Published on July 1, 2022 by Shiba Kumar Khuntia

Back in March-2020 when Covid-19 struck the world, everything went to a standstill. Most of the major economies have shut down/locked down their businesses. Post that period, we saw a pent-up demand, but unfortunately, it wasn't supported by the supply side. Eventually, we got to a point where major ports in the world witnessed severe congestion due to labor shortages, which led to a significant increase in dwell time for vessels. By 2021 end to early 2022, we were left with a massive crunch in the supply chain but demand was still robust, which has led to the current situation of high inflation. To tackle inflation, central banks across the world have started increasing interest rates. Corporates have also started offering lucrative compensation to labor and implemented steps for automation but these measures have provided only short-term relief. Instead profit margins were under pressure due to increased logistics and operating costs. Going ahead, lower guidance and the conservatism around margins and earnings across various sectors, we are expected to see compressed multiples and weak stock performance, thus uncertainty in the stock markets will continue through 2022. Therefore, unless we see any improvement in the global supply chain ecosystem, long-term relief from inflation and stock market stability is a far-fetched reality.

Building up of the perfect storm:

Even as the global economy was struggling with the previous Covid-19 challenges, we encountered two major events in the beginning of the year -- the Russian invasion of Ukraine and the recent lockdowns in China. The Russian invasion has increased oil prices, while the Chinese zero-covid policy has further damaged the already deteriorated supply chain.

Digging deeper into supply chain headwinds, at least 27 cities in China are under full or partial lockdown. As a result, transportation to reach ports from manufacturing hubs have been impacted, particularly in Shanghai, the world’s busiest container port. This has led to increased lead time to as many as 15 days. Although, it has come down a bit because of some relaxation in Covid policies, it is still at 10 days. In March, ships from China to Seattle were taking ~1 day which has increased to 4 days by April end. Per Project44, shipment delays between China and major ports in US & Europe have quadrupled since late March. Additionally, per Windward, ~20% of global ships are currently waiting outside of congested ports. And almost 25% of those ships are outside Chinese ports -- 412 ships (384 alone in the Port of Shanghai as of April 25), up 58% since February. All these factors have led to high inflationary conditions across the world.

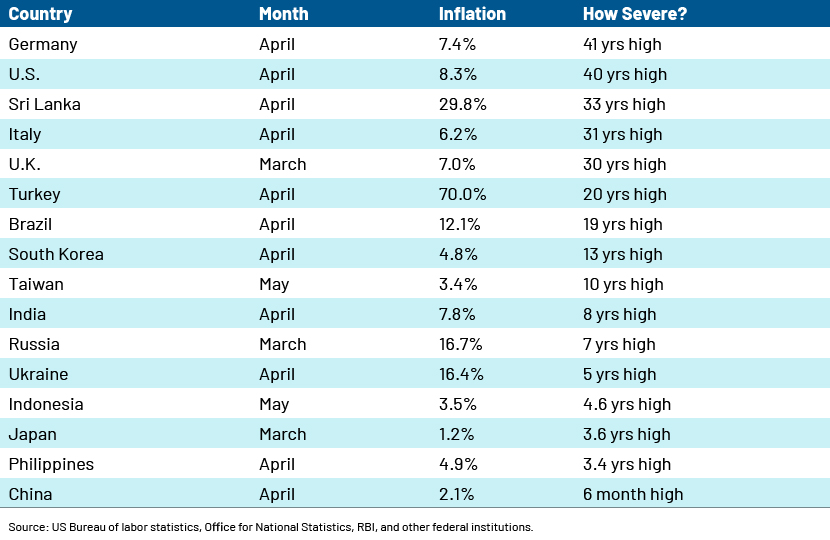

Inflation at multi-year high globally:

Given the above scenarios, inflation across geographies touched record levels.

Measures at various levels but still inadequate

To tackle record levels of inflation, global central banks have started increasing interest rates recently, including the Federal Reserve’s 50bps rate hike along with the announcement of reducing its balance sheet by $47.5b every month till September; the Reserve Bank of Australia hiked 25bps, the first time in 12yrs; Reserve Bank of India hiked 40bps, the first time in 4yrs; Banco Central do Brasil hiked 100bps, the 10th consecutive time since 2021; Bank of England hiked 25bps to 1%, the highest interest rate since 13yrs; and Central Bank of Chile hiked 125bps. Other central banks like European Central Bank and Spanish central bank have also hinted at contractionary monetary policies by July.

