Published on July 14, 2022 by Sridhar Shivaram

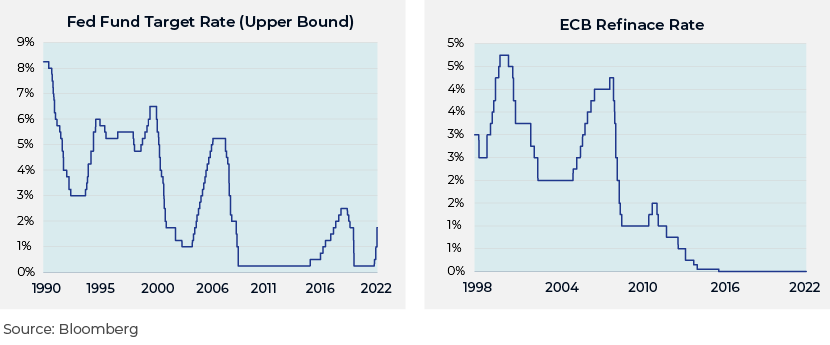

The pandemic delivered the most severe blow to the global economy since the Great Depression, making global central banks act decisively and focus on economic growth. The Federal Open Market Committee (FOMC) lowered its target rate by 50bps to 1-1.25% in March 2020 and announced plans to increase its holdings in Treasuries and mortgage-backed securities by at least USD500bn and USD200bn, respectively. The European Central Bank (ECB), while keeping its refinancing rate unchanged at 0%, introduced its staggered stimulus measures, with peak asset purchases of EUR1,850bn. The Bank of England (BoE) cut its base rate to 0.25% in March 2020 from 0.75% and then to 0.10%. Global rate markets saw all-time-low rates across the Treasury curve and a strong liquidity-driven rally across equity, debt, commodity, and new-age investments.

Many central banks have provided liquidity measures to help alleviate the tightening financial conditions due to the pandemic, including an adequate supply of credit to households and businesses.

Changing course

The Federal Reserve (Fed) slashed its target rate at the start of the pandemic to overcome the severe damage to the economy and financial markets due to the lockdowns that resulted in the unemployment of 22m citizens. However, a number of factors have forced the central bank to control inflation, a situation policymakers dismissed as “transitory” last year. Policy reactions have been unprecedented. Governments have introduced massive stimulus measures and estimated deficits on a scale not seen since World War II.

The question that arises now is how to finance fiscal deficits and prevent them from disturbing the markets. The actions of central banks have again emphasised their role in crisis management as they swiftly cut policy interest rates and launch large-scale measures to maintain balance sheets. However, the delay in deciding to work on balance sheet size and tightening financial conditions ignored the possibilities of a surge in prices and a tighter labour market.

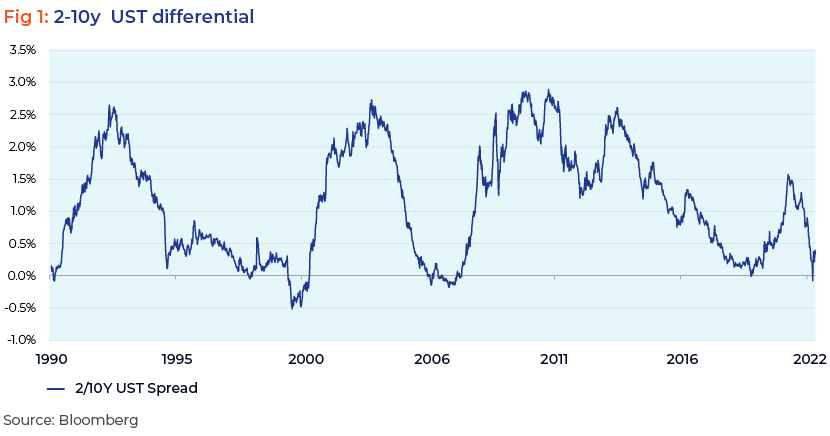

Such monetary policy-related errors have raised the risk of recession in the coming years. Perhaps the best predictor of a US recession is the 2-10y UST spread that turned negative on 1 April 2022 and remained negative on the following trade day (Fig 1). US recessions have, historically, always occurred within two years of the yield curve inverting. The key reason for bond markets predicting a possible recession is that the Fed’s decision to continue with its economic support programme until February 2022, despite a tightening labour market, led to inflation reaching 8.5% in March, the sharpest increase in the annual rate since 1981.

