Published on January 6, 2021 by Rohan Verma

The onslaught of the COVID-19 pandemic has caught the global oil and gas industry by surprise and has prompted many major oil & gas firms to review their investment strategy. The pandemic is adding to the woes of the oil & gas industry which is already plagued by declining oil prices and oversupply. The spread of the virus has triggered an economic slowdown which in turn has taken a toll on the Mergers & Acquisitions activity in the oil and gas sector globally. This has been exacerbated by production cuts in the downstream value chain, frequent assessments of short-term strategies to identify core and non-core assets and portfolios, and unprecedented cuts in operating spend and capital outlays.

Deal Landscape in the Oil & Gas Sector

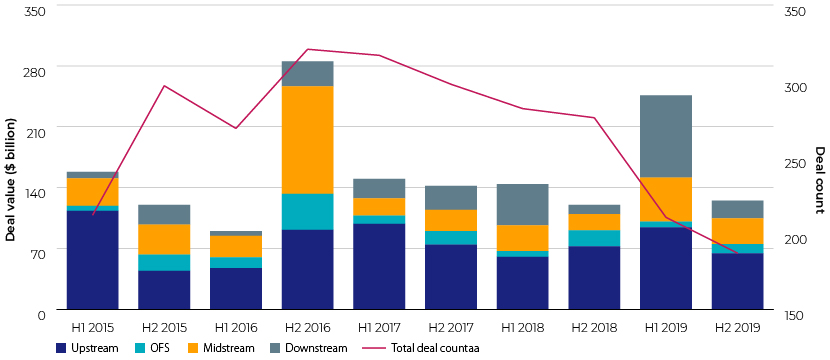

The past few years have seen M&A activity plummeting across sectors and geographies, however, the total deal value in 2019 was above the five-year average despite a collapse in deal count as shown below primarily attributable to large-scale consolidation as well as large-scale, noncore divestitures from oil & gas majors.

Source: Deloitte

The majority of deals currently in the pipeline involve either financially distressed companies or stranded assets that are unwilling to be consolidated or are being offered very low valuations. Private equity players are particularly apprehensive about investing given the current market scenario, even though valuations are materially lower leading to a drop in deal activity in both downstream and upstream sectors.

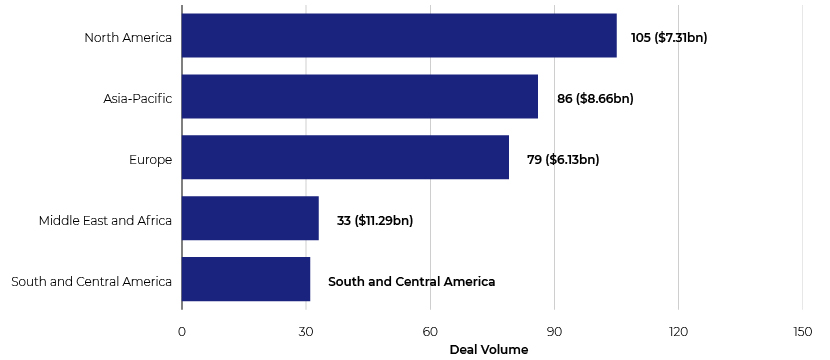

Total oil & gas industry M&A deals worth $23.95bn were announced globally in Q2 2020 which were markedly low as compared to the same period last year.1 Middle East and Africa held the top position, with total announced deals in the period worth $11.29bn. At the country level, the United Arab Emirates topped the list in terms of deal value at $10.12bn. Form a volume perspective, North America emerged as the top region for oil & gas industry M&A deals globally, followed by Asia-Pacific and then Europe.

M&A oil & gas by region in Q2 2020

Source: Global Data Deals Database

The snag in deal activity can be primarily attributed to the following factors:

-

Most of the acquisition targets, particularly in the United States are under huge financial stress with accumulated distressed assets that have deteriorating bottom lines and are burdened by high, expensive debt

-

Lower oil prices have put a strain on the bottom line of small upstream players drying up their fundraising capacity

-

Distressed players in the industry are holding on to their assets for sustenance thereby diminishing the possibility of divestures

-

Shift in private equity focus from early stage oil producers to companies with proven reserves, which are less susceptible to oil price fluctuations bolstered by the fact that US based Oil & Gas focused funds have been the lowest yielding assets over the last 10 years2

-

Prominent Oil & Gas firms with the firepower to drive M&A are currently focusing on devising new strategies to reduce operational costs, rather than putting efforts on M&A due diligence

In the wake of the global headwinds facing the oil & gas industry many oil & gas firms are taking deliberate steps to manage uncertainity in order to strengthen their resilience and ensure long-term sustainability.

Major Trends

The downstream sector has in particular witnessed a strong recovery in the past few months, with Global investment in new downstream oil refining and integrated chemicals capacity likely to average $55 billion per year to 20253.

