Published on December 16, 2024 by Raj Kotecha

As the world continues to navigate the aftermath of the pandemic, the US quick-service restaurant (QSR) sector is facing unprecedented challenges. The sector is dominated by players such as Starbucks, McDonald’s, Wendy’s, Darden, Chipotle, Domino’s and Restaurant Brands International. The impact of food inflation, driven by uncertain macroeconomic factors, has made it difficult for the sector to maintain profits. The ongoing Russia-Ukraine war has significantly disrupted food prices due to blocked Black Sea ports, causing wheat prices to surge by 50% immediately after the invasion from 15 February 2022 to 7 March 2022, as Russia and Ukraine together account for c.33% of global wheat exports.

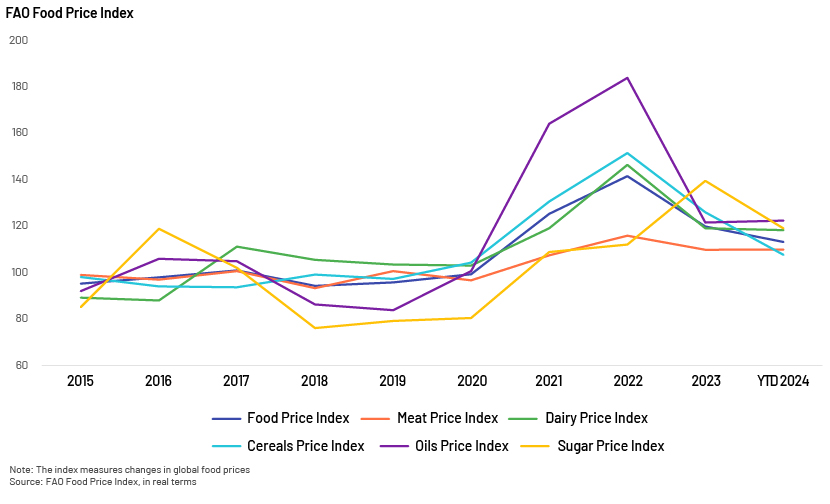

As a result, the FAO Food Price Index (FFPI) has exhibited significant fluctuation, reflecting volatility in food markets. While the index remained relatively stable in 2015, subsequent years saw sharp price increases. For instance, the spike in oil prices in 2016 through to the peak in 2022, the increase in dairy prices since 2017 and record-high cereal prices in 2022 due to the conflict. However, projections for 2024 indicate a potential downtrend in the index.

Impact of price hikes, the drop in customer traffic and climate change

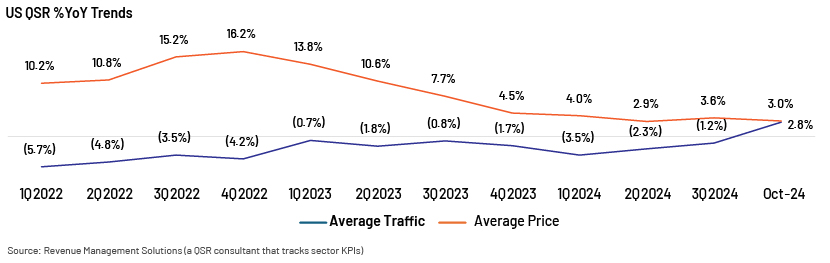

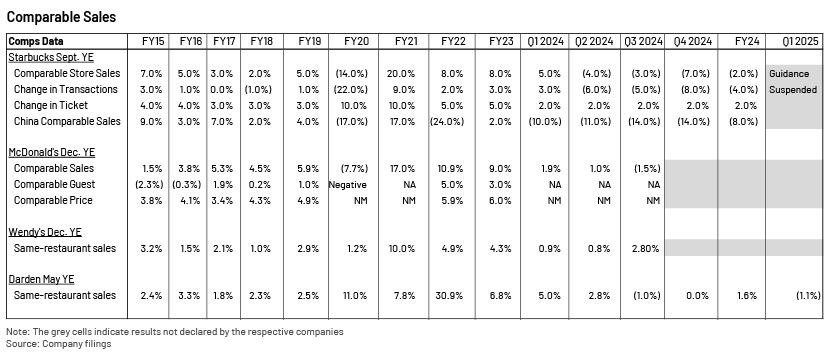

The QSR sector faced challenges in 2022 due to an increase in food costs and possible labour shortages. This led to the highest menu prices, causing a drop in customers. However, the trend has started to show signs of easing as of 2024. The interplay in 2024 so far indicates stability, with an opportunity for businesses to adjust price strategies more favourably to attract higher footfall.

Importantly, climate change, particularly the El Niño effect, is significantly affecting the production and pricing of cocoa and coffee, creating an additional layer of complexity on top of increased competition from local Chinese coffee chains such as Luckin and Cotti, damaging coffee behemoth Starbucks’s top line. The inflation impact on restaurants is further exacerbated by such climate-driven disruptions, adding pressure to pricing and supply chain management.

The cocoa market is experiencing a supply deficit, projected at 4.461m tonnes, reflecting a contraction of 11.7% y/y for 2023/24, leading to a price spike of over 78% y/y to USD6,582.86/tonne in October 2024. Similarly, the heat wave in Vietnam is affecting Robusta coffee production, with forecasts indicating a 10-16% decline in output for the coming season, with coffee prices already up by 63% since mid-July 2024.