Global markets started 2022 on a very strong note, but the focus moved gradually to the geopolitical environment, inflation, commodity prices and rate tightening. At the most recent FOMC meeting, the Fed raised rates by 75bps, the biggest move since 1994, and the market expects it to raise rates in excess of 3% this year. More importantly, the FOMC’s summary of economic projections has changed significantly since March 2022; the median projection for the target rate is 3.4% by end-2022, implying another 175bps hike. Increased rate hikes are expected to drag down GDP growth to 1.7% in 2022 and 1.7% in 2023 (from previous estimates of 2.8% and 2.2%, respectively), with the unemployment rate also inching higher from 2022 to 2024. The FOMC has turned hawkish on inflation, acknowledging the labour market, which has been the tightest in 50 years, and increasing inflationary expectations, something the Fed is determined to combat. The FOMC projects the Fed funds rate at 3.8% at end-2023 and remaining way above the neutral level for the next two and a half years in efforts to curb inflation.

Geopolitical tensions between Russia and Ukraine, coupled with COVID-19-related curbs in China, have led to supply-chain disruptions. Asset classes have been correcting across the board, and new-issuance volumes have been down a significant 30% since last year. The short-dated rate curve has also increased substantially vs the long-tenor curve, i.e., 240bps (US 2-year Treasury) vs 140 bps (US 30-year Treasury). The yield curve inverted for a while, suggesting expectations of long-term rates adjusting to a new normal.

As witnessed in previous risk-off environments, we saw increasing redemption initially, with investors either gravitating towards domestic markets or sitting on cash amid a volatile rate environment. Emerging-market funds saw inflows, with investors willing to deploy funds owing to limited new issuance, high cash surpluses and estimates with rate hikes priced in.

The Fed is not the only institution to have made such policy errors. The ECB, at its meeting on 10 March 2022, merely scaled back asset purchases over the next three months, continuing to buy EUR40bn in April 2022 and “reducing” its net bond buying to EUR30bn in May 2022 and EUR20bn in June 2022. However, the exceptional level of bond buying seemed not to acknowledge that Eurozone inflation had already reached 5.1% y/y in January 2022 and 5.9% y/y in February 2022. Unlike the Fed, the Eurozone takes CPI and core inflation into account; inflation for the region had been consistently above 2% y/y since October 2021 and should have made the ECB consider adjusting its monetary policy. Inflation is expected to have surged to 7.5% y/y in March 2022 and further thereafter.

However, recent economic fundamentals seem stable as output remains limited amid labour and supply shortages. Central banks are now attempting to achieve a fine balance between combatting inflation and sustaining economic growth. Yet, rate hikes cannot be expected to reduce inflation sharply, as inflation is mainly due to higher energy prices.

ECB policymakers have recently been focusing on whether or not to declare the size and duration of their upcoming asset purchases, designed to control borrowing costs for nations such as Italy and other debt-laden countries. The authority is set to announce the new mechanism in July, along with its first rate hike in more than a decade, in response to a spike in bond yields that has significantly impacted the most indebted parts of the region.

