market is projected to grow at a CAGR of 25.4% over 2021-28, according to Fortune Business Insights. The share of EVs is still low (about 5% of new-vehicle sales), and any tax loss could be easily absorbed by transferring funds from state GFs to the STF. However, if the current taxing structure continues, the burden on state GFs may increase significantly, leaving states with structurally imbalanced budgets. Michigan’s Mackinac Center for Public Policy proposes that legislators adopt a user fee system, charging vehicle owners on mileage, like billing users of utility services.

How Acuity Knowledge Partners can help

We have been supporting asset managers for over 20 years and providing them with scalable and customized solutions. Our Municipal Credit Research team’s support has helped clients enhance coverage and free up onshore bandwidth to focus on more-value-add tasks.

Sources:

State Annual Comprehensive Financial Reports

What is the Highway Trust Fund, and how is it financed? | Tax Policy Center

The Infrastructure Bill’s Impact on the Highway Trust Fund | Committee for a Responsible

Effects of a Federal Gas Tax Holiday – Penn Wharton Budget Model (upenn.edu)

S. Electric Vehicle Market Size, Share & Forecast, 2021-2028 (fortunebusinessinsights.com)

Michigan's Road Forward: Replacing the Fuel Tax with Mileage-Based User Fees (mackinac.org)

What's your view?

About the Author

Ashutosh has over nine years of experience in credit research, with expertise in US municipal markets and not-for-profit corporates. He currently supports a US-based global investment manager, with a focus on taxable and tax-exempt US municipal debt. Ashutosh provides investment recommendations and commentary on the credits through periodic review and keeping a track of developments. He holds a Master of Business Administration in Finance and a Bachelor of Technology in Electrical and Electronics Engineering.

Like the way we think?

Next time we post something new, we'll send it to your inbox