Published on January 30, 2025 by Anjali Gairola

In this fast-paced and ever-changing business and macroeconomic environment, knowing the true value of your business is extremely important. Business valuation is the process of determining the economic value of a business or company. The process includes assessing the company’s financial health, assets, liabilities, market position and potential for growth to establish a fair and reasonable value.

Knowing the true value of a business is not always easy for an owner or its stakeholders. Business owners are likely to be biased while valuing their own businesses due to emotional attachment, lack of objectivity, financial interest and limited skillset. This is where independent valuation comes into play. An independent valuation of the business can help determine its true value, provide a baseline to better understand the company’s position, progress, prospects, value enhancement, succession plan, mergers and acquisitions, etc. Businesses often employ valuation services of a third party for new transactions, paying taxes, changes in ownership and other events to ensure fairness and accuracy and for proper oversight of fiduciary duties.

Simply put, it is important to have an independent third-party valuation periodically in order to be up to date with the value of the business amid an ever-changing business environment, to ensure being better equipped to make smart business decisions. Third-party valuation services provide an independent and unbiased opinion that business owners/stakeholders may miss. A business appraiser not only offers specialised knowledge of conducting valuations but also provides valuable insights on industry trends and their effects on the company's value.

Why is independent valuation important?

-

Baseline value: In the context of strategic business decisions, establishing clear goals is crucial. By obtaining an external viewpoint on the business's value and the industry landscape, one can effectively assess future advancements against a reliable baseline.

-

Risk mitigation: An independent valuation enables businesses to reduce the risks associated with wrongly measured assets or equity, thereby minimising the likelihood of financial setbacks and avoiding a potential legal or financial challenge.

-

Accurate decision making: During business operations, events such as mergers, acquisitions, divestitures or partnerships may necessitate an independent valuation prior to structural or ownership changes. This facilitates informed decisions regarding pricing, negotiations and target acquisitions.

-

Transparency in financial reporting: An independent valuation enhances the credibility of a company's financial statements, instilling greater confidence among shareholders, creditors, investors and other stakeholders.

-

Dispute resolution: In situations involving shareholder disputes or partnership dissolutions, an independent valuation can provide a fair and precise resolution based on the findings of the valuation report.

-

Ease of availability of credit: When engaging with banks and other external financing entities, an objective business valuation can effectively convey your business's worth, aiding in capital acquisition. Financial institutions often require this information to evaluate and approve funding requests.

-

Regulatory and compliance requirements: Independent business valuations may be essential for a variety of legal or regulatory purposes, such as financial reporting, taxation and litigation. By enlisting a professional valuation firm, you can ensure compliance with all relevant standards and regulations.

How valuations may be inflated

Inflated business valuations have frequently been associated with valuation fraud, as evidenced from cases such as Enron, WeWork and Satyam Computers. Conducting an independent enterprise valuation can safeguard against such fraudulent practices.

Valuation fraud can manifest in a number of situations such as the following:

-

Mergers and acquisitions: A company may be sold at an inflated price by presenting deceptive financial statements and growth forecasts, leading to significant financial loss to the buyer once the true value is disclosed.

-

Fraudulent valuations for loan acquisition: Companies may assert that they have secured substantial contracts or agreements that enhance their valuation, enabling them to obtain large loans for contracts that are either fabricated or grossly exaggerated.

-

Intellectual property valuations: Businesses may artificially inflate the value of their intellectual property – such as patents, trademarks or proprietary technologies – to enhance the overall valuation of the company.

-

Real estate valuations: Companies holding considerable real estate or physical assets may misrepresent their value to inflate the overall business valuation. They may use falsified appraisals or selectively report assets to present a misleading impression of the company's worth. An investor could be misled into purchasing the business based on these inflated asset valuations.

-

Venture capital funding: In the realm of venture capital, some founders or startups may present overly optimistic or fabricated financial projections to inflate their business valuation, often exaggerating market size, growth potential or customer demand to attract more investment.

-

Loan default schemes: A company may secure a substantial loan based on inflated valuation reports and subsequently default on the loan, leaving the lender with collateral that does not correspond to the original valuation.

-

Fabricated customer contracts or revenue inflation: Companies seeking to enhance their valuation may falsify customer contracts or revenue figures to present a misleading impression of their financial health.

Valuation scams can undermine trust in financial markets, whereas an independent enterprise valuation provides the necessary checks and balances to ensure valuations are accurate, fair and reliable.

How recent trends in credit markets increase demand for independent valuation

Changes in credit markets, borrowing conditions and debt availability directly influence valuation. With the outlook for leveraged lending in FY25 dependent on factors such as interest rate, economic growth and market sentiment, companies would face different borrowing conditions that will impact their valuation.

The US leveraged lending market faced the following challenges in FY24 that triggered the need for independent valuation:

-

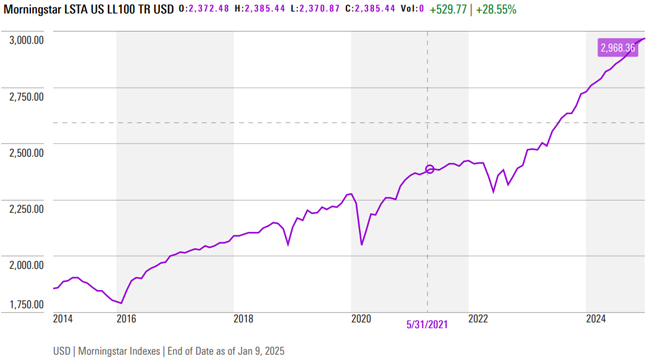

Rising default rates: Defaults on leveraged loans have surged to a four-year high, with a 7.2% default rate in FY24. Independent valuation enables stakeholders to assess recoverable values and mitigate risk.