In the global context, the following factors are driving investments:

-

Consolidation and modernization of China's refining sector

-

Middle East Exporters focusing on strategic expansions

-

Surge in chemical demand aiding the petrochemical industry

-

Midstream assets becoming lucrative targets

-

Private Equity players mopping up attractive deals

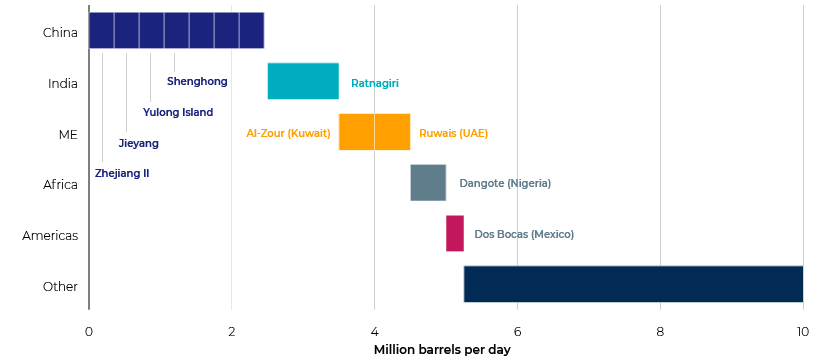

China participating in Megaprojects leading to downstream expansion

China is investing heavily in mega-refineries (refineries with capacity>0.3 million bpd) which essentially integrates fuel and chemical production. China, in its current state is facing shortage of petrochemicals, however, with these projects in pipeline it is poised to meet this shortfall by extracting a greater share of petrochemicals from each oil barrel and accelerate the phase-out of China’s small independent refiners, which are mostly simple fuel-oriented facilities.

Global downstream capacity additions to 2025

Source: Bloomberg NEF. Note: Highlighted projects are >300k b/d capacity

Heavy Investment in downstream assets by Middle East Majors

National Oil Companies in the region are actively pumping money into major growth centers across Asia Pacific with investments in countries like India becoming a strategic necessity. Investing across geographies acts as a natural hedge against oil price volatility and the long-term risks to oil demand amid the energy transition.

Strong demand for petrochemicals

Chemical production in particular has become an increasingly important end-use across various industries with demand typically projected above GDP for developed countries. The continued push into petrochemicals by oil and gas majors has directly induced standalone petrochemical companies to compete. This could drive further M&A activity as petrochemical companies look to shed disadvantaged assets or move downstream into more specialized intermediates. Majority of capacity additions in the near future will have a strong focus on petrochemicals with established oil & gas majors looking to boost up petrochemical production.

Strong deal making in the near future for midstream assets

Midstream assets will continue to be a value-creating component for the oil & gas industry value chain in light of the current economic scenario with large corporations on the lookout for well-located midstream assets supported by contracts with creditworthy counterparties as potential targets. Midstream assets have become a strategic necessity for firms in these times as the costs of contracting these services to third parties has become prohibitive given the low oil prices. Eventually, demand will pick up post COVID-19 and with lower oil prices making it expensive to store and transport oil & gas it will be imperative for oil & gas companies to own strategic midstream assets to optimize its value chain.

Private Equity Leading from the front

As reported by Bain Capital4, Private Equity players have accumulated a lot of dry powder in 2020 and are currently on the lookout for high yielding attractive investment opportunities to diversify and enhance their existing portfolios. The PE sector saw 10 deals happen in Q2 2020 with the $1.4bn private equity deal with CenterPoint Energy by Bluescape Energy Partners, Elliott Management and Fidelity Management & Research taking top position. Portfolio reshuffling and liquidity-driven transactions could play a pivotal role in driving private equity investments with investors pivoting from production to infrastructure assets.

Acuity Advantage

Acuity Knowledge Partners has been assisting energy and utility firms with benchmarking analysis helping identify attractive acquisition targets. Our team of experienced valuation professionals and industry experts can help identify and understand intrinsic values of potential targets and help you decide the attractiveness of potential assets. We offer transaction analysis by identifying and benchmarking the industry peer universe and drawing analysis that aid in better investment decisions.

Bibliography/Sources:

1. Global Data’s deals database

2. Preqin Database

3.Bloomberg - https://about.bnef.com/blog/downstream-oil-investment-shrugs-off-covid-19/

4. Bain Capital Private Equity Report 2020

5. Deloitte M&A Report - https://www2.deloitte.com/us/en/pages/energy-and-resources/articles/oil-and-gas-mergers-and-acquisitions.html

6. Offshore Technology Report- https://www.offshore-technology.com/deals-analysis/oil-gas-industry-ma-deals-in-q2-2020/

7. JWN Energy Report- https://www.jwnenergy.com/article/2020/7/27/pandemic-hits-upstream-m-hard-q2-2020/

8. BCG Report- https://www.bcg.com/publications/2020/covid-19-causes-uncertainty-in-oil-and-gas-mergers-and-acquisitions%20

9. PWC M&A Report

What's your view?

About the Author

Rohan is aligned with Acuity’s Lending Services Division with over 13 years of experience in project execution and delivery of financial, valuation, credit risk analysis and strategy related projects for the Financial Institutions Group (FIG), Private Equity & Venture Capital, and Corporate clients. Rohan posesses an MBA with a specialization in Finance & Strategy along with the CMA and CFA designation.

He specializes in strategy development, deal structuring, financial analysis, DCF Valuation, trading comps, transaction comps, and financial modelling, and has in the past supported the deal structuring and corporate finance teams of various clients including the Big 4 firms. He has also proactively worked on various strategy and technology consulting assignments including a feasibility study. He currently supports one of the largest banks..Show More

Comments

07-Jan-2021 11:41:10 am

Well presented.

Like the way we think?

Next time we post something new, we'll send it to your inbox