Published on February 24, 2021 by Sonal Saini

Capital markets in Africa, once seen as a high yield opportunity, are losing their attraction due to unprecedented economic uncertainties witnessed over the past few years. This market volatility is expected to remain and haunt the market in the foreseeable future as well.

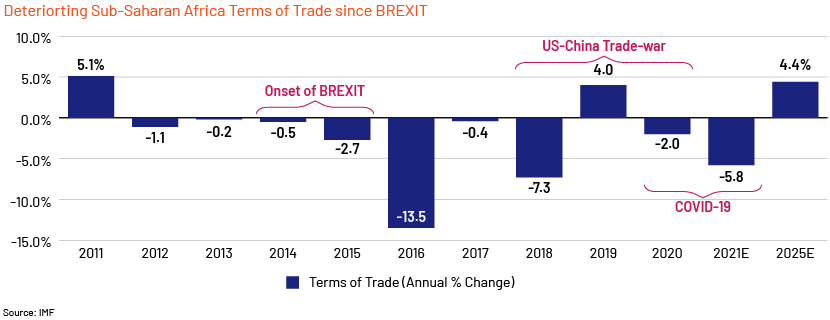

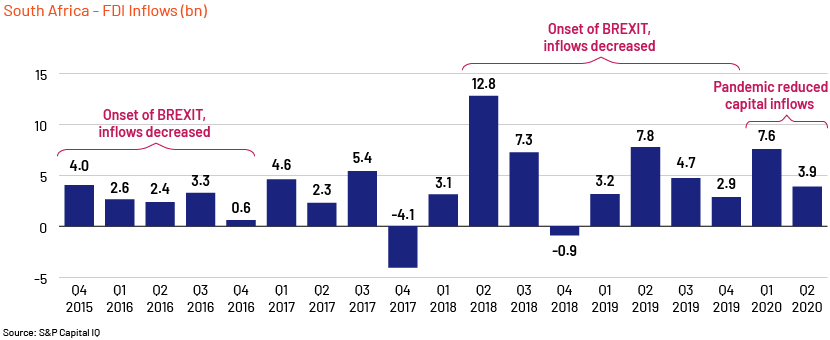

The African economy, including its capital markets, continues to remain sensitive to global geopolitical tensions. These tensions / uncertainties began in 2015 with the onset of BREXIT, as it raised concerns about the prospects of future capital flows into the region and got further aggravated by the latest US-China trade conflict which is likely to increase the cost of procurement for several companies and governments in the region, given China is an important trade partner for most of the African countries. This, coupled with declining commodity prices, has caused a major set-back to the market sentiment especially for the countries rich in the hydrocarbon sector, therefore negatively affecting their financials.

Moreover, the current business environment as a whole remains stressed by the enduring impact of the ongoing COVID-19 pandemic and the economic outlook for Africa continues to stay blurry.

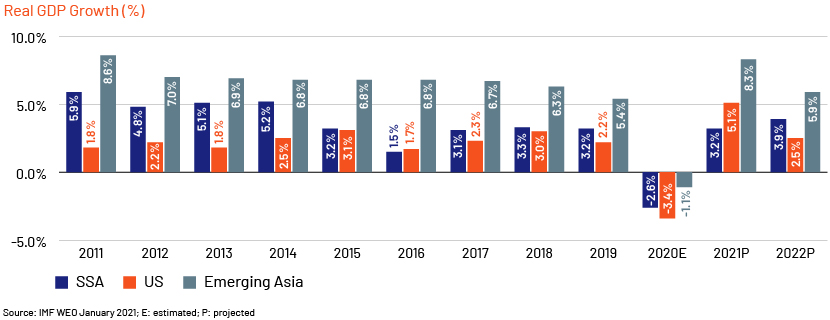

Africa is estimated to be the hardest-hit region, followed by the Europe, North America and the Middle East. Besides, Africa and more particularly Sub-Saharan Africa (SSA) is expected to take a longer time to recover from the slowdown compared to the other regions, due to shortage of necessary resources as well as the fiscal space to act accordingly. Consequently, the SSA region is expected to contract markedly by 2.6% in 2020.

Equity capital flows plummeted to all time low, factoring geopolitical tensions

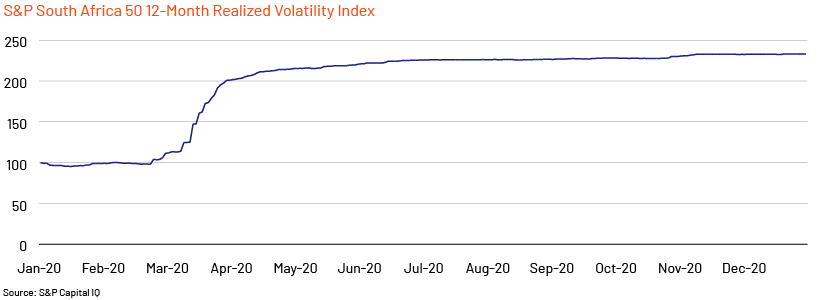

The already struggling African capital markets witnessed the lowest equity capital flows for the entire decade in 2019. According to a report by PwC, overall equity capital market activity in 2019 declined both in value and volume terms by 44% and 29% y-o-y, respectively. This got further aggravated by COVID-19 and had sent the market fundamentals for a toss. Growing implied volatility in major regional markets like South Africa, Nigeria and Kenya is deflecting global capital away from the continent to low yield, stable markets like US.

