Published on May 7, 2024 by Shashank Rao

What happened and when…

On 13 April 2024, Iran began its first full-scale military air strike against Israel, in retaliation against an alleged Israeli air strike on an Iranian consulate building in Syrian capital Damascus on 1 April 2024 that killed two senior members of Iran’s Islamic Revolutionary Guard Corps. This was against the backdrop of the war in Gaza since last October, sparked by Palestinian group Hamas's assault on nearby Israeli communities. Iran and Israel have historically been arch-enemies, engaged in a years-long shadow war-type situation, especially after the Islamic Revolution in Iran in 1979.

It is reported that while Iran launched more than 300 drones and missiles towards Israel, Israel managed to intercept 99% of the barrage outside its airspace or over the country with the help of US forces.

In the recent past…

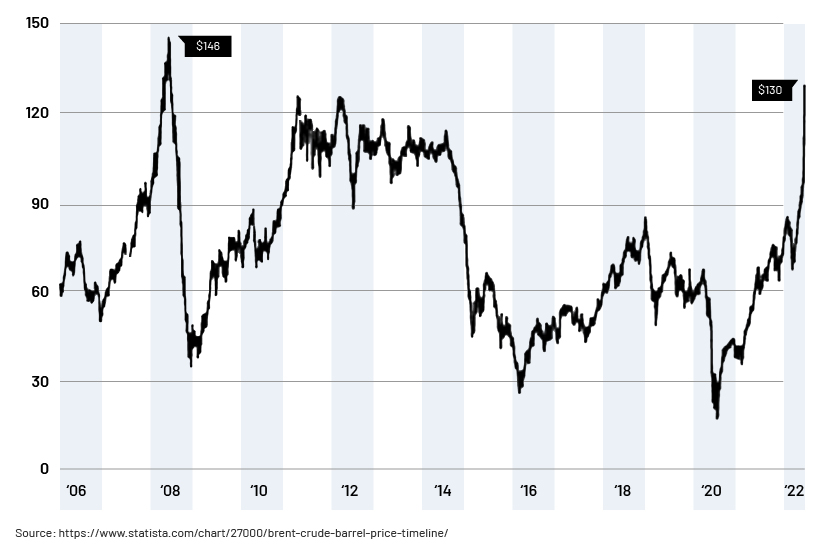

Such episodes of geopolitical tension usually have a ripple effect on oil prices, raising them due to speculation that global oil supply would be hampered. For instance, subsequent to the outbreak of the Russia-Ukraine war on 24 February 2022, the WTI crude oil futures price reached USD133.5 per barrel and the Brent crude oil futures price reached USD139.1 per barrel on 7 March 2022 (the highest prices since July 2008 and significantly higher than WTI at USD76 and Brent at USD84 at the beginning of 2022); this was due to supply concerns as Western nations imposed sanctions on Russia, one of the world's major oil exporters. The price increase led not only to higher prices at fuel stations, but also to higher prices of countless other goods as businesses adjusted their prices to cover higher costs.

Daily Brent oil price per barrel (in USD)

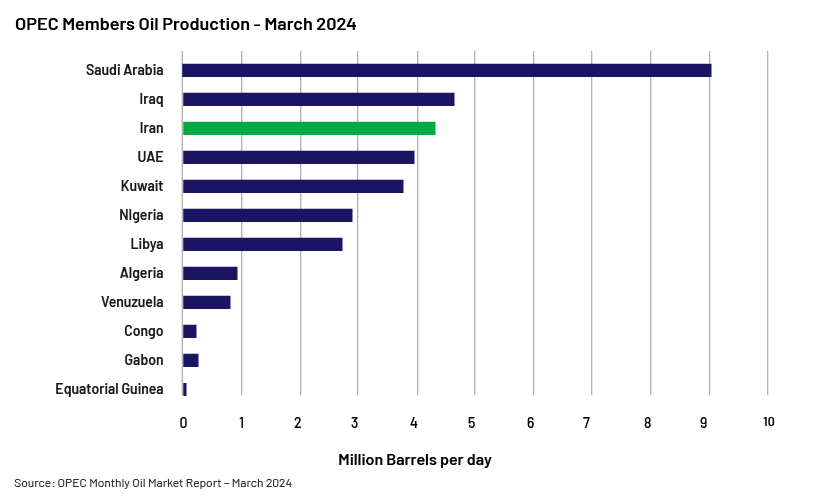

Iran is the world’s seventh largest oil producer and the third largest member, by production, of the Organization of the Petroleum Exporting Countries (OPEC), according to OPEC’s Monthly Oil Market Report for March 2024. It is reported to have produced around 3.2m barrels per day or about 12% of OPEC’s total oil production in March 2024. Any disruption to production due to war in the region could have severe repercussions for world oil supply.

