Published on February 4, 2025 by Ankit Agrawal

-

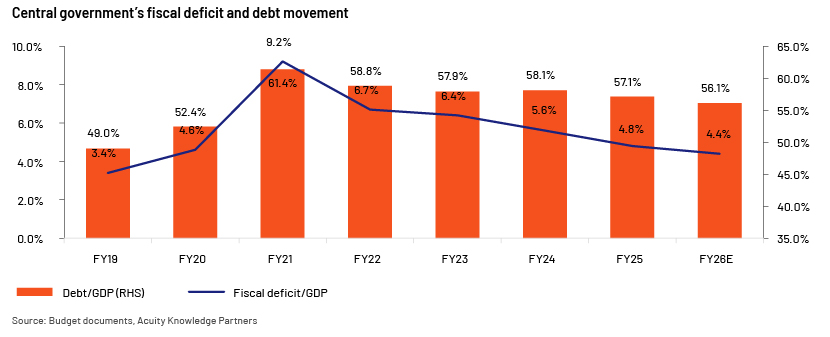

The government is on track to achieving its multi-year fiscal consolidation target by bringing fiscal deficit/GDP ratio to 4.4% by FY26 (ending 31 March 2026) (vs 4.8% projected for FY25).

-

The government intends to scale down debt/GDP to c.50% by FY31 from 58.1% in FY24, setting the stage for a potential credit rating upgrade over the medium term.

-

The government’s fiscal consolidation efforts are impacting the country’s economic growth, pegged at 6.3-6.8% y/y for FY26. This is driven by a lack of aggressive capital expenditure allocation needed to drive growth above 8% y/y – a crucial target for India to achieve developed economy status by 2047.

-

Given the recent tax cut announcement (USD12bn, or 0.3% of GDP) and ongoing fiscal discipline efforts, a cut in benchmark rates over the near term could remain supportive of economic growth.

Income tax cuts to drive consumption

Finance Minister (FM) Nirmala Sitharaman delivered a pro-growth FY26 budget against a weak economic backdrop, with GDP growth expected at 6.4% y/y in FY25 – the weakest since the COVID-19 pandemic. The most notable budget proposals include income tax relief for households, striking a balance between consumption boost and fiscal consolidation.

The budget provides exemption on personal income tax to all individuals earning up to INR1.28m annually, up from INR680k previously. The tax relief, estimated to cost c.INR1tn (USD12bn) in lost revenue to the exchequer, will likely be funded through a mix of elevated revenue collection (+11.0% y/y) and depressed capex. The tax cut aims to reduce the burden on the middle class and increase their disposable income. Additionally, the budget has rationalised rates of tax deducted at source and tax collected at source and introduced significant changes to rental income and self-occupied properties, offering further relief to taxpayers.

Other key announcements

-

The government launched Nuclear Energy Mission, aiming to develop 100GW of nuclear power capacity by 2047. It intends to amend related laws to facilitate greater private sector participation. The budget also emphasised renewable energy capacity expansion and allows states to borrow up to 0.5% of GSDP to reform electricity distribution companies.

-

The budget modified the UDAN scheme (regional air connectivity scheme) to enhance regional connectivity to 120 new destinations from the current 88 and seeks to help airlines carry 40m passengers over the next decade, up from the 15m currently.

-

To boost employment and upskilling, the FM announced a raft of measures including the establishment of 5 National Centres of Excellence for Skilling and 50,000 Atal Tinkering Labs in government schools, capacity expansion in IITs and medical institutes and the setting up of a Centre of Excellence in AI.

-

The government also announced changes to custom duties (major items highlighted in table below).

| Item | New duty rate | Old rate |

| Flat panel display | 20% | 10% |

| Electronics and IT goods | 0-10% | 2.5-15% |

| Life-saving medicines | 0-5% | As applicable |

| Lithium-ion-battery waste | Nil | 5% |

| Capital goods for manufacturing of lithium batteries | Nil | As applicable |

| Space sector | Nil | As applicable |

Source: Budget documents, Acuity Knowledge Partners

-

The budget also includes policies to shore up agriculture; start-ups; MSMEs and labour-intensive sectors such as leather and toys.

Key economic indicators

| FY21 | FY22 | FY23 | FY24 | FY25 (P) | FY26 (BE) | |

| Nominal GDP (in INR tn) | 198.3 | 236.0 | 269.5 | 295.4 | 324.1 | 357.0 |

| Real GDP growth | -6.6% | 8.7% | 7.0% | 8.2% | 6.4% | 6.6% |

| Fiscal deficit to GDP | 9.2% | 6.7% | 6.4% | 5.6% | 4.8% | 4.4% |

| Central government debt to GDP | 61.4% | 58.8% | 57.9% | 58.1% | 57.1% | 56.1% |

| Interest expenses to revenue receipts | 41.6% | 37.1% | 39.0% | 39.0% | 36.9% | 37.3% |

| State's fiscal deficit to GSDP | 4.1% | 2.8% | 2.7% | 2.9% | 3.2%* | NA |

| State governments’ debt to GSDP | 31.0% | 29.1% | 28.2% | 28.5% | 28.8%* | NA |

Source: Budget documents, Reserve Bank of India, Acuity Knowledge Partners

P = provisional data; BE = budget estimate; NA = not available

Government delivers on fiscal consolidation

The government is on track to achieving its multi-year goal of narrowing the fiscal deficit to below 4.5% of GDP by FY26. Since FY22, it has steadily plugged the gap primarily through increased revenue generation rather than expense cuts while sustaining high-quality expenditure. For FY26, the government has set a fiscal-deficit-to-GDP target of 4.4%.