In addition to the central banks' action, we saw corporates have also started building up their inventory levels in the past few months amid the global supply chain crunch. The idea was to keep the inventory in hand to meet anticipated demands, but the restocking trend hasn’t been strong. Additionally, companies have raised wages for truck drivers and introduced other compensation plans like wage premiums, bonuses, and trainings to lure employees. Besides that, we are witnessing companies like Amazon, Kraft Heinz, and UPS spending heavily to introduce automation, digitization, and other innovative technologies to their supply chain operations to avoid logistical crunches. While we believe these initiatives may give some relief in the short term, unless we see any improvement in the global supply chain ecosystem, long-term relief from inflation is a far-fetched reality.

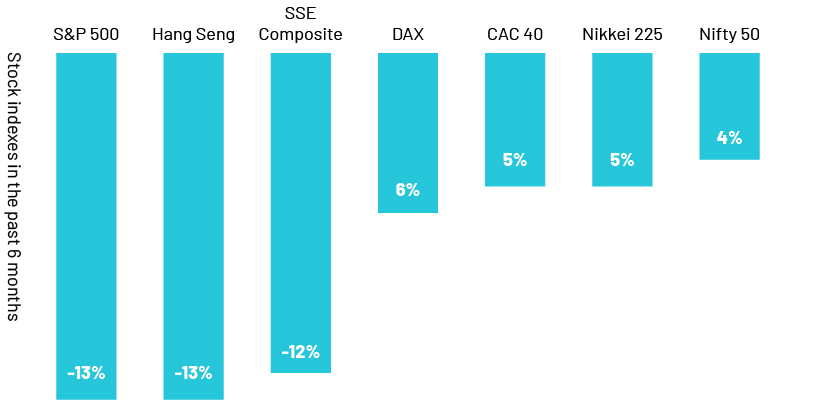

Impact on corporate earnings and stock markets:

Over the past few quarters companies are restocking inventories to meet the anticipated demand, but the major caveat would be if the production level slows down, that will have negative impact on margins. Additionally, during 1Q22 earnings release, we have witnessed most of the companies have either maintained or lowered their 2022 guidance. That said we should also give credit to some of sectors like equipment rentals and defence where companies have raised the guidance which will have positive impact on the stock prices. Equipment rentals companies are expected to benefit from fleet productivity primarily driven by solid non-residential construction spending and continued demand from infrastructure and industrial end markets amid supply chain issues. Defence companies have increased guidance driven by geopolitical situation aroused from Russia-Ukraine war which has forced countries primarily Europe to increase defense spending. However, the fact remains; we are surrounded by weak macro environment. Given the above challenges, stock indexes have also corrected in the past 6 months.

Therefore, given the continued challenges around margins and earnings due to the persistent supply chain disruptions and higher inflation, we believe overall the stock markets will remain weak through 2022. Hence, investors are advised to be stock specific with primarily focus on secular growth, execution quality, and FCF generation.

Bibliography:

Laura He, CNN Business, May 2022, “Shipping delays are back as China's lockdowns ripple around the world”.

Bhaskar Dutta, The Economics Times, May 2022, “The week that was for global central banks: 6 rate hikes, recession fears deepen”.

Rachel Wolff, Insider Intelligence, May 2022, “Companies are taking decisive steps to shore up their supply chains”.

Reuters, May 2022, “ECB policymaker says rates will rise 'very soon'”.

What's your view?

About the Author

Shiba Kumar Khuntia is part of the Investment Research team at Acuity Knowledge Partners. He has spent more than four years in his current role covering the U.S. Industrial Machinery at Acuity Knowledge Partners and currently supports sell-side clients with research assignments including industry research, economic research, thematic reports, and earnings reviews. He holds an MBA in Finance from Rizvi Institute of Management, Mumbai.

Like the way we think?

Next time we post something new, we'll send it to your inbox