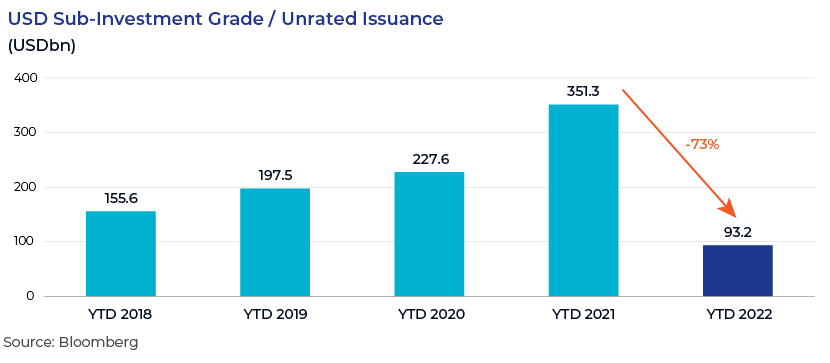

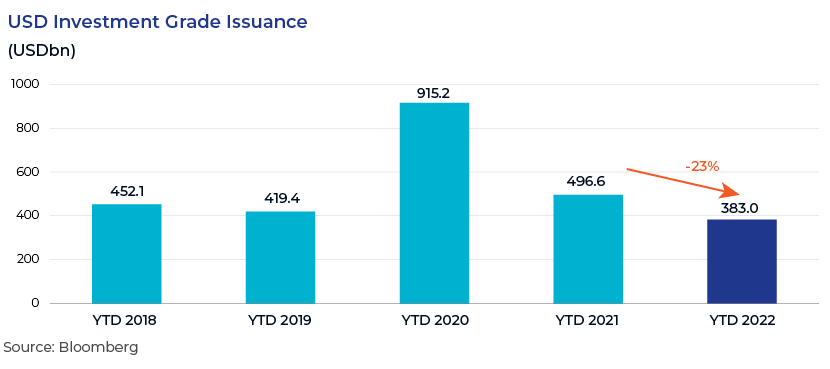

The impact on primary markets

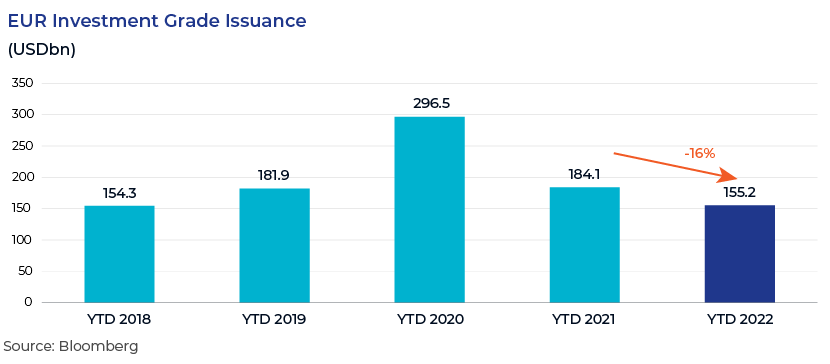

Current market volatility, driven by rising rates, geopolitical tensions and recession fears, is hindering investor appetite for both high-grade and high-yield corporate bonds, and companies that can currently afford to issue bonds are refusing to pay enough to convince investors to return to the market. As a result, issuance volumes across asset classes have dropped significantly, as the following charts show. The USD sub-investment/unrated primary market saw the largest decline of 73% in June 2022 YTD vs June 2021 YTD, according to Bloomberg data, while the USD high-grade primary market and the EUR high-grade primary market saw declines of 23% and 16%, respectively, during the period.

With the Fed’s efforts to tackle rising inflation fuelling concerns about a possible recession, spreads on US high-yield corporate bonds surpassed 500bps for the first time since November 2020. Rising high-yield bond spreads are making the primary markets more expensive for issuers that struggle to attract investors due their poor credit ratings.

Outflows from credit funds have been consistent for several months now. Fund flows have impacted the market to such an extent that it has affected primary markets as cash-constrained investors require a switch from bond syndicate desks, unattractive for traders to facilitate given the widening spreads and poor market liquidity. Poor market liquidity has put further pressure on new-issue premia, which have surged in the past 12 months for corporate bonds.

How is the larger investor base likely to react to the current interest rate regime?

The Fed’s move to reduce its USD9.0tn balance sheet comes alongside steep rate hikes to tackle persistent inflation. Quantitative tightening, along with rate hikes, has led to concerns about a global recession. With the emerging-market space severely impacted, primarily due to high crude oil prices and global supply-chain disruptions, institutions expect a significant drop in global GDP. Front loading of rates by the Fed, more palatable FOMC minutes and a stable geopolitical environment should boost investor sentiment going forward.

We also expect investor portfolios, primarily focused on Greater China and North Asia, to diversify gradually to other Asian markets. Investors sitting on the fence with large amounts of dry powder are also likely to focus increasingly on investing in credit markets as the interest rate environment stabilises. The international debt markets have always provided issuers with some of the most liquid, long-tenor and diversified sources of funding. Global investors have over the years been increasing asset allocation to India and been very keen to evaluate and invest in debut credit. Issuance from new sectors and new issuers from existing sectors are gaining traction, as they offers diversification and rarity value.

How Acuity Knowledge Partners can help

Acuity Knowledge Partners is a leading provider of high-value research, analytics and business intelligence to the financial services sector. We support over 400 financial institutions and consulting companies through our specialist workforce of more than 4,000 analysts and delivery experts across our global delivery network. We provide bespoke support to debt capital markets (DCM) teams of investment banks and advisory firms across the world through a wide range of solutions for corporate DCM, Financial Institutions Group (FIG) DCM, Sovereign, Supranationals and Agencies (SSA) DCM and sustainable DCM teams. Our team of DCM experts regularly tracks macroeconomic factors affecting the markets and provides end-to-end support, from deal origination to execution, including the most intricate financial analysis and after-market support.

Sources:

https://www.federalreserve.gov/monetarypolicy/files/monetary20220504a1.pdf

https://www.ecb.europa.eu/pub/pdf/fsr/ecb.fsr202111~8b0aebc817.en.pdf

Tags:

What's your view?

About the Author

Sridhar has been working with Acuity’s Global Capital Markets (GCM) team for over 4 years. He is currently supporting the GCM team of a major European investment bank and has demonstrated his proficiency in comprehending the Investment Grade and High Yield bond markets across the United States, Asia and EMEA. Prior to joining Acuity, Sridhar was working with an Indian mid-size investment bank where he was responsible for providing assistance to Investment Advisory and DCM Origination and Sales teams in their fund raising initiatives. Sridhar holds a Post Graduate Diploma in Management, specializing in Finance from New Delhi Institute of Management. He is also passionate about the equity markets,..Show More

Like the way we think?

Next time we post something new, we'll send it to your inbox