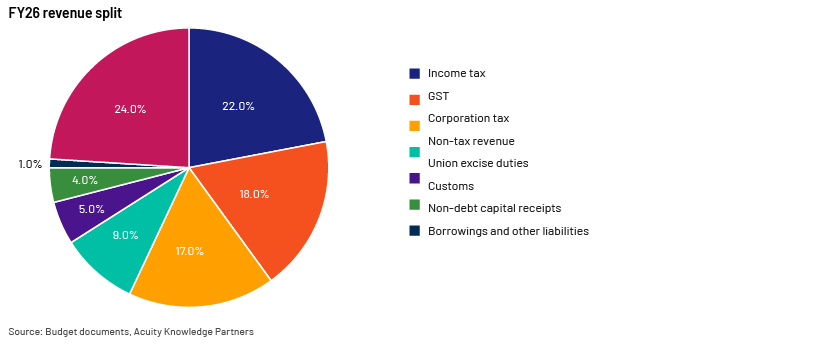

Revenue

The budget estimates conservative revenue growth of 10.8% y/y (compared to FY25 provisional data), against the nominal GDP growth estimate of 10.1% y/y for FY26. Growth in tax revenue (+11.0% y/y) is supported by increased revenue from personal income tax (+14.4% y/y), goods and services tax (GST; +10.9% y/y) and corporate income tax (+10.4% y/y). Although the personal income tax growth estimate looks optimistic given the tax cuts announced (INR1tn in foregone tax revenue), it does not pose a threat, as increased consumption will likely culminate in heightened corporate income tax and GST revenue collection.

On non-tax revenue, the government projected another year of bumper dividends from the RBI and other financial institutions (INR2.6tn vs INR2.3tn in FY25), due to the sale of foreign exchange to stabilise the Indian rupee.

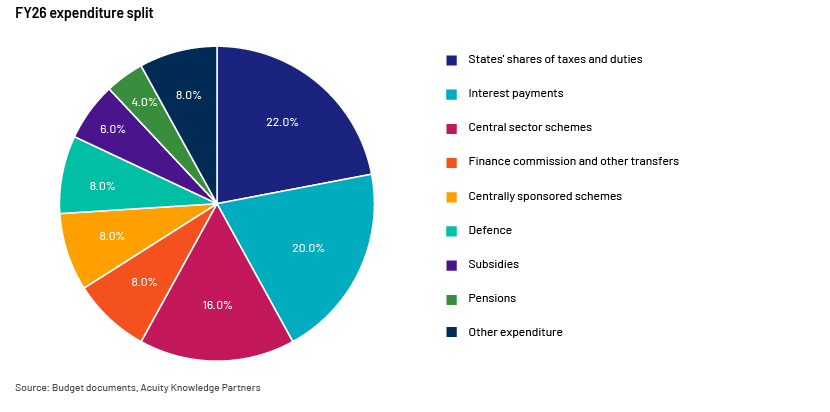

Expenditure

The budget estimates expenditure growth at 7.4% y/y in FY26. Allocations to rural development, agriculture and allied sectors and education are budged to increase 39.9% y/y, 21.7% y/y and 12.8% y/y, respectively. Despite the government’s failure to meet the capex target in FY25, due to delays in the execution of projects thanks to the Lok Sabha elections, the government is committed to maintaining high-quality spending, with capex pegged at INR11.2tn (+10.1% y/y) for FY26, accounting for 22% of the total expenditure. The outlay on subsidies is expected to remain flat y/y, at INR3.8tn, but growing interest payment (+12.2% y/y to INR12.8tn) should continue to weaken the government’s debt affordability (interest payment to revenue receipt projected at 37.3% in FY26 [vs 36.9% in FY25]).

Deficit and debt

For FY26, the government projects a fiscal deficit of 4.4% of GDP, which will be funded through net debt assumption of INR15.7tn (c.USD181bn), including net market borrowings of INR11.5tn (c.USD133bn). Debt to GDP is estimated at 56.1% in FY26 (vs 57.1% in FY25 and 58.1% in FY24).

In the 2021 budget, the government had set out on a fiscal consolidation path to taper the fiscal deficit to GDP to below 4.5% by FY26. Having achieved this target, its fiscal priorities have shifted to reduce the debt to GDP to c.50% by FY31 from 58.1% in FY24. This will likely help rebuild fiscal buffer to support growth when needed.

Budget and its impact on asset classes

The equity market has experienced high volatility on the budget day. During the budget presentation, the market crashed on the announcement of lower capex plans before recovering to end flat compared to the day’s opening levels. Realty, FMCG, consumer durables and automobiles performed well, while energy, infrastructure, pharma and PSU banks lost ground. The bond and foreign exchange markets were close on Saturday.

On Monday, the 10-year government bond yield edged up 1bp on opening on the higher gross borrowing target set for FY26 before retreating 3bps to end at 6.67% on hopes of an interest rate cut by the RBI later in the week. Meanwhile, the Indian rupee slid past 87 to the US dollar, down 0.8% during the day, on concerns surrounding US tariffs, stronger oil prices and continued FII sell-off in equity markets.

Sources

-

Union Budget document

-

Ministry of Statistics and Programme Implementation

-

Controller General of Accounts

-

Reserve Bank of India

What's your view?

About the Author

Ankit has over 11 years of experience in fixed income credit research, focusing on bank, sovereign and corporate credit reviews. He has worked with three of the largest buy-side asset managers, based in Europe and the US, assisting with investment decisions. He is actively involved in discussing themes and issuer updates and is adept at writing detailed credit reviews and building in-depth financial models to present his investment case. Ankit holds a Master of Business Administration (Finance) from Symbiosis International University.

Like the way we think?

Next time we post something new, we'll send it to your inbox