-

Increased loan issuance: Leveraged loan issuance in the US in September 2024 was approximately 2.5 times more than in September 2023, according to Moody’s.

-

Influence of private equity: Private equity-backed companies defaulted at a rate of 17% from January 2022 to August 2024, nearly double the rate of non-private equity-backed firms, according to Moody’s.

Leveraged lending market and independent enterprise valuation

The leveraged lending market will likely influence how much debt companies can take on in FY25. The more debt a company has, the higher its financial risk (i.e. risk of default, less creditworthiness). If lending conditions are favourable and companies secure cheap financing, they may increase their leverage to fund growth, potentially increasing their enterprise valuation (EV). However, too much leverage can raise the risk of distress, especially if interest rates rise or economic conditions worsen. Independent valuation experts consider both the debt levels and the risk profiles of companies when determining the EV. If the leveraged lending outlook shows that access to cheap capital is tightening or that credit spreads are widening, a valuation will likely reflect a higher risk premium for companies with high debt levels. This could result in lower valuation to account for the increased default risk and higher cost of capital. Conversely, if lending remains accessible, the valuation could factor in the potential for higher returns, leading to a higher EV.

Leveraged lending market and M&A activity

-

The leveraged lending market directly impacts M&A activity, particularly leveraged buyouts (LBOs) where private equity firms rely heavily on debt to finance acquisitions.

-

In a favourable lending environment, there is more capital available for deals, leading to higher valuations of target companies. However, if the lending environment tightens in FY25, it could reduce the volume of LBOs and M&A deals, leading to a reduction in valuation.

-

When conducting an independent enterprise valuation, in the context of an M&A transaction, conditions prevailing in the leveraged market must be accounted for. An independent enterprise valuation would then be able to assess the true value of a company.

How does the outlook for the leveraged market impact demand/need for independent valuation?

-

If the forecast for leveraged finance indicates a tightening of credit or an increase in borrowing costs, companies may face challenges in refinancing or restructuring their debt. Those aiming to ease their debt load or reorganise or modify their capital structure will require an independent enterprise valuation to evaluate their financial condition and identify the most effective strategy.

-

LBOs and leveraged loan volumes rebounded in FY24. Recent trends indicate that LBOs supported by leveraged loans are regaining market share from direct lenders.

-

The number of deals non-bank lenders secured surged in FY22 and FY23, while the leveraged loan market saw limited activity due to prevailing market uncertainty. In the first two quarters of FY24, leveraged loan volumes surged by 76%, reaching USD41.4bn, compared to USD23.5bn in the first half of FY23. Leveraged loans, which constituted only 46% of the USD50.8bn in LBO debt financing during the first half of FY23 regained market share in FY24, increasing their share to 68%. This represents USD41.4bn of the total USD69.2bn in LBO debt financing in the first half of FY24.

The outlook for leveraged lending in FY25 is closely linked to demand for independent enterprise valuation services. A favourable lending environment may stimulate M&A activity, private equity transactions and refinancing efforts, all of which typically necessitate thorough independent valuations. Conversely, a restrictive lending environment could dampen deal-making and financing activities while simultaneously heightening demand for valuations in distressed scenarios, restructuring efforts or compliance-related situations. Regardless of the prevailing outlook, independent enterprise valuation would remain essential for companies navigating the changing credit landscape, particularly in assessing risk, debt levels and growth opportunities. Given this outlook for leveraged lending, demand for an independent valuation service is expected to rise, prompting banks to engage independent valuation providers.

Acuity Knowledge Partners provides one-stop solutions for business valuation

An independent enterprise valuation is a crucial tool for businesses and their stakeholders to make informed decisions, ensure regulatory compliance and assess the value of their enterprises. Smaller banks frequently face challenges in accessing reputable independent valuation firms due to high costs and a limited pool of providers. Furthermore, these institutions often lack the resources necessary to effectively evaluate the quality of valuation services available to them.

Acuity Knowledge Partners is the premier provider of customised research and analytical support to the financial services sector. With a global team of 6,200 analysts, we serve over 690 clients in the sector, including 1,050 analysts dedicated to supporting more than 100 commercial and corporate banks, ranging from the largest global institutions to regional lenders of various sizes. We have helped clients from diverse sectors with precise enterprise valuations. Our valuation experts come with extensive experience in a wide array of sectors, businesses and transactions and deliver accurate and equitable valuations by employing all relevant valuation methodologies tailored to the different business scenarios.

Sources:

-

https://www.bing.com/search?pglt=43&q=benefits+of+independent+valuation

-

https://www.bing.com/search?q=leveraged+loan+market&qs=n&form

-

The Dark Side Of Venture Capital: Five Scams To Watch Out For

-

How Valuation Experts Adjust Their Analysis for Fraud | theKFORDgroup

-

Appraisal Fraud: Unveiling the Dark Side of Real Estate Valuation

-

LBOs on the rebound: How leveraged loans are stealing the spotlight from direct lenders in 2024

-

PE-Backed Firms Suffering Higher Default Rates, Moody’s Says

Tags:

What's your view?

About the Author

A postgraduate in Management (Finance) with nearly 6+ years of total work experience in lending industry including 3 years in Acuity Knowledge Partners. Well-versed in financial modeling, financial analysis, valuation, writing reports, Credit portfolio monitoring and leveraged finance.

Like the way we think?

Next time we post something new, we'll send it to your inbox