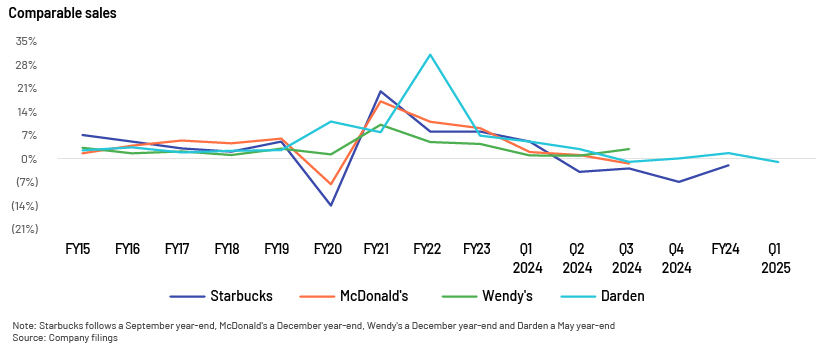

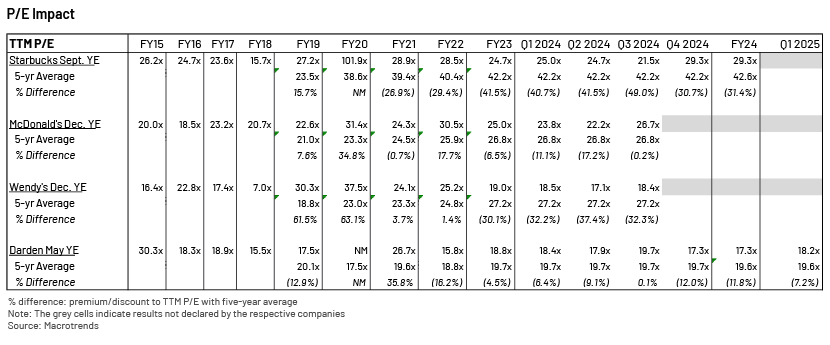

The impact of food inflation on the businesses reveals a notable trend of steady growth from FY15 to FY19. However, since FY20, these companies have been striving to regain their attractive valuations by passing increased costs to customers. Strategies such as adjusting menu prices, promotional offers, loyalty programmes and introducing new premium food items reflect initiatives to maintain customer traffic.

Pricing tactics for resilient valuation

While a race to the bottom could hurt the fast-food chains, especially at a time of soft consumer spending, McDonald’s and Burger King have introduced value-centric USD5 meal options as a strategic move to boost sales. Similarly, Wendy’s has launched a competitive USD3 breakfast deal, signalling a broader sector trend aimed at boosting customer footfall amid an increase in cost-conscious consumers. This was followed by Chili’s introducing a “3 for Me” promotion that offers a customisable meal starting at USD10.99 with add-ons at USD2.49. Continuing the trend, Denny’s has revamped its USD2, USD4, USD6, USD8 and USD10 meal options to drive sales mix, and BJ’s Restaurant & Brewhouse has introduced a limited-time USD13 Pizookie Meal Deal to mitigate rising costs. This approach aligns with “barbell pricing”, where food chains offer both affordable and premium options, with fewer options in the middle, to address market fluctuations and inflationary pressures.

Demand and spending forecasts

Food inflation has been a persistent issue affecting both low- and high-income households. In the year ended May 2024, there was a notable decline in transactions by customers with annual household income less than USD75,000, with an even steeper drop among those earning less than USD50,000 a year, from last year, according to Ricardo Cardenas, CEO of Darden Restaurants (DRI), reflecting the inflation impact on restaurants and the economic pressure faced by consumers shifting preferences and habits. On a more optimistic note, the November and September 2024 Fed funds rate cut by 75bps to 4.50% to 4.75% from 5.25% to 5.50% may offer some relief to free up additional budget for discretionary spending, enabling families to spend marginally more on dining out.

Forecasts suggest that while rates may not return to pre-pandemic levels immediately, the QSR sector is expected to experience steady growth through 2025, with projected increases in consumer spending on prepared food and non-alcoholic beverages, reaching USD921.7bn in 2025 from USD895.1bn in 2024; by segment, USD323.7bn is forecast to be spent in the QSR sector, followed by USD153.8bn on casual dining and USD81.5bn on fast-casual dining.

As these trends unfold, businesses should adapt their strategies to meet evolving consumer preferences, focusing on quality, convenience and innovative offerings to capture a larger share of an expanding market, and maintain a cautious approach as they navigate the complexities of the global sector.

How Acuity Knowledge Partners can help

We are a preeminent consultancy serving the financial sector, offering tailored research, analytics, and technology support. With more than two decades of experience and expertise in assisting investors, asset managers, banks, consulting firms, brokerages, and market research consulting services, partnering with us helps clients efficiently build and maintain views on macros and valuation. This helps the investment community focus on revenue-generating initiatives and operational efficiencies, improving decision-making capabilities and cutting operational costs to drive earlier-than-expected time-weighted returns on investments.

Sources:

-

Some Vietnam coffee farms thrive despite drought, but may not stop espresso price hikes | Reuters

-

Robusta coffee prices hit record high due to supply shortage | Mint

Tags:

What's your view?

About the Author

With more than 7 years of experience in Equity Research, Raj is currently supporting Acuity’s leading Buy-side client covering global markets along with multiple industries. On top of this, his interests lie in integration of Big Tech, AI and Media. He holds a Master’s & Bachelor’s in Business Administration Finance with CFA Level 1 certification

Like the way we think?

Next time we post something new, we'll send it to your inbox