The current oil scenario

On 12 April 2024, the day before the weekend attack, Brent oil closed at a six-month high of around USD92.2 per barrel, after Israel’s allies warned that an Iranian attack was imminent. However, the price fell about 3% on the following Monday (15 April 2024) and another 3% by Wednesday (17 April 2024), closing at around USD87.4 per barrel. Crude oil futures also fell as the market dismissed the risk of a wider war between the two nations as world leaders urged Israel not to retaliate. Specifically, on Tuesday (16 April 2024), the WTI oil contract for May 2024 delivery fell by 5% while the June Brent futures contract lost 8%, highlighting that oil traders did not react negatively but discounted any immediate threat to oil supply.

The short-term impact on oil

The unexpected rise in US crude inventories to their highest level since June last year, as reported by the US Energy Information Administration over the week ended 19 April 2024, coupled with lower refinery utilisation, is adding to the bearish sentiment putting downward pressure on oil prices. The oil market is likely to remain bearish in the immediate term, with rising US inventories, combined with subdued global demand and investor sentiment towards avoiding a conflict in the Middle East, suggesting that oil prices may continue to struggle to find higher ground. OPEC’s spare production capacity of about 6m barrels per day could also be used gradually in the event of a spike in oil prices.

On the flip side…

We do not rule out oil reaching USD100 per barrel in the event of a further escalation of geopolitical conflict and even breaching USD130 if a broader conflict disrupts oil flow. As such, a further escalation of the Israel-Iran war would remain a key issue, as it could affect oil supply from the Middle East and further burden Iran’s oil exports, already under sanctions by the US and EU. A warning from the US Treasury that the US intends to impose new sanctions on Iran in the coming days could also push oil prices upward.

In fact, on 13 April 2024, Iran seized an Israel-affiliated container ship near the Strait of Hormuz, according to an Iranian state media report. The Strait of Hormuz, located between Oman and Iran, is a crucial trading route for almost 20% of the world’s total oil supply or about 21m barrels per day. Any further disruption to oil flow via this route may put further inflationary pressure on oil prices. In addition, Israel’s retaliatory strike on Iran less than a week after Iran’s drone and missile attack on Israel, as reported by US officials, raises concern of a widening conflict in the Middle East.

The near term could be very volatile for oil given the ongoing geopolitical tensions and usual increase in fuel demand due to the summer driving season in the US and Europe. The potential recovery of China’s economy could also weigh on oil demand (with China being one of the biggest importers of crude oil), increasing prices. China’s economy has grown faster than expected, with GDP growth in the January-March 2024 quarter at 5.3% versus a year ago, higher than 4.6% growth expected by the economists polled by Reuters, and higher than 5.2% growth since the fourth quarter of 2023.

How Acuity Knowledge Partners can help

We have partnered with macroeconomic research firms, global investment banks, asset management firms and hedge funds over the years, working closely with their research, strategy and investment teams to provide them with the information and analysis required for investment decision-making. These firms have leveraged our sector-specific/macroeconomic research experience to rapidly increase internal analyst bandwidth and expand coverage. We set up dedicated teams of analysts (CAs, MBAs, CFAs) to support our clients on a wide range of activities including idea generation, macroeconomic research, financial analysis, thematic research, building databases and providing regular sector coverage. Each output is customised, based on the client’s requirement, and made available for their exclusive use. This ensures our clients a unique, sustainable edge.

Sources:

What's your view?

About the Author

Shashank has over nine years of financial research experience across sell-side and buy-side accounts due to handling equity research roles across sectors. In his previous roles at Acuity Knowledge Partners, he supported UK- and US-based financial firms, showcasing proficiency in building financial models, financial analysis, secondary research, ESG research, analysing sector trends and writing initiation reports and thematic research pieces. Shashank holds an MBA in Finance and a bachelor’s degree in engineering. He also holds a post-graduate degree in Data Science and Business Analytics from the University of Texas at Austin.

Like the way we think?

Next time we post something new, we'll send it to your inbox