Diving yields show flight to safe havens among domestic investors

On the debt front, yields have declined sharply throughout the continent, owing to the spur in local demand for fixed income products, coupled with central bank easing, liquidity injections and government bond buying. According to Fitch, the government debt burden across the Sub-Saharan Africa (SSA) is growing at a much faster pace and to higher levels, therefore increasing the risk of rating downgrades and defaults.

Foreign participation in fixed-income declined to eight-year low in South Africa, stood almost negligible in Nigeria, and has declined significantly in Ghana. Nigeria, the second-largest fixed income market in SSA, has become unattractive for global investors given the forex liquidity issues.

COVID-19, the new enemy of the state, extending the time to recovery

Adding fuel to the fire, impact of COVID-19 from the onset of 2020 and subsequent economic lockdown has notably dampened business activity across the region leading to rise in liquidations and insolvencies. Financial services, real-estate, manufacturing and hospitality industries were the hardest-hit businesses during the lockdown.

South Africa, the most established market in the region, saw its business confidence index decline to a 35-year low of 77.8 points in April 2020. Seasonally adjusted insolvencies in South Africa had increased considerably by 455% m-o-m in May. South Africa also witnessed aggressive selling of government bonds in early 2020, forcing the central bank to enforce emergency liquidity measures and launch a quantitative easing style purchase of bonds in the secondary market. The fiscal packages to combat the COVID-19 has led to a significant increase in the public debt. The treasury had predicted that debt to GDP ratio in 2020 would breach 80% as the government borrows more and more in response to the pandemic.

New investments can offer hope for a recovery

It is however argued that synergistic M&As can prove to be an important catalyst at this time, stimulating the sluggish economy by boosting investment, mobilizing funds and providing the much-needed fuel for growth and expansion for the regional economy. Most of the African markets are heavily discounted at this time and present a gamut of opportunities for investors with high appetite for risk.

For the markets, on the other hand, the capital itself is not likely to provide any instant traction to the market’s trajectory but will surely help in keeping the liquidity afloat, boosting the aggregate demand and uplifting the sentiments, as well as allow some time for the economies to sustain in the slowdown while they draft their respective plans for the new normalcy and equilibrium.

A Peek into the market dynamics in select countries

-

Nigeria: Business activity is seeing a rebound but will remain below potential. The slump in oil prices and expectations of a slow and gradual recovery is anticipated to hurt Nigeria severely, the country is only expected to return to its stable levels by 2024

-

South Africa: The economy is still struggling for any positive momentum as growth plunged to its lowest thread. South Africa was already in recession in the final quarter of 2019 and a further contraction of 7% is expected in 2020. The country is not expected to return to a pre-COVID GDP per capita level any time before 2024

-

Angola: The second biggest economy in SSA, is also expected to witness contraction for the fifth consecutive year in 2020

-

Egypt: The Country is expected to recover quicker attributed to a strong growth trajectory in the pre-COVID era, however might still take at least two years to bounce back

-

Diversified economies: Those economies whose growth models are based on domestic consumption, healthy local private sectors and relatively robust agricultural sectors, located both in East and West Africa, would prove more resilient

-

Tourism dependent countries: The economies like Morocco and Tunisia are expected to hurt from the downturn. While Morocco is anticipated to bounce back in 2023, Tunisia is likely to recover late by 2025. Mauritius economy is expected to recover relatively sooner by 2022-23 supported by the country’s sound growth rates witnessed in pre-COVID period

Post 2020, however, the volume of Sub-Saharan African debt issuance is expected to gain momentum. The countries are getting ready to gradually decrease COVID-19 related emergency support from IMF and other multi-lateral institutions and seek to take advantage of record-low borrowing costs from global markets. For example, Ivory Coast and Benin tapped the market in November 2020 and January 2021, respectively and Nigeria, Ghana and Kenya are likely to follow suit. Nevertheless, the African nations would still face high borrowing costs as the spreads remain elevated. The path to recovery will surely be long.

Acuity Knowledge Partners is a leading provider of research and analytics to investment banks and advisory firms globally. We have a specific focus on the African region and partner with multiple investment banking teams in SSA, providing market knowledge, domain expertise and key insights, which enable them to understand requirements and constraints of critical sectors such as agriculture, infrastructure, retail, healthcare and real estate, related to their growing economies across the continent, helping to grow their businesses with a competitive edge.

What's your view?

About the Author

Sonal Saini has been associated with the firm for c.6 years. He has experience of managing capital market and financial research projects for bulge bracket investment banks. In his current role, he is supporting Debt Advisory team of an EMEA focused investment bank, handling research extensive tasks. His responsibility include end-to-end project execution, management and client engagement. Prior to joining Acuity, he worked with a market research firm Preparing extensive research reports on several industry verticals and performing trend analysis. Sonal holds Masters’ degree in Economics and is CFA-II candidate.

Like the way we think?

Next time we post something new, we'll send it to your inbox