Published on May 27, 2020 by Sanjiv Singh

The world is in shock and still figuring out a way to deal with the current health and economically disastrous situation. The “best” solution has not turned out to be the best for business and industries. Social-distancing measures have put most of the world in lockdown, creating a demand void in the market, with a ripple effect across global economies. To stop the pandemic, the world needs to break the chain of infection, but in efforts to do so, it has broken down the global supply chain – the central nervous system of world economics. Macroeconomic data still indicates resilience, but at the micro level, business is in substantial turmoil. This is not limited to a particular geography, race or economic status.

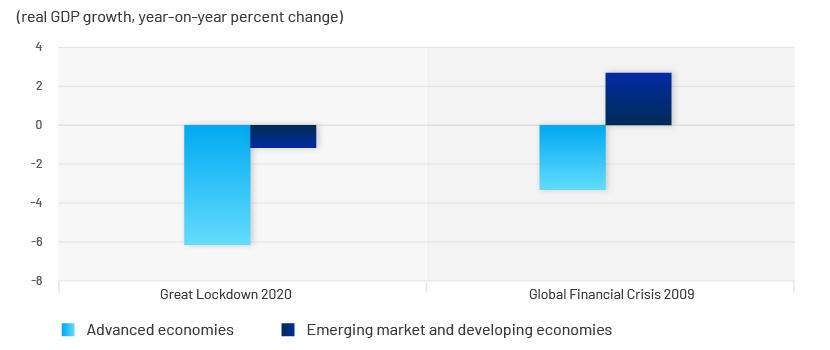

IMF reports suggest the scenario is worse than the Great Depression. It says that “Under the assumption that the pandemic and required containment peaks in the second quarter for most countries in the world, and recedes in the second half of this year, in the April World Economic Outlook we project global growth in 2020 to fall to -3 percent. This is a downgrade of 6.3 percentage points from January 2020, a major revision over a very short period. This makes the Great Lockdown the worst recession since the Great Depression, and far worse than the Global Financial Crisis. The cumulative loss to global GDP over 2020 and 2021 from the pandemic crisis could be around 9 trillion dollars, greater than the economies of Japan and Germany, combined.

For this year, growth in advanced economies is projected at -6.1 percent. Emerging market and developing economies with normal growth levels which were well above advanced economies are also projected to have negative growth rates in 2020. Income per capita is projected to shrink for over 170 countries. Both advanced economies and emerging market and developing economies are expected to partially recover in 2021.”

The fittest and most disciplined will have better chances of survival, as per the experts; the same goes for business: only the robust, strategic and precognitive would weather this crisis.

Banking and asset management companies are not immune. This crisis has created a unique situation in the financial world – it has not only increased market volatility, but also tested all pillars of governance, as it has all functions, such as liquidity, credit, and risk management. Maintaining delivery while adhering to regulations and client expectations is only the initial nightmare; the aftermath and the recovery phase will bring their own sets of challenges. If experts are to be believed, the recovery will likely be more of a V-shaped one rather than the normal U-shaped recovery. Although there are two different opinions being promoted in the market with respect to a V-shaped or U-shaped recovery that may sound positive for business and government, we cannot ignore the fact that banking and asset management companies will still be dealing with new volatility and related new issues and stress. Will the current work infrastructure cope with the continued stress?

Very few industries have the flexibility of getting their employees to work from home; of these, only a further few are able to move their work. Financial firms have been flexible enough to move all or critical work, so employees could work from home to comply with social-distancing regulations and lockdowns. This has tested the resilience of business continuity plans but also opened doors to manage new venues.

The financial sector is the most data-sensitive sector, with each step it takes under microscopic surveillance to assure privacy, security, and transparency, increasing stress on its control functions.

The current challenges are high market volatility and the related increase in transaction volumes, loss of productivity, stringent cost margins and the ability of risk and control systems to manage delivery from the work-from-home environment. The volatile market is in full swing, leading to large trade volumes and increasing pressure on existing workforces. Volatility will likely be the norm for a while as economies keep injecting stimulus to stay afloat.

With falling demand, a looming recession and related cost pressures, companies’ ability to hire staff to weather the crisis may decline, increasing their backlog.

The work-from-home environment has its share of control issues. Additional surveillance is the need of the hour to ensure there are no information security breaches and we have complete control over MNPI and client data. However, the significant spike in transaction volumes and use of different, uncontrolled communication channels have increased the risk of data breach.

With declining earnings and margins, fast and focused decision making, and strategic and innovative thinking become all the more important to navigate through a rough and choppy market.

Acuity Knowledge Partners’ solution

We create tailor-made dynamic functions with a robust, responsive and proficient control framework and process delivery. We have a very experienced tool-agnostic team able to provide support in investment compliance, trade surveillance, and corporate, forensic and crime compliance. We are experienced in providing unique solutions with the help of our state-of-the-art technology.

We have a pool of subject-matter experts for process delivery, training, projects and automation to mitigate costs. Our established compliance capabilities help clients identify problems and opportunities to navigate through a challenging business environment.

Sources

Tags:

What's your view?

About the Author

Sanjiv Singh has over 12 years of experience in compliance, having worked for various firms including J.P. Morgan and AXA . His expertise spans across the Investment compliance and Change Management. At Acuity Knowledge Partners he is responsible for management support of Investment Compliance Services. Sanjiv has done his MBA from IIPM Pune.

Like the way we think?

Next time we post something new, we'll send it to your inbox